As per Intent Market Research, the Packaging and Labeling Services Market was valued at USD 55.6 Billion in 2024-e and will surpass USD 86.1 Billion by 2030; growing at a CAGR of 7.6% during 2025-2030.

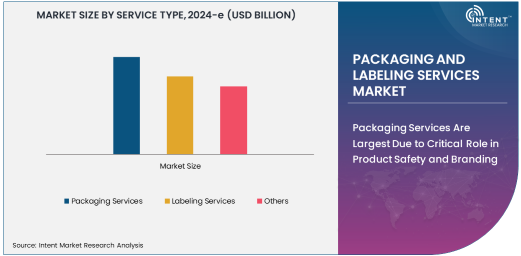

Packaging Services Are Largest Due to Critical Role in Product Safety and Branding

The packaging and labeling services market is experiencing substantial growth, driven by the increasing demand for efficient, secure, and visually appealing packaging solutions across various industries. Among the service types, packaging services are the largest due to their essential role in ensuring the safety, quality, and attractiveness of products. Packaging services encompass a wide range of activities, including design, manufacturing, and testing, all aimed at providing protective packaging that meets industry-specific requirements. This service is particularly critical for sectors like food and beverage, pharmaceuticals, and cosmetics, where product integrity and consumer trust are paramount.

Packaging services are not only vital for product protection but also play a key role in branding and marketing. As businesses compete for consumer attention, the packaging design and quality become increasingly important for differentiation in the marketplace. The growing focus on sustainability is further driving the demand for innovative packaging solutions, with an increasing shift toward recyclable, biodegradable, and environmentally friendly packaging materials. As packaging remains a cornerstone of product delivery, the packaging services segment will continue to dominate the packaging and labeling services market.

Primary Packaging Type Is Fastest Growing Due to Direct Consumer Interaction and Protection Needs

Primary packaging is the fastest growing segment in the packaging and labeling services market, driven by its direct interaction with consumers and its crucial role in protecting the product. Primary packaging is the first layer of packaging that directly holds the product, making it essential for product safety, shelf life, and consumer appeal. This packaging type is particularly important for industries such as food and beverage, pharmaceuticals, and cosmetics, where the integrity of the product and compliance with regulatory standards are critical.

The demand for primary packaging is growing rapidly as companies prioritize functionality, convenience, and safety in their packaging design. Innovations in materials, such as sustainable plastics, biodegradable options, and protective coatings, are fueling the growth of the primary packaging segment. As consumers demand more transparency and information, primary packaging also serves as a medium for product labeling, nutritional information, and branding, which further drives its importance. As consumer preferences for packaging that ensures product freshness and safety continue to rise, primary packaging will remain the fastest growing segment in the market.

Food & Beverage End-User Industry Is Largest Due to High Demand for Packaging and Labeling Solutions

The food and beverage industry is the largest end-user of packaging and labeling services, accounting for a significant share of the market. This sector's high demand for packaging and labeling solutions is driven by the need to ensure product safety, extend shelf life, and comply with regulatory requirements. Packaging plays a critical role in preserving the quality of food and beverage products, and labeling provides essential information such as ingredients, nutritional facts, and expiration dates, which are vital for consumer decision-making.

As consumer preferences continue to evolve, the food and beverage industry is also embracing sustainable packaging solutions to meet the growing demand for eco-friendly products. Additionally, the rise of e-commerce and the increased importance of convenience have led to an expansion of packaging formats, further driving demand for packaging and labeling services in this sector. With the food and beverage industry continuing to grow and innovate, it will remain the largest end-user of packaging and labeling services in the market.

North America Is Largest Region Due to Advanced Regulatory Framework and Consumer Demand for Quality Packaging

North America is the largest region in the packaging and labeling services market, driven by its advanced regulatory frameworks and the strong consumer demand for high-quality packaging solutions. The United States and Canada have established stringent regulations for product labeling and packaging, especially in industries such as food, pharmaceuticals, and cosmetics, where compliance with safety standards is critical. These regulations require packaging and labeling services to meet high standards of quality, ensuring that products are safely delivered to consumers while maintaining brand integrity.

The region's well-developed retail and e-commerce sectors are further propelling the demand for packaging and labeling services, as companies seek to provide differentiated, sustainable, and functional packaging to attract consumers. As sustainability becomes a focal point for North American businesses, there is an increasing trend toward eco-friendly packaging solutions, which is further boosting the market for packaging and labeling services. With a strong emphasis on regulatory compliance and consumer preference for premium packaging, North America will continue to lead the global packaging and labeling services market.

Leading Companies and Competitive Landscape

The packaging and labeling services market is competitive, with key players such as Amcor, WestRock, Smurfit Kappa, and Avery Dennison leading the way. These companies are focused on providing comprehensive packaging and labeling solutions that cater to a wide range of industries, including food and beverage, pharmaceuticals, and cosmetics. Leading players are investing in advanced technologies to enhance the functionality, sustainability, and design of packaging and labeling services, with a strong emphasis on reducing environmental impact.

The competitive landscape is also characterized by a focus on customization, as companies seek to meet the specific needs of their clients with tailored packaging and labeling solutions. Additionally, strategic partnerships, acquisitions, and technological advancements are common strategies employed by market leaders to maintain their competitive edge. As the demand for sustainable, innovative, and high-quality packaging solutions continues to grow, these leading players are well-positioned to capture a significant share of the global packaging and labeling services market.

Recent Developments:

- Amcor Limited expanded its portfolio of sustainable packaging solutions, focusing on reducing plastic waste with new eco-friendly labeling technologies.

- WestRock Company introduced a new line of secondary packaging solutions aimed at reducing material usage and improving overall product protection during transportation.

- Sealed Air Corporation unveiled a new labeling system designed to offer improved traceability and compliance for pharmaceutical products.

- Smurfit Kappa Group launched a customized packaging service aimed at the automotive sector, enhancing product safety and efficiency in shipping.

- Berry Global Inc. introduced new automated packaging and labeling services designed to streamline production and minimize packaging waste.

List of Leading Companies:

- Amcor Limited

- International Paper Company

- Sealed Air Corporation

- WestRock Company

- Smurfit Kappa Group

- DS Smith Packaging

- UFlex Limited

- Berry Global Inc.

- Tetra Pak

- Avery Dennison Corporation

- R.R. Donnelley & Sons Company

- Quad/Graphics, Inc.

- CCL Industries Inc.

- Mondi Group

- Huhtamaki Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 55.6 Billion |

|

Forecasted Value (2030) |

USD 86.1 Billion |

|

CAGR (2025 – 2030) |

7.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Packaging and Labeling Services Market By Service Type (Packaging Services, Labeling Services), By Packaging Type (Primary Packaging, Secondary Packaging, Tertiary Packaging), and By End-User Industry (Food & Beverage, Pharmaceutical, Cosmetics & Personal Care, Electronics, Automotive) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Amcor Limited, International Paper Company, Sealed Air Corporation, WestRock Company, Smurfit Kappa Group, DS Smith Packaging, UFlex Limited, Berry Global Inc., Tetra Pak, Avery Dennison Corporation, R.R. Donnelley & Sons Company, Quad/Graphics, Inc., CCL Industries Inc., Mondi Group, Huhtamaki Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Packaging and Labeling Services Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Packaging Services |

|

4.2. Labeling Services |

|

4.3. Others |

|

5. Packaging and Labeling Services Market, by Packaging Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Primary Packaging |

|

5.2. Secondary Packaging |

|

5.3. Tertiary Packaging |

|

5.4. Others |

|

6. Packaging and Labeling Services Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Food & Beverage |

|

6.2. Pharmaceutical |

|

6.3. Cosmetics & Personal Care |

|

6.4. Electronics |

|

6.5. Automotive |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Packaging and Labeling Services Market, by Service Type |

|

7.2.7. North America Packaging and Labeling Services Market, by Packaging Type |

|

7.2.8. North America Packaging and Labeling Services Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Packaging and Labeling Services Market, by Service Type |

|

7.2.9.1.2. US Packaging and Labeling Services Market, by Packaging Type |

|

7.2.9.1.3. US Packaging and Labeling Services Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Amcor Limited |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. International Paper Company |

|

9.3. Sealed Air Corporation |

|

9.4. WestRock Company |

|

9.5. Smurfit Kappa Group |

|

9.6. DS Smith Packaging |

|

9.7. UFlex Limited |

|

9.8. Berry Global Inc. |

|

9.9. Tetra Pak |

|

9.10. Avery Dennison Corporation |

|

9.11. R.R. Donnelley & Sons Company |

|

9.12. Quad/Graphics, Inc. |

|

9.13. CCL Industries Inc. |

|

9.14. Mondi Group |

|

9.15. Huhtamaki Group |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Packaging and Labeling Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Packaging and Labeling Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Packaging and Labeling Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA