As per Intent Market Research, the Payment Integrity Market was valued at USD 13.3 billion in 2024-e and will surpass USD 28.3 billion by 2030; growing at a CAGR of 13.5% during 2025 - 2030.

The payment integrity market focuses on ensuring that financial transactions, particularly in industries like healthcare, insurance, and banking, are accurate, secure, and compliant with regulations. With increasing fraud cases, payment errors, and the growing reliance on digital payments, this market has become essential for organizations aiming to maintain financial accuracy and reduce operational inefficiencies. As the demand for more secure and accurate payment processing rises, the payment integrity market is expected to witness significant growth across various sectors.

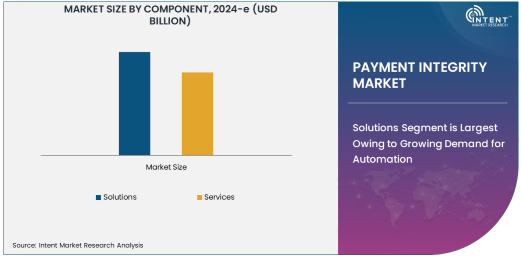

Solutions Segment is Largest Owing to Growing Demand for Automation

In the payment integrity market, the solutions segment is the largest, driven by the increasing adoption of automated systems to detect fraud and improve claims accuracy. Solutions such as software platforms for claim review, fraud prevention, and data analytics have become essential for organizations aiming to reduce administrative costs and enhance operational efficiency. As businesses across healthcare, insurance, and finance sectors seek to integrate more automated tools, the demand for advanced solutions, such as AI-powered platforms, continues to rise.

These solutions not only help organizations streamline their payment processes but also improve compliance with regulatory standards. The rise of digital payments and the growing complexity of payment systems have made it necessary for businesses to adopt more robust solutions that can handle large volumes of transactions securely and efficiently. This trend is expected to continue, with the solutions segment maintaining its dominance in the coming years.

Claim Review Segment is Fastest Growing Due to Increased Fraud Prevention Efforts

The claim review segment is the fastest-growing within the payment integrity market, as businesses focus on ensuring the accuracy of claims before processing payments. This process helps identify discrepancies, fraudulent claims, and errors, reducing the risk of overpayments and financial losses. With the healthcare industry being one of the largest users of claim review systems, the segment is seeing rapid growth, driven by stringent regulatory requirements and the increasing need to manage complex claims data.

Furthermore, advancements in machine learning and artificial intelligence are enhancing the accuracy and efficiency of claim review processes. These technologies allow for more precise detection of errors and fraud, contributing to the expansion of the segment. As businesses look to reduce manual oversight and improve payment accuracy, the demand for automated claim review solutions is expected to continue to rise.

Healthcare Application is Largest Due to Regulatory Pressures and Cost Management

In terms of application, the healthcare sector is the largest and continues to dominate the payment integrity market. This is primarily due to the increasing complexity of healthcare claims, the rise of fraudulent billing practices, and the need for regulatory compliance. Healthcare providers must ensure that payments are accurate and meet the standards set by government and private insurers. As a result, payment integrity solutions tailored to the healthcare sector have become a necessity to reduce overpayments, prevent fraud, and maintain compliance with healthcare regulations.

Additionally, the healthcare industry’s shift toward electronic health records (EHR) and electronic billing systems has created an environment ripe for the implementation of payment integrity solutions. These solutions help healthcare organizations streamline their claims processes, reduce administrative burden, and improve financial health by identifying overpayments and fraud before payments are made.

Insurance Companies End-User is Largest Owing to Rising Fraud and Errors

Within the end-user segment, insurance companies represent the largest user of payment integrity solutions. The insurance industry faces significant challenges related to fraudulent claims, billing errors, and compliance issues. As the volume of claims increases, insurance companies are investing heavily in payment integrity solutions to mitigate risks, reduce operational costs, and improve the accuracy of claims processing. With advanced fraud detection tools and claims review solutions, insurance companies are able to reduce the likelihood of fraudulent payouts and enhance overall operational efficiency.

The complexity of insurance claims, coupled with stringent regulations, has made payment integrity an essential component of the insurance sector. As the industry continues to evolve, particularly with the integration of digital platforms, the demand for sophisticated payment integrity tools is expected to grow.

North America Region is Largest Market Owing to High Adoption and Technological Advancements

The North America region is the largest market for payment integrity solutions, owing to the high adoption of digital payment systems, the increasing complexity of healthcare and insurance claims, and stringent regulatory requirements. The United States, in particular, leads the market due to the growth of the healthcare sector and the increasing need for accurate billing and claims processing. Additionally, the region’s advanced technological infrastructure and high levels of investment in fraud detection and prevention contribute to North America's dominance in the market.

The region also benefits from favorable regulatory environments that encourage the adoption of payment integrity solutions. With the increasing focus on reducing fraud in sectors like healthcare and insurance, North America is expected to maintain its leadership in the global payment integrity market.

Competitive Landscape

The competitive landscape of the payment integrity market is characterized by the presence of several major players, including Optum, Cognizant Technology Solutions, Change Healthcare, Conduent, and FICO. These companies offer a range of solutions and services designed to meet the needs of different industries, including healthcare, insurance, and banking. The competition is primarily driven by technological advancements, with companies leveraging artificial intelligence, machine learning, and big data analytics to improve the accuracy and efficiency of payment integrity solutions.

As the market expands, companies are increasingly focusing on strategic partnerships, acquisitions, and product innovations to enhance their market position. Collaboration with healthcare providers, insurers, and government agencies has become a key strategy to increase the adoption of payment integrity solutions. The growing demand for secure, efficient, and compliant payment processes is expected to fuel further competition, leading to continuous improvements in the solutions and services offered by market players.

Recent Developments:

- Optum, a subsidiary of UnitedHealth Group, announced a merger with Change Healthcare to enhance their payment integrity solutions for the healthcare sector. This merger aims to improve claim accuracy and reduce fraud through AI-powered technologies.

- Cognizant acquired TMG’s healthcare business, expanding its capabilities in payment integrity services. This acquisition strengthens Cognizant’s position in providing fraud prevention and claims review solutions.

- Experian launched a new fraud detection platform that integrates machine learning to identify anomalies in payment transactions. This service is aimed at reducing fraudulent claims in both healthcare and insurance sectors.

- Conduent announced an expansion of its payment integrity services tailored to the insurance market. The new suite of services focuses on improving claims accuracy and minimizing payment fraud using advanced data analytics.

- FICO unveiled a payment integrity platform designed specifically for healthcare providers. The platform incorporates AI-driven algorithms to identify fraudulent claims and streamline claims processing.

List of Leading Companies:

- Optum, Inc.

- Cognizant Technology Solutions Corporation

- Change Healthcare

- Experian Plc

- Conduent Inc.

- Truven Health Analytics (acquired by IBM Watson Health)

- McKesson Corporation

- Cotiviti, Inc.

- Firstsource Solutions Ltd.

- DXC Technology

- Quest Diagnostics

- FICO

- Availity, LLC

- MedInsight, Inc.

- Emdeon (acquired by Change Healthcare)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 13.3 Billion |

|

Forecasted Value (2030) |

USD 28.3 Billion |

|

CAGR (2025 – 2030) |

13.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Payment Integrity Market By Component (Solutions, Services), By Type (Claim Review, Pre-Payment Review, Post-Payment Review, Fraud Detection and Prevention, Recovery Audit), By Application (Healthcare, Insurance, Government, Banking and Financial Services, Retail), By End-User (Insurance Companies, Healthcare Providers, Government Agencies, Financial Institutions, Retailers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Optum, Inc., Cognizant Technology Solutions Corporation, Change Healthcare, Experian Plc, Conduent Inc., Truven Health Analytics (acquired by IBM Watson Health), McKesson Corporation, Cotiviti, Inc., Firstsource Solutions Ltd., DXC Technology, Quest Diagnostics, FICO, Availity, LLC, MedInsight, Inc., Emdeon (acquired by Change Healthcare) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Payment Integrity Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Solutions |

|

4.2. Services |

|

5. Payment Integrity Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Claim Review |

|

5.2. Pre-Payment Review |

|

5.3. Post-Payment Review |

|

5.4. Fraud Detection and Prevention |

|

5.5. Recovery Audit |

|

6. Payment Integrity Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Healthcare |

|

6.2. Insurance |

|

6.3. Government |

|

6.4. Banking and Financial Services |

|

6.5. Retail |

|

7. Payment Integrity Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Insurance Companies |

|

7.2. Healthcare Providers |

|

7.3. Government Agencies |

|

7.4. Financial Institutions |

|

7.5. Retailers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Payment Integrity Market, by Component |

|

8.2.7. North America Payment Integrity Market, by Type |

|

8.2.8. North America Payment Integrity Market, by Application |

|

8.2.9. North America Payment Integrity Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Payment Integrity Market, by Component |

|

8.2.10.1.2. US Payment Integrity Market, by Type |

|

8.2.10.1.3. US Payment Integrity Market, by Application |

|

8.2.10.1.4. US Payment Integrity Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Optum, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Cognizant Technology Solutions Corporation |

|

10.3. Change Healthcare |

|

10.4. Experian Plc |

|

10.5. Conduent Inc. |

|

10.6. Truven Health Analytics (acquired by IBM Watson Health) |

|

10.7. McKesson Corporation |

|

10.8. Cotiviti, Inc. |

|

10.9. Firstsource Solutions Ltd. |

|

10.10. DXC Technology |

|

10.11. Quest Diagnostics |

|

10.12. FICO |

|

10.13. Availity, LLC |

|

10.14. MedInsight, Inc. |

|

10.15. Emdeon (acquired by Change Healthcare) |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Payment Integrity Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Payment Integrity Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Payment Integrity Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA