As per Intent Market Research, the Pharmaceutical Solvents Market was valued at USD 4.3 Billion in 2024-e and will surpass USD 6.8 Billion by 2030; growing at a CAGR of 8.0% during 2025 - 2030.

The pharmaceutical solvents market plays a crucial role in the formulation and production of various pharmaceutical products. Solvents are essential in drug formulation processes, helping dissolve, purify, and stabilize active pharmaceutical ingredients (APIs). These solvents facilitate the creation of liquid formulations, such as syrups, oral solutions, and injections, as well as play an integral part in the extraction and purification of medicinal compounds. As the demand for complex drug formulations, biologics, and advanced therapies increases, the role of pharmaceutical solvents becomes even more critical. With stringent regulatory requirements and increasing concerns over environmental impact, the market for pharmaceutical solvents is evolving to include more sustainable and specialized options.

The pharmaceutical solvents market is shaped by the growing demand for advanced drug delivery systems and the expanding range of pharmaceutical applications. The market is experiencing steady growth, driven by factors such as the rising prevalence of chronic diseases, an aging population, and continuous innovations in drug research and development. Furthermore, the shift towards more sustainable solvents that meet regulatory requirements, such as reduced toxicity and biodegradability, is expected to drive innovation and influence the market dynamics in the coming years.

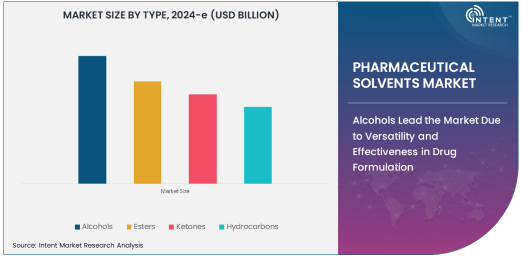

Alcohols Lead the Market Due to Versatility and Effectiveness in Drug Formulation

Alcohols are the largest segment in the pharmaceutical solvents market, primarily due to their versatility and effectiveness in a wide range of pharmaceutical applications. Alcohols such as ethanol and isopropanol are commonly used in drug formulation, extraction, and purification processes. Their solubility properties and ability to dissolve a variety of active ingredients make them indispensable in the production of oral solutions, injections, and syrups. In addition, alcohols are frequently used in the preparation of tinctures and as antiseptics in pharmaceutical products.

The demand for alcohol-based solvents is driven by their ability to provide consistent and reliable results in drug manufacturing. Alcohols are particularly favored in applications such as dissolution and solubilization, where they facilitate the dissolution of poorly soluble drugs, enhancing their bioavailability and efficacy. As pharmaceutical companies continue to focus on developing novel drug formulations and enhancing delivery systems, the use of alcohols as solvents is expected to remain a dominant and growing segment in the market.

Drug Formulation Drives the Largest Application of Pharmaceutical Solvents

Drug formulation is the largest application segment in the pharmaceutical solvents market, as solvents are integral to the creation of various dosage forms, including oral solutions, injectables, and topical formulations. Solvents are used to dissolve active pharmaceutical ingredients (APIs) and create stable, effective, and easily administered drugs. With the increasing demand for liquid formulations, especially in pediatric and geriatric populations, solvents play a pivotal role in enhancing drug efficacy and patient compliance.

Pharmaceutical manufacturers are constantly seeking solvents that can improve the solubility and bioavailability of drugs, particularly for poorly soluble compounds. As the pharmaceutical industry moves towards more personalized medicines and complex drug delivery systems, the need for effective drug formulation will continue to drive the demand for pharmaceutical solvents. Furthermore, advancements in solvent technology are expected to support innovations in formulation techniques, ensuring that drug products meet evolving regulatory standards and patient needs.

Pharmaceutical Manufacturers Dominate the End-Use Industry

Pharmaceutical manufacturers are the largest end-use industry for pharmaceutical solvents, driven by the continuous demand for new drug formulations, biologics, and advanced therapeutic products. These manufacturers utilize solvents in various stages of production, from drug synthesis and extraction to final formulation and packaging. The use of solvents is crucial in ensuring the proper dissolution of APIs and maintaining the stability and quality of the finished product.

As the pharmaceutical industry grows and diversifies, manufacturers are increasingly investing in new solvent technologies that offer greater efficiency, safety, and compliance with environmental regulations. The demand for high-quality pharmaceutical products, along with the need to streamline production processes and reduce costs, is expected to continue driving growth in the pharmaceutical solvents market. Pharmaceutical manufacturers are also placing greater emphasis on sustainability, seeking solvents that are less toxic and more biodegradable, which is further influencing market trends.

North America Leads the Market Due to Advanced Pharmaceutical Manufacturing

North America is the largest region in the pharmaceutical solvents market, driven by the region's well-established pharmaceutical industry and advanced manufacturing capabilities. The United States, in particular, is a key market for pharmaceutical solvents, as it is home to many global pharmaceutical companies that lead in drug development and production. The presence of large pharmaceutical manufacturers, coupled with robust research and development activities, makes North America a dominant region for the use of pharmaceutical solvents.

In addition to technological advancements and a strong regulatory framework, North America benefits from increasing investments in biologics, personalized medicine, and new drug delivery systems. The growing trend of sustainability and eco-friendly practices is also driving the development of more specialized solvents, which aligns with the region's focus on environmental impact. As pharmaceutical companies continue to innovate and adapt to changing market demands, North America's pharmaceutical solvents market is expected to remain at the forefront of global growth.

Competitive Landscape and Key Players

The pharmaceutical solvents market is highly competitive, with several key players dominating the industry. Leading companies in this market include BASF SE, Dow Inc., Solvay S.A., Merck & Co., and Evonik Industries AG. These companies focus on expanding their product portfolios through strategic mergers and acquisitions, as well as investing in research and development to innovate and provide sustainable solvent solutions.

The competitive landscape is characterized by a growing emphasis on environmentally friendly and sustainable solvents, as manufacturers are under increasing pressure to meet stringent regulatory standards and reduce their environmental footprint. Companies are also investing in advanced technologies to improve solvent performance and compatibility with newer drug formulations. With the pharmaceutical industry continually evolving, the competitive environment in the pharmaceutical solvents market will remain dynamic, with key players focusing on meeting the diverse needs of pharmaceutical manufacturers and enhancing product quality.

Recent Developments:

- BASF SE expanded its pharmaceutical solvent production facilities in Asia to cater to the increasing demand for drug formulation solutions in the region.

- Dow Inc. launched a new line of sustainable solvents, focusing on reducing environmental impact while maintaining performance in pharmaceutical applications.

- Evonik Industries AG introduced a new solvent-based solution for drug delivery systems, enhancing the solubility and bioavailability of certain pharmaceutical compounds.

- AkzoNobel N.V. partnered with a leading pharmaceutical manufacturer to provide specialized solvents for high-end drug formulation applications.

- Eastman Chemical Company expanded its pharmaceutical solvent portfolio, introducing new solvents for use in extraction and purification processes in drug manufacturing.

List of Leading Companies:

- BASF SE

- Dow Inc.

- Huntsman International LLC

- Solvay S.A.

- Merck & Co., Inc.

- AkzoNobel N.V.

- Eastman Chemical Company

- Evonik Industries AG

- SABIC

- LyondellBasell Industries N.V.

- Wacker Chemie AG

- ExxonMobil Corporation

- Lanxess AG

- Chevron Phillips Chemical Company LLC

- Royal Dutch Shell PLC

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.3 Billion |

|

Forecasted Value (2030) |

USD 6.8 Billion |

|

CAGR (2025 – 2030) |

8.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Pharmaceutical Solvents Market by Type (Alcohols, Esters, Ketones, Hydrocarbons, Water), by Application (Drug Formulation, Extraction and Purification, Dissolution and Solubilization), by End-Use Industry (Pharmaceutical Manufacturers, Contract Manufacturing Organizations (CMOs), Research and Development (R&D)); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Dow Inc., Huntsman International LLC, Solvay S.A., Merck & Co., Inc., AkzoNobel N.V., Evonik Industries AG, SABIC, LyondellBasell Industries N.V., Wacker Chemie AG, ExxonMobil Corporation, Lanxess AG, Royal Dutch Shell PLC |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Pharmaceutical Solvents Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Alcohols |

|

4.2. Esters |

|

4.3. Ketones |

|

4.4. Hydrocarbons |

|

4.5. Water |

|

5. Pharmaceutical Solvents Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Drug Formulation |

|

5.2. Extraction and Purification |

|

5.3. Dissolution and Solubilization |

|

6. Pharmaceutical Solvents Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Pharmaceutical Manufacturers |

|

6.2. Contract Manufacturing Organizations (CMOs) |

|

6.3. Research and Development (R&D) |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Pharmaceutical Solvents Market, by Type |

|

7.2.7. North America Pharmaceutical Solvents Market, by Application |

|

7.2.8. North America Pharmaceutical Solvents Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Pharmaceutical Solvents Market, by Type |

|

7.2.9.1.2. US Pharmaceutical Solvents Market, by Application |

|

7.2.9.1.3. US Pharmaceutical Solvents Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BASF SE |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Dow Inc. |

|

9.3. Huntsman International LLC |

|

9.4. Solvay S.A. |

|

9.5. Merck & Co., Inc. |

|

9.6. AkzoNobel N.V. |

|

9.7. Eastman Chemical Company |

|

9.8. Evonik Industries AG |

|

9.9. SABIC |

|

9.10. LyondellBasell Industries N.V. |

|

9.11. Wacker Chemie AG |

|

9.12. ExxonMobil Corporation |

|

9.13. Lanxess AG |

|

9.14. Chevron Phillips Chemical Company LLC |

|

9.15. Royal Dutch Shell PLC |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Pharmaceutical Solvents Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Pharmaceutical Solvents Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Pharmaceutical Solvents Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA