As per Intent Market Research, the Pesticide Adjuvants Market was valued at USD 5.5 Billion in 2024-e and will surpass USD 8.0 Billion by 2030; growing at a CAGR of 6.4% during 2025-2030.

The pesticide adjuvants market is experiencing significant growth as the demand for agricultural productivity increases globally. These adjuvants, which are substances added to pesticide formulations, enhance the performance of pesticides, improving their effectiveness and ensuring better results for farmers. The market is driven by the need for more efficient and sustainable agricultural practices, as well as the growing demand for high-quality crops. The increasing focus on environmental sustainability and regulations has also pushed for innovative adjuvant solutions that are both effective and eco-friendly. This market is diverse, with various types, applications, and functions contributing to its expansion across different regions.

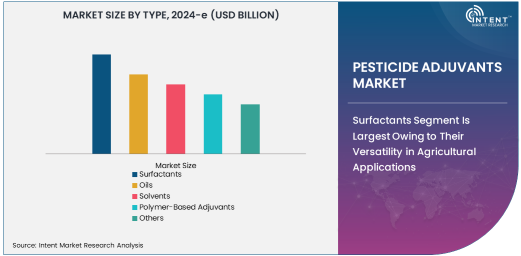

Surfactants Segment Is Largest Owing to Their Versatility in Agricultural Applications

Among the various types of pesticide adjuvants, surfactants hold the largest market share due to their versatility and essential role in improving the effectiveness of pesticide applications. Surfactants reduce the surface tension of water, allowing pesticides to spread more evenly on plant surfaces, ensuring better coverage and improved absorption. They are widely used in both herbicide and fungicide formulations, making them indispensable in crop protection. Their ability to enhance pesticide performance, especially in challenging environmental conditions, has led to their dominance in the market.

The demand for surfactants in pesticide formulations is expected to continue growing, driven by the increasing need for more efficient chemical applications and pest control measures. As farmers seek to maximize crop yields and minimize pesticide waste, surfactants remain a key ingredient in achieving optimal pest control outcomes. This trend is further supported by the rising adoption of precision farming techniques, where surfactants play a pivotal role in improving pesticide application accuracy.

Crop Protection Application Is Fastest Growing Owing to Rising Agricultural Demands

The crop protection application segment is the fastest growing segment in the pesticide adjuvants market, primarily driven by the need to ensure better crop yields and protect crops from pests and diseases. As the global population continues to rise, there is an increasing demand for higher agricultural productivity, which has spurred the need for effective crop protection solutions. Pesticide adjuvants, particularly those designed for crop protection, enhance the performance of herbicides, insecticides, and fungicides, making them more efficient in controlling pests and diseases.

The growth in this segment is also supported by the adoption of integrated pest management (IPM) practices, which encourage the use of adjuvants to improve the efficacy of chemical treatments. Additionally, the ongoing research into new adjuvants that can reduce pesticide usage while maintaining effectiveness is expected to further accelerate growth in the crop protection application segment. This trend aligns with the global push for more sustainable and environmentally friendly agricultural practices.

Wetters/Spreader Function Is Largest Owing to Enhanced Pesticide Coverage

In terms of function, the wetters/spreader category is the largest and most commonly used in the pesticide adjuvants market. Wetters and spreaders are designed to improve the spreading ability of pesticides, ensuring that they cover a larger surface area of the plant. This is particularly important in the application of herbicides, fungicides, and insecticides, where uniform coverage is essential for effective pest control. Wetters/spreaders reduce the surface tension of water, enabling pesticides to wet the surface of leaves and other plant tissues more effectively.

The dominance of wetters/spreaders is due to their broad use across various crops and their ability to enhance the performance of nearly all types of pesticides. As the demand for better coverage and more efficient pesticide use grows, wetters/spreaders are expected to remain crucial to the pesticide adjuvants market, driving their continued growth in both developed and emerging markets.

Liquid Adjuvants Formulation Is Largest Owing to Ease of Application

The liquid adjuvants formulation is the largest in the pesticide adjuvants market, owing to the ease of application and uniformity they provide in pesticide formulations. Liquid adjuvants dissolve easily in water-based pesticide solutions, ensuring better stability and improved performance. They are particularly useful in large-scale agricultural applications, where precision and ease of use are essential for maximizing efficiency. The widespread adoption of liquid adjuvants is also attributed to their versatility in various weather conditions, making them suitable for different crops and regions.

The liquid formulation's market dominance is expected to continue due to its convenience and compatibility with various pesticide types. Liquid adjuvants are also favored in regions where large-scale irrigation systems are common, as they can be easily mixed with irrigation water for more efficient application. The growing need for cost-effective and scalable pesticide application methods further supports the demand for liquid adjuvants.

North America Region Is Largest Due to Advanced Agricultural Practices

North America holds the largest share of the pesticide adjuvants market, driven by the region's advanced agricultural practices and high adoption of technological innovations in farming. The United States, in particular, is a major consumer of pesticide adjuvants, owing to its vast agricultural sector and extensive use of chemical pesticides for crop protection. The region's focus on improving crop yields and reducing environmental impact through better pesticide management has created a robust demand for high-performance adjuvants.

The North American market is also supported by government regulations that encourage the use of safe and effective pesticide products, further boosting the market for adjuvants. As the demand for sustainable agricultural solutions increases, North America is expected to maintain its leadership in the pesticide adjuvants market, with a growing focus on eco-friendly and bio-based adjuvants.

Competitive Landscape and Leading Companies

The pesticide adjuvants market is highly competitive, with key players continuously innovating to develop more effective and sustainable solutions. Leading companies such as BASF SE, Dow Chemicals, Croda International, and Evonik Industries dominate the market through their extensive product portfolios and strategic partnerships. These companies are investing heavily in research and development to create advanced adjuvants that improve pesticide efficiency and reduce environmental impact.

The competitive landscape is marked by a strong focus on product innovation, with many companies exploring bio-based and environmentally friendly adjuvants to meet the increasing demand for sustainable agricultural solutions. Strategic mergers and acquisitions are also common in the market, as companies seek to expand their product offerings and global reach. Overall, the pesticide adjuvants market is poised for continued growth, driven by the need for more effective, sustainable, and efficient agricultural practices.

Recent Developments:

- BASF SE launched a new biodegradable wetting agent aimed at improving pesticide efficiency while being environmentally friendly.

- Dow Chemicals announced the acquisition of a leading adjuvant producer to enhance its crop protection portfolio and expand its market share in the pesticide adjuvants segment.

- Evonik Industries has signed a strategic partnership with a leading agrochemical company to co-develop novel adjuvants that improve pesticide delivery in precision agriculture.

- Helena Chemical Company received regulatory approval for its new line of adjuvants designed to enhance pesticide performance in high-humidity environments.

- Clariant AG introduced a new range of oil-based adjuvants, designed to optimize the absorption and performance of pesticides in diverse climates, as part of its sustainability initiative in agriculture.

List of Leading Companies:

- BASF SE

- Dow Chemicals

- Croda International

- Clariant AG

- Solvay S.A.

- AkzoNobel N.V.

- Huntsman Corporation

- Evonik Industries AG

- ADAMA Agricultural Solutions

- Wilbur-Ellis Company

- Nufarm Ltd.

- SABIC

- Helena Chemical Company

- Kraton Polymers

- Lamberti S.p.A.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 5.5 Billion |

|

Forecasted Value (2030) |

USD 8.0 Billion |

|

CAGR (2025 – 2030) |

6.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Pesticide Adjuvants Market By Type (Surfactants, Oils, Solvents, Polymer-Based Adjuvants), By Application (Crop Protection, Non-Crop Protection, Forestry, Turf & Ornamentals), By Function (Wetters/Spreader, Stickiness Enhancers, Defoaming Agents, Penetrants, Drift Control Agents), By Formulation (Liquid Adjuvants, Solid Adjuvants) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Dow Chemicals, Croda International, Clariant AG, Solvay S.A., AkzoNobel N.V., Huntsman Corporation, Evonik Industries AG, ADAMA Agricultural Solutions, Wilbur-Ellis Company, Nufarm Ltd., SABIC, Helena Chemical Company, Kraton Polymers, Lamberti S.p.A. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Pesticide Adjuvants Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Surfactants |

|

4.2. Oils |

|

4.3. Solvents |

|

4.4. Polymer-Based Adjuvants |

|

4.5. Others |

|

5. Pesticide Adjuvants Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Crop Protection |

|

5.2. Non-Crop Protection |

|

5.3. Forestry |

|

5.4. Turf & Ornamentals |

|

6. Pesticide Adjuvants Market, by Function (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Wetters/Spreader |

|

6.2. Stickiness Enhancers |

|

6.3. Defoaming Agents |

|

6.4. Penetrants |

|

6.5. Drift Control Agents |

|

6.6. Other Functions |

|

7. Pesticide Adjuvants Market, by Formulation (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Liquid Adjuvants |

|

7.2. Solid Adjuvants |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Pesticide Adjuvants Market, by Type |

|

8.2.7. North America Pesticide Adjuvants Market, by Application |

|

8.2.8. North America Pesticide Adjuvants Market, by Function |

|

8.2.9. North America Pesticide Adjuvants Market, by Formulation |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Pesticide Adjuvants Market, by Type |

|

8.2.10.1.2. US Pesticide Adjuvants Market, by Application |

|

8.2.10.1.3. US Pesticide Adjuvants Market, by Function |

|

8.2.10.1.4. US Pesticide Adjuvants Market, by Formulation |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. BASF SE |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dow Chemicals |

|

10.3. Croda International |

|

10.4. Clariant AG |

|

10.5. Solvay S.A. |

|

10.6. AkzoNobel N.V. |

|

10.7. Huntsman Corporation |

|

10.8. Evonik Industries AG |

|

10.9. ADAMA Agricultural Solutions |

|

10.10. Wilbur-Ellis Company |

|

10.11. Nufarm Ltd. |

|

10.12. SABIC |

|

10.13. Helena Chemical Company |

|

10.14. Kraton Polymers |

|

10.15. Lamberti S.p.A. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Pesticide Adjuvants Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Pesticide Adjuvants Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Pesticide Adjuvants Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA