As per Intent Market Research, the Pharma 4.0 Market was valued at USD 11.9 Billion in 2024-e and will surpass USD 33.8 Billion by 2030; growing at a CAGR of 19.0% during 2025-2030.

Pharma 4.0 is reshaping the pharmaceutical industry by integrating advanced digital technologies to optimize production, improve regulatory compliance, and enhance drug development processes. This digital transformation in the pharmaceutical sector is driven by technologies such as artificial intelligence (AI), industrial IoT, blockchain, robotics, and more, collectively referred to as Pharma 4.0 technologies. The adoption of these technologies enables pharmaceutical companies to streamline operations, improve efficiency, and foster innovation in drug discovery and manufacturing.

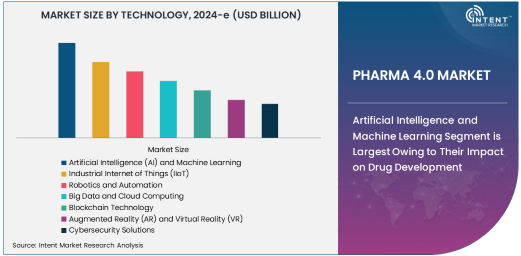

Artificial Intelligence and Machine Learning Segment is Largest Owing to Their Impact on Drug Development

Artificial Intelligence (AI) and Machine Learning (ML) are the driving forces behind the most significant advancements in Pharma 4.0. These technologies allow pharmaceutical companies to accelerate drug discovery, improve clinical trial processes, and optimize manufacturing operations. AI and ML algorithms enable the analysis of vast amounts of data, identifying potential drug candidates more efficiently and reducing the time and cost associated with traditional R&D methods. As a result, AI-driven solutions are the largest segment in the Pharma 4.0 market, with their widespread adoption across various stages of pharmaceutical production and drug development.

In drug discovery, AI can predict the efficacy and safety of new compounds, while ML models help in identifying biomarkers and designing patient-specific therapeutic regimens. These capabilities have transformed the pharmaceutical industry, enabling faster and more accurate drug development. AI and ML are expected to maintain their dominant position in the market, with a high growth trajectory driven by ongoing advancements in data analytics and computational models.

Drug Discovery and Development Application is Fastest Growing Owing to AI Integration

The drug discovery and development application is the fastest-growing segment within Pharma 4.0, largely due to the increasing integration of artificial intelligence and machine learning. AI-driven platforms are revolutionizing how new drugs are identified, tested, and brought to market. These technologies can process large datasets, including genomics and clinical trial data, to discover novel drug compounds and predict their success in clinical trials. As pharma companies aim to reduce the time and cost of drug discovery, AI and ML are becoming indispensable tools in the development of new therapeutic agents.

AI is also enabling precision medicine, where drugs are tailored to individual patient profiles based on their genetic makeup. This personalized approach improves the efficacy of treatments and reduces the likelihood of adverse reactions, thus further driving the demand for AI-powered drug discovery platforms. This segment is expected to continue its rapid growth as more pharmaceutical companies adopt AI solutions to speed up the development of new therapies.

Pharmaceutical Manufacturers are the Largest End-User Industry in Pharma 4.0

Pharmaceutical manufacturers constitute the largest end-user industry within the Pharma 4.0 market. These companies are at the forefront of adopting digital technologies to enhance manufacturing processes, improve quality control, and ensure compliance with regulatory standards. Automation, robotics, and AI technologies are widely used in pharmaceutical manufacturing to streamline production lines, optimize supply chains, and reduce operational costs. The use of these technologies not only increases production efficiency but also enhances product quality and consistency, which is crucial in the highly regulated pharmaceutical industry.

Pharmaceutical manufacturers are increasingly implementing smart manufacturing solutions, which include real-time monitoring of production processes and the use of digital twins for predictive maintenance. The integration of AI and IoT in manufacturing has enabled pharmaceutical companies to enhance manufacturing flexibility, reduce downtime, and ensure the timely delivery of high-quality products. As a result, pharmaceutical manufacturers are leading the adoption of Pharma 4.0 technologies, making them the largest end-user segment in this market.

Asia-Pacific is the Fastest Growing Region in the Pharma 4.0 Market

Asia-Pacific is the fastest growing region in the Pharma 4.0 market. The region's rapid adoption of digital technologies in manufacturing and drug development is driving the market's growth. Countries like China, India, and Japan are investing heavily in digital transformation to modernize their pharmaceutical industries and meet the growing demand for advanced healthcare solutions. With a large population base and a rising demand for healthcare, the Asia-Pacific region presents significant opportunities for Pharma 4.0 technologies, especially in drug discovery, personalized medicine, and manufacturing process automation.

The growing pharmaceutical industry in Asia-Pacific is also supported by favorable government policies and incentives that encourage the adoption of advanced technologies. Furthermore, the increasing presence of multinational pharmaceutical companies in the region has accelerated the pace of digital transformation. As a result, Asia-Pacific is projected to experience the highest growth rate in the Pharma 4.0 market, driven by technological advancements, regulatory changes, and increasing investments in healthcare infrastructure.

Competitive Landscape and Leading Companies in the Pharma 4.0 Market

The Pharma 4.0 market is highly competitive, with a mix of established players and new entrants innovating to provide advanced digital solutions for the pharmaceutical industry. Leading companies like Siemens AG, IBM Corporation, Rockwell Automation, and GE Healthcare are at the forefront of driving Pharma 4.0 adoption. These companies offer a wide range of solutions, including AI-powered platforms, IoT-based manufacturing systems, and blockchain-based supply chain management tools.

In addition to these industry giants, there are specialized players in Pharma 4.0, such as Dassault Systèmes, which focuses on digital manufacturing and simulation solutions, and Accenture, which provides consulting services for digital transformation in the pharmaceutical sector. The competitive landscape is marked by strategic partnerships, acquisitions, and collaborations, as companies seek to strengthen their portfolios and expand their market presence. As the Pharma 4.0 market continues to evolve, these companies are expected to lead the market with continuous innovation and expansion into emerging markets.

Recent Developments:

- Siemens AG announced the expansion of its Digital Enterprise Suite for the pharmaceutical industry, offering advanced automation solutions designed to help pharmaceutical manufacturers improve production efficiency and regulatory compliance.

- IBM Corporation has partnered with a leading pharmaceutical company to implement AI-based solutions for drug discovery, improving the speed and accuracy of identifying promising drug candidates.

- Rockwell Automation Inc. launched a new AI-driven software platform aimed at enhancing manufacturing process control, improving data integrity, and ensuring compliance in pharmaceutical manufacturing.

- Accenture acquired a digital transformation firm to strengthen its Pharma 4.0 portfolio, expanding its capabilities in supply chain optimization and smart manufacturing solutions for the pharmaceutical sector.

- GE Healthcare unveiled its new IoT-based medical device platform designed to improve supply chain visibility and enhance real-time monitoring for pharmaceutical manufacturers.

List of Leading Companies:

- Siemens AG

- IBM Corporation

- Rockwell Automation Inc.

- Dassault Systèmes

- GE Healthcare

- Accenture

- Honeywell International Inc.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Johnson & Johnson

- Medtronic PLC

- Novartis International AG

- Amgen Inc.

- Pfizer Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 11.9 Billion |

|

Forecasted Value (2030) |

USD 33.8 Billion |

|

CAGR (2025 – 2030) |

19.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Pharma 4.0 Market By Technology (Artificial Intelligence and Machine Learning, Industrial Internet of Things, Robotics and Automation, Big Data and Cloud Computing, Blockchain Technology, Augmented Reality and Virtual Reality, Cybersecurity Solutions), By Application (Drug Discovery and Development, Manufacturing Process Automation, Supply Chain Optimization, Quality Control and Compliance, Personalized Medicine, Regulatory Compliance and Reporting), By End-User Industry (Pharmaceutical Manufacturers, Biotech Companies, Contract Research Organizations, Contract Manufacturing Organizations, Research and Academic Institutions, Healthcare Providers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Siemens AG, IBM Corporation, Rockwell Automation Inc., Dassault Systèmes, GE Healthcare, Accenture, Honeywell International Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Johnson & Johnson, Medtronic PLC, Novartis International AG, Amgen Inc., Pfizer Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Pharma 4.0 Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Artificial Intelligence (AI) and Machine Learning |

|

4.2. Industrial Internet of Things (IIoT) |

|

4.3. Robotics and Automation |

|

4.4. Big Data and Cloud Computing |

|

4.5. Blockchain Technology |

|

4.6. Augmented Reality (AR) and Virtual Reality (VR) |

|

4.7. Cybersecurity Solutions |

|

5. Pharma 4.0 Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Drug Discovery and Development |

|

5.2. Manufacturing Process Automation |

|

5.3. Supply Chain Optimization |

|

5.4. Quality Control and Compliance |

|

5.5. Personalized Medicine |

|

5.6. Regulatory Compliance and Reporting |

|

6. Pharma 4.0 Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Pharmaceutical Manufacturers |

|

6.2. Biotech Companies |

|

6.3. Contract Research Organizations (CROs) |

|

6.4. Contract Manufacturing Organizations (CMOs) |

|

6.5. Research and Academic Institutions |

|

6.6. Healthcare Providers |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Pharma 4.0 Market, by Technology |

|

7.2.7. North America Pharma 4.0 Market, by Application |

|

7.2.8. North America Pharma 4.0 Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Pharma 4.0 Market, by Technology |

|

7.2.9.1.2. US Pharma 4.0 Market, by Application |

|

7.2.9.1.3. US Pharma 4.0 Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Siemens AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. IBM Corporation |

|

9.3. Rockwell Automation Inc. |

|

9.4. Dassault Systèmes |

|

9.5. GE Healthcare |

|

9.6. Accenture |

|

9.7. Honeywell International Inc. |

|

9.8. Microsoft Corporation |

|

9.9. Oracle Corporation |

|

9.10. SAP SE |

|

9.11. Johnson & Johnson |

|

9.12. Medtronic PLC |

|

9.13. Novartis International AG |

|

9.14. Amgen Inc. |

|

9.15. Pfizer Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Pharma 4.0 Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Pharma 4.0 Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Pharma 4.0 Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA