As per Intent Market Research, the Urothelial Cancer Treatment Market was valued at USD 6.9 Billion in 2024-e and will surpass USD 13.1 Billion by 2030; growing at a CAGR of 11.2% during 2025 - 2030.

The urothelial cancer treatment market is expanding as the prevalence of urothelial carcinoma, particularly bladder cancer, continues to rise globally. Urothelial cancer primarily affects the urinary system, including the bladder, kidneys, and ureters. Early detection, combined with advancements in treatment options, has led to improved survival rates for patients. The market for urothelial cancer treatments is characterized by a growing demand for targeted therapies, immunotherapies, and chemotherapy, as well as evolving treatment protocols to offer personalized care for patients. With ongoing research and development, new drug types and combination therapies are further transforming treatment approaches for urothelial cancer.

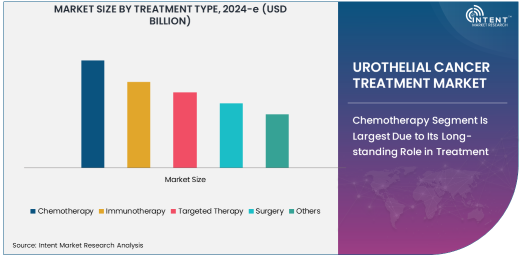

The treatment modalities for urothelial cancer include chemotherapy, immunotherapy, targeted therapy, surgery, and others. Among these, chemotherapy remains a cornerstone in the management of advanced urothelial cancer, though immunotherapy and targeted therapies are gaining traction due to their effectiveness in specific patient populations. The drug types used for these treatments range from traditional chemotherapeutic agents to cutting-edge immune checkpoint inhibitors, monoclonal antibodies, and tyrosine kinase inhibitors. Hospitals and oncology clinics are the primary end-use industries for urothelial cancer treatments, where advanced medical infrastructure supports the delivery of these therapies.

Chemotherapy Segment Is Largest Due to Its Long-standing Role in Treatment

The chemotherapy segment is the largest in the urothelial cancer treatment market, owing to its long-standing role in managing advanced-stage urothelial cancers, particularly bladder cancer. Chemotherapy has been the standard treatment for many years, especially for patients with locally advanced or metastatic urothelial cancer. The primary chemotherapeutic agents, such as cisplatin and carboplatin, are often used in combination with other drugs to improve efficacy. Chemotherapy is typically used in neoadjuvant, adjuvant, or palliative settings, depending on the stage and progression of the cancer.

While newer therapies are gaining ground, chemotherapy continues to be widely used in clinical practice due to its proven effectiveness and accessibility. Many patients with advanced urothelial cancer, who may not be candidates for more targeted therapies, rely on chemotherapy for symptom management and survival. Despite the side effects associated with chemotherapy, its ability to reduce tumor size and improve patient outcomes in many cases ensures its dominant position in the treatment of urothelial cancer.

Immunotherapy Segment Is Fastest Growing Due to Breakthrough Drugs

The immunotherapy segment is the fastest growing in the urothelial cancer treatment market, primarily driven by the introduction of immune checkpoint inhibitors. These treatments, such as pembrolizumab (Keytruda) and atezolizumab (Tecentriq), have revolutionized the management of urothelial cancer, particularly in patients with advanced or metastatic disease who have failed traditional chemotherapy. Immunotherapy works by harnessing the body’s immune system to recognize and attack cancer cells, leading to improved survival rates and prolonged disease-free periods in many patients.

Immunotherapy's ability to offer durable responses with relatively fewer side effects compared to chemotherapy is one of the key factors behind its rapid growth. The increasing number of clinical trials exploring the use of immune checkpoint inhibitors in combination with other therapies is expected to drive further market growth. With the growing number of approvals for immunotherapy drugs and the positive results observed in clinical studies, this segment is poised for continued expansion, making immunotherapy the fastest-growing treatment modality for urothelial cancer.

Hospitals Are Largest End-Use Industry Due to Advanced Treatment Facilities

Hospitals are the largest end-use industry for urothelial cancer treatments, owing to their ability to offer comprehensive care, advanced diagnostic tools, and specialized treatment options. Hospitals provide a wide range of services, including chemotherapy, immunotherapy, and surgery, for urothelial cancer patients, supported by experienced oncologists and medical professionals. The infrastructure and equipment available in hospitals allow for the administration of complex treatments, including chemotherapy regimens, targeted therapies, and immunotherapies.

Additionally, hospitals are equipped with the necessary facilities for patients who require intensive care or surgical interventions, making them the preferred setting for managing advanced-stage urothelial cancer. The rising demand for effective cancer treatment, coupled with the increasing number of patients diagnosed with urothelial cancer, ensures that hospitals continue to dominate the urothelial cancer treatment market.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure and High Adoption of New Treatments

North America is the largest region in the urothelial cancer treatment market, primarily driven by the region’s advanced healthcare infrastructure, high rates of cancer diagnosis, and rapid adoption of new treatment modalities. The United States, in particular, has seen a significant increase in the use of immunotherapies and targeted therapies, thanks to regulatory approvals and the widespread availability of cutting-edge treatments. The region is home to numerous hospitals, oncology clinics, and research institutions that are at the forefront of urothelial cancer treatment and research.

Furthermore, the high prevalence of urothelial cancer in North America, along with increasing awareness and early detection, contributes to the rising demand for advanced treatments. North America’s strong healthcare policies, reimbursement systems, and research-driven approach to cancer treatment are expected to continue supporting its position as the largest region in the urothelial cancer treatment market.

Leading Companies and Competitive Landscape

The urothelial cancer treatment market is highly competitive, with several leading pharmaceutical companies making significant strides in the development and commercialization of therapies. Companies such as Bristol-Myers Squibb, Merck & Co., Roche, Eli Lilly, and AstraZeneca are key players, each offering a range of drugs targeting urothelial cancer. These companies are investing heavily in research and development, focusing on expanding the indications for their existing drugs and exploring novel treatment options, including combination therapies.

The competitive landscape is characterized by innovation in immunotherapy and targeted therapy development, as well as ongoing clinical trials aimed at improving patient outcomes. Partnerships and collaborations between pharmaceutical companies and academic institutions are common as they work to discover new drugs and treatment regimens. With continued research and technological advancements, the urothelial cancer treatment market is expected to experience significant growth, particularly in the areas of immunotherapy and targeted therapy.

Recent Developments:

- Roche announced the launch of a new immunotherapy drug for advanced urothelial cancer, aimed at improving patient survival rates.

- Merck & Co. received FDA approval for its novel immunotherapy for bladder cancer, significantly expanding its oncology portfolio.

- AstraZeneca completed the clinical trial for its targeted therapy for urothelial cancer, showing promising results in terms of progression-free survival.

- Pfizer introduced a new combination treatment regimen for urothelial cancer, targeting both immune checkpoint inhibition and chemotherapy for better efficacy.

- Bristol-Myers Squibb reported that its latest monoclonal antibody, used in urothelial cancer treatment, achieved a higher overall survival rate in phase III trials.

List of Leading Companies:

- Roche Holding AG

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- AstraZeneca plc

- Pfizer Inc.

- Johnson & Johnson

- Sanofi S.A.

- Eli Lilly and Company

- Novartis International AG

- Bayer AG

- GlaxoSmithKline plc

- Seattle Genetics, Inc.

- Ipsen S.A.

- Exelixis, Inc.

- Clovis Oncology, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 6.9 Billion |

|

Forecasted Value (2030) |

USD 13.1 Billion |

|

CAGR (2025 – 2030) |

11.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Urothelial Cancer Treatment Market by Treatment Type (Chemotherapy, Immunotherapy, Targeted Therapy, Surgery), by Drug Type (Chemotherapeutic Agents, Immune Checkpoint Inhibitors, Monoclonal Antibodies, Tyrosine Kinase Inhibitors), by End-Use Industry (Hospitals, Oncology Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Roche Holding AG, Bristol-Myers Squibb Company, Merck & Co., Inc., AstraZeneca plc, Pfizer Inc., Johnson & Johnson, Eli Lilly and Company, Novartis International AG, Bayer AG, GlaxoSmithKline plc, Seattle Genetics, Inc., Ipsen S.A., Clovis Oncology, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Urothelial Cancer Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Chemotherapy |

|

4.2. Immunotherapy |

|

4.3. Targeted Therapy |

|

4.4. Surgery |

|

4.5. Others |

|

5. Urothelial Cancer Treatment Market, by Drug Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Chemotherapeutic Agents |

|

5.2. Immune Checkpoint Inhibitors |

|

5.3. Monoclonal Antibodies |

|

5.4. Tyrosine Kinase Inhibitors |

|

5.5. Others |

|

6. Urothelial Cancer Treatment Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Oncology Clinics |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Urothelial Cancer Treatment Market, by Treatment Type |

|

7.2.7. North America Urothelial Cancer Treatment Market, by Drug Type |

|

7.2.8. North America Urothelial Cancer Treatment Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Urothelial Cancer Treatment Market, by Treatment Type |

|

7.2.9.1.2. US Urothelial Cancer Treatment Market, by Drug Type |

|

7.2.9.1.3. US Urothelial Cancer Treatment Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Roche Holding AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bristol-Myers Squibb Company |

|

9.3. Merck & Co., Inc. |

|

9.4. AstraZeneca plc |

|

9.5. Pfizer Inc. |

|

9.6. Johnson & Johnson |

|

9.7. Sanofi S.A. |

|

9.8. Eli Lilly and Company |

|

9.9. Novartis International AG |

|

9.10. Bayer AG |

|

9.11. GlaxoSmithKline plc |

|

9.12. Seattle Genetics, Inc. |

|

9.13. Ipsen S.A. |

|

9.14. Exelixis, Inc. |

|

9.15. Clovis Oncology, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Urothelial Cancer Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Urothelial Cancer Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Urothelial Cancer Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA