As per Intent Market Research, the Plant Based Milk Market was valued at USD 20.2 billion in 2023 and will surpass USD 40.1 billion by 2030; growing at a CAGR of 10.3% during 2024 - 2030.

The plant-based milk market has seen rapid growth as consumers increasingly embrace dairy alternatives for various reasons, including lactose intolerance, veganism, and concerns over health and environmental sustainability. This shift in consumer preferences has led to a surge in demand for plant-based milk products, ranging from almond milk to oat milk and soy milk. Plant-based milk is now a mainstream alternative to traditional dairy, providing a nutritious, lactose-free option for individuals seeking to reduce their animal-based product consumption. The variety in flavors, fortification options, and different base ingredients has further fueled the market's expansion, appealing to a broader range of consumers across different age groups and dietary needs.

The market is also driven by innovations in plant-based milk production, with manufacturers focusing on improving taste, texture, and nutritional content to meet consumer expectations. Additionally, the rising awareness of the environmental benefits of plant-based diets, including lower carbon footprints and reduced water usage compared to dairy farming, is accelerating the adoption of plant-based milk across the globe. As more consumers make conscious choices about their food and beverage intake, the demand for plant-based milk is expected to continue to grow, with new product offerings further expanding the market's potential.

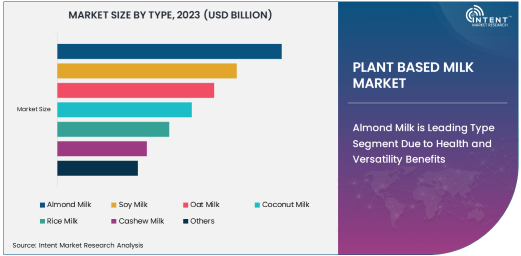

Almond Milk is Leading Type Segment Due to Health and Versatility Benefits

Almond milk is the leading type in the plant-based milk market, attributed to its versatility, mild taste, and health benefits. Almond milk is naturally low in calories, rich in vitamins, and a good source of healthy fats, making it a popular choice for those looking to reduce their calorie intake or maintain a heart-healthy diet. Its neutral flavor makes it suitable for a wide range of culinary applications, from smoothies to baked goods, which further contributes to its widespread adoption. Additionally, the increasing awareness of almond milk’s nutritional content, which often includes added vitamins and minerals like calcium and vitamin E, has contributed to its prominence in the market.

Almond milk’s growth has been accelerated by its increasing availability in supermarkets and online platforms, with many consumers opting for it as a healthier, dairy-free alternative. The ongoing expansion of almond milk varieties, such as sweetened, unsweetened, and flavored options, has helped cater to diverse consumer tastes. As a result, almond milk remains a dominant player in the plant-based milk market, enjoying both broad consumer acceptance and a growing product base.

Oat Milk is Fastest Growing Type Segment Due to Taste and Sustainability Factors

Oat milk is the fastest growing type segment in the plant-based milk market, driven by its creamy texture, naturally sweet flavor, and sustainability benefits. Oat milk has emerged as a popular choice among consumers who seek a dairy alternative that offers a similar mouthfeel to cow’s milk, particularly in coffee and lattes. Its naturally sweet and mild flavor profile has contributed to its popularity, especially in cafes and coffee shops, where it is increasingly used as a dairy alternative for specialty drinks. Furthermore, oat milk’s appeal lies in its environmentally friendly production process, as oats require fewer resources, such as water and land, compared to other plant-based milk sources, making it a more sustainable option.

The rising preference for oat milk can also be linked to its nutritional benefits, as it is often fortified with vitamins, minerals, and fiber, offering a nutrient-dense alternative to traditional dairy milk. As more consumers become aware of its health and environmental benefits, oat milk is expected to continue its rapid growth in the coming years, further solidifying its place in the plant-based milk market.

Original Flavor Profile is Dominant Due to Versatility and Minimal Additives

The original flavor profile is the most dominant in the plant-based milk market, as it provides a neutral taste that can be easily incorporated into a variety of applications without overwhelming the flavors of other ingredients. Original-flavored plant-based milks are typically unsweetened, making them suitable for both savory and sweet dishes, from smoothies to cooking and baking. The minimalist nature of the original flavor appeals to consumers looking for a simple, clean product that doesn’t contain unnecessary additives or excessive sugars. This demand for basic, versatile plant-based milk options has helped the original flavor segment remain the leading choice for many consumers.

Moreover, many health-conscious consumers prefer the original flavor due to its lower sugar content compared to flavored alternatives. The growing trend towards low-sugar and natural food options further supports the dominance of the original flavor in the market. As more consumers seek healthier alternatives, the preference for unsweetened, original-flavored plant-based milk is expected to continue to drive market growth.

Calcium-Fortified Plant-Based Milk is Fastest Growing Due to Health and Nutritional Benefits

The calcium-fortified segment is the fastest growing in the plant-based milk market, driven by increasing consumer demand for products that support bone health and overall nutritional needs. Many plant-based milk options, including almond, soy, and oat milk, are fortified with calcium to offer a comparable benefit to traditional dairy milk. As consumers become more conscious of their dietary requirements, especially in relation to bone health, the availability of fortified plant-based milks that offer essential nutrients like calcium has gained significant traction. This trend is particularly relevant for those who avoid dairy products due to lactose intolerance, dietary restrictions, or vegan lifestyles.

Calcium-fortified plant-based milks are positioned as a nutritious and convenient alternative, offering consumers the benefit of essential vitamins and minerals while maintaining the core advantages of plant-based products. The rising awareness of bone health and the importance of calcium in preventing osteoporosis is likely to continue driving the demand for calcium-fortified plant-based milk in the years to come.

Food and Beverages is the Largest End-Use Industry Due to Widespread Consumer Adoption

The food and beverages industry is the largest end-use sector for plant-based milk, driven by the widespread adoption of plant-based milk alternatives across various consumer segments. The versatility of plant-based milks allows them to be used in a wide range of food and beverage products, including smoothies, baked goods, cereals, ice cream, and coffee. This has contributed to the growing integration of plant-based milks into mainstream food products, as manufacturers look to cater to the increasing demand for dairy alternatives.

Additionally, the food and beverages industry benefits from the growing number of consumers who are transitioning to plant-based diets or reducing their dairy intake due to health, ethical, or environmental concerns. As this trend continues, the food and beverages sector is expected to remain the largest end-use industry for plant-based milk, offering a broad range of opportunities for growth and innovation.

Asia Pacific is Fastest Growing Region Due to Rising Health Consciousness and Vegan Trends

The Asia Pacific region is the fastest growing in the plant-based milk market, driven by increasing health consciousness, the rise of veganism, and the growing popularity of plant-based diets. Countries such as China, India, Japan, and Australia are witnessing a surge in demand for plant-based milk as consumers seek dairy alternatives due to lactose intolerance, ethical concerns, and health benefits. In particular, the younger population in these countries is increasingly adopting plant-based diets, influencing the growth of plant-based milk products.

Additionally, the increasing availability of plant-based milk in supermarkets, health food stores, and online platforms in Asia Pacific is further contributing to market growth. As consumers become more educated about the benefits of plant-based diets and plant-based milk alternatives, the demand for these products is expected to rise significantly in the region, making Asia Pacific a key area for future market expansion.

Competitive Landscape and Leading Companies

The plant-based milk market is highly competitive, with numerous key players actively expanding their product portfolios and innovating to meet the growing demand for dairy alternatives. Leading companies in the market include Califia Farms, Danone (Silk), Oatly, Alpro (part of Danone), and Califia Farms. These companies are focusing on offering a wide range of plant-based milk options, including fortified versions, flavored options, and unique ingredients, to cater to the diverse needs of consumers.

The competitive landscape is marked by continuous product innovation, as companies strive to improve the taste, nutritional value, and sustainability of their offerings. As the market for plant-based milk continues to expand, companies will likely continue to focus on marketing strategies, packaging innovations, and expanding their distribution networks to stay competitive in this rapidly growing market.

Recent Developments:

- In November 2024, Oatly launched a new line of oat-based milk with added protein and vitamins to target the growing demand for fortified dairy alternatives.

- In October 2024, Danone expanded its plant-based milk portfolio by introducing a new almond milk product fortified with calcium and vitamin D.

- In September 2024, Califia Farms announced the launch of a new flavored oat milk line, including vanilla and chocolate options.

- In August 2024, Nestlé launched a new coconut milk-based drink targeting health-conscious consumers seeking dairy-free beverages.

- In July 2024, Silk unveiled a new range of plant-based milk fortified with additional protein to appeal to athletes and fitness enthusiasts.

List of Leading Companies:

- Danone S.A.

- Oatly

- Califia Farms

- Nestlé S.A.

- The Hain Celestial Group, Inc.

- Blue Diamond Growers

- Ripple Foods

- Earth’s Own Food Company

- Vita Coco

- Mooala

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 20.2 billion |

|

Forecasted Value (2030) |

USD 40.1 billion |

|

CAGR (2024 – 2030) |

10.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Plant Based Milk Market By Type (Almond Milk, Soy Milk, Oat Milk, Coconut Milk, Rice Milk, Cashew Milk), By Flavor Profile (Original, Vanilla, Chocolate, Sweetened, Unsweetened), By Fortification (Calcium-Fortified, Vitamin D-Fortified, Protein-Fortified), By End-Use Industry (Food and Beverages, Dairy Alternatives, Nutritional Supplements, Cosmetics and Personal Care) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Danone S.A., Oatly, Califia Farms, Nestlé S.A., The Hain Celestial Group, Inc., Blue Diamond Growers, Ripple Foods, Earth’s Own Food Company, Vita Coco, Mooala, , , , , |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Plant Based Milk Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Almond Milk |

|

4.2. Soy Milk |

|

4.3. Oat Milk |

|

4.4. Coconut Milk |

|

4.5. Rice Milk |

|

4.6. Cashew Milk |

|

4.7. Others |

|

5. Plant Based Milk Market, by Flavor Profile (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Original |

|

5.2. Vanilla |

|

5.3. Chocolate |

|

5.4. Sweetened |

|

5.5. Unsweetened |

|

6. Plant Based Milk Market, by Fortification (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Calcium-Fortified |

|

6.2. Vitamin D-Fortified |

|

6.3. Protein-Fortified |

|

6.4. Others |

|

7. Plant Based Milk Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Food and Beverages |

|

7.2. Dairy Alternatives |

|

7.3. Nutritional Supplements |

|

7.4. Cosmetics and Personal Care |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Plant Based Milk Market, by Type |

|

8.2.7. North America Plant Based Milk Market, by Flavor Profile |

|

8.2.8. North America Plant Based Milk Market, by Fortification |

|

8.2.9. North America Plant Based Milk Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Plant Based Milk Market, by Type |

|

8.2.10.1.2. US Plant Based Milk Market, by Flavor Profile |

|

8.2.10.1.3. US Plant Based Milk Market, by Fortification |

|

8.2.10.1.4. US Plant Based Milk Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Danone S.A. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Oatly |

|

10.3. Califia Farms |

|

10.4. Nestlé S.A. |

|

10.5. The Hain Celestial Group, Inc. |

|

10.6. Blue Diamond Growers |

|

10.7. Ripple Foods |

|

10.8. Earth’s Own Food Company |

|

10.9. Vita Coco |

|

10.10. Mooala |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Plant Based Milk Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Plant Based Milk Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Plant Based Milk Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA