As per Intent Market Research, the Orthokeratology Market was valued at USD 502.6 million in 2024-e and will surpass USD 1,085.8 million by 2030; growing at a CAGR of 13.7% during 2025 - 2030.

The orthokeratology (Ortho-K) market is experiencing growth driven by the increasing prevalence of refractive errors such as myopia, astigmatism, and presbyopia. Ortho-K involves the use of specially designed contact lenses that are worn overnight to reshape the cornea, providing a non-surgical solution to correct vision. This technique is particularly popular in children for controlling the progression of myopia (nearsightedness), as well as in adults seeking to reduce dependence on glasses or contact lenses during the day. The growing awareness of the benefits of Ortho-K lenses, alongside the advancements in lens technology, is fueling the market's expansion.

The rising incidence of refractive vision problems globally, especially myopia, which has been identified as a growing concern in both developed and developing countries, is contributing to the increased adoption of Ortho-K lenses. Furthermore, the shift toward non-invasive and customizable treatments for vision correction is also supporting the growth of the market. Orthokeratology is being recognized for its potential in halting the progression of myopia in children, as well as offering a convenient and effective treatment for adults with refractive errors. With technological advancements in lens design and materials, the market is poised for significant growth in the coming years.

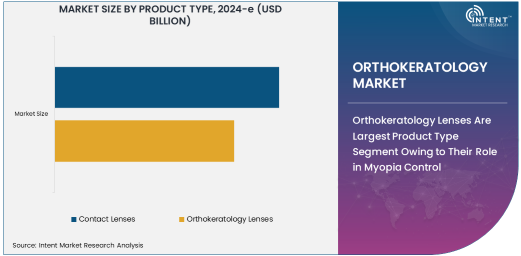

Orthokeratology Lenses Are Largest Product Type Segment Owing to Their Role in Myopia Control

Orthokeratology lenses, also known as Ortho-K lenses, are the largest product type segment in the market, driven by their critical role in myopia control, particularly in children. Ortho-K lenses are designed to reshape the cornea overnight, temporarily correcting refractive errors, and providing clear vision during the day without the need for glasses or traditional contact lenses. This non-invasive approach to myopia management has gained widespread acceptance among both parents and eye care professionals, especially for children who are at risk of progressive myopia.

Myopia is becoming more prevalent globally, especially in younger populations, and this trend has led to a growing demand for effective solutions to control its progression. Ortho-K lenses are a key intervention in slowing down myopia progression, reducing the need for higher prescriptions as children age. The popularity of Ortho-K lenses is further supported by their convenience, as patients can remove the lenses overnight and avoid the discomfort of wearing corrective lenses during the day. With their ability to provide long-term vision correction and myopia control, orthokeratology lenses are expected to remain the dominant product segment in the market.

Myopia Control Is Fastest-Growing Application Segment Owing to Rising Myopia Prevalence

Myopia control is the fastest-growing application segment in the orthokeratology market, driven by the rising prevalence of myopia, particularly in children and adolescents. Myopia is a refractive error in which distant objects appear blurred, and its increasing prevalence, especially among younger populations, has raised concerns about long-term eye health. As myopia progresses over time, it can lead to more severe vision issues, such as retinal detachment and glaucoma, making it crucial to manage its progression early. Orthokeratology has emerged as one of the most effective methods for controlling myopia progression, especially in pediatric patients.

The demand for myopia control is growing globally, as parents and healthcare professionals seek non-invasive alternatives to traditional glasses and contact lenses. Research has shown that orthokeratology can significantly slow down the elongation of the eye, which is the primary cause of worsening myopia. As more children are diagnosed with myopia at younger ages, the adoption of Ortho-K lenses for myopia control is expected to increase, making it the fastest-growing application segment. This growing concern about myopia and its potential impact on eye health is contributing to the increasing adoption of orthokeratology lenses as a preventive and corrective measure.

Pediatric Age Group Is Largest Segment Owing to Early Myopia Intervention

The pediatric age group is the largest segment in the orthokeratology market, primarily due to the increasing focus on early intervention for myopia in children. Myopia is often diagnosed in children as early as age 6, and if left untreated, it tends to progress rapidly during the early years of life. Early intervention is critical to prevent myopia from worsening and leading to more severe vision complications later in life. Orthokeratology lenses are one of the most effective non-surgical treatments available for controlling myopia progression in children.

Pediatric patients are increasingly being prescribed Ortho-K lenses as a preventive measure to manage the early onset of myopia. These lenses are especially popular because they offer a convenient, non-invasive solution that avoids the need for children to wear glasses or daily contact lenses. As the incidence of myopia in children continues to rise, driven by factors such as increased screen time and less time spent outdoors, the demand for orthokeratology lenses in pediatric populations is expected to grow. This focus on myopia control in children ensures that the pediatric age group remains the largest segment in the orthokeratology market.

North America Is Largest Region Owing to High Adoption Rates and Awareness of Myopia Control

North America is the largest region in the orthokeratology market, driven by high adoption rates of Ortho-K lenses and increasing awareness about the importance of myopia control. The United States, in particular, has witnessed a rise in the number of children diagnosed with myopia, leading to an increasing demand for effective myopia management solutions such as orthokeratology. North American consumers are highly receptive to new technologies and non-invasive treatments, and many parents seek orthodontic solutions for their children to prevent myopia from progressing.

Additionally, North America has a well-established healthcare system with a high level of access to eye care professionals, making it easier for patients to receive prescriptions for Ortho-K lenses. The growing recognition of the importance of myopia control in children, combined with a large number of optometrists and ophthalmologists offering orthokeratology services, has contributed to North America's dominance in the market. As the prevalence of myopia continues to rise in the region, North America will remain the largest market for orthokeratology lenses and myopia control treatments.

Competitive Landscape: Key Players and Market Trends

The orthokeratology market is competitive, with key players such as CooperVision, Essilor, Bausch & Lomb, and Menicon dominating the sector. These companies are leading the development of orthokeratology lenses and are continuously innovating to improve lens design, comfort, and effectiveness. CooperVision’s “MyDay” and Menicon’s “Menicon Z” are among the popular brands offering orthokeratology lenses for myopia control.

The market is also witnessing new entrants and smaller companies that are offering specialized Ortho-K lenses for different refractive errors such as astigmatism and presbyopia. As awareness of the benefits of orthokeratology grows, especially among pediatric patients, competition in the market is expected to intensify. Companies are focusing on technological advancements in lens materials and designs, with a particular emphasis on improving the comfort and wearability of Ortho-K lenses. Digital tools and 3D imaging are being integrated into the prescription process to customize lenses more precisely for individual patient needs. As the orthokeratology market continues to evolve, companies will need to differentiate themselves through innovation, quality, and customer service to maintain a competitive edge.

Recent Developments:

- In January 2023, CooperVision announced the launch of its latest generation of myopia control contact lenses with enhanced comfort.

- In October 2022, Bausch + Lomb received regulatory approval for its new line of orthokeratology lenses designed for patients with astigmatism.

- In February 2023, Euclid Systems introduced a new range of ortho-k lenses that offer a more rapid corneal reshaping process.

- In March 2023, Paragon Vision Sciences expanded its distribution of orthokeratology lenses across Asia.

- In July 2023, Menicon launched a breakthrough hybrid contact lens designed to improve comfort for long-term orthokeratology wearers.

List of Leading Companies:

- CooperVision

- Johnson & Johnson Vision Care

- Bausch + Lomb

- Euclid Systems

- OrthoKera

- Paragon Vision Sciences

- Visionary Optics

- EyeCare Professionals

- Toric Technologies

- MiSight (CooperVision)

- ART Optical

- Allergan

- Contamac

- Menicon

- No. 7 Contact Lenses

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 502.6 million |

|

Forecasted Value (2030) |

USD 1,085.8 million |

|

CAGR (2025 – 2030) |

13.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Orthokeratology Market By Product Type (Contact Lenses, Orthokeratology Lenses), By Application (Myopia Control, Astigmatism, Presbyopia), By Age Group (Pediatric, Adult) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

CooperVision, Johnson & Johnson Vision Care, Bausch + Lomb, Euclid Systems, OrthoKera, Paragon Vision Sciences, Visionary Optics, EyeCare Professionals, Toric Technologies, MiSight (CooperVision), ART Optical, Allergan, Contamac, Menicon, No. 7 Contact Lenses |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Orthokeratology Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Contact Lenses |

|

4.1.1. Gas Permeable Lenses |

|

4.1.2. Rigid Gas Permeable (RGP) |

|

4.1.3. Hybrid Contact Lenses |

|

4.1.4. Others |

|

4.2. Orthokeratology Lenses |

|

5. Orthokeratology Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Myopia Control |

|

5.2. Astigmatism |

|

5.3. Presbyopia |

|

6. Orthokeratology Market, by Age Group (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Pediatric |

|

6.2. Adult |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Orthokeratology Market, by Product Type |

|

7.2.7. North America Orthokeratology Market, by Application |

|

7.2.8. North America Orthokeratology Market, by Age Group |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Orthokeratology Market, by Product Type |

|

7.2.9.1.2. US Orthokeratology Market, by Application |

|

7.2.9.1.3. US Orthokeratology Market, by Age Group |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. CooperVision |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Johnson & Johnson Vision Care |

|

9.3. Bausch + Lomb |

|

9.4. Euclid Systems |

|

9.5. OrthoKera |

|

9.6. Paragon Vision Sciences |

|

9.7. Visionary Optics |

|

9.8. EyeCare Professionals |

|

9.9. Toric Technologies |

|

9.10. MiSight (CooperVision) |

|

9.11. ART Optical |

|

9.12. Allergan |

|

9.13. Contamac |

|

9.14. Menicon |

|

9.15. No. 7 Contact Lenses |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Orthokeratology Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Orthokeratology Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Orthokeratology Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA