As per Intent Market Research, the Plastic Resin Market was valued at USD 685.3 billion in 2023 and will surpass USD 1,246.7 billion by 2030; growing at a CAGR of 8.9% during 2024 - 2030.

The Plastic Resin Market is a dynamic sector poised for significant growth, primarily driven by the increasing demand for lightweight, durable, and versatile materials across various industries. Plastic resins are essential in producing a wide range of products, from packaging materials to automotive components and consumer goods. The market's expansion is influenced by technological advancements, innovation in resin formulations, and the growing focus on sustainability, with manufacturers seeking eco-friendly alternatives to traditional materials.This growth trajectory is supported by the increasing penetration of plastics in emerging economies and the rising demand for high-performance plastics in various applications. As the industry evolves, the emphasis on recycling and circular economy practices is expected to shape the market landscape, driving further innovation and investment.

Polyethylene Segment is Largest Owing to Versatile Applications

The polyethylene segment stands as the largest subsegment within the plastic resin market, primarily due to its extensive range of applications across diverse industries. Polyethylene, available in various forms such as low-density (LDPE) and high-density polyethylene (HDPE), is widely used in packaging, consumer goods, automotive components, and construction materials. Its favorable properties, including chemical resistance, flexibility, and durability, make it a preferred choice for manufacturers.

The rise in e-commerce and the subsequent demand for packaging solutions have further solidified polyethylene's market dominance. As businesses seek efficient and cost-effective packaging options, the polyethylene segment is anticipated to maintain robust growth, driven by continuous innovations in resin formulations and processing techniques. Furthermore, the growing emphasis on sustainability has led to increased investment in recyclable polyethylene materials, enhancing its market position.

Polypropylene Segment is Fastest Growing Owing to Robust Demand in Automotive Sector

The polypropylene segment is the fastest-growing subsegment within the plastic resin market, fueled by the burgeoning demand from the automotive and packaging sectors. Polypropylene's lightweight nature, high chemical resistance, and versatility have made it a popular choice for automotive applications, such as interior components, bumpers, and under-the-hood parts. The push for fuel-efficient vehicles has further accelerated the adoption of polypropylene, as its lightweight properties contribute to overall vehicle weight reduction.

Additionally, the rise in demand for sustainable packaging solutions is boosting the polypropylene segment, as manufacturers increasingly utilize this resin for producing recyclable and biodegradable packaging materials. As the automotive industry transitions toward greener technologies and materials, the polypropylene segment is expected to experience substantial growth, driven by innovation and expanding applications.

Polystyrene Segment is Largest Owing to Demand for Insulation Materials

The polystyrene segment is notable for its size and importance within the plastic resin market, particularly in the production of insulation materials. Polystyrene, including both expandable polystyrene (EPS) and solid polystyrene, is widely used in building and construction for insulation applications due to its excellent thermal resistance and lightweight properties. The growing emphasis on energy-efficient buildings and the rising demand for eco-friendly insulation solutions have propelled the use of polystyrene in the construction sector.

Moreover, polystyrene is used extensively in packaging applications, particularly for consumer products and electronics, due to its shock-absorbing qualities. The versatility and cost-effectiveness of polystyrene continue to make it a popular choice among manufacturers, thereby maintaining its substantial presence in the plastic resin market.

Acrylonitrile Butadiene Styrene (ABS) Segment is Fastest Growing Owing to Demand in Consumer Electronics

The Acrylonitrile Butadiene Styrene (ABS) segment is emerging as the fastest-growing subsegment within the plastic resin market, driven by the increasing demand for durable and high-performance materials in consumer electronics. ABS is favored for its excellent impact resistance, thermal stability, and ease of processing, making it ideal for producing components such as housings, casings, and fixtures in various electronic devices.

The rapid growth of the consumer electronics industry, characterized by innovation and product diversification, has significantly boosted the demand for ABS. Additionally, the rising trend of smart home devices and IoT products is expected to further propel the ABS segment, as manufacturers seek robust materials capable of withstanding the rigors of daily use. The continuous advancement in ABS formulations and its applications in diverse industries position this segment for significant growth in the coming years.

.jpg)

Asia-Pacific Region is Fastest Growing Owing to Industrial Expansion

The Asia-Pacific region is the fastest-growing market for plastic resins, propelled by rapid industrial expansion and increasing manufacturing capabilities in countries such as China, India, and Southeast Asian nations. The region's robust economic growth has fueled demand across various sectors, including automotive, consumer goods, and construction, driving the need for versatile plastic resin solutions.

Furthermore, the growth of the e-commerce sector in Asia-Pacific has intensified the demand for packaging materials, significantly benefiting the plastic resin market. Government initiatives aimed at promoting industrial development and foreign investments in the manufacturing sector are also contributing to the region's impressive growth. As Asia-Pacific continues to be a global manufacturing hub, the plastic resin market is expected to thrive, attracting investments and fostering innovation.

North America Region is Largest Owing to Established Market Presence

North America is recognized as the largest market for plastic resins, primarily due to its established industrial base and significant investments in research and development. The presence of major players in the automotive, aerospace, and consumer goods industries has created a robust demand for high-quality plastic resin solutions. Additionally, stringent regulatory standards for product quality and environmental sustainability have necessitated the adoption of advanced materials in the region.

The increasing focus on innovation and the development of bio-based and recycled plastics are also shaping the market landscape in North America. As companies strive to meet consumer demands for sustainable products, the plastic resin market in this region is poised for continued growth, maintaining its leadership position.

Top 10 Companies and Competitive Landscape

The plastic resin market is characterized by a competitive landscape with several key players actively striving to enhance their market position through innovation and strategic initiatives. The top companies in this market include:

- BASF SE

- Dow Chemical Company

- ExxonMobil Chemical Company

- LyondellBasell Industries N.V.

- SABIC

- INEOS Group AG

- Mitsubishi Chemical Corporation

- DuPont de Nemours, Inc.

- Covestro AG

- Formosa Plastics Corporation

These companies are engaged in continuous research and development efforts to create advanced plastic resin solutions that meet the evolving needs of various industries. The competitive landscape is characterized by collaborations, partnerships, and acquisitions aimed at expanding product offerings and enhancing technological capabilities. As the demand for plastic resins continues to grow, companies are likely to focus on sustainability and innovation, positioning themselves as leaders in this dynamic market.

Report Objectives:

The report will help you answer some of the most critical questions in the Plastic Resin Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Plastic Resin Market?

- What is the size of the Plastic Resin Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 685.3 billion |

|

Forecasted Value (2030) |

USD 1,246.7 billion |

|

CAGR (2024 – 2030) |

8.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

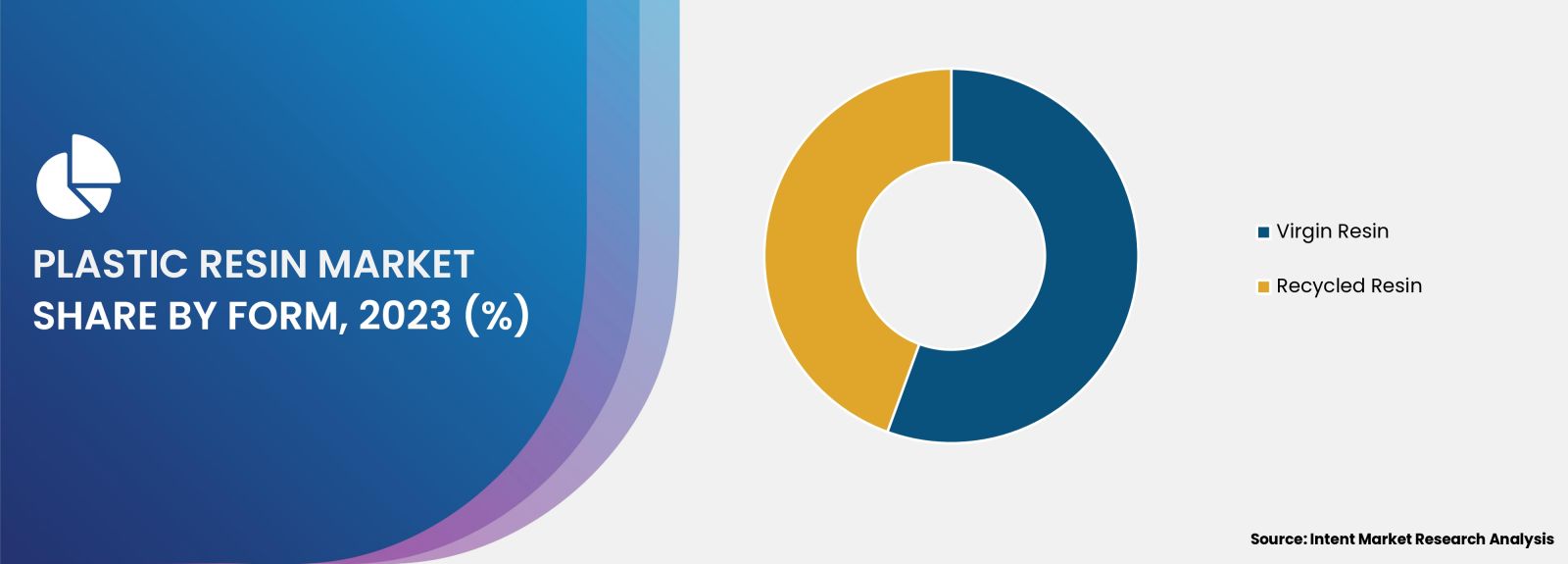

Segments Covered |

Plastic Resin Market By Resin Type (PE, PP, PVC, PS, PET, ABS, PC), By Form (Virgin Resin, Recycled Resin), and By Application (Packaging, Automotive, Construction, Consumer Goods, Electrical & Electronics, Medical Devices, Textiles) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Plastic Resin Market, by Resin Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Polyethylene (PE) |

|

4.2. Polypropylene (PP) |

|

4.3. Polyvinyl Chloride (PVC) |

|

4.4. Polystyrene (PS) |

|

4.5. Polyethylene Terephthalate (PET) |

|

4.6. Acrylonitrile Butadiene Styrene (ABS) |

|

4.7. Polycarbonate (PC) |

|

4.8. Others |

|

5. Plastic Resin Market, by Form (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Virgin Resin |

|

5.2. Recycled Resin |

|

6. Plastic Resin Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Packaging |

|

6.2. Automotive |

|

6.3. Construction |

|

6.4. Consumer Goods |

|

6.5. Electrical & Electronics |

|

6.6. Medical Devices |

|

6.7. Textiles |

|

6.8. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Plastic Resin Market, by Resin Type |

|

7.2.7. North America Plastic Resin Market, by Form |

|

7.2.8. North America Plastic Resin Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Plastic Resin Market, by Resin Type |

|

7.2.9.1.2. US Plastic Resin Market, by Form |

|

7.2.9.1.3. US Plastic Resin Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BASF |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Arkema |

|

9.3. Chevron Phillips Chemical |

|

9.4. Covestro |

|

9.5. Dow |

|

9.6. DuPont |

|

9.7. Eastman |

|

9.8. Evonik |

|

9.9. ExxonMobil |

|

9.10. Formosa |

|

9.11. INEOS |

|

9.12. LG Chem |

|

9.13. LyondellBasell |

|

9.14. SABIC |

|

9.15. TotalEnergies |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Plastic Resin Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Plastic Resin Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Plastic Resin ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Plastic Resin Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA