As per Intent Market Research, the Portable Projector Market was valued at USD 1.7 billion in 2023 and will surpass USD 2.8 billion by 2030; growing at a CAGR of 7.3% during 2024 - 2030.

The portable projector market has emerged as a significant segment within the global consumer electronics landscape, driven by the increasing demand for compact and versatile projection solutions across various sectors. These lightweight and easily transportable devices cater to diverse applications, including business presentations, educational purposes, home entertainment, and outdoor activities. With advancements in display technology and growing consumer preferences for on-the-go solutions, portable projectors have become increasingly popular, enhancing the way individuals and organizations share visual content.

This robust growth can be attributed to several factors, including technological advancements, the proliferation of smartphones, and the rising demand for interactive and immersive experiences. As more consumers and businesses recognize the benefits of portable projection technology, the market is poised for substantial expansion in the coming years.

Business Segment is Largest Owing to Increasing Demand for Remote Presentations

The business segment remains the largest in the portable projector market, primarily driven by the rising demand for effective remote presentations and collaborative work environments. As businesses increasingly adopt flexible work arrangements, the need for portable projectors has surged, enabling employees to deliver impactful presentations from various locations. These devices offer high-resolution displays, ease of connectivity, and lightweight designs, making them ideal for professionals who require mobility without sacrificing quality.

Moreover, the trend of hybrid working models has prompted companies to invest in portable projection solutions that facilitate seamless communication and collaboration. Features such as wireless connectivity and compatibility with multiple devices further enhance the appeal of portable projectors in business settings. As organizations continue to embrace innovative technologies to support remote work and enhance productivity, the business segment is expected to maintain its dominant position in the portable projector market throughout the forecast period.

Education Segment is Fastest Growing Owing to Increasing Adoption of Interactive Learning

The education segment is the fastest-growing sub-segment within the portable projector market, fueled by the increasing adoption of interactive learning environments and digital education tools. Educational institutions are increasingly integrating technology into their teaching methodologies, with portable projectors playing a crucial role in facilitating engaging and interactive lessons. These devices enable educators to display multimedia content, collaborate on projects, and enhance the overall learning experience for students.

The demand for portable projectors in educational settings has been further accelerated by the shift toward hybrid and remote learning models, especially in the wake of the COVID-19 pandemic. Schools and universities are investing in portable projection technology to ensure that students can participate in dynamic learning experiences, regardless of their physical location. As the education sector continues to prioritize technology-enhanced learning, the portable projector market is expected to witness significant growth in this segment.

Home Entertainment Segment is Largest Owing to Rising Demand for Compact Solutions

The home entertainment segment is characterized by the largest share of the portable projector market, driven by the increasing demand for compact and versatile projection solutions for home use. Consumers are seeking alternatives to traditional large-screen TVs, and portable projectors offer an excellent option for those looking to create a cinema-like experience in their homes. With advancements in image quality, brightness, and connectivity options, portable projectors are becoming increasingly popular for movie nights, gaming, and sports viewing.

Additionally, the rise of streaming services has led to a growing appetite for high-quality visual content at home. Portable projectors allow users to project large images onto any available surface, providing flexibility and convenience for various viewing situations. As manufacturers continue to innovate and improve the performance of portable projectors, this segment is likely to see sustained growth as consumers increasingly turn to these devices for their home entertainment needs.

Outdoor Segment is Fastest Growing Owing to Increasing Popularity of Outdoor Activities

The outdoor segment is experiencing rapid growth within the portable projector market, primarily driven by the increasing popularity of outdoor activities and events. As consumers seek to enhance their outdoor experiences, portable projectors have emerged as essential tools for activities such as camping, outdoor movie nights, and backyard gatherings. The lightweight and compact nature of these devices allows users to easily transport them to different locations, making them ideal for various outdoor settings.

Moreover, advancements in battery technology and durability have improved the performance of portable projectors in outdoor environments. Features such as wireless connectivity and the ability to project images in daylight conditions have further expanded their appeal among outdoor enthusiasts. As more consumers embrace the idea of outdoor entertainment and experiences, the outdoor segment is poised for significant growth in the portable projector market.

Fastest Growing Region: Asia-Pacific Region

The Asia-Pacific region is emerging as the fastest-growing market for portable projectors, driven by rapid urbanization, increasing disposable income, and a growing preference for modern technology. Countries such as China, India, and Japan are witnessing significant growth in demand for portable projection solutions across various sectors, including education, business, and entertainment. The rise of the middle-class population in these countries is also contributing to the increasing adoption of portable projectors for both professional and personal use.

Additionally, the region is home to several leading manufacturers and technology companies that are actively investing in research and development to enhance their product offerings. The proliferation of start-ups focused on innovative portable projection solutions further accelerates market growth in Asia-Pacific. As the region continues to embrace digital transformation and prioritize technology in various aspects of life, it is expected to maintain its position as a key player in the global portable projector market.

Competitive Landscape

The competitive landscape of the portable projector market is characterized by the presence of several key players and a dynamic environment marked by rapid technological advancements. Leading companies such as Epson, BenQ, Sony, and LG Electronics dominate the market by offering a diverse range of portable projector products tailored to various applications. These companies are actively engaged in strategic partnerships, mergers, and acquisitions to enhance their market presence and expand their product portfolios.

Furthermore, the market is witnessing the emergence of niche players and start-ups specializing in innovative portable projection solutions. These companies are focusing on developing cutting-edge technologies, such as smart projectors with integrated streaming capabilities and portable devices with enhanced brightness and image quality. As competition intensifies, players in the portable projector market are likely to invest heavily in research and development to maintain their competitive edge and capitalize on emerging trends, ensuring a vibrant and rapidly evolving market landscape through the forecast period and beyond.

Report Objectives:

The report will help you answer some of the most critical questions in the Portable Projector Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Portable Projector Market?

- What is the size of the Portable Projector Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.7 billion |

|

Forecasted Value (2030) |

USD 2.8 billion |

|

CAGR (2024 – 2030) |

7.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Portable Projector Market By Technology (Digital Light Processing (DLP), Liquid Crystal Display (LCD), Light Emitting Diode (LED)), By Lumens (Less than 500, 500 to 3000, More than 3000), By Resolution (SVGA (800 x 600), XGA (1024 x 768), FHD (1920 x 1080), 4K UHD (3840 x 2160)), By Connectivity (Wired , Wireless ), By Application (Home Entertainment, Business and Education, Outdoor and Travel, Event and Venue) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

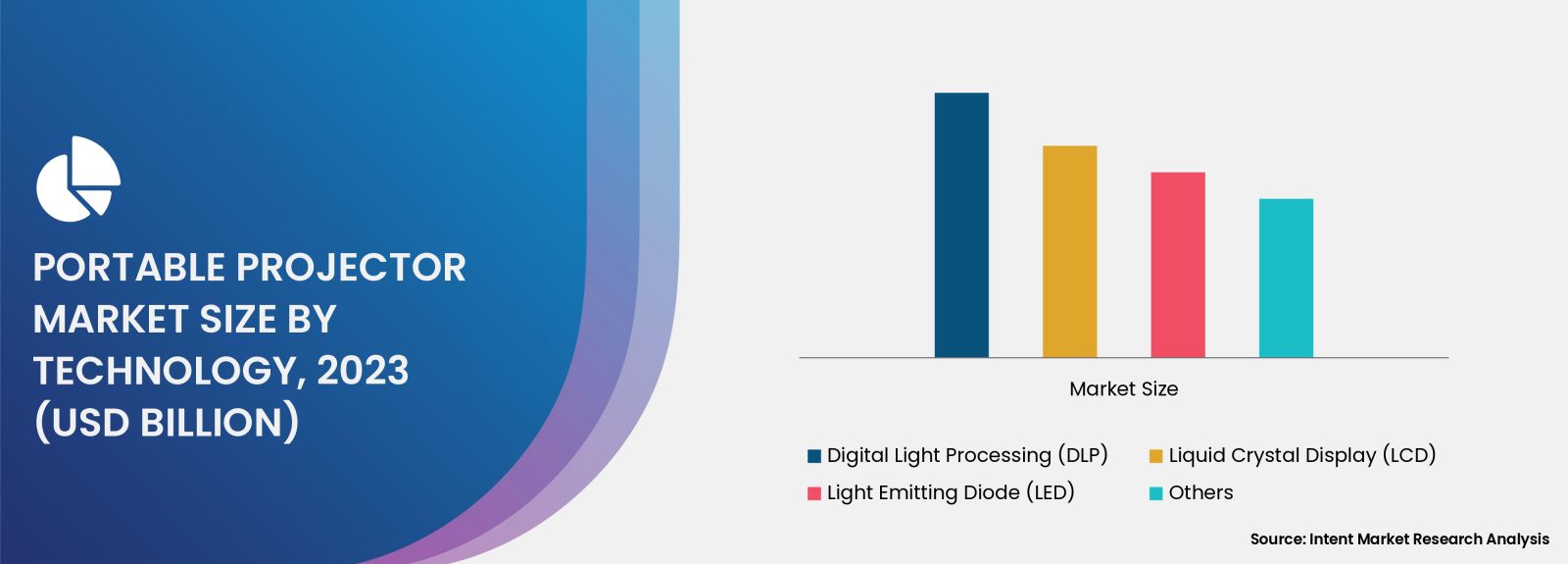

4. Portable Projector Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Digital Light Processing (DLP) |

|

4.2. Liquid Crystal Display (LCD) |

|

4.3. Light Emitting Diode (LED) |

|

4.4. Others |

|

5. Portable Projector Market, by Lumens (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Less than 500 |

|

5.2. 500 to 3000 |

|

5.3. More than 3000 |

|

6. Portable Projector Market, by Resolution (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. SVGA (800 x 600) |

|

6.2. XGA (1024 x 768) |

|

6.3. FHD (1920 x 1080) |

|

6.4. 4K UHD (3840 x 2160) |

|

6.5. Others |

|

7. Portable Projector Market, by Connectivity (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Wired |

|

7.2. Wireless |

|

8. Portable Projector Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Home Entertainment |

|

8.2. Business & Education |

|

8.3. Outdoor & Travel |

|

8.4. Event & Venue |

|

8.5. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Portable Projector Market, by Technology |

|

9.2.7. North America Portable Projector Market, by Lumens |

|

9.2.8. North America Portable Projector Market, by Resolution |

|

9.2.9. North America Portable Projector Market, by Connectivity |

|

9.2.10. North America Portable Projector Market, by Application |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Portable Projector Market, by Technology |

|

9.2.11.1.2. US Portable Projector Market, by Lumens |

|

9.2.11.1.3. US Portable Projector Market, by Resolution |

|

9.2.11.1.4. US Portable Projector Market, by Connectivity |

|

9.2.11.1.5. US Portable Projector Market, by Application |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Epson |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Acer |

|

11.3. BenQ |

|

11.4. Kodak |

|

11.5. LG Electronics |

|

11.6. NEC Display |

|

11.7. Panasonic |

|

11.8. Samsung |

|

11.9. Sony Corporation |

|

11.10. ViewSonic |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Portable Projector Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Portable Projector Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Portable Projector ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Portable Projector Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA