As per Intent Market Research, the PET Bottles Market was valued at USD 26.7 Billion in 2024-e and will surpass USD 36.8 Billion by 2030; growing at a CAGR of 5.5% during 2025-2030.

The PET bottles market has seen substantial growth due to the increasing demand for lightweight, durable, and recyclable packaging solutions. With the rise in consumer goods, packaged beverages, and advancements in sustainable packaging technologies, PET bottles have become the go-to packaging material across several industries. The market continues to evolve, driven by innovations in design, material efficiency, and environmental impact. This growth is significantly influenced by the increasing awareness of sustainability and the need for more eco-friendly packaging solutions.

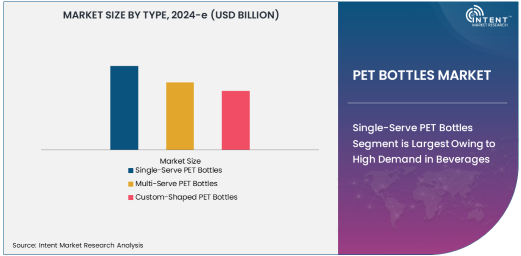

Single-Serve PET Bottles Segment is Largest Owing to High Demand in Beverages

Single-serve PET bottles are increasingly favored due to their cost-effectiveness, and companies are focusing on reducing material usage to enhance recyclability. Innovations, such as incorporating post-consumer recycled content (PCR), are also contributing to their growing market share. With the rise in demand for bottled beverages, this segment is projected to continue leading the PET bottles market.

Food & Beverage Application is Largest Owing to Bottled Drink Demand

The food and beverage application segment is the largest in the PET bottles market, owing to the high demand for bottled beverages such as water, soft drinks, fruit juices, and alcoholic beverages. PET bottles offer an ideal packaging solution for beverages due to their strength, transparency, and ability to preserve product integrity. As consumers increasingly opt for ready-to-drink beverages, both in-store and on-the-go, the need for PET bottles in the food and beverage industry continues to rise.

In particular, bottled water holds a significant share of this segment, driven by growing health-consciousness among consumers. Moreover, convenience and portability are key factors pushing the demand for PET bottles in the beverage industry. Brands are also focusing on introducing eco-friendly variants by using recycled PET (rPET), which aligns with sustainability trends in the packaging sector.

Food & Beverage Industry is Largest End-User Owing to High Demand for Packaged Drinks

The food and beverage industry is the largest end-user of PET bottles, owing to the high demand for bottled drinks. This sector continues to dominate the market with its vast array of products, including carbonated drinks, bottled water, juices, and smoothies. The convenience of PET bottles, which are lightweight, shatterproof, and easy to transport, has cemented their position as the preferred packaging material for beverages.

With the expanding consumer base and an increasing number of beverage options available, the food and beverage industry remains the largest driver of PET bottle demand. Furthermore, innovations aimed at improving the recyclability of PET bottles are helping companies meet sustainability goals while maintaining the packaging's functionality and appeal. As bottled beverage consumption continues to rise globally, especially in emerging markets, the food and beverage sector will continue to be a dominant force in the PET bottles market.

500 ml – 1 Liter Capacity is Largest Owing to High Usage in Bottled Drinks

The 500 ml to 1-liter capacity range of PET bottles is the largest in terms of volume, largely driven by their widespread use in bottled water, soft drinks, and other beverages. This size is particularly popular due to its ideal portion size for individual consumption, making it the go-to choice for consumers looking for a convenient and portable drink option. The 500 ml to 1-liter capacity is also favored by manufacturers as it allows for greater scalability and cost-efficiency in production.

As the demand for bottled beverages, particularly water and soft drinks, remains high, this capacity range continues to lead the market. Furthermore, the growing focus on promoting healthy hydration habits has propelled the demand for bottled water, particularly in this size category, which makes it the dominant format in the market.

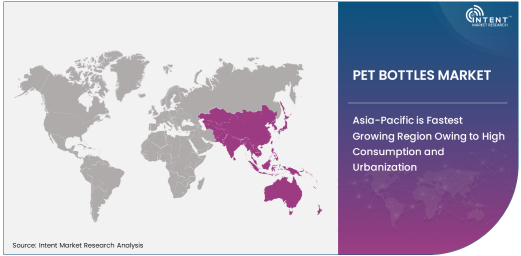

Asia-Pacific is Fastest Growing Region Owing to High Consumption and Urbanization

Asia-Pacific is the fastest growing region in the PET bottles market due to rapid industrialization, urbanization, and increasing consumer demand for packaged beverages. The region is witnessing a surge in the consumption of bottled water, soft drinks, and other beverages, driven by a growing middle class and rising disposable incomes. Additionally, the region has seen significant improvements in infrastructure, leading to easier access to bottled beverages in both urban and rural areas.

China and India, in particular, are key contributors to the growth in this region, with their large populations and expanding urban centers driving demand for single-serve and multi-serve PET bottles. Moreover, the region is becoming increasingly focused on sustainability, with growing interest in recycled PET and eco-friendly packaging solutions. As the demand for bottled beverages continues to rise, Asia-Pacific’s rapid growth in the PET bottles market is expected to maintain its strong momentum through 2030.

Leading Companies and Competitive Landscape

The PET bottles market is highly competitive, with several leading companies striving to maintain their market share through continuous innovation and sustainable practices. Key players such as Amcor plc, Berry Global, Inc., Plastipak Packaging, Inc., and Alpla Werke Alwin Lehner GmbH & Co KG dominate the market, focusing on producing high-quality PET bottles that cater to various industries, including food and beverage, personal care, and pharmaceuticals. These companies are investing heavily in research and development to improve the recyclability of PET bottles and reduce their environmental footprint.

The competitive landscape is also shaped by partnerships and acquisitions, as companies look to expand their product offerings and enhance their sustainability credentials. Innovations such as lightweight bottles, rPET usage, and custom-shaped bottles are key differentiators in the market. With growing regulatory pressures for sustainable packaging, the competitive dynamics are expected to remain focused on innovation, eco-friendly solutions, and market expansion.

Recent Developments:

- Amcor announced the launch of a new line of fully recyclable PET bottles designed for the beverage industry in 2024, marking a significant step toward sustainable packaging solutions.

- Berry Global acquired an eco-friendly packaging company, expanding its capabilities in the production of sustainable PET bottles that are fully recyclable and made from post-consumer recycled content.

- Plastipak launched a new range of lightweight PET bottles that reduce material usage by 15%, offering a more sustainable solution for the beverage industry.

- Resilux entered into a partnership with a leading beverage company to develop a new range of PET bottles with a reduced carbon footprint, aligning with the increasing demand for environmental responsibility.

- Krones introduced an innovative PET bottle production system that reduces energy consumption and enhances recyclability, catering to the growing demand for sustainable packaging in the beverage sector.

List of Leading Companies:

- Amcor plc

- Berry Global, Inc.

- Plastipak Packaging, Inc.

- Alpla Werke Alwin Lehner GmbH & Co KG

- Greiner Packaging International GmbH

- Resilux NV

- Sidel Group

- Krones AG

- Husky Injection Molding Systems Ltd.

- Mondi Group

- ClearPath Recycling

- LyondellBasell Industries N.V.

- PET Power GmbH

- Constantia Flexibles Group GmbH

- Intercontinental Packaging Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 26.7 Billion |

|

Forecasted Value (2030) |

USD 36.8 Billion |

|

CAGR (2025 – 2030) |

5.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

PET Bottles Market By Type (Single-Serve PET Bottles, Multi-Serve PET Bottles, Custom-Shaped PET Bottles), By Application (Food & Beverage, Personal Care & Cosmetics, Household Products, Pharmaceuticals, Industrial Products), By End-User Industry (Food & Beverage Industry, Personal Care & Cosmetics Industry, Pharmaceutical Industry, Household Products Industry), By Capacity (Less than 500 ml, 500 ml – 1 liter, 1 liter – 2 liters, Above 2 liters) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Amcor plc, Berry Global, Inc., Plastipak Packaging, Inc., Alpla Werke Alwin Lehner GmbH & Co KG, Greiner Packaging International GmbH, Resilux NV, Sidel Group, Krones AG, Husky Injection Molding Systems Ltd., Mondi Group, ClearPath Recycling, LyondellBasell Industries N.V., PET Power GmbH, Constantia Flexibles Group GmbH, Intercontinental Packaging Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. PET Bottles Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Single-Serve PET Bottles |

|

4.2. Multi-Serve PET Bottles |

|

4.3. Custom-Shaped PET Bottles |

|

5. PET Bottles Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Food & Beverage |

|

5.2. Personal Care & Cosmetics |

|

5.3. Household Products |

|

5.4. Pharmaceuticals |

|

5.5. Industrial Products |

|

5.6. Others |

|

6. PET Bottles Market, by Capacity (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Less than 500 ml |

|

6.2. 500 ml – 1 liter |

|

6.3. 1 liter – 2 liters |

|

6.4. Above 2 liters |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America PET Bottles Market, by Type |

|

7.2.7. North America PET Bottles Market, by Application |

|

7.2.8. North America PET Bottles Market, by Capacity |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US PET Bottles Market, by Type |

|

7.2.9.1.2. US PET Bottles Market, by Application |

|

7.2.9.1.3. US PET Bottles Market, by Capacity |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Amcor plc |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Berry Global, Inc. |

|

9.3. Plastipak Packaging, Inc. |

|

9.4. Alpla Werke Alwin Lehner GmbH & Co KG |

|

9.5. Greiner Packaging International GmbH |

|

9.6. Resilux NV |

|

9.7. Sidel Group |

|

9.8. Krones AG |

|

9.9. Husky Injection Molding Systems Ltd. |

|

9.10. Mondi Group |

|

9.11. ClearPath Recycling |

|

9.12. LyondellBasell Industries N.V. |

|

9.13. PET Power GmbH |

|

9.14. Constantia Flexibles Group GmbH |

|

9.15. Intercontinental Packaging Limited |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the PET Bottles Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the PET Bottles Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the PET Bottles Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA