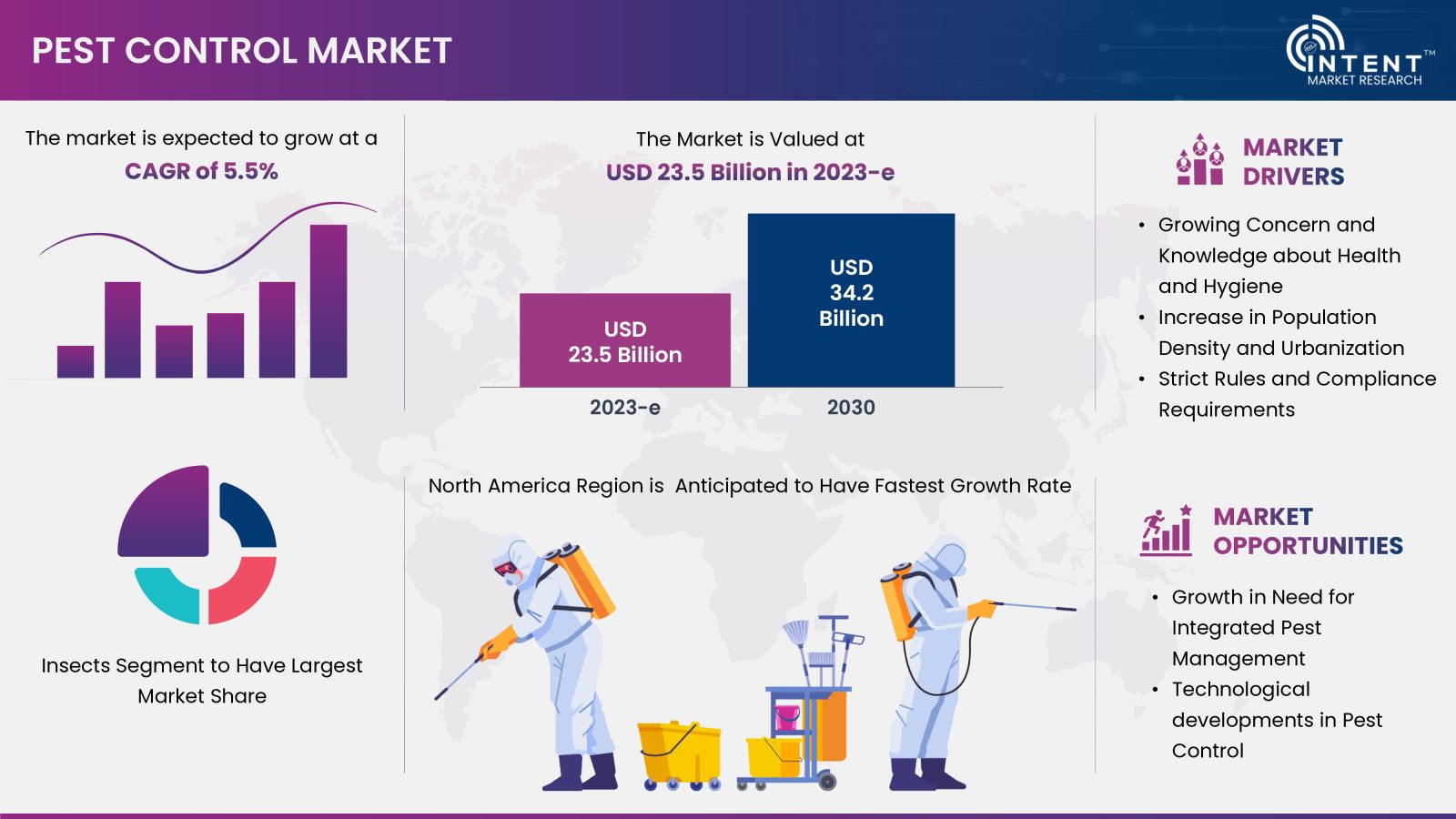

Pest Control Market is expected to grow from USD 23.5 billion in 2023-e to USD 34.2 billion by 2030, at a CAGR of 5.5% during the forecast period. Pest control is competitive market, the prominent players in the global market include ADAMA, Anticimex, BASF, Bayer, Corteva, Dodson, Ecolab, FMC, Godrej Agrovet, Rentokil, Rollins, Sumitomo, Syngenta, and Terminix.

Every year, pests cause 20% to 40% of the world's crop production to be lost. According to the Food and Agriculture Organization of the United Nations, invasive insects cost the world economy about USD 70 billion annually, and plant diseases about USD 220 billion. Another major biotic barrier to the world's food production is weeds. Rodents, cockroaches, and mosquitoes can cause property damage, spread diseases and trigger allergies.

Effective pest control strategies can stop property damage, lower the risk of allergies, stop the spread of illness, and create a healthy living environment. Environmental Health and Safety (EH&S) works to guarantee pests (health and structural vectors) are managed safely and hygienically, adhering to relevant state and federal laws.

Key Findings of the Pest Control Market Study

Growing Concern and Knowledge about Health and Hygiene Will Drive the Market

To preserve public health and safety, pest control is crucial. Experts in pest control employ a range of techniques, such as inspections, trapping, and pesticide applications to locate and eradicate infestations. The pest control market is experiencing growth driven by an increasing concern and improved awareness regarding health and hygiene. As people and businesses become more conscious of the health risks associated with pests, there is a heightened emphasis on pest management to uphold clean and sanitary surroundings.

Pests being recognized as carriers of diseases have become a significant motivator for the adoption of professional pest control services. This heightened awareness spans various sectors, encompassing residential, commercial, and industrial spaces. With consumers gaining greater knowledge about the potential health consequences linked to pests, there is a rising demand for efficient pest control solutions, propelling the market's expansion

Enforcement of Strict Regulatory Laws is Hindering the Use of Pest Control

Pest control techniques, particularly those involving chemical applications are restricted by regulations. In certain circumstances, the efficacy of pest management can be impacted by restrictions on the use of specific fumigants or outdoor pesticides. It takes a long time and money to register pest control products with regulatory bodies. Strict laws requiring product approval hinders the market's ability to receive new and creative solutions making it difficult for the sector to adjust to changing pest problems.

Insect Pest Control Fuels the Market Addressing Growing Concerns for Health and Urbanization Challenges

The need for effective management of insect pests is becoming more urgent as indicated by the growing demand for pest control services. As the world's population grows, urbanization increases, and climate patterns shift, favorable conditions for insect infestations arise. The World Health Organization (WHO) said that by 2080, there will be a 244% increase in fly populations.

According to the Centre for Agriculture and Bioscience International, the Asian tiger mosquito, primarily found in Indonesia, Nepal, India, Malaysia, Myanmar, Thailand, Taiwan, and Vietnam, has expanded quickly over the past ten years to 28 different countries. The WHOs Large Analysis and Review of European Housing and Health Status (LARES) survey revealed that approximately 60% of residential areas grapple with at least one insect problem. This finding highlights a substantial market opportunity for the pest control industry, emphasizing the escalating demand for effective pest management solutions.

.jpg)

Cutting-Edge Chemical Formulations is Growing the Demand for Synthetic Pest Control

The demand for synthetic pest control is on the rise, driven by cutting-edge chemical formulations. These advanced formulations represent a technological leap in pest management, offering increased efficacy and precision. The development of sophisticated synthetic pesticides addresses diverse pest challenges, contributing to heightened demand. The market shift towards these cutting-edge solutions underscores the significance of technological innovation in shaping the pest control industry.

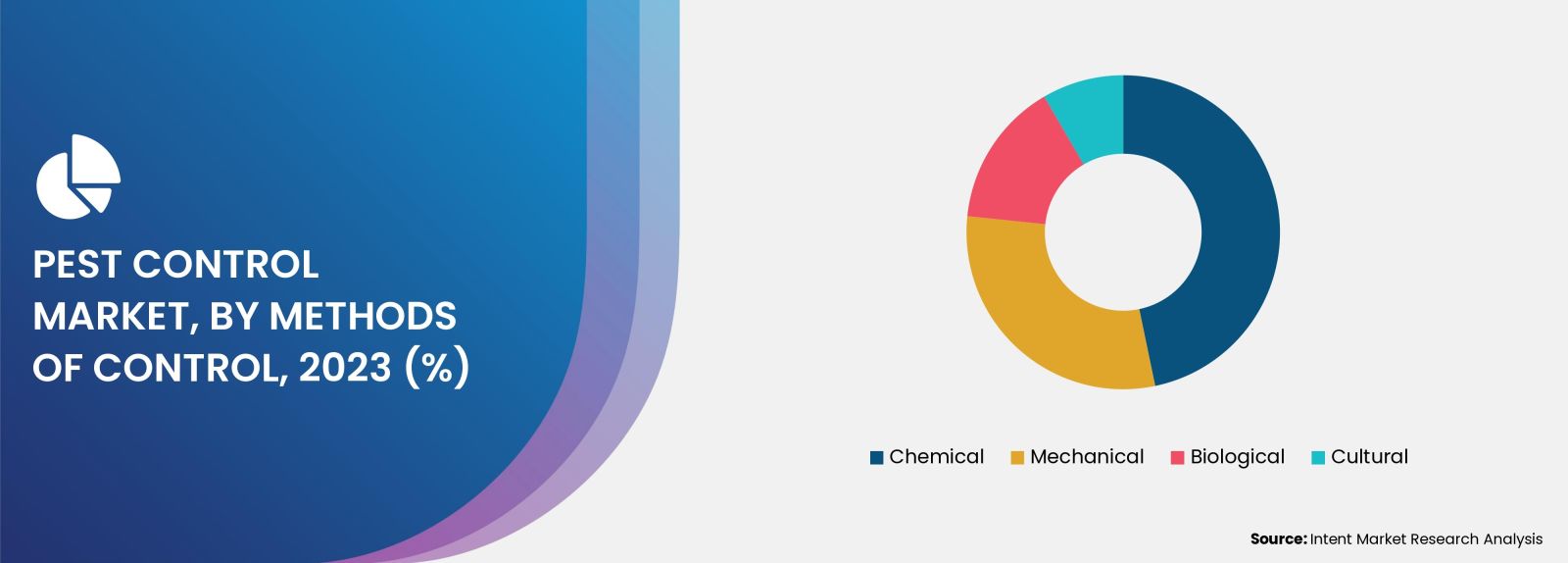

Chemical Control Method to Boost the Pest Control Market Growth

The pest control market is experiencing significant momentum, propelled by the dominance of chemical pest control methods. This approach involves the utilization of toxic or poisonous substances to combat pests and manage the diseases they can transmit. Chemical pesticides, being readily available, effective, stable, and relatively affordable, emerge as a driving force in pest management strategies. The broad-spectrum nature of chemical pesticides allows for the simultaneous control of various pest species, proving especially valuable in scenarios with diverse pest populations.

Sprays are Paving the Way for Even Distribution of Pest Control Products

Sprays are used to apply pest control in chosen amounts to various surfaces and locations. By reaching places that might be challenging to reach with other methods, spraying enables the wide and even distribution of pest control products. This technique works well in a variety of pest control situations as it can be applied both indoors and outdoors. Furthermore, improvements in spray technology have resulted in the creation of more environmental friendly and targeted formulations that have a reduced negative impact on the environment.

Commercial Segment is Driving the Market Growth

The commercial segment plays pivotal role in driving the market growth. Presently, businesses and industries prioritize pest management to maintain hygiene standards and ensure the safety of both employees and customers. Stringent regulations, especially in sectors like hospitality, food processing, and healthcare, mandate extensive pest control measures. The expanding footprint of commercial spaces and the acceleration of global trade contribute to a continuous surge in the demand for professional pest control services.

North America is Poised for Significant Market Growth in the Forecast Period

North America stands poised for substantial growth in the pest control market. The region's robust expansion is attributed to various factors, including heightened awareness of health and safety standards, increasing urbanization, and stringent regulations across industries. As urban areas expand and populations grow, the demand for pest control services rises, driven by the need to maintain hygienic living and working environments. Additionally, advancements in technology and a proactive approach towards pest management contribute to the market's upward trajectory.

Key players operating in the global pest control market are ADAMA, Anticimex, BASF, Bayer, Corteva, Dodson, Ecolab, FMC, Godrej Agrovet, Rentokil, Rollins, Sunitomo, Syngenta and Terminix. Major market players have started adopting several strategies to improve their market share. For example, in June 2023, Bayer’s agricultural division, Bayer CropScience, teamed up with Crystal Crop Protection to create and introduce innovative pest management solutions that will help paddy farmers all over India. This collaboration marks a significant turning point in India's efforts to increase crop protection methods and rice farmer yields.

Pest Control Market Coverage

The report provides key insights into the pest control market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players and the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 23.5 Billion |

|

Forecast Revenue (2030) |

USD 34.2 Billion |

|

CAGR (2024-2030) |

5.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

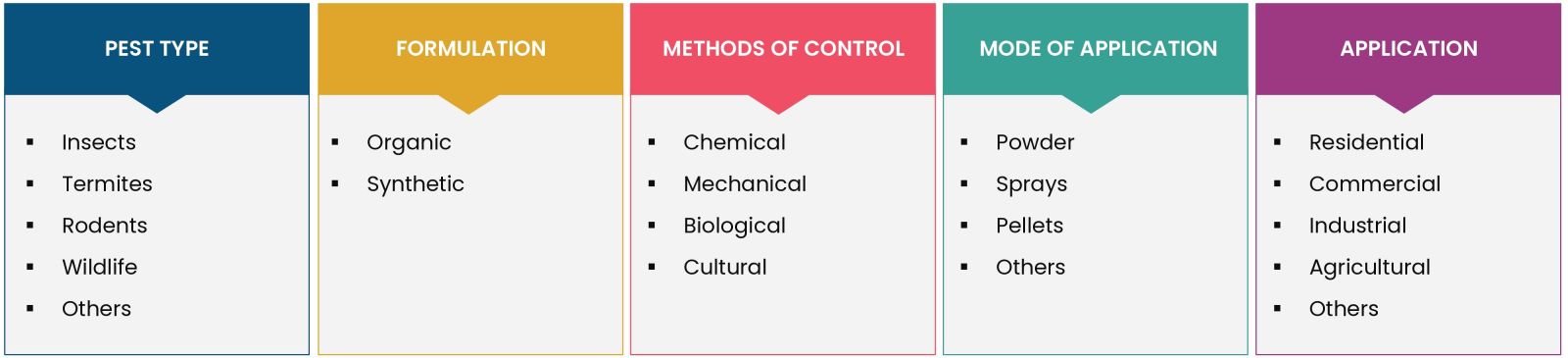

Segments Covered |

By Pest Type (Insects, Termites, Rodents, Wildlife, Others), By Formulation (Organic, Synthetic), By Methods of Control (Chemical Control (Insecticides, Rodenticides, Disinfectants), Biological Control (Predators, Parasites, Pathogen), Mechanical Control (Traps, Barriers, Exclusion Methods), Cultural Control (Crop Rotation, Hygiene Practices, Habitat Modification)), By Mode of Application (Powder, Sprays, Pellets, Others), By Application (Residential, Commercial, Industrial, Agricultural, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

ADAMA, Anticimex, BASF, Bayer, Corteva, Dodson, Ecolab, FMC, Godrej Agrovet, Rentokil, Rollins, Sumitomo, Syngenta, and Terminix |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.1.1. Growing concern and knowledge about health and hygiene |

|

4.1.2. Strict rules and compliance requirements |

|

4.1.3. Advancements in pest control technologies |

|

4.2. Market Growth Restraints |

|

4.2.1. Enforcement of strict regulatory laws |

|

4.2.2. Chemicals used in pest control pose health risks. |

|

4.3. Market Growth Opportunities |

|

4.3.1. Need for Integrated Pest Management (IPM) |

|

4.3.2. Emergence of biological pest management techniques |

|

5.Market Outlook |

|

5.1. Supply Chain Analysis |

|

5.2. Technology Trends |

|

5.3. Patent Analysis |

|

5.4. PORTER’S Five Forces Analysis |

|

5.5. PESTLE Analysis |

|

5.6. Regulatory Landscape |

|

6.Market Segment Outlook |

|

6.1. Segment Synopsis |

|

6.2. By Pest Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.2.1. Insects |

|

6.2.2. Termites |

|

6.2.3. Rodents |

|

6.2.4. Others |

|

6.3. By Formulation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.3.1. Organic |

|

6.3.2. Synthetic |

|

6.4. By Methods of Control (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.4.1. By Chemical Control |

|

6.4.1.1. Insecticides |

|

6.4.1.2. Rodenticides |

|

6.4.1.3. Disinfectants |

|

6.4.2. By Biological Control |

|

6.4.2.1. Predators |

|

6.4.2.2. Parasites |

|

6.4.2.3. Pathogens |

|

6.4.3. By Mechanical Control |

|

6.4.3.1.Traps |

|

6.4.3.2.Barriers |

|

6.4.3.3.Exclusion methods |

|

6.4.4. By Cultural Control |

|

6.4.4.1.Crop rotation |

|

6.4.4.2.Hygiene practices |

|

6.4.4.3.Habitat modification |

|

6.5. By Mode of Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.5.1. Powder |

|

6.5.2. Sprays |

|

6.5.3. Pellets |

|

6.5.4. Others |

|

6.6. By Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.6.1. Residential |

|

6.6.2. Commercial |

|

6.6.3. Industrial |

|

6.6.4. Agricultural |

|

6.6.5. Others |

|

7.Regional Outlook |

|

7.1. Global Market Synopsis |

|

7.2. North America (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.2.1. North America Pest Control Market Outlook |

|

7.2.2. US |

|

7.2.2.1.US Pest Control Market, By Pest Type |

|

7.2.2.2.US Pest Control Market, By Formulation |

|

7.2.2.3.US Pest Control Market, By Methods of Control |

|

7.2.2.4.US Pest Control Market, By Mode of Application |

|

7.2.2.5.US Pest Control Market, By Application |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3. Canada |

|

7.2.4. Mexico |

|

7.3. Europe (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.3.1. Europe Pest Control Market Outlook |

|

7.3.2. Germany |

|

7.3.3. UK |

|

7.3.4. France |

|

7.3.5. Spain |

|

7.3.6. Italy |

|

7.4. Asia-Pacific (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.4.1. Asia-Pacific Pest Control Market Outlook |

|

7.4.2. China |

|

7.4.3. India |

|

7.4.4. Japan |

|

7.4.5. South Korea |

|

7.4.6. Australia |

|

7.5. Latin America (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.5.1. Latin America Pest Control Market Outlook |

|

7.5.2. Brazil |

|

7.5.3. Argentina |

|

7.6. Middle East & Africa (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.6.1. Middle East & Africa Pest Control Market Outlook |

|

7.6.2. Saudi Arabia |

|

7.6.3. UAE |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Company Strategy Analysis |

|

8.3. Competitive Matrix |

|

9.Company Profiles |

|

9.1. Pest Control Companies |

|

9.1.1. ADAMA |

|

9.1.1.1.Company Synopsis |

|

9.1.1.2.Company Financials |

|

9.1.1.3.Product/Service Portfolio |

|

9.1.1.4.Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2. Anticimex |

|

9.1.3. BASF |

|

9.1.4. Bayer |

|

9.1.5. Corteva |

|

9.1.6. Dodson |

|

9.1.7. Ecolab |

|

9.1.8. FMC |

|

9.1.9. Rentokil |

|

9.1.10. Rollins |

|

9.1.11. Sumitomo |

|

9.1.12. Syngenta |

|

9.1.13. Terminix |

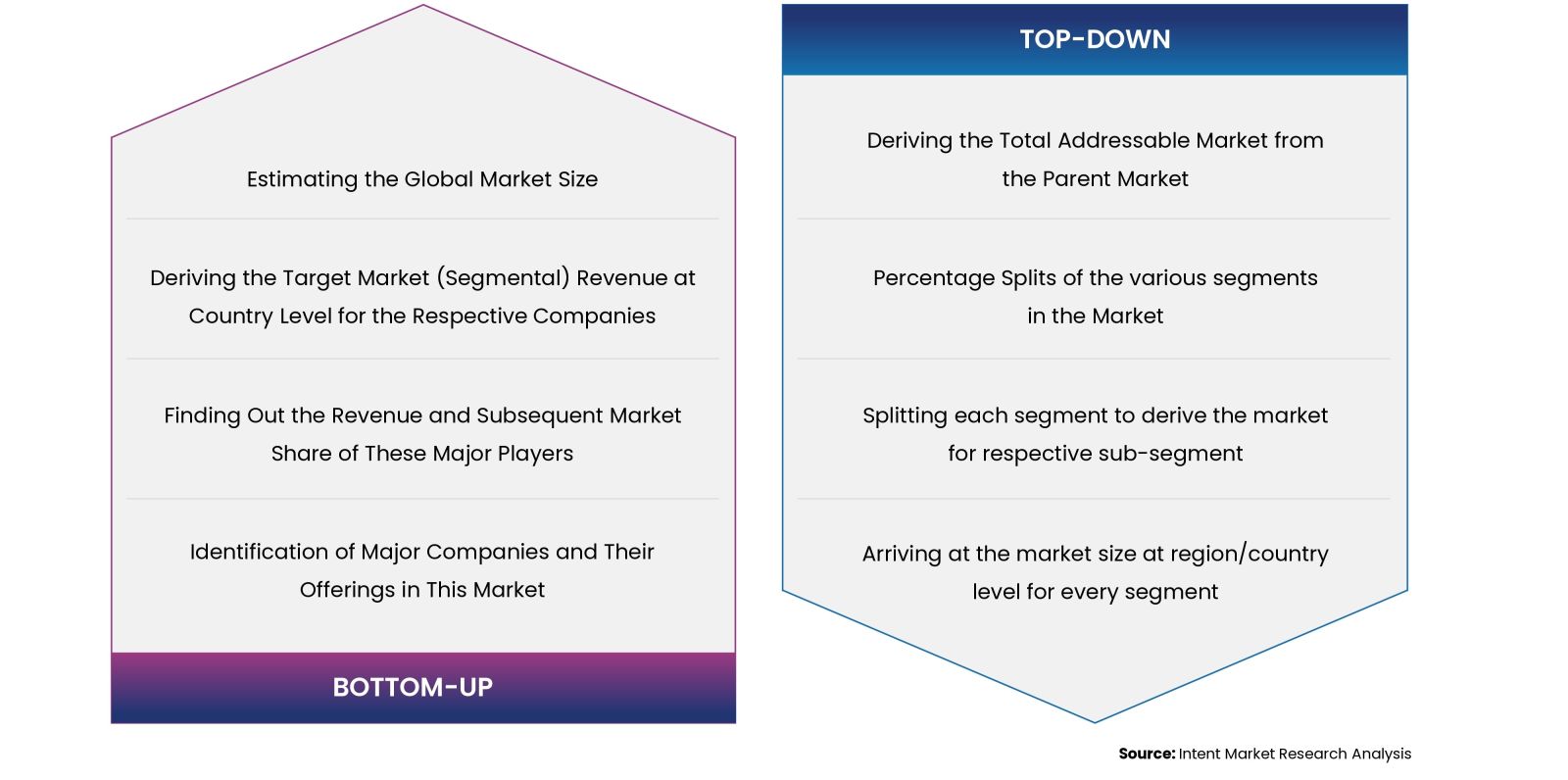

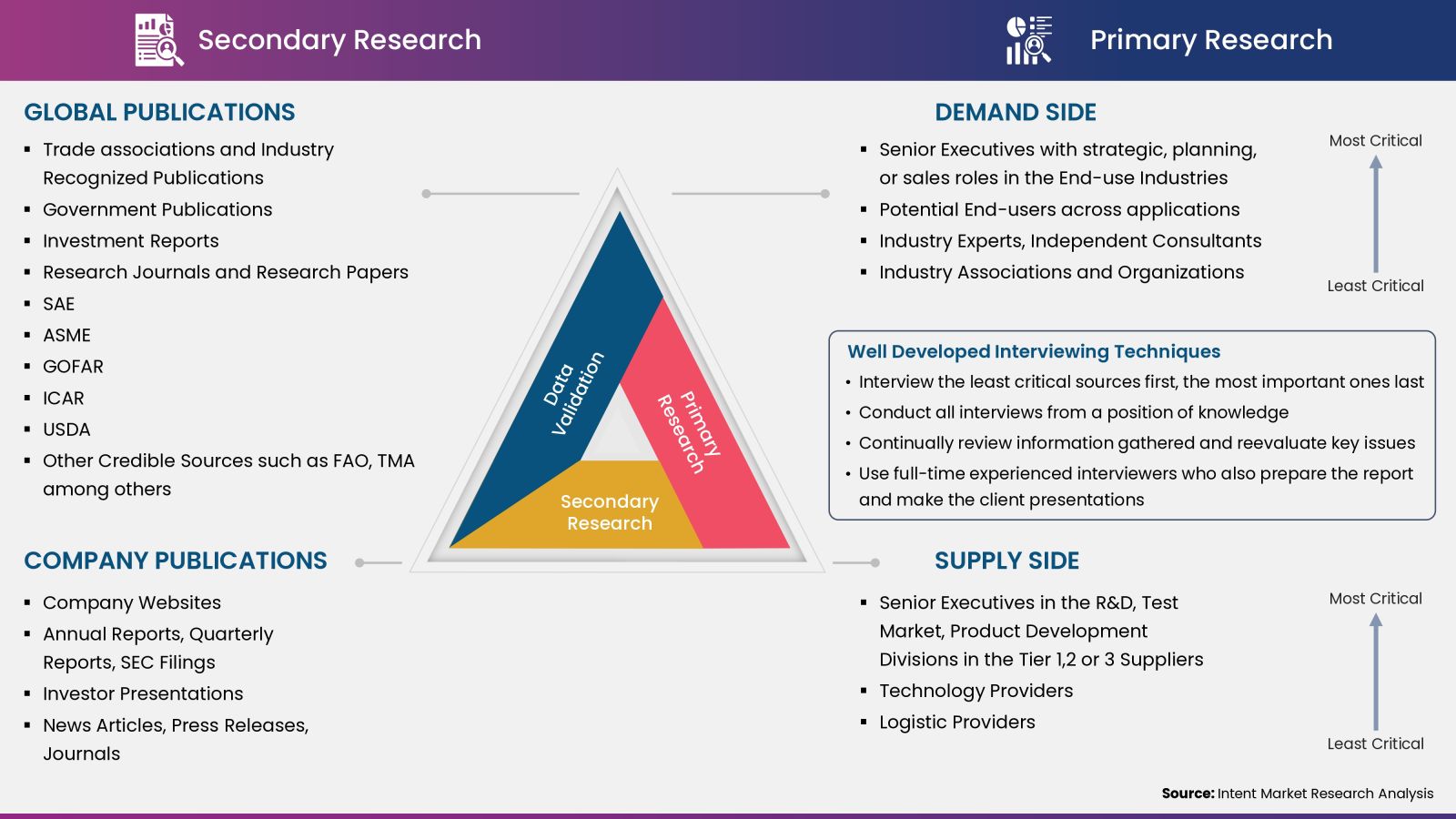

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.