As per Intent Market Research, the Petroleum Market was valued at USD 4921.9 Billion in 2024-e and will surpass USD 6941.6 Billion by 2030; growing at a CAGR of 5.9% during 2025-2030.

The global petroleum market plays a vital role in driving economic growth, providing energy to industries, and fueling transportation worldwide. This market includes various products such as crude oil, natural gas liquids (NGLs), refined petroleum products, and petrochemical feedstocks. The demand for these products is closely tied to industrial growth, energy needs, and geopolitical factors, all influencing the supply chain and pricing. As global economies industrialize, especially in emerging markets, the demand for petroleum-based products continues to grow, ensuring the vitality of this sector. In this context, several subsegments within the petroleum market are poised for continued growth, including crude oil, refined products, and natural gas liquids.

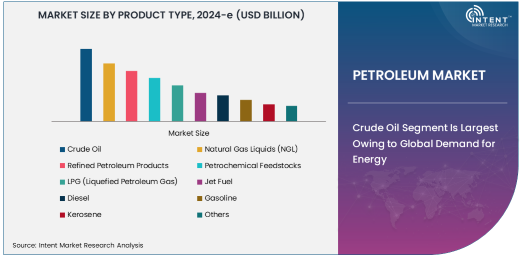

Crude Oil Segment Is Largest Owing to Global Demand for Energy

Crude oil has historically been the largest subsegment in the petroleum market due to its significance in global energy production. As the primary source of transportation fuels, industrial energy, and petrochemical feedstocks, crude oil remains essential in the world's energy mix. The market demand for crude oil remains robust, particularly in emerging economies such as China and India, where industrialization and rising population levels are driving energy consumption. Furthermore, geopolitical factors and supply constraints from major oil-producing regions contribute to fluctuations in prices, reinforcing the importance of crude oil in the global market.

The largest producers of crude oil include countries such as Saudi Arabia, the United States, and Russia, whose policies and production levels influence global oil markets. With ongoing advancements in drilling technology such as hydraulic fracturing and deepwater drilling, companies are able to access previously untapped oil reserves, further strengthening crude oil's dominance. Demand is expected to continue growing, albeit at a slower pace in developed nations due to increasing energy efficiency and renewable energy adoption.

Petrochemical Feedstocks Segment Is Fastest Growing Due to Industry Expansion

The petrochemical feedstocks segment is the fastest growing within the petroleum market, driven by the increasing demand for plastics, synthetic rubber, and other petrochemical products. This subsegment includes products like ethylene, propylene, benzene, and toluene, which serve as essential building blocks for a wide variety of industrial and consumer goods. As industries such as automotive, construction, and packaging continue to expand, so too does the demand for petrochemical feedstocks.

The rise of synthetic materials in various applications, including packaging, electronics, and medical supplies, is fueling the growth of this segment. Additionally, innovations in the petrochemical industry, such as the development of bioplastics and the use of more sustainable feedstock, have further accelerated the market's growth. With global population growth and increasing urbanization, the demand for petrochemical feedstocks is expected to remain strong, making this subsegment a key driver of the petroleum market in the coming years.

Automotive Industry Dominates End-User Industry Due to Fuel Needs

The automotive industry is the largest end-user of petroleum products, particularly gasoline and diesel. The sector’s demand for fuels to power vehicles is a major contributor to global petroleum consumption. As the number of vehicles on the road continues to rise, especially in emerging markets, the automotive industry's demand for petroleum products remains robust. While there is a growing shift toward electric vehicles (EVs) and alternative energy sources, traditional internal combustion engine (ICE) vehicles still make up the majority of the global fleet, ensuring sustained demand for petroleum products.

The ongoing growth of the automotive industry, particularly in regions like Asia-Pacific, is expected to continue driving demand for gasoline and diesel. In addition, the expansion of electric vehicle infrastructure and hybrid vehicles may moderate, but not completely eliminate, the need for petroleum-based fuels. As the automotive industry continues to evolve, petroleum products will remain integral to the sector’s fueling needs for the foreseeable future.

Direct Sales Distribution Channel Is Largest Owing to Bulk Transactions

The direct sales distribution channel is the largest in the petroleum market, accounting for a significant portion of the industry's transactions. Direct sales involve transactions between petroleum producers and large-scale consumers or distributors, such as refineries, energy companies, and industrial manufacturers. These sales typically occur in bulk, allowing for the efficient and cost-effective movement of large volumes of petroleum products.

The direct sales model is essential for meeting the energy demands of major industries, including power generation, petrochemicals, and transportation. Bulk purchases of crude oil, refined products, and other petroleum-based goods are often negotiated directly between suppliers and large consumers, ensuring a streamlined supply chain. This distribution method remains dominant due to its ability to handle large-scale transactions with minimal intermediary involvement.

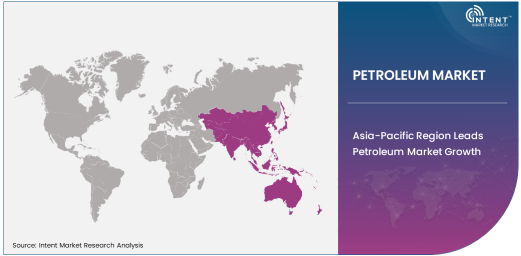

Asia-Pacific Region Leads Petroleum Market Growth

Asia-Pacific is the largest and fastest-growing region in the petroleum market, driven by significant industrialization, urbanization, and increasing energy demand. Countries like China and India are key drivers of this growth, with both nations witnessing rapid economic development and population expansion. The demand for petroleum products such as gasoline, diesel, and petrochemical feedstocks is particularly high in these markets, fueling the expansion of the petroleum industry.

The region's growing automotive and energy sectors, along with increasing infrastructure investments, are expected to sustain the demand for petroleum products. Furthermore, Asia-Pacific's expanding manufacturing base and rising consumer consumption are contributing to a steady increase in petroleum needs. As the demand for energy continues to rise in this region, Asia-Pacific is projected to remain a dominant player in the global petroleum market for the foreseeable future.

Competitive Landscape and Leading Companies

The petroleum market is highly competitive, with major multinational companies dominating production, refining, and distribution activities. Leading companies such as ExxonMobil, Royal Dutch Shell, BP, and Saudi Aramco are key players in the global market, controlling substantial portions of the supply chain and influencing pricing. These companies continue to invest in exploration, refining technologies, and downstream operations to meet the growing demand for petroleum products.

In addition to traditional oil and gas giants, regional players, such as India’s Reliance Industries and China’s PetroChina, are also making significant strides in the market. With increasing focus on sustainability and diversification, companies are exploring opportunities in renewable energy, biofuels, and petrochemical innovations. The competitive landscape is shaped by ongoing investments in new exploration technologies, mergers and acquisitions, and the shift towards cleaner energy solutions. As the petroleum market evolves, these leading companies are poised to navigate the challenges of an increasingly complex energy landscape.

Recent Developments:

ExxonMobil has partnered with IBM to develop AI-driven technologies to optimize refinery operations and improve efficiency.

- Chevron completed the acquisition of Noble Energy for $13 billion, expanding its reach in the Eastern Mediterranean and other key regions.

- Saudi Aramco announced plans to increase its oil production capacity to 13 million barrels per day, boosting its market share and oil reserves.

- BP finalized the sale of its upstream oil and gas assets in Alaska to Hilcorp for $5.6 billion as part of its strategy to focus on cleaner energy sources.

- Sinopec, China’s largest oil company, announced plans to invest in green energy projects, signaling a shift toward more sustainable energy solutions in the future.

List of Leading Companies:

- ExxonMobil

- Royal Dutch Shell

- Chevron

- BP

- TotalEnergies

- Sinopec Limited

- Saudi Aramco

- Gazprom

- ConocoPhillips

- Eni S.p.A.

- PetroChina

- Lukoil

- Reliance Industries

- Indian Oil Corporation

- Marathon Petroleum

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4921.9 Billion |

|

Forecasted Value (2030) |

USD 6941.6 Billion |

|

CAGR (2025 – 2030) |

5.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Petroleum Market By Product Type (Crude Oil, Natural Gas Liquids, Refined Petroleum Products, Petrochemical Feedstocks, LPG, Jet Fuel, Diesel, Gasoline, Kerosene), By End-User Industry (Oil & Gas, Petrochemicals, Automotive, Aviation, Energy & Power, Chemicals, Agriculture, Construction, Shipping & Marine), By Distribution Channel (Direct Sales, Distributors, Online Retailers, Industrial Sales, Wholesale, Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

ExxonMobil, Royal Dutch Shell, Chevron, BP, TotalEnergies, Sinopec Limited, Saudi Aramco, Gazprom, ConocoPhillips, Eni S.p.A., PetroChina, Lukoil, Reliance Industries, Indian Oil Corporation, Marathon Petroleum |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Petroleum Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Crude Oil |

|

4.2. Natural Gas Liquids (NGL) |

|

4.3. Refined Petroleum Products |

|

4.4. Petrochemical Feedstocks |

|

4.5. LPG (Liquefied Petroleum Gas) |

|

4.6. Jet Fuel |

|

4.7. Diesel |

|

4.8. Gasoline |

|

4.9. Kerosene |

|

4.10. Others |

|

5. Petroleum Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Oil & Gas |

|

5.2. Petrochemicals |

|

5.3. Automotive |

|

5.4. Aviation |

|

5.5. Energy & Power |

|

5.6. Chemicals |

|

5.7. Agriculture |

|

5.8. Construction |

|

5.9. Shipping & Marine |

|

5.10. Others |

|

6. Petroleum Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Direct Sales |

|

6.2. Distributors |

|

6.3. Online Retailers |

|

6.4. Industrial Sales |

|

6.5. Wholesale |

|

6.6. Retail |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Petroleum Market, by Product Type |

|

7.2.7. North America Petroleum Market, by End-User Industry |

|

7.2.8. North America Petroleum Market, by Distribution Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Petroleum Market, by Product Type |

|

7.2.9.1.2. US Petroleum Market, by End-User Industry |

|

7.2.9.1.3. US Petroleum Market, by Distribution Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. ExxonMobil |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Royal Dutch Shell |

|

9.3. Chevron |

|

9.4. BP |

|

9.5. TotalEnergies |

|

9.6. Sinopec Limited |

|

9.7. Saudi Aramco |

|

9.8. Gazprom |

|

9.9. ConocoPhillips |

|

9.10. Eni S.p.A. |

|

9.11. PetroChina |

|

9.12. Lukoil |

|

9.13. Reliance Industries |

|

9.14. Indian Oil Corporation |

|

9.15. Marathon Petroleum |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Petroleum Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Petroleum Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Petroleum Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA