As per Intent Market Research, the Packaging Testing Market was valued at USD 7.6 Billion in 2024-e and will surpass USD 11.4 Billion by 2030; growing at a CAGR of 7.1% during 2025-2030.

The packaging testing market plays a crucial role in ensuring that packaging materials and products meet required standards for safety, quality, and performance. As the demand for packaged goods grows across various industries, ensuring the reliability, durability, and compliance of packaging materials becomes increasingly important. Packaging testing encompasses various methods, including mechanical, chemical, environmental, and performance testing, to evaluate the integrity and functionality of packaging solutions. With the rise in e-commerce and stricter regulatory standards, industries are increasingly turning to packaging testing to ensure their products are well-protected, meet quality standards, and remain safe throughout the distribution chain.

The packaging testing market is experiencing rapid growth due to the rising need for high-quality packaging that ensures the safety and preservation of products, particularly in food, beverage, pharmaceuticals, and consumer electronics sectors. Additionally, the global shift toward sustainable packaging and the growing demand for eco-friendly solutions have driven the need for comprehensive testing services to assess the environmental impact and effectiveness of new materials. As consumer expectations for high-quality, safe, and environmentally responsible packaging continue to rise, the market for packaging testing is expected to grow significantly, with companies focusing on developing more advanced testing methods to meet these evolving needs.

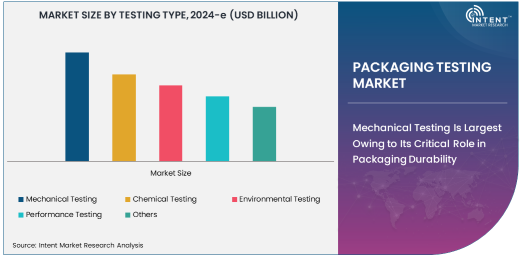

Mechanical Testing Is Largest Owing to Its Critical Role in Packaging Durability

Mechanical testing is the largest segment in the packaging testing market due to its critical role in evaluating the strength, durability, and protective properties of packaging materials. This type of testing assesses the ability of packaging to withstand physical forces during transportation, handling, and storage. Mechanical tests include tensile strength, compression resistance, drop testing, and impact resistance, all of which are essential for ensuring that the packaging can adequately protect the contents from damage. For industries such as food and beverage, pharmaceuticals, and consumer electronics, ensuring the packaging can endure physical stresses is vital for maintaining product integrity and preventing costly damage.

The demand for mechanical testing is particularly high in the food and beverage sector, where packaging must meet specific criteria for durability and safety. Additionally, the growing e-commerce market has heightened the need for packaging that can withstand the rigors of shipping and handling. As online sales continue to increase, the importance of mechanical testing in ensuring the integrity of packaging and preventing product damage during transit cannot be overstated. Companies are increasingly investing in mechanical testing to improve packaging designs and ensure compliance with industry regulations, leading to its dominance in the packaging testing market.

Food & Beverage Industry Is Largest End-User Due to High Packaging Volume

The food and beverage industry is the largest end-user of packaging testing services, owing to the high volume of packaged products and the critical need for safe and reliable packaging. In this sector, packaging must not only preserve the quality and freshness of products but also comply with strict safety regulations to prevent contamination and spoilage. Packaging testing in the food and beverage sector ensures that packaging materials meet the required standards for food safety, shelf life, and environmental impact. With the growing demand for ready-to-eat meals, beverages, and snacks, companies are increasingly investing in packaging testing to ensure that their products meet quality and safety standards throughout the supply chain.

As the food and beverage industry becomes more focused on sustainability, testing for eco-friendly and recyclable packaging materials is also gaining traction. Environmental testing, in particular, is becoming a key part of packaging testing for food and beverage companies as they look to reduce their environmental footprint. The emphasis on food safety, product integrity, and sustainability in this industry is expected to continue driving the demand for comprehensive packaging testing solutions, further solidifying its position as the largest end-user of packaging testing services.

North America Is Largest Region Due to Stringent Regulatory Standards

North America is the largest region in the packaging testing market, driven by stringent regulatory standards and a robust manufacturing sector. The region is home to numerous industries, including food and beverage, pharmaceuticals, cosmetics, and consumer electronics, all of which require packaging testing to meet regulatory requirements and ensure the safety and quality of products. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) enforce strict packaging standards, particularly in the food, pharmaceutical, and healthcare industries, contributing to the region's dominance in the packaging testing market.

The growth of e-commerce in North America has also played a significant role in driving demand for packaging testing services, as businesses seek to ensure their packaging can withstand the challenges of shipping and handling. As companies increasingly focus on improving packaging sustainability and adopting new materials, the need for comprehensive testing to evaluate environmental impact and material performance is rising. North America's advanced testing infrastructure, coupled with its strong regulatory environment, makes it a key market for packaging testing services.

Leading Companies and Competitive Landscape

The packaging testing market is highly competitive, with a wide range of companies offering testing solutions across different sectors. Leading players in the market include Bureau Veritas, Intertek Group plc, SGS S.A., TUV Rheinland, and Eurofins Scientific. These companies provide a comprehensive suite of packaging testing services, including mechanical, chemical, environmental, and performance testing, catering to a diverse range of industries such as food and beverage, pharmaceuticals, cosmetics, and consumer electronics.

The competitive landscape is characterized by a strong focus on innovation, with companies continuously developing new testing methods to address the evolving needs of industries. Additionally, companies are expanding their service offerings to include sustainability testing as businesses increasingly seek to adopt environmentally friendly packaging solutions. The market is also seeing an increasing number of partnerships and collaborations between testing service providers and packaging manufacturers to offer integrated testing solutions. As packaging safety, sustainability, and performance remain top priorities for industries worldwide, the packaging testing market is expected to remain competitive, with companies striving to stay ahead through technological advancements and service diversification.

Recent Developments:

- Intertek Group Plc introduced a new packaging testing solution focused on improving compliance with global food safety regulations, ensuring better consumer protection.

- SGS SA launched an enhanced environmental testing service to assess the impact of packaging materials on the environment throughout the product lifecycle.

- Bureau Veritas S.A. expanded its portfolio by adding new testing services for pharmaceutical packaging, emphasizing regulatory compliance and safety.

- TÜV SÜD Group unveiled a comprehensive performance testing solution for cosmetics packaging, improving packaging durability and shelf-life testing.

- UL LLC developed a new series of testing services for electronic product packaging, focusing on moisture resistance and shock absorption.

List of Leading Companies:

- Intertek Group Plc

- SGS SA

- Bureau Veritas S.A.

- TÜV SÜD Group

- Eurofins Scientific

- UL LLC

- MTS Systems Corporation

- Applus+

- ALS Limited

- Covance, Inc.

- TÜV Rheinland AG

- Dekra SE

- Lloyd's Register Group Limited

- Systech International

- Testing Machines, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.6 Billion |

|

Forecasted Value (2030) |

USD 11.4 Billion |

|

CAGR (2025 – 2030) |

7.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Packaging Testing Market By Testing Type (Mechanical Testing, Chemical Testing, Environmental Testing, Performance Testing), By Application (Food & Beverage Packaging, Pharmaceutical Packaging, Cosmetics Packaging, Consumer Electronics Packaging), and By End-User Industry (Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Electronics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Intertek Group Plc, SGS SA, Bureau Veritas S.A., TÜV SÜD Group, Eurofins Scientific, UL LLC, MTS Systems Corporation, Applus+, ALS Limited, Covance, Inc., TÜV Rheinland AG, Dekra SE, Lloyd's Register Group Limited, Systech International, Testing Machines, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Packaging Testing Market, by Testing Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Mechanical Testing |

|

4.2. Chemical Testing |

|

4.3. Environmental Testing |

|

4.4. Performance Testing |

|

4.5. Others |

|

5. Packaging Testing Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Food & Beverage Packaging |

|

5.2. Pharmaceutical Packaging |

|

5.3. Cosmetics Packaging |

|

5.4. Consumer Electronics Packaging |

|

5.5. Others |

|

6. Packaging Testing Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Food & Beverage |

|

6.2. Pharmaceuticals |

|

6.3. Cosmetics & Personal Care |

|

6.4. Electronics |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Packaging Testing Market, by Testing Type |

|

7.2.7. North America Packaging Testing Market, by Application |

|

7.2.8. North America Packaging Testing Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Packaging Testing Market, by Testing Type |

|

7.2.9.1.2. US Packaging Testing Market, by Application |

|

7.2.9.1.3. US Packaging Testing Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Intertek Group Plc |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. SGS SA |

|

9.3. Bureau Veritas S.A. |

|

9.4. TÜV SÜD Group |

|

9.5. Eurofins Scientific |

|

9.6. UL LLC |

|

9.7. MTS Systems Corporation |

|

9.8. Applus+ |

|

9.9. ALS Limited |

|

9.10. Covance, Inc. |

|

9.11. TÜV Rheinland AG |

|

9.12. Dekra SE |

|

9.13. Lloyd's Register Group Limited |

|

9.14. Systech International |

|

9.15. Testing Machines, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Packaging Testing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Packaging Testing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Packaging Testing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA