As per Intent Market Research, the Plant-Based Butter Market was valued at USD 2.3 billion in 2023 and will surpass USD 3.5 billion by 2030; growing at a CAGR of 6.3% during 2024 - 2030.

The plant-based butter market has witnessed significant growth in recent years as consumers increasingly opt for dairy-free alternatives due to health, ethical, and environmental concerns. The demand for plant-based products has intensified as more people adopt vegan, lactose-free, and vegetarian diets. This trend is supported by a growing awareness of the health benefits associated with plant-based eating, including lower cholesterol and saturated fat intake. With innovations in flavor, texture, and quality, plant-based butter has become a staple in households, foodservice industries, and commercial kitchens. The market is projected to expand further as dietary preferences continue to shift and more plant-based options become available.

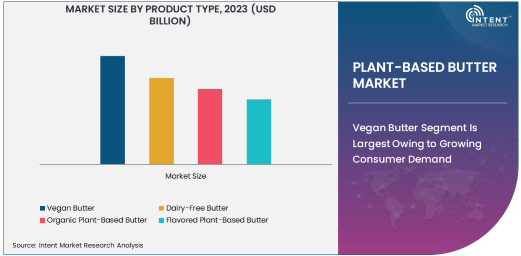

Vegan Butter Segment Is Largest Owing to Growing Consumer Demand

The vegan butter segment dominates the plant-based butter market, driven by the rapid growth of veganism and an increasing number of consumers avoiding dairy products. Vegan butter is made entirely from plant-based ingredients, such as oils, and is free from dairy, making it a popular choice among vegans, lactose-intolerant individuals, and health-conscious consumers. As veganism continues to gain popularity worldwide, the demand for dairy-free alternatives has surged, positioning vegan butter as the largest subsegment. Major food manufacturers are responding to this trend by diversifying their product ranges with more vegan butter options, further expanding the market's reach.

The growth of the vegan butter subsegment is also fueled by its versatility in culinary applications, from spreads to baking and cooking. Many brands now offer vegan butter in a variety of flavors, mimicking the taste and texture of traditional butter. This increases its appeal to a wider consumer base, including those who may not strictly follow a vegan diet but are looking to reduce their dairy consumption. As the acceptance of plant-based diets continues to rise, the vegan butter segment is expected to maintain its leading position in the market.

Soy-Based Butter Segment Is Fastest Growing Due to High Availability and Affordability

Among the various plant-based butter sources, soy-based butter is the fastest-growing subsegment. Soy is one of the most widely used ingredients for plant-based alternatives due to its cost-effectiveness, availability, and nutritional benefits. Soy-based butter is rich in protein and healthy fats, making it an appealing choice for consumers looking for a nutritious alternative to dairy butter. Additionally, soybeans are a major crop in many regions, making soy-based butter affordable and easy to produce, contributing to its rapid market adoption.

Soy-based butter also benefits from its compatibility with a variety of culinary applications, such as baking, cooking, and spreading. With the growing trend of plant-based eating, soy-based butter is gaining popularity in both households and foodservice settings. The versatility of soy as a raw material for butter alternatives positions it as a key player in the expanding plant-based butter market. As consumer awareness about the benefits of soy increases, this segment is expected to continue its rapid growth trajectory.

Food Service Industry End-Use Is Largest Due to Rising Demand for Plant-Based Options

The food service industry is the largest end-use segment for plant-based butter, driven by the increasing demand for plant-based menu options in restaurants, cafes, and fast food chains. As consumers become more health-conscious and environmentally aware, they seek out vegan and dairy-free choices when dining out. This shift in consumer preferences has prompted many food service providers to incorporate plant-based butter into their menus, offering alternatives for cooking, baking, and spreading. The rise in plant-based eating habits, combined with the proliferation of plant-based food options in restaurants, has significantly boosted the demand for plant-based butter in the food service industry.

The growing popularity of plant-based diets and the rise of vegan and vegetarian restaurants have made plant-based butter a staple ingredient in many food establishments. Additionally, fast food chains and cafes are increasingly offering dairy-free menu options, further increasing the demand for plant-based butter. This trend is expected to continue as more consumers embrace plant-based living, making the food service industry the largest and most influential end-user segment for plant-based butter.

Stick Packaging Type Is Most Common Due to Consumer Preferences for Convenience

The stick packaging type is the most common form for plant-based butter, as it offers convenience, portability, and ease of use for consumers. Stick packaging allows consumers to easily measure and apply the butter, making it ideal for baking, cooking, and spreading. The segment benefits from the preference for standard butter formats, which are commonly used in households and foodservice applications. Stick packaging is also more familiar to consumers, as it mirrors the traditional butter format, aiding in the transition to plant-based options.

This packaging format provides added convenience for consumers who wish to use plant-based butter in everyday cooking or baking. Stick packaging is also relatively easy to store and has a longer shelf life, making it a popular choice among manufacturers and consumers alike. The stick packaging segment is anticipated to continue to lead the market as it aligns with consumer preferences for ease of use and familiarity in plant-based butter products.

Supermarkets/Hypermarkets Distribution Channel Is Largest Due to Wide Accessibility

The supermarkets and hypermarkets distribution channel is the largest segment in the plant-based butter market, owing to their wide accessibility, convenience, and variety of products. These retail stores serve as one of the primary points of purchase for plant-based butter, as consumers prefer shopping at large retail outlets where they can find a variety of plant-based food options, including butter alternatives. Additionally, supermarkets and hypermarkets offer competitive pricing and promotional deals, which further attract consumers to purchase plant-based butter in bulk.

With the increasing availability of plant-based products in mainstream supermarkets and hypermarkets, the segment is expected to maintain its dominance. These retail outlets are also capitalizing on the growing demand for plant-based products by expanding their plant-based offerings, attracting a broader consumer base. The convenience and accessibility of supermarkets and hypermarkets make them a key channel for distributing plant-based butter, positioning this segment as the largest in the market.

North America Is the Largest Region Due to High Consumer Adoption of Plant-Based Diets

North America remains the largest region in the plant-based butter market, driven by the high adoption rate of plant-based diets, particularly in the United States and Canada. The region has seen a significant increase in vegan and dairy-free product consumption, aided by rising health-consciousness, environmental concerns, and ethical considerations regarding animal welfare. The growing trend of plant-based eating, combined with the increasing number of restaurants offering vegan and dairy-free options, has led to a surge in demand for plant-based butter.

North America also boasts a well-established retail infrastructure, with supermarkets, hypermarkets, and e-commerce platforms providing easy access to plant-based butter products. The region's progressive stance on health and sustainability, along with increasing consumer awareness, is expected to drive continued growth in the plant-based butter market in the coming years. North America is expected to maintain its position as the largest market, with further innovations in plant-based products fueling continued consumer adoption.

Competitive Landscape and Leading Companies

The plant-based butter market is highly competitive, with several prominent players leading the industry. Companies such as Miyoko's Creamery, Earth Balance (Conagra Brands), Upfield (Flora Plant-Based), and Oatly Group are at the forefront of product innovation, offering a wide range of plant-based butter options. These companies are leveraging advancements in food technology to improve the taste, texture, and nutritional profiles of their products, meeting the demands of health-conscious and environmentally aware consumers.

The competitive landscape is also marked by strategic mergers, acquisitions, and partnerships aimed at expanding product portfolios and increasing market reach. As competition intensifies, companies are focusing on differentiation through unique product offerings, such as organic, flavored, and regional plant-based butter variants. The rise in consumer demand for plant-based products will continue to drive innovation and competition in the market, with companies striving to capture a larger share of the growing plant-based butter segment.

Recent Developments:

- Miyoko's Creamery launched a new line of organic, dairy-free butter alternatives to cater to the growing demand for premium plant-based products.

- Oatly Group expanded its product range with a new oat-based butter, capitalizing on the popularity of oats in plant-based diets.

- Unilever (I Can't Believe It's Not Butter) has committed to using more sustainable palm oil in their plant-based butter products to align with environmental goals.

- Conagra Brands (Earth Balance) introduced a new flavored plant-based butter spread to cater to the expanding demand for plant-based innovation in culinary applications.

- (Flora Plant-Based) has acquired a new facility in the U.S. to increase production of plant-based spreads in response to growing consumer demand for plant-based alternatives.

List of Leading Companies:

- Earth Balance (Conagra Brands)

- Miyoko's Creamery

- Oatly Group

- Flora Plant-Based

- Violife Foods

- Kite Hill

- Nutiva

- Pure Blends

- Country Crock (Upfield)

- I Can't Believe It's Not Butter! (Unilever)

- Rebel Kitchen

- The Vegan Warehouse

- Chobani (Plant-Based Butter)

- Treeline Cheese

- Nutolea

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.3 Billion |

|

Forecasted Value (2030) |

USD 3.5 Billion |

|

CAGR (2024 – 2030) |

6.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Plant-Based Butter Market By Product Type (Vegan Butter, Dairy-Free Butter, Organic Plant-Based Butter, Flavored Plant-Based Butter), By Source (Soy-Based Butter, Almond-Based Butter, Coconut-Based Butter, Cashew-Based Butter, Other Plant-Based Sources), By End-Use (Household, Food Service Industry, Bakery & Confectionery, Fast Food Chains), By Packaging Type (Stick, Tub, Spreadable, Block), By Distribution Channel (Online, Supermarkets/Hypermarkets, Health Food Stores, Convenience Stores, Specialty Stores) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Earth Balance (Conagra Brands), Miyoko's Creamery, Oatly Group, Flora Plant-Based, Violife Foods, Kite Hill, Nutiva, Pure Blends, Country Crock (Upfield), I Can't Believe It's Not Butter! (Unilever), Rebel Kitchen, The Vegan Warehouse, Chobani (Plant-Based Butter), Treeline Cheese, Nutolea |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Plant-Based Butter Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Vegan Butter |

|

4.2. Dairy-Free Butter |

|

4.3. Organic Plant-Based Butter |

|

4.4. Flavored Plant-Based Butter |

|

5. Plant-Based Butter Market, by Source (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Soy-Based Butter |

|

5.2. Almond-Based Butter |

|

5.3. Coconut-Based Butter |

|

5.4. Cashew-Based Butter |

|

5.5. Other Plant-Based Sources |

|

6. Plant-Based Butter Market, by End-Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Household |

|

6.2. Food Service Industry |

|

6.3. Bakery & Confectionery |

|

6.4. Fast Food Chains |

|

6.5. Others |

|

7. Plant-Based Butter Market, by Packaging Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Stick |

|

7.2. Tub |

|

7.3. Spreadable |

|

7.4. Block |

|

7.5. Others |

|

8. Plant-Based Butter Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Online |

|

8.2. Supermarkets/Hypermarkets |

|

8.3. Health Food Stores |

|

8.4. Convenience Stores |

|

8.5. Specialty Stores |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Plant-Based Butter Market, by Product Type |

|

9.2.7. North America Plant-Based Butter Market, by Source |

|

9.2.8. North America Plant-Based Butter Market, by End-Use |

|

9.2.9. North America Plant-Based Butter Market, by Packaging Type |

|

9.2.10. North America Plant-Based Butter Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Plant-Based Butter Market, by Product Type |

|

9.2.11.1.2. US Plant-Based Butter Market, by Source |

|

9.2.11.1.3. US Plant-Based Butter Market, by End-Use |

|

9.2.11.1.4. US Plant-Based Butter Market, by Packaging Type |

|

9.2.11.1.5. US Plant-Based Butter Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Earth Balance (Conagra Brands) |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Miyoko's Creamery |

|

11.3. Oatly Group |

|

11.4. Flora Plant-Based |

|

11.5. Violife Foods |

|

11.6. Kite Hill |

|

11.7. Nutiva |

|

11.8. Pure Blends |

|

11.9. Country Crock (Upfield) |

|

11.10. I Can't Believe It's Not Butter! (Unilever) |

|

11.11. Rebel Kitchen |

|

11.12. The Vegan Warehouse |

|

11.13. Chobani (Plant-Based Butter) |

|

11.14. Treeline Cheese |

|

11.15. Nutolea |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Plant-Based Butter Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Plant-Based Butter Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Plant-Based Butter Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA