As per Intent Market Research, the Organic Seeds Market was valued at USD 3.9 Billion in 2024-e and will surpass USD 8.3 Billion by 2030; growing at a CAGR of 13.3% during 2025-2030.

The organic seeds market is gaining momentum, driven by increasing consumer demand for organic produce and the adoption of sustainable agricultural practices. Organic seeds, produced without synthetic chemicals or genetic modification, are integral to organic farming. They ensure compliance with organic certification standards and play a pivotal role in meeting the growing preference for chemical-free and environmentally friendly food products. As awareness about the environmental and health benefits of organic produce rises, the demand for organic seeds is expected to experience robust growth across various regions and applications.

Technological advancements in seed breeding, the rise of urban farming initiatives, and supportive government policies are further catalyzing the market's expansion. Additionally, the surge in home gardening, particularly after the COVID-19 pandemic, has created new opportunities for the organic seeds market.

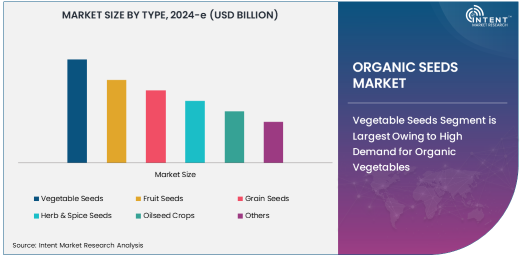

Vegetable Seeds Segment is Largest Owing to High Demand for Organic Vegetables

Vegetable seeds dominate the organic seeds market, accounting for the largest share due to the consistently high demand for organic vegetables globally. Organic vegetable farming ensures pesticide-free and nutrient-rich produce, which aligns with the preferences of health-conscious consumers. Key crops such as tomatoes, cucumbers, carrots, and leafy greens are the most sought-after, driven by both household and commercial demand.

Farmers and gardeners prioritize organic vegetable seeds because of their superior adaptability to organic farming conditions and compliance with certification requirements. The segment's growth is further fueled by urban farming initiatives, vertical farming techniques, and community-supported agriculture programs that emphasize the cultivation of fresh, organic vegetables.

Hybrid Trait Segment is Fastest Growing Due to Superior Yield and Disease Resistance

The hybrid trait segment is witnessing the fastest growth in the organic seeds market, driven by the need for high-yield, disease-resistant crop varieties in organic farming. Hybrid seeds are carefully bred through controlled pollination to combine desirable traits, such as improved yield, enhanced pest resistance, and adaptability to diverse climates. These benefits make hybrid seeds a popular choice among organic farmers striving for profitability and efficiency.

As organic farming expands into regions with challenging climatic conditions, hybrid organic seeds are becoming indispensable for maintaining consistent productivity. Research and development efforts by seed producers to create high-performing organic hybrids further bolster the growth of this segment.

Outdoor Farming Type is Largest Owing to Widespread Adoption of Traditional Practices

Outdoor farming remains the largest segment in the organic seeds market, reflecting the predominant reliance on traditional open-field agricultural practices. Most organic farmers operate in outdoor environments, where organic seeds are sown to cultivate a diverse range of crops, including vegetables, fruits, grains, and oilseeds. Outdoor farming allows for large-scale production, making it the preferred choice for commercial farming.

The segment benefits from government subsidies, certifications, and training programs aimed at promoting sustainable practices. Additionally, the increasing adoption of crop rotation, companion planting, and soil health improvement techniques in outdoor farming supports the widespread use of organic seeds.

Commercial Farming End-Use Segment is Largest Owing to Growing Organic Food Demand

Commercial farming leads the organic seeds market as large-scale organic farms cater to the rising global demand for organic food products. Organic-certified seeds ensure compliance with stringent regulatory standards, making them indispensable for commercial growers. The segment's growth is propelled by increasing investments in organic agriculture by both governments and private entities.

As supermarkets, restaurants, and food brands expand their organic offerings, commercial farmers are scaling up production to meet demand. Organic seed producers are also introducing region-specific varieties to support large-scale cultivation, further strengthening this segment's dominance.

North America is Largest Region Owing to Well-Established Organic Farming Practices

North America holds the largest share in the organic seeds market, driven by the region's mature organic farming sector and high consumer demand for organic food. The U.S. and Canada are at the forefront, supported by government initiatives, certifications, and subsidies for organic farming. Retail chains and food service providers in the region are also heavily promoting organic produce, contributing to the growth of the organic seeds market.

The region's advanced agricultural infrastructure, robust R&D investments, and widespread awareness about sustainability further solidify its leadership. With the expansion of urban gardening and organic farming initiatives, North America is expected to maintain its dominance in the organic seeds market.

Competitive Landscape and Key Players

The organic seeds market is highly competitive, with key players focusing on innovation and product development to meet the evolving needs of farmers and consumers. Leading companies in the market include Monsanto BioAg (Bayer), Syngenta, Vitalis Organic Seeds, Johnny's Selected Seeds, and High Mowing Organic Seeds. These companies invest significantly in R&D to develop region-specific and high-performing organic seed varieties.

Emerging players and regional companies are also contributing to the market by offering cost-effective and locally adapted organic seeds. Partnerships between seed producers, governments, and research institutions are fostering innovation and market growth. The competitive landscape is marked by a balance between established giants and agile regional firms, ensuring continuous progress and opportunities in the organic seeds market.

Recent Developments:

- Bayer AG introduced a new range of certified organic vegetable seeds, catering to sustainable farming needs.

- Syngenta AG announced its partnership with organic farmers to develop new hybrid seeds tailored for organic farming.

- High Mowing Organic Seeds launched a new e-commerce platform to improve access to certified organic seeds for gardeners and farmers.

- Corteva Agriscience developed advanced seed treatments to protect organic seeds from pests and diseases without chemical inputs.

- Vitalis Organic Seeds expanded its product portfolio with a focus on organic heirloom seeds for niche markets.

List of Leading Companies:

- Bayer AG

- Syngenta AG

- BASF SE

- Corteva Agriscience

- Groupe Limagrain

- Sakata Seed Corporation

- Rijk Zwaan

- East-West Seed International

- High Mowing Organic Seeds

- Johnny's Selected Seeds

- Seeds of Change

- Vitalis Organic Seeds

- Navdanya

- Mahyco Seeds Ltd.

- Bejo Zaden BV

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.9 Billion |

|

Forecasted Value (2030) |

USD 8.3 Billion |

|

CAGR (2025 – 2030) |

13.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Organic Seeds Market By Type (Vegetable Seeds, Fruit Seeds, Grain Seeds, Herb & Spice Seeds, Oilseed Crops), By Trait (Open-Pollinated, Hybrid, Heirloom), By Farming Type (Indoor Farming, Outdoor Farming), and By End-Use (Commercial Farming, Household/Gardening, Seed Producers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, Groupe Limagrain, Sakata Seed Corporation, Rijk Zwaan, East-West Seed International, High Mowing Organic Seeds, Johnny's Selected Seeds, Seeds of Change, Vitalis Organic Seeds, Navdanya, Mahyco Seeds Ltd., Bejo Zaden BV |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Organic Seeds Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Vegetable Seeds |

|

4.2. Fruit Seeds |

|

4.3. Grain Seeds |

|

4.4. Herb & Spice Seeds |

|

4.5. Oilseed Crops |

|

4.6. Others |

|

5. Organic Seeds Market, by Trait (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Open-Pollinated |

|

5.2. Hybrid |

|

5.3. Heirloom |

|

6. Organic Seeds Market, by Farming Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Indoor Farming |

|

6.2. Outdoor Farming |

|

7. Organic Seeds Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Commercial Farming |

|

7.2. Household/Gardening |

|

7.3. Seed Producers |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Organic Seeds Market, by Type |

|

8.2.7. North America Organic Seeds Market, by Trait |

|

8.2.8. North America Organic Seeds Market, by Farming Type |

|

8.2.9. North America Organic Seeds Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Organic Seeds Market, by Type |

|

8.2.10.1.2. US Organic Seeds Market, by Trait |

|

8.2.10.1.3. US Organic Seeds Market, by Farming Type |

|

8.2.10.1.4. US Organic Seeds Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Bayer AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Syngenta AG |

|

10.3. BASF SE |

|

10.4. Corteva Agriscience |

|

10.5. Groupe Limagrain |

|

10.6. Sakata Seed Corporation |

|

10.7. Rijk Zwaan |

|

10.8. East-West Seed International |

|

10.9. High Mowing Organic Seeds |

|

10.10. Johnny's Selected Seeds |

|

10.11. Seeds of Change |

|

10.12. Vitalis Organic Seeds |

|

10.13. Navdanya |

|

10.14. Mahyco Seeds Ltd. |

|

10.15. Bejo Zaden BV |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Organic Seeds Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Organic Seeds Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Organic Seeds Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA