As per Intent Market Research, the Phenoxyethanol Preservatives Market was valued at USD 194.8 Million in 2024-e and will surpass USD 469.5 Million by 2030; growing at a CAGR of 15.8% during 2025-2030.

The phenoxyethanol preservatives market has experienced significant growth due to the increasing demand for preservatives that offer effective antimicrobial properties, extended shelf life, and safety for various applications. Phenoxyethanol, a common preservative, is primarily used in cosmetics and personal care products, pharmaceuticals, food and beverages, and household and industrial products. This preservative is especially valued for its ability to prevent the growth of harmful microorganisms, ensuring the stability and longevity of products. As consumer awareness regarding product safety and quality continues to rise, the demand for phenoxyethanol as a preservative is expanding, driving its use across multiple industries.

Phenoxyethanol preservatives are gaining favor in the market due to their relatively low toxicity and ability to work effectively at low concentrations, which makes them an ideal choice for formulations requiring longer shelf lives without compromising safety. Both synthetic and natural variants of phenoxyethanol are used, depending on the target application and consumer preferences. The growth of organic and clean-label products is also shaping the demand for natural phenoxyethanol as an alternative to synthetic variants, especially in the cosmetics and personal care sector.

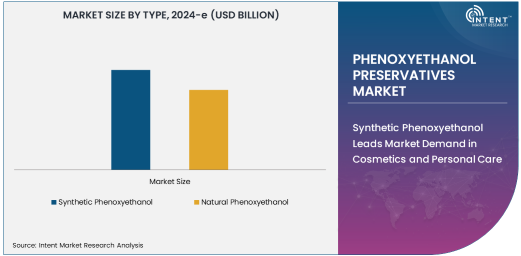

Synthetic Phenoxyethanol Leads Market Demand in Cosmetics and Personal Care

Synthetic phenoxyethanol is the largest segment in the phenoxyethanol preservatives market, particularly within the cosmetics and personal care industry. Synthetic phenoxyethanol is widely used as a preservative in skin care, hair care, and makeup products due to its efficacy in preventing bacterial and fungal contamination. It is also effective against a broad spectrum of microorganisms, which is crucial for the safety of cosmetic formulations that come into frequent contact with skin.

The continued rise of personal care products, coupled with a growing preference for longer-lasting, safe, and stable formulations, drives the demand for synthetic phenoxyethanol. Additionally, synthetic phenoxyethanol is more cost-effective than its natural counterpart, making it a popular choice for mass-produced cosmetics. As the cosmetics and personal care industry continues to grow globally, especially in emerging markets, the demand for synthetic phenoxyethanol as an essential preservative is projected to expand further.

Natural Phenoxyethanol Gaining Traction in Clean-Label Cosmetics

Natural phenoxyethanol is the fastest-growing segment in the phenoxyethanol preservatives market, particularly due to the increasing consumer demand for clean-label, organic, and eco-friendly products. Natural phenoxyethanol, derived from natural sources, appeals to health-conscious consumers who are seeking alternatives to synthetic chemicals. This shift towards natural preservatives aligns with the broader trend toward organic and cruelty-free personal care products, further boosting the market for natural phenoxyethanol.

In cosmetics and personal care, natural phenoxyethanol is becoming increasingly popular in high-end, organic skincare products, as it allows manufacturers to maintain a balance between product safety and consumer expectations for natural ingredients. Additionally, as regulations around product labeling and ingredient transparency continue to tighten globally, natural phenoxyethanol is gaining favor as a preservative that aligns with sustainability and natural wellness trends. This makes it one of the fastest-growing subsegments, particularly in premium skincare, baby care, and health-oriented beauty products.

Pharmaceuticals Sector Propels Phenoxyethanol Growth

The pharmaceuticals industry is a significant end-user of phenoxyethanol preservatives, particularly in injectable formulations, topical products, and certain over-the-counter medications. Phenoxyethanol's antimicrobial properties make it an ideal preservative in pharmaceutical products, ensuring their safety and extending their shelf life. It is commonly used in eye drops, nasal sprays, and vaccines, where contamination can lead to serious health risks. Given the critical need for safety in pharmaceutical formulations, phenoxyethanol remains a popular choice.

The pharmaceutical industry’s continued expansion, driven by increasing health awareness, aging populations, and greater access to healthcare, further supports the growth of phenoxyethanol in this sector. As regulatory standards continue to prioritize product safety, the demand for effective and safe preservatives like phenoxyethanol is likely to increase, contributing to its market growth.

Asia-Pacific Region to Dominate Phenoxyethanol Preservatives Market

Asia-Pacific is expected to be the largest and fastest-growing region in the phenoxyethanol preservatives market. This growth is driven by the increasing consumption of cosmetics and personal care products, particularly in countries like China, India, and Japan, where rising disposable incomes and changing consumer preferences are contributing to a burgeoning beauty and wellness market. Additionally, the expansion of the pharmaceutical industry in Asia-Pacific, fueled by the increasing healthcare needs of its growing population, further supports the demand for preservatives like phenoxyethanol.

In the cosmetics and personal care sector, the region is seeing a significant shift toward natural and organic products, boosting the demand for natural phenoxyethanol. Meanwhile, synthetic phenoxyethanol continues to dominate in mass-market personal care products due to its affordability and effectiveness. With rapid industrialization and the adoption of Western consumer trends, Asia-Pacific’s demand for phenoxyethanol preservatives is expected to continue rising, making it a key region in the global market.

Competitive Landscape: Leading Companies and Market Trends

The phenoxyethanol preservatives market is highly competitive, with key players continuously innovating to meet the evolving demands of various industries. Leading companies in the market include BASF SE, The Dow Chemical Company, Lonza Group, and Clariant International Ltd., which are at the forefront of product development, ensuring the supply of high-quality phenoxyethanol derivatives. These companies invest significantly in research and development to cater to the growing demand for natural and effective preservatives.

The market is characterized by a mix of established multinational corporations and specialized local players that focus on niche applications, particularly in the clean-label segment. Competitive strategies in the phenoxyethanol preservatives market include expanding product portfolios, forming strategic partnerships, and enhancing production capabilities to meet the growing global demand. As the consumer demand for safe, non-toxic, and sustainable ingredients continues to rise, leading companies are focusing on offering environmentally friendly and naturally derived preservative solutions, especially for the cosmetics and pharmaceutical industries.

Recent Developments:

- BASF SE launched a new line of preservatives with Phenoxyethanol as the key ingredient, enhancing product shelf-life in the cosmetic industry.

- Lonza Group expanded its production capacity for Phenoxyethanol to meet the rising demand from the personal care sector.

- Solvay SA introduced a sustainable Phenoxyethanol-based preservative solution that complies with global environmental standards.

- Clariant AG unveiled an innovative formulation using Phenoxyethanol that improves the stability of natural skincare products.

- Symrise AG announced a collaboration with leading cosmetic brands to provide preservative systems featuring Phenoxyethanol.

List of Leading Companies:

- BASF SE

- Dow Chemical Company

- Lonza Group

- Akema Fine Chemicals

- Clariant AG

- Solvay SA

- Vantage Specialty Chemicals

- Eastman Chemical Company

- Galaxy Surfactants Ltd.

- Lubrizol Corporation

- Symrise AG

- Innospec Inc.

- Zhejiang Realsun Chemical Co., Ltd.

- Shenzhen DBChem Co., Ltd.

- Ever Chemical (Shanghai) Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 194.8 Million |

|

Forecasted Value (2030) |

USD 469.5 Million |

|

CAGR (2025 – 2030) |

15.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Phenoxyethanol Preservatives Market By Type (Synthetic Phenoxyethanol, Natural Phenoxyethanol), By End-Use Application (Cosmetics and Personal Care, Pharmaceuticals, Food and Beverages, Household and Industrial Products) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Dow Chemical Company, Lonza Group, Akema Fine Chemicals, Clariant AG, Solvay SA, Vantage Specialty Chemicals, Eastman Chemical Company, Galaxy Surfactants Ltd., Lubrizol Corporation, Symrise AG, Innospec Inc., Zhejiang Realsun Chemical Co., Ltd., Shenzhen DBChem Co., Ltd., Ever Chemical (Shanghai) Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Phenoxyethanol Preservatives Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Synthetic Phenoxyethanol |

|

4.2. Natural Phenoxyethanol |

|

5. Phenoxyethanol Preservatives Market, by End-Use Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cosmetics and Personal Care |

|

5.2. Pharmaceuticals |

|

5.3. Food and Beverages |

|

5.4. Household and Industrial Products |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Phenoxyethanol Preservatives Market, by Type |

|

6.2.7. North America Phenoxyethanol Preservatives Market, by End-Use Application |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Phenoxyethanol Preservatives Market, by Type |

|

6.2.8.1.2. US Phenoxyethanol Preservatives Market, by End-Use Application |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. BASF SE |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. Dow Chemical Company |

|

8.3. Lonza Group |

|

8.4. Akema Fine Chemicals |

|

8.5. Clariant AG |

|

8.6. Solvay SA |

|

8.7. Vantage Specialty Chemicals |

|

8.8. Eastman Chemical Company |

|

8.9. Galaxy Surfactants Ltd. |

|

8.10. Lubrizol Corporation |

|

8.11. Symrise AG |

|

8.12. Innospec Inc. |

|

8.13. Zhejiang Realsun Chemical Co., Ltd. |

|

8.14. Shenzhen DBChem Co., Ltd. |

|

8.15. Ever Chemical (Shanghai) Co., Ltd. |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Phenoxyethanol Preservatives Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Phenoxyethanol Preservatives Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Phenoxyethanol Preservatives Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA