As per Intent Market Research, the Photoacoustic Imaging Market was valued at USD 152.2 Million in 2024-e and will surpass USD 398.1 Million by 2030; growing at a CAGR of 17.4% during 2025-2030.

The photoacoustic imaging market is poised for significant growth, driven by its ability to combine the advantages of optical and ultrasound imaging technologies. This hybrid modality offers superior resolution and penetration depth, making it a valuable tool in various diagnostic and research applications. The growing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is propelling the adoption of photoacoustic imaging across the healthcare sector. Moreover, technological advancements and increased investment in research and development are broadening its application scope.

The market is segmented by product type, technology, application, and end-user, each contributing to the diverse utility of photoacoustic imaging systems. Among these, optical-resolution photoacoustic imaging (OR-PAI) and imaging systems dominate due to their superior performance and adaptability to a wide range of clinical and research settings.

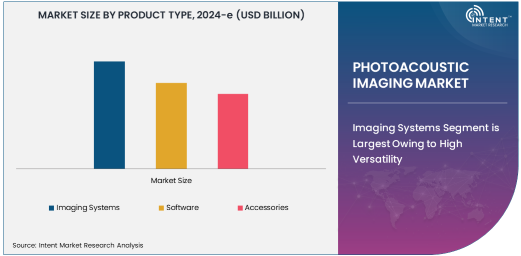

Imaging Systems Segment is Largest Owing to High Versatility

Imaging systems hold the largest share in the photoacoustic imaging market, owing to their high versatility and adoption in both clinical and preclinical applications. These systems are extensively used in oncology diagnostics, cardiovascular imaging, and neurological disorder research. Their ability to deliver real-time, high-resolution images with deep tissue penetration has made them indispensable in early disease detection and monitoring.

The increasing deployment of imaging systems in hospitals, diagnostic centers, and research laboratories underscores their critical role in improving diagnostic accuracy and patient outcomes. As healthcare providers prioritize advanced diagnostic tools, the demand for photoacoustic imaging systems is expected to remain robust.

Optical-Resolution Photoacoustic Imaging (OR-PAI) is Fastest Growing Due to Superior Resolution

The optical-resolution photoacoustic imaging (OR-PAI) segment is experiencing rapid growth, driven by its ability to provide high-resolution images at a microscopic level. OR-PAI is particularly valuable in oncology and neurological research, where precise visualization of microvascular structures is essential. This technology’s ability to differentiate between oxygenated and deoxygenated blood further enhances its utility in tumor detection and monitoring.

The adoption of OR-PAI is being fueled by advancements in laser technology and the increasing integration of artificial intelligence for image analysis. As precision medicine and personalized healthcare gain traction, OR-PAI is expected to emerge as a cornerstone technology for cutting-edge diagnostics and research.

Oncology Diagnostics Segment is Largest Due to Rising Cancer Prevalence

Oncology diagnostics is the largest application segment in the photoacoustic imaging market, attributed to the growing global burden of cancer. Photoacoustic imaging's capability to detect tumors in their early stages by visualizing tumor vasculature and hypoxia has made it a game-changer in oncology diagnostics. This non-invasive technique not only aids in early detection but also in monitoring treatment efficacy, particularly in chemotherapy and radiotherapy.

The integration of photoacoustic imaging with other modalities like MRI and CT further enhances its diagnostic potential. With increasing investments in cancer research and a growing focus on early disease detection, the oncology diagnostics segment is expected to maintain its dominance.

Research Laboratories are Fastest Growing Due to Rising R&D Investments

The research laboratories segment is witnessing the fastest growth among end-users, driven by escalating investments in preclinical and translational research. Photoacoustic imaging is increasingly being utilized in drug discovery, biomedical research, and studies involving complex biological processes. Its ability to provide detailed insights into tissue physiology and molecular interactions has made it indispensable for researchers.

Collaborations between academic institutions and industry players are further fostering innovation in this space. As governments and private organizations continue to fund advanced imaging research, the adoption of photoacoustic imaging in laboratories is set to grow exponentially.

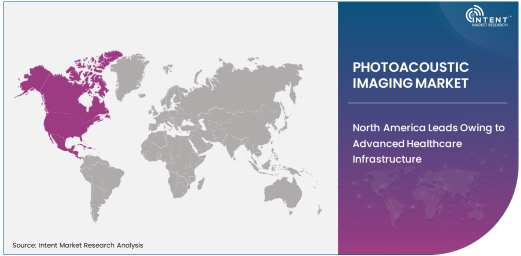

North America Leads Owing to Advanced Healthcare Infrastructure

North America is the largest market for photoacoustic imaging, primarily due to its advanced healthcare infrastructure and high investment in medical technology research. The region’s strong focus on early disease detection and precision medicine has driven the adoption of innovative imaging modalities like photoacoustic imaging. Additionally, the presence of key market players and extensive funding for oncology and cardiovascular research further contribute to the market's growth in this region.

The United States, in particular, is at the forefront, with a significant number of research institutions and diagnostic centers adopting this technology. As healthcare providers in North America continue to embrace advanced diagnostic tools, the region’s leadership in the market is expected to persist.

Competitive Landscape: Innovations Driving Market Growth

The photoacoustic imaging market is characterized by intense competition, with leading companies such as FUJIFILM VisualSonics, iThera Medical, and Canon Medical Systems driving innovation. These players are focusing on developing next-generation imaging systems with enhanced resolution, deeper penetration, and user-friendly interfaces. Collaborations with research institutions and hospitals are enabling companies to expand their product offerings and application scope.

The market is also witnessing the emergence of startups specializing in niche applications of photoacoustic imaging, further intensifying competition. As technological advancements continue to redefine imaging capabilities, companies are investing heavily in R&D to maintain a competitive edge in this dynamic market.

Recent Developments:

- Fujifilm VisualSonics Inc. launched an advanced photoacoustic imaging system for oncology diagnostics.

- Endra Life Sciences Inc. expanded its partnership with research institutions to develop new imaging solutions.

- iThera Medical GmbH introduced a compact hybrid imaging system for clinical applications.

- Siemens Healthineers AG announced the integration of AI in their photoacoustic imaging systems.

- Seno Medical Instruments, Inc. developed an AI-enabled photoacoustic imaging platform for breast cancer diagnostics.

List of Leading Companies:

- Fujifilm VisualSonics Inc.

- Canon Medical Systems Corporation

- Hitachi, Ltd.

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Seno Medical Instruments, Inc.

- Endra Life Sciences Inc.

- iThera Medical GmbH

- Kibero GmbH

- TomoWave Laboratories

- Advantest Corporation

- Vibronix, Inc.

- CIRS (Computerized Imaging Reference Systems, Inc.)

- Sonic Concepts, Inc.

- Visualsonics, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 152.2 Million |

|

Forecasted Value (2030) |

USD 398.1 Million |

|

CAGR (2025 – 2030) |

17.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Photoacoustic Imaging Market By Product Type (Imaging Systems, Software, Accessories), By Technology (Optical-Resolution Photoacoustic Imaging (OR-PAI), Acoustic-Resolution Photoacoustic Imaging (AR-PAI)), By Application (Oncology Diagnostics, Cardiovascular Diagnostics, Neurological Disorders, Drug Discovery), By End-User (Hospitals, Research Laboratories, Diagnostic Centers, Academic & Research Institutions) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Fujifilm VisualSonics Inc., Canon Medical Systems Corporation, Hitachi, Ltd., Siemens Healthineers AG, Koninklijke Philips N.V., Seno Medical Instruments, Inc., Endra Life Sciences Inc., iThera Medical GmbH, Kibero GmbH, TomoWave Laboratories, Advantest Corporation, Vibronix, Inc., CIRS (Computerized Imaging Reference Systems, Inc.), Sonic Concepts, Inc., Visualsonics, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Photoacoustic Imaging Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Imaging Systems |

|

4.2. Software |

|

4.3. Accessories |

|

5. Photoacoustic Imaging Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Optical-Resolution Photoacoustic Imaging (OR-PAI) |

|

5.2. Acoustic-Resolution Photoacoustic Imaging (AR-PAI) |

|

5.3. Others |

|

6. Photoacoustic Imaging Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Oncology Diagnostics |

|

6.2. Cardiovascular Diagnostics |

|

6.3. Neurological Disorders |

|

6.4. Drug Discovery |

|

6.5. Others |

|

7. Photoacoustic Imaging Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Research Laboratories |

|

7.3. Diagnostic Centers |

|

7.4. Academic & Research Institutions |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Photoacoustic Imaging Market, by Product Type |

|

8.2.7. North America Photoacoustic Imaging Market, by Technology |

|

8.2.8. North America Photoacoustic Imaging Market, by Application |

|

8.2.9. North America Photoacoustic Imaging Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Photoacoustic Imaging Market, by Product Type |

|

8.2.10.1.2. US Photoacoustic Imaging Market, by Technology |

|

8.2.10.1.3. US Photoacoustic Imaging Market, by Application |

|

8.2.10.1.4. US Photoacoustic Imaging Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Fujifilm VisualSonics Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Canon Medical Systems Corporation |

|

10.3. Hitachi, Ltd. |

|

10.4. Siemens Healthineers AG |

|

10.5. Koninklijke Philips N.V. |

|

10.6. Seno Medical Instruments, Inc. |

|

10.7. Endra Life Sciences Inc. |

|

10.8. iThera Medical GmbH |

|

10.9. Kibero GmbH |

|

10.10. TomoWave Laboratories |

|

10.11. Advantest Corporation |

|

10.12. Vibronix, Inc. |

|

10.13. CIRS (Computerized Imaging Reference Systems, Inc.) |

|

10.14. Sonic Concepts, Inc. |

|

10.15. Visualsonics, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Photoacoustic Imaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Photoacoustic Imaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Photoacoustic Imaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA