As per Intent Market Research, the Pet Furniture Market was valued at USD 2.3 billion in 2024-e and will surpass USD 3.5 billion by 2030; growing at a CAGR of 7.1% during 2025 - 2030.

The pet furniture market has experienced significant growth due to a growing trend among pet owners to provide their pets with comfortable and functional living spaces. With a surge in pet ownership globally, the demand for pet furniture has expanded, particularly as pet owners are increasingly seeking products that enhance their pets' comfort and well-being. Among various product types, pet beds and sofas have emerged as the largest subsegment, driven by pet owners' desire for premium, durable, and cozy furniture to complement their living spaces.

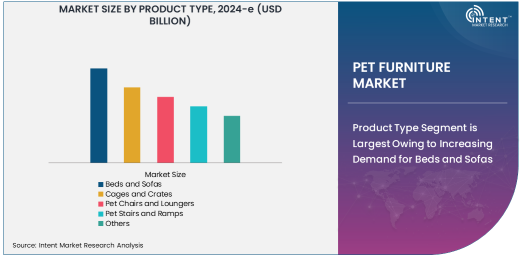

Product Type Segment is Largest Owing to Increasing Demand for Beds and Sofas

Pet beds and sofas are highly sought-after due to their ability to provide comfort, security, and style. These products cater specifically to pets' need for rest and relaxation, offering a variety of designs, from orthopedic beds for older pets to stylish sofas designed to blend with home décor. The availability of a wide range of materials, sizes, and designs further fuels the demand, ensuring that pet owners can find the ideal solution for their pets. With more pet owners viewing pets as family members, the comfort of pets is becoming a priority, positioning the bed and sofa subsegment as the most significant contributor to market growth.

Material Type Segment is Fastest Growing Due to Rising Preference for Fabric

In the pet furniture market, material type plays a crucial role in determining the comfort, durability, and aesthetic appeal of products. Among various materials, fabric is the fastest-growing subsegment, driven by its versatility, comfort, and increasing popularity among pet owners. Fabric pet furniture provides a soft and cozy environment for pets while offering a range of textures and colors that appeal to pet owners who want their pet’s furniture to seamlessly blend with their home décor.

The fabric subsegment is expanding rapidly due to its ability to offer a variety of options that cater to different pet types and preferences. Fabric furniture, especially those made with durable and easy-to-clean materials, has become a popular choice for pet owners with cats and dogs. Additionally, fabric furniture is often more affordable than leather or wood options, making it an attractive choice for a larger demographic of pet owners. The demand for fabric-based pet furniture is expected to continue to rise as pet owners seek both functional and fashionable solutions for their pets' comfort.

Pet Type Segment is Largest Due to Dominance of Dogs

The pet type segment in the pet furniture market reflects the varying needs of different animals, with each pet type requiring specific designs and materials. Among all pet types, dogs dominate the market, driving the largest share of pet furniture sales. Dogs, being the most common household pet, require more furniture options, such as beds, crates, and sofas, to meet their comfort and lifestyle needs. The growing pet humanization trend, where pets are increasingly treated as family members, has further amplified the demand for specialized dog furniture.

This subsegment's growth is also fueled by the increasing number of dog owners who prioritize pet comfort and invest in high-quality furniture. Dogs, due to their size, activity levels, and sleeping habits, often require larger and more supportive furniture solutions. As a result, brands have introduced a range of products specifically designed for dogs, including orthopedic beds, adjustable lounges, and crates. This focus on tailored solutions for dogs has solidified their position as the largest and most profitable subsegment within the pet furniture market.

Distribution Channel Segment is Fastest Growing Due to Surge in Online Retail

The distribution channel segment of the pet furniture market has seen a shift in recent years, with online retail emerging as the fastest-growing subsegment. The convenience of online shopping, coupled with the rise in e-commerce platforms, has transformed how pet owners purchase furniture for their pets. Online retail offers a wide variety of products, often with the added benefit of customer reviews, detailed product descriptions, and easy comparison options, which have proven attractive to modern consumers.

Region Segment is Largest Owing to North America’s Dominance

The regional distribution of the pet furniture market showcases different dynamics depending on geographic location, with North America holding the largest market share. The United States, in particular, is a key driver due to its high pet ownership rates and a well-established pet care culture. The demand for pet furniture in North America is also fueled by the rising disposable incomes, as pet owners are increasingly willing to spend on premium products that enhance the comfort of their pets. Additionally, the region's well-developed retail infrastructure and the ease of accessing pet furniture through various distribution channels contribute to North America's dominance in the market.

North America’s pet furniture market continues to grow, driven by a combination of factors such as the increasing trend of pet humanization and the desire for high-quality pet products. The strong presence of leading companies and a growing preference for pet comfort and luxury further enhance the region's position as the largest market. As pet ownership continues to rise in the region, the demand for innovative and stylish pet furniture solutions is expected to remain strong, ensuring North America's continued dominance in the global pet furniture market.

Leading Companies and Competitive Landscape

The global pet furniture market is highly competitive, with several key players leading the industry by offering innovative products designed to cater to the diverse needs of pets and their owners. Companies like Petmate, Snoozer Pet Products, and PetFusion are at the forefront of the market, offering a wide range of pet furniture products such as beds, sofas, and crates. These companies focus on differentiating themselves through high-quality materials, durable designs, and specialized products that cater to specific pet needs, such as orthopedic beds for aging pets or eco-friendly options.

The market also sees strong competition from other brands like Frisco, Armarkat, and K&H Pet Products, which continually innovate to meet the growing demand for functional and aesthetically pleasing pet furniture. As the market expands, there is an increasing emphasis on online retail, with brands enhancing their digital presence and e-commerce strategies to reach a broader audience. Companies are also exploring mergers, acquisitions, and partnerships to expand their product portfolios and increase market penetration. The competitive landscape is expected to remain dynamic as companies invest in R&D and adapt to changing consumer preferences for quality, comfort, and design in pet furniture.

Recent Developments:

- In 2024, Petmate introduced an environmentally friendly pet furniture collection made from recycled materials, expanding its sustainable product offerings.

- In a strategic move to expand its luxury pet furniture offerings, Snoozer Pet Products acquired Petfusion, a leading brand in premium pet furniture, in late 2023.

- Frisco announced the addition of new pet beds and sofas to its collection in Q1 2024, aimed at providing more comfort and style for pets.

- In 2023, Petmaker entered into a distribution agreement with a global retailer, allowing its premium pet furniture to be sold in over 2,000 stores worldwide.

- K&H Pet Products Launches Smart Pet BedK&H Pet Products unveiled a smart pet bed in early 2024, which includes temperature control features for pets, enhancing comfort and sleep quality for pets.

List of Leading Companies:

- Petmate

- Snoozer Pet Products

- Vesper

- Go Pet Club

- PetFusion

- Frisco

- Merrick Pet Care

- Armarkat

- K&H Pet Products

- MidWest Homes for Pets

- Bergan Pet Products

- Petsfit

- Serta

- PetPals

- Petmaker

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.3 Billion |

|

Forecasted Value (2030) |

USD 3.5 Billion |

|

CAGR (2025 – 2030) |

7.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Pet Furniture Market By Product Type (Beds and Sofas, Cages and Crates, Pet Chairs and Loungers, Pet Stairs and Ramps), By Material Type (Wood, Metal, Fabric, Plastic, Leather), By Pet Type (Dogs, Cats, Birds, Small Animals), By Distribution Channel (Online Retail, Offline Retail, Specialty Pet Stores, Supermarkets/Hypermarkets, Direct Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Petmate, Snoozer Pet Products, Vesper, Go Pet Club, PetFusion, Frisco, Merrick Pet Care, Armarkat, K&H Pet Products, MidWest Homes for Pets, Bergan Pet Products, Petsfit, Serta, PetPals, Petmaker |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Pet Furniture Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Beds and Sofas |

|

4.2. Cages and Crates |

|

4.3. Pet Chairs and Loungers |

|

4.4. Pet Stairs and Ramps |

|

4.5. Others |

|

5. Pet Furniture Market, by Material Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Wood |

|

5.2. Metal |

|

5.3. Fabric |

|

5.4. Plastic |

|

5.5. Leather |

|

6. Pet Furniture Market, by Pet Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Dogs |

|

6.2. Cats |

|

6.3. Birds |

|

6.4. Small Animals |

|

6.5. Others |

|

7. Pet Furniture Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Online Retail |

|

7.2. Offline Retail |

|

7.3. Specialty Pet Stores |

|

7.4. Supermarkets/Hypermarkets |

|

7.5. Direct Sales |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Pet Furniture Market, by Product Type |

|

8.2.7. North America Pet Furniture Market, by Material Type |

|

8.2.8. North America Pet Furniture Market, by Pet Type |

|

8.2.9. North America Pet Furniture Market, by |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Pet Furniture Market, by Product Type |

|

8.2.10.1.2. US Pet Furniture Market, by Material Type |

|

8.2.10.1.3. US Pet Furniture Market, by Pet Type |

|

8.2.10.1.4. US Pet Furniture Market, by |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Petmate |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Snoozer Pet Products |

|

10.3. Vesper |

|

10.4. Go Pet Club |

|

10.5. PetFusion |

|

10.6. Frisco |

|

10.7. Merrick Pet Care |

|

10.8. Armarkat |

|

10.9. K&H Pet Products |

|

10.10. MidWest Homes for Pets |

|

10.11. Bergan Pet Products |

|

10.12. Petsfit |

|

10.13. Serta |

|

10.14. PetPals |

|

10.15. Petmaker |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Pet Furniture Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Pet Furniture Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Pet Furniture Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA