As per Intent Market Research, the Plastic to Fuel Market was valued at USD 9.7 billion in 2024-e and will surpass USD 12.9 billion by 2030; growing at a CAGR of 4.2% during 2025 - 2030.

The Plastic to Fuel Market is evolving rapidly due to the increasing focus on sustainability and the need to reduce plastic waste. With the growing awareness of environmental issues, technologies that convert plastic waste into valuable fuels are gaining significant traction. This market is driven by the need to address the mounting plastic waste problem while simultaneously producing cleaner fuels that contribute to reducing reliance on fossil fuels. Several technologies are being developed and implemented globally, and various feedstock types are being explored to meet the demand for alternative fuels. The market is also expanding across different industries, including automotive, energy, and utilities, which are adopting these solutions to further their sustainability goals. Geographically, the market is witnessing significant developments in North America, Europe, and Asia Pacific, with each region focusing on different aspects of the plastic-to-fuel ecosystem.

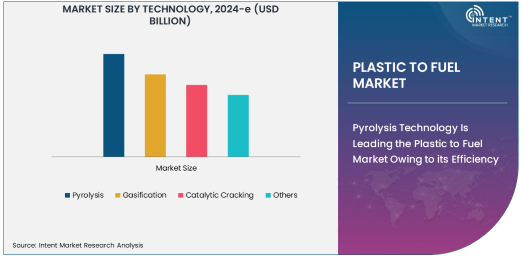

Pyrolysis Technology Is Leading the Plastic to Fuel Market Owing to its Efficiency

Pyrolysis technology stands as the largest subsegment in the Plastic to Fuel market, largely due to its widespread adoption and ability to effectively convert plastic waste into fuel. This technology involves heating plastic in the absence of oxygen to break it down into smaller molecules, which can then be processed into fuel. Pyrolysis offers several advantages, such as the ability to process a wide variety of plastics, including those contaminated with food waste or mixed plastics, which are often unsuitable for traditional recycling methods. The efficiency and scalability of pyrolysis plants make it an attractive option for large-scale waste-to-fuel operations, which is why it dominates the global market.

Pyrolysis technology is also advantageous in terms of its low energy consumption compared to other methods, such as gasification, making it a cost-effective solution for plastic waste management. Additionally, the fuel produced through pyrolysis can be used in a variety of applications, including as a substitute for diesel or gasoline. This versatility, combined with its efficiency, has led to a surge in the number of pyrolysis plants being set up worldwide, particularly in developed markets with stringent waste management regulations.

Polyethylene (PE) Dominates the Feedstock Segment Due to Its Prevalence in Consumer Products

Polyethylene (PE) is the largest feedstock type used in the Plastic to Fuel market, driven by its widespread use in packaging materials and consumer goods. PE is one of the most common plastics found in everyday products, such as plastic bags, bottles, and packaging films, making it the most readily available and processed feedstock for plastic-to-fuel operations. The vast volume of PE waste generated globally creates a significant opportunity for its conversion into usable fuel, ensuring that this feedstock remains in high demand within the industry.

The dominance of PE is also driven by its easier conversion into fuel compared to other types of plastics. Its chemical structure is relatively simple, which allows for more efficient processing, especially in pyrolysis and catalytic cracking processes. As a result, PE-based plastic-to-fuel technologies are being increasingly adopted by companies aiming to mitigate plastic waste and produce cleaner energy alternatives. This widespread availability and ease of processing make PE the most prominent feedstock in the market.

Energy & Utilities Industry Is Leading in Adoption of Plastic to Fuel Solutions

The energy and utilities sector is one of the largest end-users of plastic-to-fuel technologies, driving demand for alternative fuels and contributing significantly to the growth of the market. As the world moves toward cleaner energy solutions, the energy sector is focusing on finding sustainable sources of fuel, and plastic-to-fuel technologies provide an attractive option. These technologies help reduce the volume of plastic waste while producing valuable fuels that can be used in power generation and other industrial processes.

The ability to convert plastic waste into usable fuel such as diesel or gas adds significant value to the energy industry. In addition to reducing carbon emissions and contributing to a circular economy, plastic-to-fuel technology helps mitigate the environmental impact of plastic waste. Energy companies are increasingly investing in these technologies to achieve their sustainability goals, making the energy and utilities industry the largest and fastest-growing end-use sector in the plastic-to-fuel market.

Asia Pacific Is the Fastest Growing Region in the Plastic to Fuel Market

Asia Pacific is expected to be the fastest-growing region in the Plastic to Fuel market, driven by the region's increasing focus on waste management and renewable energy solutions. Countries like China, India, and Japan are exploring and investing in waste-to-fuel technologies to address their growing plastic waste crisis. In these markets, plastic waste is often not effectively recycled or disposed of, creating a large opportunity for plastic-to-fuel solutions to reduce waste and create alternative energy sources. The rapid industrialization in these regions also contributes to the rising demand for energy, making plastic-to-fuel technologies even more attractive.

Moreover, many countries in Asia Pacific are enhancing their environmental regulations, encouraging industries to adopt sustainable waste management practices. This regulatory push, combined with the region’s growing industrial base, is expected to drive significant growth in the plastic-to-fuel market. As governments and private companies continue to invest in renewable energy and waste-to-energy technologies, Asia Pacific is poised to lead the market in terms of adoption and technological advancements.

Competitive Landscape: Leading Companies in the Plastic to Fuel Market

The Plastic to Fuel market is characterized by a competitive landscape of established players and new entrants working on advancing waste-to-fuel technologies. Key companies like Plastic Energy, Agilyx, and Verdigris Technologies are leading the charge, with a strong focus on developing innovative solutions that can efficiently process plastic waste into fuel. These companies are investing heavily in research and development, constantly improving the efficiency of their technologies while also expanding their global footprint.

In addition to technological advancements, companies in the market are also focusing on strategic partnerships and collaborations to strengthen their market positions. Mergers and acquisitions are common, as companies aim to gain access to new technologies or expand their production capabilities. The competitive environment is dynamic, with players continuously innovating to capture a larger share of the growing plastic-to-fuel market. As the market matures, it is expected that the competition will intensify, with leading companies focusing on scalability, cost-effectiveness, and sustainability to meet the increasing demand for alternative fuels.

Recent Developments:

- Plastic Energy has launched a new pyrolysis plant in Spain, aiming to scale up its plastic-to-fuel conversion capabilities and contribute to the circular economy.

- Verdigris Technologies raised $25 million in Series B funding to expand its plastic-to-fuel operations, focusing on advanced pyrolysis technology to accelerate fuel production.

- Agilyx and Shell have partnered to develop new chemical recycling technologies for converting plastic waste into synthetic fuels, enhancing sustainability in the energy sector.

- Waste2Tricity has opened a new catalytic cracking facility to process mixed plastic waste into high-value fuels, targeting the UK and European markets.

- Covanta and SUEZ have announced a joint venture to build a new plastic-to-fuel plant in North America, aiming to reduce plastic waste and support renewable energy goals.

List of Leading Companies:

- Plastic Energy

- Waste2Tricity

- Verdigris Technologies

- Anellotech

- Green EnviroTech Holdings

- Agilyx

- AcelorMittal

- Origin Materials

- Carbon Clean Solutions

- Covanta

- SUEZ Recycling & Recovery

- Enval

- Biofabrik

- Plastic2Oil

- Global Petro

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 9.7 Billion |

|

Forecasted Value (2030) |

USD 12.9 Billion |

|

CAGR (2025 – 2030) |

4.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Plastic to Fuel Market by Technology (Pyrolysis, Gasification, Catalytic Cracking), by Feedstock Type (Polyethylene, Polypropylene, Polystyrene, Polyvinyl Chloride), by End-Use Industry (Automotive, Energy & Utilities, Packaging, Construction) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Plastic Energy, Waste2Tricity, Verdigris Technologies, Anellotech, Green EnviroTech Holdings, Agilyx, AcelorMittal, Origin Materials, Carbon Clean Solutions, Covanta, SUEZ Recycling & Recovery, Enval, Biofabrik, Plastic2Oil, Global Petro |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Plastic To Fuel Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Pyrolysis |

|

4.2. Gasification |

|

4.3. Catalytic Cracking |

|

4.4. Others |

|

5. Plastic To Fuel Market, by Feedstock Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Polyethylene (PE) |

|

5.2. Polypropylene (PP) |

|

5.3. Polystyrene (PS) |

|

5.4. Polyvinyl Chloride (PVC) |

|

5.5. Others |

|

6. Plastic To Fuel Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Automotive |

|

6.2. Energy & Utilities |

|

6.3. Packaging |

|

6.4. Construction |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Plastic To Fuel Market, by Technology |

|

7.2.7. North America Plastic To Fuel Market, by Feedstock Type |

|

7.2.8. North America Plastic To Fuel Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Plastic To Fuel Market, by Technology |

|

7.2.9.1.2. US Plastic To Fuel Market, by Feedstock Type |

|

7.2.9.1.3. US Plastic To Fuel Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Plastic Energy |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Waste2Tricity |

|

9.3. Verdigris Technologies |

|

9.4. Anellotech |

|

9.5. Green EnviroTech Holdings |

|

9.6. Agilyx |

|

9.7. AcelorMittal |

|

9.8. Origin Materials |

|

9.9. Carbon Clean Solutions |

|

9.10. Covanta |

|

9.11. SUEZ Recycling & Recovery |

|

9.12. Enval |

|

9.13. Biofabrik |

|

9.14. Plastic2Oil |

|

9.15. Global Petro |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Plastic to Fuel Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Plastic to Fuel Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Plastic to Fuel Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA