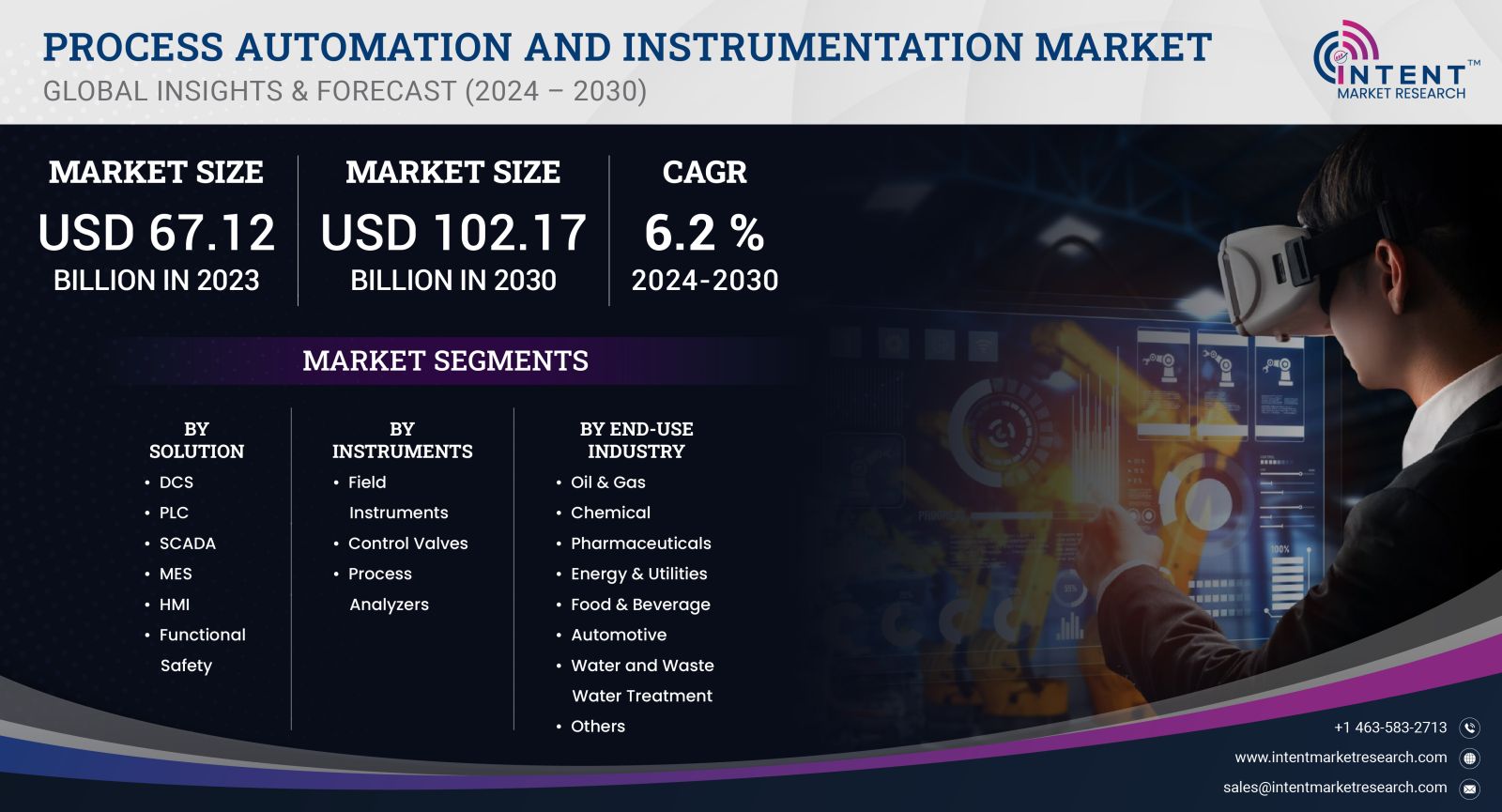

As per Intent Market Research, the Process Automation and Instrumentation Market was valued at USD 67.12 billion in 2023 and will surpass USD 102.17 billion by 2030; growing at a CAGR of 6.2% during 2024 - 2030.

The process automation and instrumentation market is a pivotal segment within the broader industrial landscape, facilitating the automation of various processes across industries such as oil and gas, chemicals, pharmaceuticals, food and beverage, and manufacturing. With increasing demands for efficiency, safety, and quality in production processes, organizations are investing heavily in advanced automation technologies and instrumentation solutions. The market is characterized by a significant shift toward digital transformation, where traditional automation systems are being replaced with smart, connected devices that enhance real-time monitoring and control capabilities.

This growth trajectory is driven by the increasing need for operational efficiency, cost reduction, and compliance with regulatory standards. Furthermore, advancements in technologies such as the Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning are reshaping the landscape of process automation, enabling more sophisticated and integrated solutions that enhance productivity across various sectors.

Control Systems Segment is Largest Owing to Integration with Advanced Technologies

The control systems segment represents the largest share within the process automation and instrumentation market, driven by the widespread adoption of distributed control systems (DCS) and supervisory control and data acquisition (SCADA) systems. Control systems are essential for managing and optimizing industrial processes, allowing operators to monitor and control equipment and systems efficiently. Their ability to integrate with advanced technologies such as AI, machine learning, and IIoT has further enhanced their functionality, making them indispensable in modern industrial applications.

Moreover, the increasing complexity of industrial processes and the need for real-time data analytics have propelled the demand for advanced control systems. Industries such as oil and gas, chemicals, and manufacturing are increasingly relying on these systems to improve operational efficiency, reduce downtime, and enhance safety. As organizations continue to prioritize digital transformation, the control systems segment is expected to maintain its leadership position in the process automation and instrumentation market.

Field Instruments Segment is Fastest Growing Owing to Enhanced Measurement Accuracy

The field instruments segment is identified as the fastest-growing area within the process automation and instrumentation market, primarily due to the rising demand for precise measurement and monitoring solutions. Field instruments, including pressure transmitters, flow meters, and temperature sensors, play a crucial role in ensuring optimal performance in various industrial processes. The need for accurate data collection and analysis is driving the adoption of advanced field instruments that offer improved accuracy, reliability, and performance.

Technological advancements in field instruments, such as wireless communication capabilities and smart sensor technology, are further enhancing their appeal. These innovations enable real-time data transmission and integration with control systems, allowing for more efficient process management. As industries strive to improve operational efficiency and reduce costs, the field instruments segment is expected to experience robust growth, positioning it as a key player in the evolving process automation and instrumentation market.

Software Segment is Largest Owing to Growing Demand for Analytics

The software segment is a significant component of the process automation and instrumentation market, driven by the growing demand for advanced analytics and process optimization solutions. Automation software, including process control software, manufacturing execution systems (MES), and data analytics platforms, enables organizations to analyze data and make informed decisions that enhance productivity and efficiency. As businesses seek to harness the power of data, the demand for sophisticated software solutions continues to rise.

Additionally, the integration of artificial intelligence and machine learning capabilities into automation software is further propelling growth in this segment. These technologies allow organizations to predict equipment failures, optimize production schedules, and enhance decision-making processes. With the increasing complexity of industrial operations and the need for real-time insights, the software segment is positioned as a crucial driver of growth in the process automation and instrumentation market.

Services Segment is Fastest Growing Owing to Demand for Support and Maintenance

The services segment within the process automation and instrumentation market is experiencing rapid growth, primarily due to the rising demand for maintenance, support, and consulting services. As industries increasingly adopt automation technologies, the need for skilled personnel and specialized services to ensure optimal system performance has become paramount. This trend is leading to a growing emphasis on service offerings that provide installation, training, and ongoing support for automation systems and instruments.

Furthermore, as organizations look to maximize their return on investment in automation technologies, they are turning to service providers for expertise in system integration and process optimization. The need for regular maintenance and support to minimize downtime and enhance system performance is driving the demand for services within the market. As a result, the services segment is expected to witness significant growth, positioning it as a vital aspect of the process automation and instrumentation landscape.

Fastest Growing Region: Asia-Pacific

The Asia-Pacific region is emerging as the fastest-growing market for process automation and instrumentation, fueled by rapid industrialization, increasing manufacturing activities, and the adoption of advanced technologies across various sectors. Countries such as China, India, and Japan are leading the way in investing in automation solutions to enhance productivity and operational efficiency. The growing emphasis on smart manufacturing and digital transformation initiatives is driving the demand for process automation technologies in the region.

Moreover, the rising need for safety and compliance in industries such as pharmaceuticals, chemicals, and food processing is further bolstering the demand for automation and instrumentation solutions. The Asia-Pacific region's burgeoning economy and expanding industrial base position it as a critical growth area for the process automation and instrumentation market, attracting investments from both local and global players.

Competitive Landscape

The competitive landscape of the process automation and instrumentation market is characterized by a diverse range of players, including established multinational corporations and innovative startups. Key companies such as Siemens, Honeywell, ABB, Emerson Electric, and Schneider Electric dominate the market, offering a wide array of automation and instrumentation solutions tailored to various industries. These companies leverage their technological expertise and extensive research and development capabilities to deliver cutting-edge products and services that meet the evolving needs of customers.

In addition to established players, numerous emerging companies are entering the market, bringing innovative solutions that cater to niche applications. The process automation and instrumentation market is witnessing a trend toward strategic partnerships, collaborations, and acquisitions as companies seek to enhance their technological capabilities and expand their market reach. As the demand for process automation technologies continues to grow across multiple sectors, the competitive landscape is expected to remain dynamic, fostering ongoing innovation and advancements in automation solutions.

Top 10 Companies in the Process Automation and Instrumentation Market

- Siemens

A global leader in automation and control technologies, Siemens offers a wide range of process automation solutions tailored to various industries. - Honeywell

Known for its innovative automation and control products, Honeywell provides advanced solutions for process industries, including oil and gas, chemicals, and manufacturing. - ABB

ABB specializes in electrification and automation technologies, offering comprehensive solutions for industrial process automation and instrumentation. - Emerson Electric

Emerson provides advanced automation technologies and services, focusing on process optimization and digital transformation for various industries. - Schneider Electric

Schneider Electric is a key player in energy management and automation, delivering innovative solutions for process industries to enhance efficiency and sustainability. - Rockwell Automation

A leading provider of industrial automation and information solutions, Rockwell Automation focuses on helping manufacturers improve productivity and operational performance. - Yokogawa Electric Corporation

Yokogawa specializes in process automation and control systems, offering advanced instrumentation and solutions for various industrial applications. - Endress+Hauser

Known for its high-quality measurement and automation solutions, Endress+Hauser provides a comprehensive portfolio of field instruments and services. - Mettler-Toledo

Mettler-Toledo offers precision instruments for weighing, measurement, and automation, serving industries such as food and beverage, pharmaceuticals, and chemicals. - KROHNE

KROHNE specializes in process instrumentation and automation solutions, providing a range of products for flow, level, pressure, and temperature measurement.

As the process automation and instrumentation market continues to evolve, these leading companies are driving innovation and shaping the future of industrial automation solutions. The competitive landscape is expected to remain dynamic, with ongoing developments that enhance the capabilities and performance of automation technologies across various sectors.

Report Objectives:

The report will help you answer some of the most critical questions in the Process Automation and Instrumentation Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Process Automation and Instrumentation market?

- What is the size of the Process Automation and Instrumentation market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 67.12 billion |

|

Forecasted Value (2030) |

USD 102.17 billion |

|

CAGR (2024 – 2030) |

6.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Process Automation and Instrumentation Market By Solutions (DCS, PLC, SCADA, MES, HMI & Functional Safety), By Instruments (Field Instruments, Control Valves & Process Analyzers), By End-Use Industry (Oil & Gas, Chemical, Pharmaceuticals, Energy & Utilities, Food & Beverage, Automotive, Water & Waste Water Treatment, Others) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Rest of Europe), Asia Pacific (China, Japan, India, South Korea & Rest of Asia Pacific), Latin America (Brazil, Argentina & Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Process Automation and Instrumentation Market, by Solution (Market Size & Forecast: USD Billion, 2022 – 2030) |

|

4.1.DCS |

|

4.2.PLC |

|

4.3.SCADA 4.4.MES 4.5.HMI 4.6.Functional Safety |

|

5.Process Automation and Instrumentation Market, by Instruments (Market Size & Forecast: USD Billion, 2022 – 2030) |

|

5.1.Field Instruments |

|

5.2.Control Valves 5.3.Process Analyzers |

|

6.Process Automation and Instrumentation Market, by End-Use Industry (Market Size & Forecast: USD Billion, 2022 – 2030) |

|

6.1.Oil & Gas 6.2.Chemical |

|

6.3.Pharmaceuticals 6.4.Energy & Utilities 6.5.Food & Beverage 6.6.Automotive 6.7.Water and Waste Water Treatment 6.5.Others |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2022 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Process Automation and Instrumentation Market, by Solution |

|

8.2.7.North America Process Automation and Instrumentation Market, by Instruments |

|

8.2.8.North America Process Automation and Instrumentation Market, by End-Use Industry |

|

*Similar segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Process Automation and Instrumentation Market, by Solution |

|

8.3.1.2.US Process Automation and Instrumentation Market, by Instruments |

|

8.3.1.3.US Process Automation and Instrumentation Market, by End-Use Industry |

|

8.3.2.Canada |

|

8.3.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.ABB |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Fuji Electric |

|

10.3.Emerson Electric |

|

10.4.Endress+Hauser Group |

|

10.5.General Electric |

|

10.6.Honeywell International |

|

10.7.Mitsubishi Electric |

|

10.8.OMRON Corporation |

|

10.9.Rockwell Automation |

|

10.10.Schneider Electric 10.11.Siemens 10.11.Yokogawa Electric Corporation |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Process Automation and Instrumentation market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the Process Automation and Instrumentation market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Process Automation and Instrumentation ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the Process Automation and Instrumentation market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA