As per Intent Market Research, the Orthopedic Contract Manufacturing Market was valued at USD 8.3 billion in 2024-e and will surpass USD 13.0 billion by 2030; growing at a CAGR of 7.8% during 2025 - 2030.

The orthopedic contract manufacturing market is growing rapidly, driven by the increasing demand for orthopedic devices and instruments, including implants, surgical tools, and associated services. As the global population ages and the prevalence of musculoskeletal disorders rises, the need for effective orthopedic treatments has surged. This market includes a variety of products such as orthopedic implants, instruments, and services such as design, prototyping, and sterilization, which are increasingly being outsourced by Original Equipment Manufacturers (OEMs) to specialized contract manufacturers. The shift towards outsourcing has been further fueled by the desire to reduce operational costs, improve efficiency, and enhance the quality of products.

Technological advancements in materials and manufacturing processes, such as additive manufacturing (3D printing) and the development of bioresorbable implants, are also propelling market growth. Furthermore, the increasing complexity of orthopedic surgeries, such as joint replacements and spinal surgeries, is driving demand for highly specialized instruments and implants. This trend has led to greater reliance on contract manufacturers who offer customized, high-quality solutions that meet specific design and regulatory requirements. As healthcare systems expand globally, especially in emerging economies, the orthopedic contract manufacturing market is expected to continue expanding, with contract manufacturers playing a critical role in delivering cost-effective and innovative solutions for the orthopedic industry.

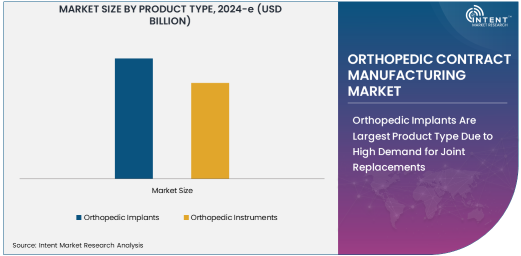

Orthopedic Implants Are Largest Product Type Due to High Demand for Joint Replacements

Orthopedic implants are the largest product type segment in the orthopedic contract manufacturing market, owing to their critical role in joint replacement surgeries, such as hip and knee replacements. The growing aging population and increasing prevalence of conditions like arthritis and osteoporosis are contributing to the rising demand for implants. As these conditions deteriorate the function of joints, patients often turn to orthopedic implants to restore mobility and relieve pain. The orthopedic implants market includes a variety of products, including those for knee, hip, shoulder, and spinal joint replacements, which are often custom-designed to meet the specific needs of patients.

Contract manufacturers play a pivotal role in the production of these implants, providing expertise in the design, prototyping, and manufacturing of devices that are tailored to meet regulatory standards and patient requirements. The high demand for joint replacements and innovations in implant materials and designs, such as metal-on-metal and ceramic-on-ceramic implants, continue to drive the growth of the orthopedic implant segment. With the increasing prevalence of orthopedic conditions requiring surgical intervention, orthopedic implants are expected to remain the dominant product type in the orthopedic contract manufacturing market.

Sterilization Services Is Fastest-Growing Service Segment Due to Increasing Regulatory Standards

Sterilization services represent the fastest-growing service segment in the orthopedic contract manufacturing market, largely due to the increasing regulatory standards surrounding the production of medical devices and implants. Sterilization is a critical step in the manufacturing process of orthopedic implants and instruments to ensure patient safety and compliance with regulatory guidelines. As the complexity of orthopedic surgeries increases and the demand for high-quality, infection-free implants rises, the need for specialized sterilization services has grown.

Contract manufacturers are increasingly offering advanced sterilization techniques, such as gamma radiation, ethylene oxide, and steam sterilization, to meet the diverse needs of orthopedic device manufacturers. These sterilization services not only ensure the safety of the products but also help manufacturers comply with stringent regulatory requirements set by agencies like the FDA and CE. As regulatory frameworks around the world become stricter, the demand for sterilization services is expected to continue growing, making it the fastest-growing service segment in the orthopedic contract manufacturing market.

OEMs Are Largest End-User Segment Due to Outsourcing of Manufacturing Processes

OEMs are the largest end-user segment in the orthopedic contract manufacturing market, driven by the growing trend of outsourcing the production of orthopedic devices and instruments to specialized manufacturers. Original Equipment Manufacturers (OEMs), who design and market orthopedic products, increasingly rely on contract manufacturers to produce high-quality products while maintaining cost-effectiveness. Outsourcing to contract manufacturers allows OEMs to focus on their core competencies, such as product innovation, marketing, and distribution, while leaving the production process to experts who can meet the stringent quality and regulatory standards required for medical devices.

The demand for orthopedic implants and instruments is rising globally, and OEMs are turning to contract manufacturers for their expertise in creating customized solutions, from design and prototyping to full-scale production and packaging. Contract manufacturers offer valuable services such as high-precision manufacturing, quality control, and regulatory compliance, making them a preferred partner for OEMs. As the need for high-quality orthopedic devices continues to grow, OEMs will remain the largest end-user segment in this market.

North America Is Largest Region Due to Well-Established Healthcare Infrastructure and High Demand for Orthopedic Devices

North America is the largest region in the orthopedic contract manufacturing market, driven by the region’s advanced healthcare infrastructure, high demand for orthopedic devices, and the presence of major orthopedic manufacturers. The United States, in particular, represents a significant portion of the market due to the high volume of orthopedic procedures, including joint replacements, spinal surgeries, and trauma treatments. The well-established healthcare system, coupled with high spending on healthcare and medical devices, creates a strong demand for orthopedic products and contract manufacturing services.

Additionally, North America is home to some of the world’s largest orthopedic device manufacturers, who rely on contract manufacturers for their production needs. The region is also a hub for innovation in orthopedic technologies, such as minimally invasive surgery techniques and advanced implant materials, further driving demand for high-quality, precision-manufactured orthopedic devices. The consistent growth in the aging population, along with the prevalence of musculoskeletal disorders, ensures that North America will continue to be the largest market for orthopedic contract manufacturing.

Competitive Landscape: Leading Companies and Market Trends

The orthopedic contract manufacturing market is highly competitive, with key players such as Sterigenics International, NAMSA, Zimmer Biomet, and Medtronic leading the market. These companies offer a broad range of services, including design and development, prototyping, manufacturing, sterilization, and packaging for orthopedic devices. Many of these companies provide end-to-end solutions, from the initial design stage through to final packaging, which is particularly attractive to orthopedic device manufacturers looking to streamline their production processes.

The competitive landscape is also shaped by the increasing trend of partnerships and acquisitions, as larger orthopedic device manufacturers seek to integrate more contract manufacturing capabilities into their operations. Smaller contract manufacturers with specialized expertise, such as those focused on advanced sterilization or additive manufacturing, are also gaining traction in the market. The shift toward more personalized and customized orthopedic devices is encouraging companies to adopt advanced manufacturing technologies, such as 3D printing, to cater to patient-specific needs. As competition intensifies, companies are focusing on expanding their capabilities, offering more comprehensive service portfolios, and meeting the stringent regulatory requirements set by various global healthcare authorities to maintain a competitive edge.

Recent Developments:

- In January 2023, Medtronic expanded its orthopedic manufacturing capabilities by acquiring a contract manufacturer specializing in spinal implants.

- In February 2023, Zimmer Biomet entered into a strategic partnership with a leading orthopedic contract manufacturer to enhance its production capabilities.

- In March 2023, Stryker Corporation announced the launch of a new line of joint replacement implants produced through its contract manufacturing division.

- In April 2023, Smith & Nephew entered into a multi-year contract manufacturing agreement with a global OEM orthopedic company to expand its product range.

- In May 2023, Orthofix announced a new partnership with a contract manufacturer to produce advanced orthopedic implants, streamlining production processes.

List of Leading Companies:

- Stryker Corporation

- Zimmer Biomet

- Medtronic

- Johnson & Johnson

- Smith & Nephew

- Orthofix

- NuVasive

- Aesculap (B. Braun)

- Knee Creations

- ConforMIS

- Integra LifeSciences

- Arthrex

- Heraeus Medical

- MicroPort Scientific Corporation

- Wright Medical Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 8.3 billion |

|

Forecasted Value (2030) |

USD 13.0 billion |

|

CAGR (2025 – 2030) |

7.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Orthopedic Contract Manufacturing Market By Product Type (Orthopedic Implants, Orthopedic Instruments), By Services (Design and Development, Prototyping, Manufacturing, Sterilization Services, Packaging and Labeling), By End-User (OEMs, Hospitals, Medical Device Companies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Stryker Corporation, Zimmer Biomet, Medtronic, Johnson & Johnson, Smith & Nephew, Orthofix, NuVasive, Aesculap (B. Braun), Knee Creations, ConforMIS, Integra LifeSciences, Arthrex, Heraeus Medical, MicroPort Scientific Corporation, Wright Medical Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Orthopedic Contract Manufacturing Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Orthopedic Implants |

|

4.1.1. Hip Implants |

|

4.1.2. Knee Implants |

|

4.1.3. Spinal Implants |

|

4.1.4. Others |

|

4.2. Orthopedic Instruments |

|

4.2.1. Surgical Instruments |

|

4.2.2. Diagnostic Instruments |

|

5. Orthopedic Contract Manufacturing Market, by Services (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Design and Development |

|

5.2. Prototyping |

|

5.3. Manufacturing |

|

5.4. Sterilization Services |

|

5.5. Packaging and Labeling |

|

5.6. Others |

|

6. Orthopedic Contract Manufacturing Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. OEMs |

|

6.2. Hospitals |

|

6.3. Medical Device Companies |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Orthopedic Contract Manufacturing Market, by Product Type |

|

7.2.7. North America Orthopedic Contract Manufacturing Market, by Services |

|

7.2.8. North America Orthopedic Contract Manufacturing Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Orthopedic Contract Manufacturing Market, by Product Type |

|

7.2.9.1.2. US Orthopedic Contract Manufacturing Market, by Services |

|

7.2.9.1.3. US Orthopedic Contract Manufacturing Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Stryker Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Zimmer Biomet |

|

9.3. Medtronic |

|

9.4. Johnson & Johnson |

|

9.5. Smith & Nephew |

|

9.6. Orthofix |

|

9.7. NuVasive |

|

9.8. Aesculap (B. Braun) |

|

9.9. Knee Creations |

|

9.10. ConforMIS |

|

9.11. Integra LifeSciences |

|

9.12. Arthrex |

|

9.13. Heraeus Medical |

|

9.14. MicroPort Scientific Corporation |

|

9.15. Wright Medical Group |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Orthopedic Contract Manufacturing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Orthopedic Contract Manufacturing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Orthopedic Contract Manufacturing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA