As per Intent Market Research, the Pet Food Bowl Market was valued at USD 3.5 Billion in 2024-e and will surpass USD 5.0 Billion by 2030; growing at a CAGR of 6.0% during 2025-2030.

The pet food bowl market has witnessed steady growth, driven by the increasing number of pet owners worldwide and the growing awareness of pet health. Pet food bowls are essential pet accessories, with various designs and materials available to suit both functional and aesthetic preferences. The market is supported by diverse product types, shapes, and materials, catering to a wide range of consumer needs. As pet owners increasingly seek convenience and style, the demand for premium, durable, and safe pet food bowls continues to rise.

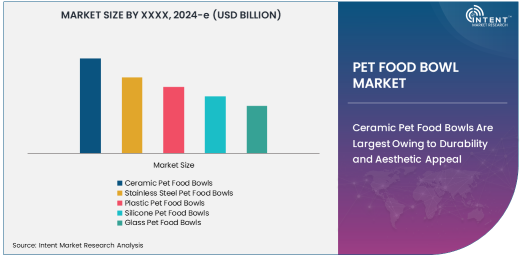

Ceramic Pet Food Bowls Are Largest Owing to Durability and Aesthetic Appeal

Among the different types of pet food bowls, ceramic pet food bowls dominate the market due to their durability, stability, and aesthetic appeal. Ceramic bowls are heavier than their plastic counterparts, making them less likely to tip over, especially for larger pets. These bowls are also highly favored for their ability to maintain the temperature of food or water, ensuring that meals stay fresh for a longer period. Additionally, ceramic bowls are available in a wide range of designs, making them popular among pet owners looking for a stylish and functional feeding solution. Their non-porous surface also resists bacterial growth, ensuring cleanliness and hygiene.

The market for ceramic pet food bowls is further reinforced by their premium nature, attracting pet owners who are willing to invest in high-quality products. Furthermore, the growing trend of eco-conscious consumerism has boosted the demand for ceramic bowls, as they are often made with more sustainable materials compared to plastic alternatives. As such, ceramic pet food bowls continue to lead the market, with a strong presence in both premium pet retail outlets and online stores.

Round Pet Food Bowls Are Fastest Growing Owing to Versatility

When it comes to shape, round pet food bowls are the fastest-growing segment in the market. Round bowls are versatile and suitable for a variety of pet types, including dogs, cats, and small mammals. They are easy to clean, which is a crucial factor for pet owners, as maintaining hygiene is a top priority. The round shape ensures that food is evenly distributed across the bowl, making it ideal for pets to access their meals without spillage. As more pet owners look for practical and easy-to-maintain feeding solutions, the demand for round bowls continues to rise.

The increasing availability of round pet food bowls in various materials and sizes has contributed to their rapid growth. Additionally, their simple yet functional design has made them a popular choice for busy pet owners who need a hassle-free feeding option. With the rise of e-commerce and online pet retailers, round pet food bowls are easily accessible to a wide audience, further boosting the segment's growth. The preference for round bowls is expected to continue, positioning them as the fastest-growing shape in the market.

Small Pet Food Bowls Are Largest Owing to Convenience and Portability

In the size category, small pet food bowls are the largest segment due to their convenience and portability. Small bowls are ideal for cats, small dogs, and other smaller pets, offering a compact and easy-to-use feeding solution. They are particularly popular among pet owners who live in apartments or smaller homes, where space is limited. Additionally, small pet food bowls are easier to store and clean, making them a practical choice for pet owners who need a functional yet space-saving solution.

The demand for small pet food bowls is further driven by the growing number of households with smaller pets. As more people adopt smaller dog breeds or cats as pets, the need for appropriately sized feeding bowls has increased. Small bowls are also more affordable, making them an attractive option for budget-conscious pet owners. This segment is expected to maintain its leading position in the market as the number of small pet owners continues to rise.

Pet Owners Are Largest End-User Owing to Growing Pet Ownership

In terms of end-users, pet owners represent the largest segment in the pet food bowl market. The increasing number of pet owners, particularly in emerging markets, has been a key driver of demand for pet food bowls. As pets become more integrated into family life, owners are increasingly investing in high-quality, durable, and stylish pet accessories, including feeding bowls. Pet owners are particularly concerned with the health and well-being of their pets, which has led to a preference for bowls that are easy to clean, non-toxic, and resistant to bacterial growth.

The segment's growth is also supported by the growing trend of pet humanization, where pets are treated as family members. This has led to increased spending on premium pet products, including food bowls. As pet ownership continues to rise, especially in regions such as North America and Europe, pet owners will remain the largest end-user group, driving the demand for various types of pet food bowls.

Online Retailers Are Fastest Growing Distribution Channel Owing to Convenience

Online retailers have emerged as the fastest-growing distribution channel for pet food bowls, thanks to the convenience of online shopping and the expanding popularity of e-commerce. The growth of online shopping has made it easier for pet owners to access a wide variety of pet products, including food bowls, at competitive prices. Online platforms also allow pet owners to read reviews, compare prices, and choose from a broader selection of materials, sizes, and designs.

Additionally, the ability to have products delivered directly to the doorstep has made online shopping a preferred option for many consumers. With the increasing use of smartphones and internet penetration across regions, online retailers are expected to continue driving growth in the pet food bowl market. This trend is particularly strong in North America and Europe, where e-commerce adoption is high, but is also gaining momentum in emerging markets.

Stainless Steel Pet Food Bowls Are Largest Material Segment Owing to Durability and Hygiene

In terms of material, stainless steel pet food bowls are the largest segment, driven by their durability and hygiene benefits. Stainless steel bowls are resistant to rust, corrosion, and scratching, making them a popular choice for pet owners. They are also easier to clean compared to other materials, ensuring that pet owners can maintain a hygienic feeding environment for their pets. Additionally, stainless steel bowls do not retain odors, which is an important consideration for pet owners seeking long-lasting and odor-free feeding solutions.

The preference for stainless steel is particularly strong in households with larger pets or multiple pets, where durability is a key consideration. This material is also highly resistant to bacterial growth, making it a popular choice for health-conscious pet owners. As pet owners become more aware of the hygiene and safety features of their pet accessories, stainless steel bowls continue to dominate the material segment.

North America Is Largest Region Owing to High Pet Ownership and Spending

North America is the largest region in the pet food bowl market, driven by high pet ownership rates and significant spending on pet products. The region has a large number of pet owners who view their pets as family members, contributing to higher demand for quality pet food bowls. The pet food bowl market in North America is also supported by the presence of several leading pet product manufacturers and retailers, making a wide range of options available to consumers.

Additionally, the growing trend of pet humanization, where pets are treated with the same care and attention as family members, has led to increased spending on premium pet products. As such, North America is expected to maintain its leading position in the pet food bowl market, with continued growth driven by an expanding pet population and increasing consumer preferences for high-quality pet accessories.

Competitive Landscape

The pet food bowl market is highly competitive, with several global and regional players offering a wide range of products. Leading companies in the market include Petmate, Amazon Basics, PetSafe, and Frisco, among others. These companies focus on innovation, product quality, and design to cater to the evolving needs of pet owners. The market is characterized by a mix of established players and emerging brands, with both premium and budget-friendly options available to consumers.

Competitive strategies in the market include product differentiation, with companies offering bowls made from various materials, shapes, and sizes. Additionally, the increasing trend of online shopping has led to a shift in sales channels, with companies focusing on e-commerce platforms to reach a larger customer base. As the market continues to grow, companies will need to focus on providing products that meet the increasing demand for durability, hygiene, and aesthetic appeal.

Recent Developments:

- Amazon Basics introduced a new range of affordable, durable pet food bowls in various materials, catering to both cats and dogs. The product line is designed for easy cleaning and enhanced durability.

- Petmate unveiled a new line of environmentally friendly pet food bowls made from recycled materials, emphasizing sustainability and offering consumers a more eco-conscious choice.

- PetSafe, a leader in pet care products, acquired a well-known brand specializing in innovative pet feeding solutions, expanding its portfolio of pet bowls and other feeding accessories.

- Frisco’s range of pet food bowls was recently certified BPA-free, reassuring pet owners that the bowls are safe for their pets, and meeting growing demand for non-toxic pet products.

- Vanness Pet Products has partnered with a major retail chain to expand its distribution network, making its high-quality pet food bowls more widely available across North America.

List of Leading Companies:

- PetSafe

- Amazon Basics

- Outward Hound

- Frisco

- Vanness Pet Products

- Loving Pets

- Snoozer Pet Products

- Petmate

- P.L.A.Y.

- K&H Pet Products

- Hartz Mountain Corporation

- Merrick Pet Care

- West Paw Design

- Pedigree

- Rubbermaid Commercial Products

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.5 Billion |

|

Forecasted Value (2030) |

USD 5.0 Billion |

|

CAGR (2025 – 2030) |

6.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Pet Food Bowl Market By Product Type (Ceramic Pet Food Bowls, Stainless Steel Pet Food Bowls, Plastic Pet Food Bowls, Silicone Pet Food Bowls, Glass Pet Food Bowls), By Shape (Round Pet Food Bowls, Square Pet Food Bowls, Oval Pet Food Bowls, Custom-Shaped Pet Food Bowls), By Size (Small Pet Food Bowls, Medium Pet Food Bowls, Large Pet Food Bowls), By End-User (Pet Owners, Pet Care Providers, Veterinary Clinics, Pet Retailers), By Distribution Channel (Online Retailers, Pet Specialty Stores, Supermarkets/Hypermarkets, Veterinary Clinics), By Material (Plastic, Stainless Steel, Ceramic, Silicone, Other Materials) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

PetSafe, Amazon Basics, Outward Hound, Frisco, Vanness Pet Products, Loving Pets, Snoozer Pet Products, Petmate, P.L.A.Y., K&H Pet Products, Hartz Mountain Corporation, Merrick Pet Care, West Paw Design, Pedigree, Rubbermaid Commercial Products |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Pet Food Bowl Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Ceramic Pet Food Bowls |

|

4.2. Stainless Steel Pet Food Bowls |

|

4.3. Plastic Pet Food Bowls |

|

4.4. Silicone Pet Food Bowls |

|

4.5. Glass Pet Food Bowls |

|

5. Pet Food Bowl Market, by Shape (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Round Pet Food Bowls |

|

5.2. Square Pet Food Bowls |

|

5.3. Oval Pet Food Bowls |

|

5.4. Custom-Shaped Pet Food Bowls |

|

6. Pet Food Bowl Market, by Size (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Small Pet Food Bowls |

|

6.2. Medium Pet Food Bowls |

|

6.3. Large Pet Food Bowls |

|

7. Pet Food Bowl Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Pet Owners |

|

7.2. Pet Care Providers |

|

7.3. Veterinary Clinics |

|

7.4. Pet Retailers |

|

8. Pet Food Bowl Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Online Retailers |

|

8.2. Pet Specialty Stores |

|

8.3. Supermarkets/Hypermarkets |

|

8.4. Veterinary Clinics |

|

9. Pet Food Bowl Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Plastic |

|

9.2. Stainless Steel |

|

9.3. Ceramic |

|

9.4. Silicone |

|

9.5. Other Materials |

|

10. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

10.1. Regional Overview |

|

10.2. North America |

|

10.2.1. Regional Trends & Growth Drivers |

|

10.2.2. Barriers & Challenges |

|

10.2.3. Opportunities |

|

10.2.4. Factor Impact Analysis |

|

10.2.5. Technology Trends |

|

10.2.6. North America Pet Food Bowl Market, by Product Type |

|

10.2.7. North America Pet Food Bowl Market, by Shape |

|

10.2.8. North America Pet Food Bowl Market, by Size |

|

10.2.9. North America Pet Food Bowl Market, by End-User |

|

10.2.10. North America Pet Food Bowl Market, by Distribution Channel |

|

10.2.11. North America Pet Food Bowl Market, by Material |

|

10.2.12. By Country |

|

10.2.12.1. US |

|

10.2.12.1.1. US Pet Food Bowl Market, by Product Type |

|

10.2.12.1.2. US Pet Food Bowl Market, by Shape |

|

10.2.12.1.3. US Pet Food Bowl Market, by Size |

|

10.2.12.1.4. US Pet Food Bowl Market, by End-User |

|

10.2.12.1.5. US Pet Food Bowl Market, by Distribution Channel |

|

10.2.12.1.6. US Pet Food Bowl Market, by Material |

|

10.2.12.2. Canada |

|

10.2.12.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

10.3. Europe |

|

10.4. Asia-Pacific |

|

10.5. Latin America |

|

10.6. Middle East & Africa |

|

11. Competitive Landscape |

|

11.1. Overview of the Key Players |

|

11.2. Competitive Ecosystem |

|

11.2.1. Level of Fragmentation |

|

11.2.2. Market Consolidation |

|

11.2.3. Product Innovation |

|

11.3. Company Share Analysis |

|

11.4. Company Benchmarking Matrix |

|

11.4.1. Strategic Overview |

|

11.4.2. Product Innovations |

|

11.5. Start-up Ecosystem |

|

11.6. Strategic Competitive Insights/ Customer Imperatives |

|

11.7. ESG Matrix/ Sustainability Matrix |

|

11.8. Manufacturing Network |

|

11.8.1. Locations |

|

11.8.2. Supply Chain and Logistics |

|

11.8.3. Product Flexibility/Customization |

|

11.8.4. Digital Transformation and Connectivity |

|

11.8.5. Environmental and Regulatory Compliance |

|

11.9. Technology Readiness Level Matrix |

|

11.10. Technology Maturity Curve |

|

11.11. Buying Criteria |

|

12. Company Profiles |

|

12.1. PetSafe |

|

12.1.1. Company Overview |

|

12.1.2. Company Financials |

|

12.1.3. Product/Service Portfolio |

|

12.1.4. Recent Developments |

|

12.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

12.2. Amazon Basics |

|

12.3. Outward Hound |

|

12.4. Frisco |

|

12.5. Vanness Pet Products |

|

12.6. Loving Pets |

|

12.7. Snoozer Pet Products |

|

12.8. Petmate |

|

12.9. P.L.A.Y. |

|

12.10. K&H Pet Products |

|

12.11. Hartz Mountain Corporation |

|

12.12. Merrick Pet Care |

|

12.13. West Paw Design |

|

12.14. Pedigree |

|

12.15. Rubbermaid Commercial Products |

|

13. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Pet Food Bowl Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Pet Food Bowl Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Pet Food Bowl Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA