As per Intent Market Research, the Packaging Foams Market was valued at USD 11.6 Billion in 2024-e and will surpass USD 17.5 Billion by 2030; growing at a CAGR of 7.1% during 2025-2030.

The packaging foams market plays a critical role in protecting products during storage and transit, offering solutions that safeguard items from impact, vibration, and environmental conditions. Packaging foams are widely used across various industries, including electronics, automotive, food and beverage, and healthcare, owing to their lightweight, cost-effective, and versatile properties. The market is driven by the growing demand for protective packaging that ensures product integrity, especially as e-commerce and global trade continue to expand. With the increasing focus on sustainability, there is a rising trend toward eco-friendly packaging solutions, prompting innovations in foam materials that are both effective and environmentally responsible. The packaging foams market is expected to continue evolving, driven by advancements in material technology and the ongoing need for high-quality protective packaging solutions across diverse industries.

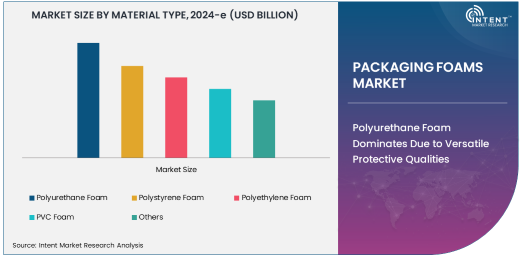

Polyurethane Foam Dominates Due to Versatile Protective Qualities

The packaging foams market is a crucial segment within the broader packaging industry, driven by the demand for protective, lightweight, and cost-effective materials that ensure the safety and integrity of products during transit and storage. Packaging foams are used across various industries to protect products from damage, provide insulation, and maintain product quality. Polyurethane foam is the largest material type in this market, owing to its versatile protective qualities, such as excellent shock absorption, flexibility, and durability. Polyurethane foam can be customized into various densities and shapes, making it an ideal choice for protecting sensitive products, especially in industries like electronics, automotive, and healthcare.

Polyurethane foam's ability to offer superior cushioning properties while being lightweight and resistant to wear and tear is driving its widespread adoption in the packaging foams market. As the demand for e-commerce and global shipping increases, the need for reliable protective packaging solutions has escalated. Polyurethane foam continues to be a material of choice due to its versatility and performance. The growing need for eco-friendly materials has also prompted innovations in the production of recyclable or biodegradable polyurethane foams, further boosting its dominance in the market.

Electronics End-User Industry Is Fastest Growing Due to Demand for Fragile Product Protection

The electronics industry is the fastest growing end-user of packaging foams, driven by the increasing demand for protective solutions that safeguard fragile and high-value products during transportation. With the surge in consumer electronics, such as smartphones, laptops, and televisions, as well as industrial electronics, packaging foams have become essential in providing reliable protection against impacts, vibrations, and external forces. Electronic devices are highly susceptible to damage during transit, making the need for protective packaging critical. Foam materials, particularly polyurethane and polyethylene, are widely used in custom designs that fit the contours of electronic products, ensuring maximum protection without adding excessive weight or bulk.

Additionally, the electronics sector is placing greater emphasis on sustainable packaging materials, as consumers and manufacturers alike seek to minimize environmental impacts. Packaging foam solutions that offer recyclability or biodegradability are gaining traction within this industry, further driving the demand for innovative foam packaging solutions. As the electronics market continues to expand globally, the need for high-performance, sustainable packaging solutions is expected to accelerate, making it a key growth driver in the packaging foams market.

Asia-Pacific Region Is Largest Due to Strong Electronics and Automotive Industries

Asia-Pacific is the largest region in the packaging foams market, driven by the rapid growth of key industries such as electronics, automotive, and healthcare. Countries like China, Japan, South Korea, and India are leading the demand for packaging foams due to their strong manufacturing capabilities and large consumer bases. The electronics and automotive sectors in the Asia-Pacific region are experiencing significant growth, which directly impacts the demand for protective packaging solutions. Packaging foams, particularly polyurethane and polyethylene foams, are widely used to protect electronics and automotive components during shipping and storage.

The Asia-Pacific region is also home to several global manufacturing hubs, making it a major supplier of products that require protective packaging. Additionally, the region's growing focus on sustainability has encouraged the development of eco-friendly packaging foam materials, further driving the market’s growth. As consumer demand for high-quality, reliable packaging solutions continues to rise, Asia-Pacific is expected to maintain its dominant position in the packaging foams market for the foreseeable future.

Leading Companies and Competitive Landscape

The packaging foams market is highly competitive, with leading companies such as Sealed Air Corporation, Pregis LLC, Armacell International, and Rogers Corporation dominating the industry. These companies are known for their innovative packaging solutions that prioritize both protection and sustainability. The competition is intense, with manufacturers constantly working to develop advanced foam materials that offer superior performance, such as better shock absorption, lighter weight, and greater sustainability.

Companies in the packaging foams market are increasingly focusing on developing eco-friendly foam materials that meet consumer demand for sustainable solutions. Partnerships with e-commerce businesses and global manufacturers are also common strategies to ensure the widespread adoption of foam packaging solutions. With continuous advancements in materials science and an increasing emphasis on environmental responsibility, the market is expected to see ongoing innovation and competitive dynamics.

Recent Developments:

- Sealed Air Corporation launched an eco-friendly line of packaging foams made from renewable materials for the food and beverage industry.

- DSM Engineering Materials expanded its production of sustainable packaging foams designed for automotive applications, focusing on reducing carbon footprints.

- BASF SE introduced a new range of polystyrene foams optimized for shock absorption, targeting the electronics packaging market.

- Armacell International S.A. unveiled an advanced polyethylene foam solution for the healthcare sector, improving thermal insulation for temperature-sensitive products.

- Rogers Corporation expanded its product offerings with innovative, high-performance packaging foams designed to reduce material waste in the automotive packaging sector.

List of Leading Companies:

- Sealed Air Corporation

- DSM Engineering Materials

- BASF SE

- Armacell International S.A.

- Rogers Corporation

- Zotefoams PLC

- Fagerdala World Foams AB

- Würth Group

- Synthos S.A.

- Pregis LLC

- DuPont de Nemours, Inc.

- ULINE

- JSP Corporation

- Evonik Industries AG

- Sonoco Products Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 11.6 Billion |

|

Forecasted Value (2030) |

USD 17.5 Billion |

|

CAGR (2025 – 2030) |

7.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Packaging Foams Market By Material Type (Polyurethane Foam, Polystyrene Foam, Polyethylene Foam, PVC Foam), By Application (Protective Packaging, Insulation Packaging, Void Fill Packaging, Food Packaging), and By End-User Industry (Electronics, Automotive, Food & Beverage, Healthcare) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sealed Air Corporation, DSM Engineering Materials, BASF SE, Armacell International S.A., Rogers Corporation, Zotefoams PLC, Fagerdala World Foams AB, Würth Group, Synthos S.A., Pregis LLC, DuPont de Nemours, Inc., ULINE, JSP Corporation, Evonik Industries AG, Sonoco Products Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Packaging Foams Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Polyurethane Foam |

|

4.2. Polystyrene Foam |

|

4.3. Polyethylene Foam |

|

4.4. PVC Foam |

|

4.5. Others |

|

5. Packaging Foams Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Protective Packaging |

|

5.2. Insulation Packaging |

|

5.3. Void Fill Packaging |

|

5.4. Food Packaging |

|

5.5. Others |

|

6. Packaging Foams Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Electronics |

|

6.2. Automotive |

|

6.3. Food & Beverage |

|

6.4. Healthcare |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Packaging Foams Market, by Material Type |

|

7.2.7. North America Packaging Foams Market, by Application |

|

7.2.8. North America Packaging Foams Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Packaging Foams Market, by Material Type |

|

7.2.9.1.2. US Packaging Foams Market, by Application |

|

7.2.9.1.3. US Packaging Foams Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Sealed Air Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. DSM Engineering Materials |

|

9.3. BASF SE |

|

9.4. Armacell International S.A. |

|

9.5. Rogers Corporation |

|

9.6. Zotefoams PLC |

|

9.7. Fagerdala World Foams AB |

|

9.8. Würth Group |

|

9.9. Synthos S.A. |

|

9.10. Pregis LLC |

|

9.11. DuPont de Nemours, Inc. |

|

9.12. ULINE |

|

9.13. JSP Corporation |

|

9.14. Evonik Industries AG |

|

9.15. Sonoco Products Company |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Packaging Foams Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Packaging Foams Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Packaging Foams Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA