As per Intent Market Research, the Orthopedic Braces and Supports Market was valued at USD 5.2 billion in 2024-e and will surpass USD 8.8 billion by 2030; growing at a CAGR of 9.3% during 2025 - 2030.

The orthopedic braces and supports market is experiencing robust growth, driven by increasing awareness of musculoskeletal health and the rising incidence of joint injuries, arthritis, and other orthopedic conditions. Orthopedic braces and supports are designed to stabilize, protect, and support joints, bones, and muscles, promoting healing and preventing further damage. The growing participation in physical activities, sports, and an aging population with age-related musculoskeletal conditions are all contributing factors to the increasing demand for braces and supports. As the global population ages, the incidence of conditions like arthritis, osteoarthritis, and sports injuries continues to rise, further bolstering the demand for these products.

Technological advancements in brace design, such as the development of lightweight, breathable, and comfortable materials, are enhancing the effectiveness of these devices. Moreover, the growing trend towards home healthcare and self-management of injuries and conditions has led to a rise in consumer demand for easy-to-use orthopedic braces and supports. With the increasing prevalence of joint injuries, sports-related issues, and chronic conditions like arthritis, the orthopedic braces and supports market is expected to witness sustained growth in the coming years.

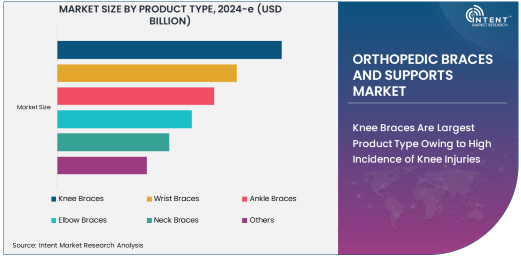

Knee Braces Are Largest Product Type Owing to High Incidence of Knee Injuries

Knee braces represent the largest product type segment in the orthopedic braces and supports market, primarily due to the high incidence of knee injuries, osteoarthritis, and other knee-related conditions. The knee is one of the most commonly injured joints, particularly in athletes and older adults. Knee braces are used to provide support, stability, and pain relief during rehabilitation or post-surgery recovery. They are also commonly used in preventive care for individuals engaged in sports or high-impact activities.

The increasing prevalence of knee osteoarthritis, which affects a large portion of the aging population, is driving the demand for knee braces. These braces help to reduce pain, protect the knee joint, and prevent further damage in individuals with degenerative joint diseases. Additionally, knee braces are often used in the recovery process following knee surgeries such as ligament reconstruction or meniscus repair, ensuring proper alignment and reducing the risk of reinjury. As knee injuries and osteoarthritis become more common, knee braces will continue to dominate the orthopedic braces and supports market.

Sports Injuries Is Fastest-Growing Application Segment Owing to Increased Physical Activity

Sports injuries are the fastest-growing application segment in the orthopedic braces and supports market, driven by the rising participation in sports and physical activities across all age groups. As more individuals engage in recreational and competitive sports, the risk of injuries, particularly joint injuries, has increased. Orthopedic braces and supports are widely used to prevent, treat, and manage sports injuries, especially in the case of ligament sprains, fractures, and muscle strains. These products help stabilize joints and provide protection during recovery, facilitating a quicker return to activity.

The popularity of fitness and recreational sports has contributed to an increase in sports injuries, particularly in high-contact sports such as football, basketball, and soccer, as well as non-contact activities like running and cycling. The demand for braces that support the knees, ankles, wrists, and other joints is therefore rising. Additionally, athletes often use braces as a preventive measure to reduce the risk of injury during intense physical activity. As awareness of sports injuries grows and more people engage in active lifestyles, the sports injuries segment will continue to experience the fastest growth in the orthopedic braces and supports market.

Home Care Is Largest End-User Segment Due to Increasing Self-management of Orthopedic Conditions

Home care is the largest end-user segment in the orthopedic braces and supports market, as more patients opt for home-based management of injuries and musculoskeletal conditions. Home care allows individuals to maintain independence while managing conditions like arthritis, sports injuries, and post-surgical recovery with minimal need for frequent hospital visits. As healthcare systems shift towards patient-centered care and as more people prefer cost-effective alternatives, orthopedic braces and supports are increasingly being used at home to support recovery and reduce dependence on clinical care.

The growing demand for home care solutions, particularly in aging populations, has resulted in more patients utilizing orthopedic braces for injury management and post-surgical rehabilitation at home. Home care settings offer convenience and comfort for individuals who may not require intensive medical supervision but still need proper support during their recovery process. The popularity of home care, combined with advancements in product design that prioritize ease of use and comfort, is expected to continue to drive the growth of this segment.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure and High Demand for Sports Medicine

North America is the largest region in the orthopedic braces and supports market, owing to its advanced healthcare infrastructure, high healthcare expenditure, and growing awareness of musculoskeletal health. The United States, in particular, is a major market for orthopedic braces and supports due to the high incidence of sports injuries, arthritis, and other musculoskeletal disorders. Additionally, the increasing demand for sports medicine and rehabilitation services in North America is contributing to the growth of this market segment. The region’s well-established healthcare systems and large population of active individuals further bolster the demand for orthopedic products.

North America’s focus on preventive healthcare and active lifestyles also contributes to the growing market for orthopedic braces. The region’s sports industry, with its extensive youth and adult participation, continues to drive the need for braces and supports for injury prevention and rehabilitation. Furthermore, North America is home to leading healthcare providers and orthopedic device manufacturers that are continually innovating to meet the rising demand for high-performance, durable, and comfortable braces and supports. As the market for orthopedic products continues to expand, North America is expected to maintain its dominance.

Competitive Landscape: Leading Companies and Market Trends

The orthopedic braces and supports market is highly competitive, with key players such as Breg, Inc., Össur, Bauerfeind, DJO Global, and Mueller Sports Medicine leading the market. These companies offer a wide range of orthopedic braces and supports designed for various applications, including joint injury, arthritis management, sports injuries, and post-surgery recovery. The competitive landscape is shaped by continuous innovation in product design, with manufacturers focusing on developing braces that are lightweight, breathable, and comfortable while maintaining high levels of support and durability.

In addition to these established players, new entrants and regional companies are emerging, offering specialized braces tailored to specific needs such as custom-fit knee braces or braces that incorporate advanced technologies, such as adjustable tension or temperature control. The market is also witnessing an increasing trend toward the use of materials that offer enhanced comfort, such as neoprene, breathable fabrics, and moisture-wicking materials. As competition intensifies, companies are focusing on product differentiation, improving customer experience, and expanding their distribution channels to maintain a competitive edge.

Recent Developments:

- In January 2023, Össur launched a next-generation knee brace designed for enhanced stability and comfort during sports activities.

- In February 2023, DJO Global expanded its product portfolio with the launch of a new ankle stabilizing brace aimed at athletes.

- In March 2023, medi GmbH & Co. KG introduced a new range of elbow braces, offering better flexibility and support for sports professionals.

- In April 2023, Zimmer Biomet announced a partnership with a healthcare provider to improve patient access to orthopedic braces and supports.

- In May 2023, Stryker Corporation acquired a leading sports injury brace manufacturer to strengthen its position in the orthopedic braces market.

List of Leading Companies:

- Bauerfeind AG

- DJO Global (Colfax Corporation)

- Össur

- DeRoyal Industries

- medi GmbH & Co. KG

- Stryker Corporation

- 3M

- Zimmer Biomet

- Smith & Nephew

- Breg Inc.

- Hanger Inc.

- Corflex

- Armstrong Medical

- Tynor Orthotics

- Bioskin

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 5.2 billion |

|

Forecasted Value (2030) |

USD 8.8 billion |

|

CAGR (2025 – 2030) |

9.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Orthopedic Braces and Supports Market By Product Type (Knee Braces, Wrist Braces, Ankle Braces, Elbow Braces, Neck Braces), By Application (Joint Injury, Arthritis and Osteoarthritis, Sports Injuries, Post-Surgery Recovery), By End-User (Hospitals, Home Care, Sports Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Bauerfeind AG, DJO Global (Colfax Corporation), Össur, DeRoyal Industries, medi GmbH & Co. KG, Stryker Corporation, 3M, Zimmer Biomet, Smith & Nephew, Breg Inc., Hanger Inc., Corflex, Armstrong Medical, Tynor Orthotics, Bioskin |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Orthopedic Braces and Supports Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Knee Braces |

|

4.1.1. Prophylactic Braces |

|

4.1.2. Functional Braces |

|

4.1.3. Rehabilitative Braces |

|

4.1.4. Others |

|

4.2. Wrist Braces |

|

4.3. Ankle Braces |

|

4.4. Elbow Braces |

|

4.5. Neck Braces |

|

4.6. Others |

|

5. Orthopedic Braces and Supports Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Joint Injury |

|

5.2. Arthritis and Osteoarthritis |

|

5.3. Sports Injuries |

|

5.4. Post-Surgery Recovery |

|

6. Orthopedic Braces and Supports Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Home Care |

|

6.3. Sports Clinics |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Orthopedic Braces and Supports Market, by Product Type |

|

7.2.7. North America Orthopedic Braces and Supports Market, by Application |

|

7.2.8. North America Orthopedic Braces and Supports Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Orthopedic Braces and Supports Market, by Product Type |

|

7.2.9.1.2. US Orthopedic Braces and Supports Market, by Application |

|

7.2.9.1.3. US Orthopedic Braces and Supports Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Bauerfeind AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. DJO Global (Colfax Corporation) |

|

9.3. Össur |

|

9.4. DeRoyal Industries |

|

9.5. medi GmbH & Co. KG |

|

9.6. Stryker Corporation |

|

9.7. 3M |

|

9.8. Zimmer Biomet |

|

9.9. Smith & Nephew |

|

9.10. Breg Inc. |

|

9.11. Hanger Inc. |

|

9.12. Corflex |

|

9.13. Armstrong Medical |

|

9.14. Tynor Orthotics |

|

9.15. Bioskin |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Orthopedic Braces and Supports Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Orthopedic Braces and Supports Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Orthopedic Braces and Supports Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA