As per Intent Market Research, the Pet Care Market was valued at USD 266.2 Billion in 2024-e and will surpass USD 368.4 Billion by 2030; growing at a CAGR of 5.6% during 2025-2030.

The pet care market has been experiencing significant growth driven by increasing pet ownership and the rising focus on pet wellness and health. With more consumers treating their pets as family members, the demand for pet food, grooming products, healthcare items, and accessories is expanding. This growing market is further fueled by innovations in product offerings and the increased availability of these products through various distribution channels. The pet care market includes segments like pet food, grooming products, healthcare products, and more, each catering to different needs of pets, whether in terms of nutrition, hygiene, or overall care.

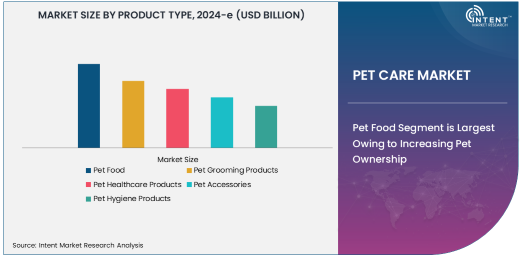

Pet Food Segment is Largest Owing to Increasing Pet Ownership

The pet food segment holds the largest share of the global pet care market, driven by the increasing demand for nutritious, high-quality food for pets. As pet owners become more aware of the importance of proper nutrition for their pets’ health and longevity, there is a noticeable shift towards premium, organic, and specialized pet foods. Pet food, especially dry and wet food, is essential to maintain the health of pets, and as a result, it continues to dominate in terms of market share. With growing disposable incomes and a focus on premiumization, the pet food segment is expected to continue its dominance in the coming years.

The demand for specialized pet food, such as food for pets with specific dietary needs (e.g., grain-free, hypoallergenic) or therapeutic foods for pets with medical conditions, is particularly strong. Brands offering high-quality, nutritional products for both dogs and cats are seeing increased consumer loyalty and market penetration. The expansion of product lines to cater to niche demands, such as food for senior pets or those with sensitive stomachs, continues to shape the competitive landscape.

Dogs Segment is Largest Among Pet Types Due to Popularity and Product Range

Among pet types, the dog segment is the largest and continues to dominate the pet care market. Dogs are the most popular pets globally, and the extensive range of pet care products available for them has contributed significantly to the growth of this segment. From food and grooming products to accessories and healthcare items, dogs are the most demanding when it comes to pet care products. The increasing humanization of pets, where dogs are seen as family members, has further heightened the demand for high-quality, premium products tailored to their health, comfort, and enjoyment.

The growing trend of pet owners spending on premium products, such as organic foods, advanced grooming tools, and specialized healthcare items, is particularly prominent in the dog segment. This shift towards premiumization is driven by the rising awareness of pet health, wellness, and longevity. Additionally, the wide variety of products available for dogs, including personalized collars, beds, and toys, makes them a significant market driver.

Online Retailers Segment is Fastest Growing Owing to Convenience and E-commerce Expansion

Among distribution channels, online retailers are the fastest-growing segment in the pet care market. The convenience of online shopping, coupled with the increasing preference for home delivery, has made e-commerce platforms a go-to destination for pet owners. Online platforms provide a wide range of pet care products, often at competitive prices, and allow consumers to compare products easily and read reviews before making a purchase. Additionally, the growth of subscription-based services for pet food and supplies has further fueled the expansion of this distribution channel.

The convenience offered by online retailers, coupled with the increasing penetration of the internet and smartphones, has significantly contributed to the growth of this segment. Consumers are increasingly opting for online shopping due to the ease of access, time-saving benefits, and convenience of getting products delivered to their doorstep. The rising preference for digital platforms and the growth of e-commerce giants like Amazon and Chewy have reshaped the dynamics of pet care distribution.

Dry Pet Food Segment is Largest Owing to Nutritional Value and Convenience

Among formulations, dry pet food is the largest segment in the pet care market. Dry food is highly popular due to its convenience, long shelf life, and ease of storage. It is often the preferred choice for pet owners due to its nutritional value and variety of options available, tailored for different age groups, sizes, and dietary needs of pets. The dry pet food segment includes brands offering complete and balanced meals for pets, with formulations designed to improve digestion, coat health, and weight management, among other benefits.

The convenience of dry pet food, particularly in terms of ease of feeding, storage, and longer shelf life, has made it a staple in households with pets. Additionally, dry pet food is often more cost-effective than wet food, driving its popularity among pet owners looking for affordable yet nutritious options for their pets. This segment is expected to maintain its dominance as pet owners continue to seek practical solutions for feeding their pets.

North America Region is Largest Due to High Pet Ownership and Expenditure

Geographically, North America is the largest region in the pet care market, driven by the high pet ownership rates and significant expenditure on pet products. The United States, in particular, has one of the highest rates of pet ownership globally, with dogs and cats being the most common pets. The market is characterized by strong consumer spending on pet food, healthcare, grooming products, and accessories. The humanization of pets and the growing focus on pet health and wellness further fuel the demand for premium pet care products in this region.

Additionally, North America’s strong retail infrastructure and the presence of major e-commerce platforms contribute to the region's growth. The increasing availability of pet care products through various distribution channels, including online retailers and specialized pet stores, supports the robust growth of the market. The North American pet care market is expected to continue its dominance due to the rising number of pet owners, increasing pet care spending, and the growing trend of pet humanization.

Competitive Landscape and Leading Companies

The pet care market is highly competitive, with numerous global and regional players vying for market share. Leading companies such as Mars Petcare, Nestlé Purina Petcare, Hill's Pet Nutrition, and Zoetis Inc. dominate the market with their extensive portfolios of pet food, healthcare products, and accessories. These companies focus on product innovation, quality, and expanding their distribution networks to maintain a competitive edge. Additionally, the increasing trend of mergers and acquisitions has enabled companies to strengthen their market position and diversify their product offerings.

The competitive landscape is further shaped by the rising demand for premium, organic, and specialized pet care products. Leading companies are focusing on expanding their portfolios to cater to the evolving needs of pet owners. Smaller players are also emerging, offering niche products and leveraging e-commerce platforms to capture a share of the growing market. The competitive dynamics in the pet care industry are likely to remain intense, with innovation and customer-centric approaches driving market growth.

Recent Developments:

- Mars Petcare announced the launch of a new line of premium dog food with functional ingredients aimed at improving digestion and overall health.

- Nestlé Purina completed the acquisition of a leading pet health company to expand its portfolio in pet healthcare and wellness products.

- Chewy Inc. has expanded its online pet care product offerings into select international markets, increasing its global footprint.

- Petco announced new sustainability initiatives focusing on reducing plastic packaging and promoting eco-friendly pet products.

- Zoetis received FDA approval for a new vaccine for dogs aimed at preventing a variety of infectious diseases, broadening its pet healthcare portfolio.

List of Leading Companies:

- Mars Petcare

- Nestlé Purina Petcare

- Hill's Pet Nutrition

- Colgate-Palmolive (Softgel)

- PetSmart Inc.

- Zoetis Inc.

- Chewy Inc.

- Spectrum Brands Holdings, Inc.

- The Iams Company

- Unicharm Corporation

- Lilly

- Ainsworth Pet Nutrition, LLC

- Petco Animal Supplies, Inc.

- Big Heart Pet Brands (J.M. Smucker)

- Blue Buffalo Co.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 266.2 Billion |

|

Forecasted Value (2030) |

USD 368.4 Billion |

|

CAGR (2025 – 2030) |

5.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Pet Care Market by Product Type (Pet Food, Pet Grooming Products, Pet Healthcare Products, Pet Accessories, Pet Hygiene Products), by Pet Type (Dogs, Cats, Birds, Small Mammals, Fish), by Distribution Channel (Online Retailers, Pet Specialty Stores, Supermarkets/Hypermarkets, Veterinary Clinics), by Formulation (Dry Pet Food, Wet Pet Food, Raw Pet Food, Pet Treats) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Mars Petcare, Nestlé Purina Petcare, Hill's Pet Nutrition, Colgate-Palmolive (Softgel), PetSmart Inc., Zoetis Inc., Chewy Inc., Spectrum Brands Holdings, Inc., The Iams Company, Unicharm Corporation, Lilly, Ainsworth Pet Nutrition, LLC, Petco Animal Supplies, Inc., Big Heart Pet Brands (J.M. Smucker), Blue Buffalo Co. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Pet Care Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Pet Food |

|

4.2. Pet Grooming Products |

|

4.3. Pet Healthcare Products |

|

4.4. Pet Accessories |

|

4.5. Pet Hygiene Products |

|

5. Pet Care Market, by Pet Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Dogs |

|

5.2. Cats |

|

5.3. Birds |

|

5.4. Small Mammals |

|

5.5. Fish |

|

5.6. Others |

|

6. Pet Care Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Online Retailers |

|

6.2. Pet Specialty Stores |

|

6.3. Supermarkets/Hypermarkets |

|

6.4. Veterinary Clinics |

|

6.5. Others |

|

7. Pet Care Market, by Formulation (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Dry Pet Food |

|

7.2. Wet Pet Food |

|

7.3. Raw Pet Food |

|

7.4. Pet Treats |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Pet Care Market, by Product Type |

|

8.2.7. North America Pet Care Market, by Pet Type |

|

8.2.8. North America Pet Care Market, by Distribution Channel |

|

8.2.9. North America Pet Care Market, by Formulation |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Pet Care Market, by Product Type |

|

8.2.10.1.2. US Pet Care Market, by Pet Type |

|

8.2.10.1.3. US Pet Care Market, by Distribution Channel |

|

8.2.10.1.4. US Pet Care Market, by Formulation |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Mars Petcare |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Nestlé Purina Petcare |

|

10.3. Hill's Pet Nutrition |

|

10.4. Colgate-Palmolive (Softgel) |

|

10.5. PetSmart Inc. |

|

10.6. Zoetis Inc. |

|

10.7. Chewy Inc. |

|

10.8. Spectrum Brands Holdings, Inc. |

|

10.9. The Iams Company |

|

10.10. Unicharm Corporation |

|

10.11. Lilly |

|

10.12. Ainsworth Pet Nutrition, LLC |

|

10.13. Petco Animal Supplies, Inc. |

|

10.14. Big Heart Pet Brands (J.M. Smucker) |

|

10.15. Blue Buffalo Co. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Pet Care Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Pet Care Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Pet Care Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA