As per Intent Market Research, the Propylene Carbonate Market was valued at USD 387.5 million in 2023 and will surpass USD 586.5 million by 2030; growing at a CAGR of 6.1% during 2024 - 2030.

The Propylene Carbonate Market is expected to witness robust growth from 2024 to 2030, driven by increasing demand across various industries including automotive, electronics, pharmaceuticals, and cosmetics. Propylene carbonate (PC) is a highly versatile solvent, renowned for its ability to dissolve a wide range of substances, making it essential in applications such as lithium-ion battery production, coatings, adhesives, and as a solvent in pharmaceuticals. The growing emphasis on environmental sustainability and the shift toward green chemistry are also fostering the market’s expansion, as propylene carbonate is a safer and more eco-friendly alternative to other solvents.

The market is projected to grow at a solid CAGR through 2030, underpinned by technological advancements and a growing focus on clean, renewable energy solutions. Key players are making significant investments in R&D to improve the quality and functionality of propylene carbonate, expanding its potential applications across a wide range of industries. This report delves into the key segments of the market, examining the largest and fastest-growing subsegments within the industry, along with regional trends that are expected to shape the market's future.

Battery Applications Segment is Largest Owing to Growing Demand for Lithium-Ion Batteries

The Battery Applications segment holds the largest share in the propylene carbonate market, driven primarily by its use as a solvent in the formulation of electrolytes for lithium-ion batteries. As the demand for electric vehicles (EVs) and portable electronic devices continues to surge, the need for efficient and high-performance batteries is increasing, which in turn fuels the demand for propylene carbonate. In lithium-ion batteries, propylene carbonate is essential for improving the ionic conductivity and stability of the electrolytes, thereby enhancing battery efficiency, lifespan, and safety.

The automotive industry's transition toward electric vehicles is one of the key drivers for the battery applications segment. As global governments introduce stricter environmental regulations and incentives for electric vehicle adoption, the demand for lithium-ion batteries is expected to rise, which directly impacts the propylene carbonate market. The increasing focus on green and energy-efficient solutions in transportation further solidifies the battery applications segment as the largest consumer of propylene carbonate in the forecast period.

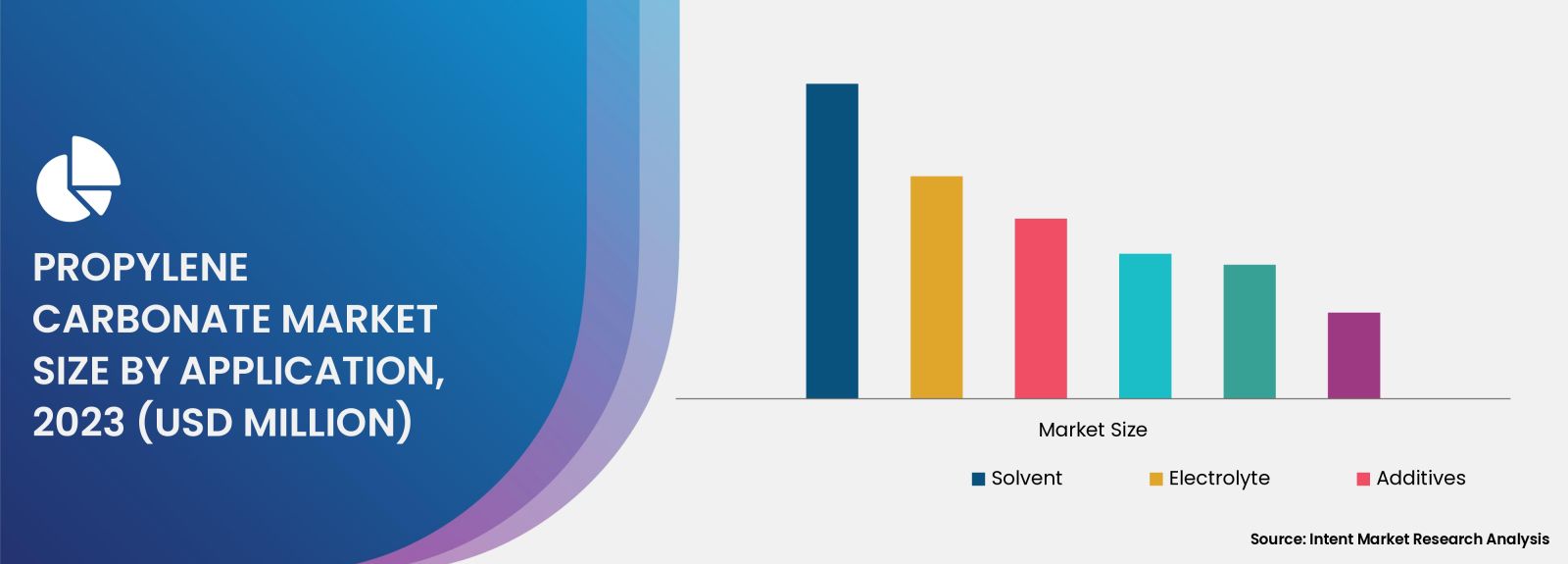

Solvent Segment is Fastest Growing Owing to Demand from Coatings and Adhesives

The Solvent segment is the fastest growing subsegment within the propylene carbonate market, driven by the increasing demand from industries such as coatings, adhesives, and cleaning products. Propylene carbonate is widely used as a solvent due to its low toxicity, high polarity, and excellent solvency power, making it ideal for formulations in paints, coatings, and adhesives. It is also used in various cleaning products, particularly those requiring the safe removal of residues or contaminants without harmful side effects.

The rise in construction and infrastructure activities, particularly in developing economies, is fueling demand for coatings and adhesives, which are major consumers of propylene carbonate as a solvent. Additionally, propylene carbonate’s environmentally friendly profile is helping it gain favor in an increasingly eco-conscious market. With governments around the world pushing for low-VOC (volatile organic compounds) alternatives in paints and coatings, propylene carbonate’s role as a sustainable solvent is expected to drive the fastest growth in the solvent segment.

Pharmaceuticals & Cosmetics Segment is Largest Owing to Safe Solvent Properties

The Pharmaceuticals & Cosmetics segment is one of the largest consumers of propylene carbonate, owing to its excellent solvency properties and compatibility with active pharmaceutical ingredients (APIs) and cosmetic formulations. In pharmaceuticals, propylene carbonate is used as a solvent for certain APIs and as an excipient in the formulation of injectable medications, topical treatments, and oral dosage forms. Its low toxicity and biodegradability make it a preferred choice in drug development and production.

Similarly, in the cosmetics industry, propylene carbonate is used in products such as moisturizers, facial cleansers, and sunscreens due to its ability to dissolve a variety of active ingredients while maintaining product stability. As consumer preferences increasingly shift toward safer, more sustainable ingredients in personal care products, the demand for propylene carbonate is expected to grow, cementing the pharmaceuticals and cosmetics segment as one of the largest in the market.

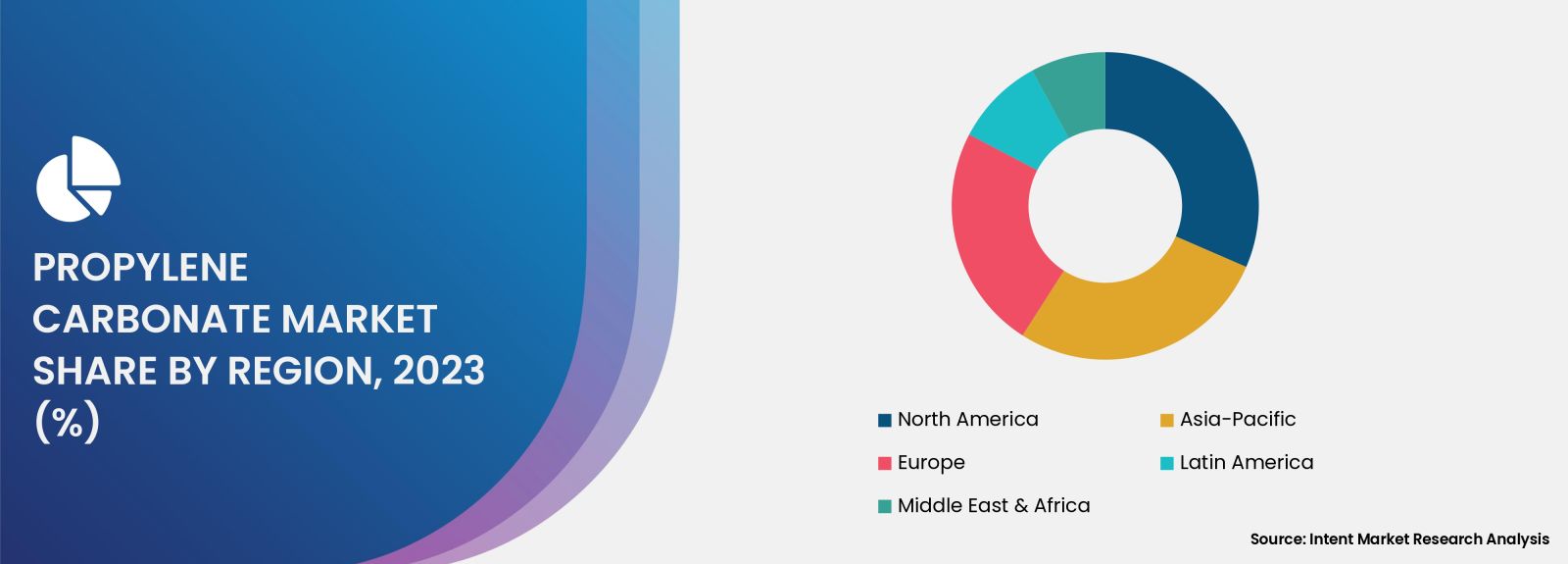

Asia Pacific is Fastest Growing Region Due to Industrial Expansion and Green Chemistry Adoption

The Asia Pacific region is poised to be the fastest-growing market for propylene carbonate, driven by rapid industrialization, increasing demand for electric vehicles, and expanding manufacturing sectors. China, India, and Japan are among the key countries driving this growth. The automotive sector in these countries, especially China, is undergoing a significant transformation with a strong emphasis on electric vehicles, creating substantial demand for lithium-ion batteries and, consequently, propylene carbonate.

Additionally, the region’s increasing focus on environmental sustainability and green chemistry is boosting the adoption of eco-friendly solvents like propylene carbonate. The shift towards low-VOC solvents in coatings, adhesives, and pharmaceuticals further supports this growth. As Asia Pacific continues to dominate the global manufacturing landscape, propylene carbonate’s role in the development of sustainable technologies and its application across a wide array of industries will continue to propel the market forward.

Leading Companies and Competitive Landscape

The Propylene Carbonate Market is competitive, with several key players actively involved in product innovation, strategic partnerships, and capacity expansions. Leading companies in the market include BASF SE, LG Chem Ltd., Dow Chemical Company, Tianjin Zhongtai Chemical Co., Ltd., and Shandong Qilu Petrochemical Co., Ltd. These companies are focusing on advancing the properties of propylene carbonate, improving its production processes, and expanding their market reach, particularly in the automotive, pharmaceutical, and coatings industries.

The competitive landscape is also characterized by a strong focus on sustainability and eco-friendly alternatives. With regulatory frameworks becoming stricter, particularly in Europe and North America, companies are increasingly shifting towards green production methods for propylene carbonate. Furthermore, many players are looking to capitalize on emerging markets, such as Asia Pacific and Latin America, where industrial growth and adoption of green technologies are accelerating. As a result, these companies are investing in R&D to improve propylene carbonate's efficiency and environmental footprint, positioning themselves as leaders in the sustainable chemicals sector.

Report Objectives:

The report will help you answer some of the most critical questions in the Propylene Carbonate Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Propylene Carbonate Market?

- What is the size of the Propylene Carbonate Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 387.5 million |

|

Forecasted Value (2030) |

USD 586.5 million |

|

CAGR (2024 – 2030) |

6.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Propylene Carbonate Market By Application (Solvent, Electrolyte, Additives, Cleaners, Catalyst), By End-Use Industry (Cosmetics & Personal Care, Paints & Coatings, Pharmaceuticals, Textile, Energy & Power, Mining) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Propylene Carbonate Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Solvent |

|

4.2. Electrolyte |

|

4.3. Additives |

|

4.4. Cleaners |

|

4.5. Catalyst |

|

4.6. Others |

|

5. Propylene Carbonate Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Cosmetics & Personal Care |

|

5.2. Paints & Coatings |

|

5.3. Pharmaceuticals |

|

5.4. Textile |

|

5.5. Energy & Power |

|

5.6. Mining |

|

5.7. Others |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Propylene Carbonate Market, by Application |

|

6.2.7. North America Propylene Carbonate Market, by End-Use Industry |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Propylene Carbonate Market, by Application |

|

6.2.8.1.2. US Propylene Carbonate Market, by End-Use Industry |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. BASF SE |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. Empower Materials |

|

8.3. Hunstman International LLC |

|

8.4. Linyi Evergreen Chemical Co., Ltd |

|

8.5. LyondellBasell Industries Holdings, B.V. |

|

8.6. MegaChem Ltd |

|

8.7. Merck KGaA |

|

8.8. ReactChem Co. Ltd. |

|

8.9. The Carl Roth GmbH |

|

8.10. Tokyo Chemical Industry (India) Pvt. Ltd. |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Propylene Carbonate Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Propylene Carbonate Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Propylene Carbonate ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Propylene Carbonate Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA