As per Intent Market Research, the Organic Substrate Packaging Material Market was valued at USD 6.8 Billion in 2024-e and will surpass USD 11.5 Billion by 2030; growing at a CAGR of 9.3% during 2025-2030.

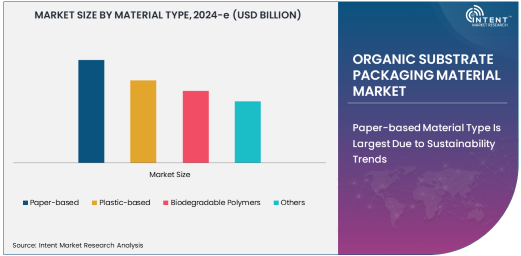

Paper-based Material Type Is Largest Due to Sustainability Trends

The organic substrate packaging material market is witnessing significant growth, driven by the increasing demand for sustainable and environmentally friendly packaging solutions. Among the different material types, paper-based packaging holds the largest share due to its renewable nature, biodegradability, and widespread consumer preference for eco-friendly products. As concerns about plastic waste and environmental sustainability intensify, paper-based materials are being increasingly adopted across various industries for packaging applications. The paper-based packaging segment is particularly popular in sectors such as food, cosmetics, and pharmaceuticals, where there is a growing emphasis on minimizing environmental impact.

Paper-based packaging offers a high degree of recyclability and biodegradability, making it an attractive choice for companies committed to reducing their carbon footprint. Its versatility in terms of design, printing capabilities, and ease of customization further enhances its appeal. As more companies seek to align with global sustainability goals and consumer expectations for greener products, the demand for paper-based packaging in the organic substrate packaging market is expected to continue growing.

Electronics Packaging Application Is Fastest Growing Due to Increased Demand for Eco-friendly Alternatives

The electronics packaging application is the fastest growing segment in the organic substrate packaging material market. With the rapid advancement of technology and the increasing demand for eco-friendly packaging solutions in the electronics industry, organic substrates are gaining popularity as an alternative to traditional plastic-based materials. The push towards sustainable packaging in electronics is driven by both consumer demand for environmentally responsible products and stricter regulatory frameworks focused on reducing electronic waste and packaging waste.

Organic substrate materials, particularly biodegradable polymers and paper-based solutions, are being explored for use in packaging for consumer electronics, mobile devices, and other electronic products. These materials not only provide sufficient protection for delicate components but also align with the growing trend toward circular economy practices. As manufacturers in the electronics industry seek to enhance sustainability in their packaging while maintaining product integrity, the adoption of organic substrate materials for electronics packaging is expected to grow rapidly.

Packaging Manufacturers End-User Is Largest Due to Central Role in Packaging Production

Packaging manufacturers are the largest end-users of organic substrate packaging materials, accounting for a significant portion of the market share. These manufacturers are responsible for producing a wide range of packaging solutions for industries such as food, pharmaceuticals, electronics, and cosmetics, among others. As the demand for organic and sustainable packaging solutions increases, packaging manufacturers are at the forefront of innovation, developing and producing eco-friendly packaging materials that meet both consumer and regulatory expectations.

Packaging manufacturers play a pivotal role in driving the adoption of organic substrate materials by offering sustainable alternatives to traditional plastic packaging. Their ability to scale production and provide customizable solutions for various industries ensures that the organic substrate packaging material market will continue to grow. Furthermore, as global regulations around packaging sustainability become more stringent, packaging manufacturers are increasingly focusing on developing packaging materials that are biodegradable, recyclable, and made from renewable resources. This positions them as key drivers of growth in the organic substrate packaging material market.

North America Is Largest Region Due to Regulatory Support and Consumer Demand for Sustainable Packaging

North America is the largest region in the organic substrate packaging material market, driven by strong regulatory support for sustainable packaging solutions and growing consumer demand for eco-friendly products. The United States and Canada are leading the way in the adoption of organic substrate materials, as both countries have implemented policies aimed at reducing plastic waste and encouraging the use of biodegradable and recyclable materials in packaging. This regulatory environment is pushing companies in various industries to adopt more sustainable packaging solutions, further driving the demand for organic substrates.

In addition to regulatory factors, the rising awareness among consumers about environmental issues and the desire for products with minimal environmental impact are contributing to the market’s growth in North America. The region’s well-established food, pharmaceutical, and electronics industries are increasingly opting for organic substrate packaging materials to align with sustainability goals and meet consumer preferences. As a result, North America is expected to maintain its dominant position in the organic substrate packaging material market.

Leading Companies and Competitive Landscape

The organic substrate packaging material market is competitive, with key players such as International Paper, Amcor, DS Smith, and Stora Enso leading the market. These companies are focused on developing innovative packaging solutions made from organic materials, such as biodegradable polymers and paper-based products, to meet the growing demand for sustainable alternatives. Leading players are investing heavily in research and development to enhance the functionality and performance of organic substrate materials while also reducing their environmental impact.

The competitive landscape is marked by a strong emphasis on sustainability, with companies increasingly prioritizing the use of renewable resources, recyclability, and biodegradability in their packaging materials. Strategic collaborations, acquisitions, and investments in new technologies are common strategies used by leading companies to strengthen their market position and meet evolving consumer and regulatory demands. As the trend toward sustainability continues to grow, these companies are well-positioned to capture the opportunities in the expanding organic substrate packaging material market.

Recent Developments:

- Amcor Limited launched a new range of biodegradable organic substrate packaging materials for food products, enhancing sustainability and reducing environmental impact.

- Tetra Pak introduced a new line of paper-based organic packaging solutions for beverages, focusing on recyclability and minimal environmental footprint.

- Sealed Air Corporation expanded its biodegradable polymer-based packaging solutions for electronics, offering improved protective qualities.

- Mondi Group unveiled a new eco-friendly packaging solution made from organic substrates for the pharmaceutical industry, ensuring greater biodegradability.

- Berry Global Inc. introduced an innovative plastic-based organic packaging material for consumer goods, designed to offer better environmental sustainability without compromising performance.

List of Leading Companies:

- Amcor Limited

- Tetra Pak

- International Paper Company

- Berry Global Inc.

- Smurfit Kappa Group

- Sealed Air Corporation

- Mondi Group

- UFlex Limited

- DS Smith Packaging

- Huhtamaki Group

- WestRock Company

- Sappi Group

- Stora Enso

- Toppan Printing Co., Ltd.

- DS Smith

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 6.8 Billion |

|

Forecasted Value (2030) |

USD 11.5 Billion |

|

CAGR (2025 – 2030) |

9.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Organic Substrate Packaging Material Market By Material Type (Paper-based, Plastic-based, Biodegradable Polymers), By Application (Electronics Packaging, Food Packaging, Pharmaceutical Packaging, Cosmetics Packaging), and By End-User (Packaging Manufacturers, Food & Beverage Companies, Electronics Manufacturers, Pharmaceutical Companies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Amcor Limited, Tetra Pak, International Paper Company, Berry Global Inc., Smurfit Kappa Group, Sealed Air Corporation, Mondi Group, UFlex Limited, DS Smith Packaging, Huhtamaki Group, WestRock Company, Sappi Group, Stora Enso, Toppan Printing Co., Ltd., DS Smith |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Organic Substrate Packaging Material Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Paper-based |

|

4.2. Plastic-based |

|

4.3. Biodegradable Polymers |

|

4.4. Others |

|

5. Organic Substrate Packaging Material Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Electronics Packaging |

|

5.2. Food Packaging |

|

5.3. Pharmaceutical Packaging |

|

5.4. Cosmetics Packaging |

|

5.5. Others |

|

6. Organic Substrate Packaging Material Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Packaging Manufacturers |

|

6.2. Food & Beverage Companies |

|

6.3. Electronics Manufacturers |

|

6.4. Pharmaceutical Companies |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Organic Substrate Packaging Material Market, by Material Type |

|

7.2.7. North America Organic Substrate Packaging Material Market, by Application |

|

7.2.8. North America Organic Substrate Packaging Material Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Organic Substrate Packaging Material Market, by Material Type |

|

7.2.9.1.2. US Organic Substrate Packaging Material Market, by Application |

|

7.2.9.1.3. US Organic Substrate Packaging Material Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Amcor Limited |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Tetra Pak |

|

9.3. International Paper Company |

|

9.4. Berry Global Inc. |

|

9.5. Smurfit Kappa Group |

|

9.6. Sealed Air Corporation |

|

9.7. Mondi Group |

|

9.8. UFlex Limited |

|

9.9. DS Smith Packaging |

|

9.10. Huhtamaki Group |

|

9.11. WestRock Company |

|

9.12. Sappi Group |

|

9.13. Stora Enso |

|

9.14. Toppan Printing Co., Ltd. |

|

9.15. DS Smith |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Organic Substrate Packaging Material Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Organic Substrate Packaging Material Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Organic Substrate Packaging Material Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA