As per Intent Market Research, the Organic Personal Care Products Market was valued at USD 12.5 Billion in 2024-e and will surpass USD 24.9 Billion by 2030; growing at a CAGR of 12.2% during 2025-2030.

The organic personal care products market has witnessed significant growth as consumers become increasingly aware of the benefits of natural ingredients and the potential risks associated with synthetic chemicals in personal care items. Organic personal care products are formulated using plant-based, chemical-free, and sustainable ingredients, which resonate with health-conscious consumers seeking alternatives to traditional beauty products. With growing concerns about environmental sustainability and product safety, the demand for organic alternatives across skincare, hair care, and cosmetics has surged, positioning this market for continued expansion.

Factors such as increasing disposable incomes, rising awareness of the harmful effects of synthetic ingredients, and the growing trend of eco-consciousness are driving the market forward. Consumers, particularly Millennials and Gen Z, are not only looking for products that are good for their skin and hair but are also increasingly making purchases based on ethical considerations, including cruelty-free and sustainably sourced ingredients. This shift in consumer preferences is reshaping the personal care industry and creating a dynamic market for organic personal care products across various segments.

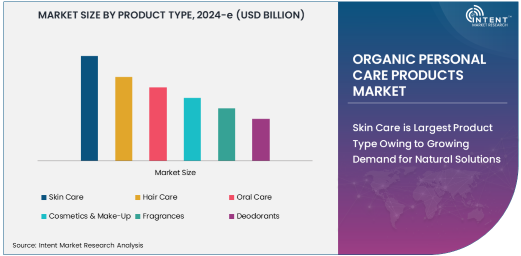

Skin Care is Largest Product Type Owing to Growing Demand for Natural Solutions

Among the various product types, skin care products dominate the organic personal care market due to the increasing consumer preference for natural and gentle solutions for their skin. The skin care segment includes a wide array of products such as organic moisturizers, cleansers, serums, and sunscreens, all of which cater to different skin types and concerns. As awareness grows regarding the harmful effects of chemicals such as parabens and sulfates, consumers are increasingly turning to organic skin care products that offer safer, more effective solutions for maintaining healthy and glowing skin.

The growing trend of "clean beauty" and a heightened focus on anti-aging, acne treatment, and sensitive skin care solutions are contributing to the dominance of the skin care segment. Consumers are seeking products made from botanical extracts, essential oils, and other natural ingredients that not only deliver results but also promote long-term skin health. This has led to an expansion of the market for organic skincare, with consumers willing to invest in premium, organic products to meet their skin care needs.

Women are Largest End-User Owing to High Fashion and Beauty Focus

Women represent the largest end-user segment in the organic personal care products market, driven by their higher spending on beauty and personal care items. Women are particularly conscious of the ingredients used in their skincare, hair care, and cosmetics products, and as a result, there is a growing demand for organic alternatives that offer better health benefits and a lower environmental impact. Organic personal care brands are catering to a diverse range of needs, from anti-aging creams to skin hydration and sensitive skin care, which appeal to women who are looking for natural, effective solutions.

Additionally, the rising trend of sustainability among female consumers is playing a major role in the growth of the organic personal care market. Women are increasingly opting for products that align with their values of environmental responsibility and health consciousness. This preference is driving the market, as women seek products that not only enhance their beauty but also protect their skin and the planet.

Oils & Serums Formulation is Fastest Growing Owing to Effectiveness and Versatility

The oils and serums formulation segment is the fastest growing in the organic personal care products market, driven by their effectiveness and versatility. Oils and serums are popular in organic skincare for their ability to target specific skin concerns with concentrated ingredients. These formulations are often packed with nourishing botanical oils such as argan, jojoba, and rosehip, which provide deep hydration, reduce inflammation, and address issues like dryness, wrinkles, and acne.

The rise of beauty routines centered around natural oils and serums has been fueled by consumer preference for products that deliver visible, long-term results without the use of synthetic chemicals. The popularity of facial oils, hair serums, and body oils among consumers who prioritize organic ingredients is contributing to the growth of this segment. As consumers continue to seek high-performance, natural solutions for their skincare and haircare needs, oils and serums are expected to lead the market in terms of growth.

Online Retailers are Largest Distribution Channel Owing to Convenience and Reach

Online retailers are the largest distribution channel in the organic personal care products market, driven by the convenience, accessibility, and broad reach of e-commerce platforms. With the rise of online shopping, consumers can easily browse and compare organic personal care products from a variety of brands, read customer reviews, and make purchases from the comfort of their homes. This channel also provides access to a wider range of organic products, often with exclusive online-only offers, making it an attractive option for consumers.

The COVID-19 pandemic further accelerated the shift to online shopping, with more consumers turning to e-commerce for their personal care needs. Additionally, the rise of direct-to-consumer (DTC) brands in the organic personal care sector has further boosted the dominance of online retail. As convenience and access to a wide range of products continue to drive consumer behavior, online retailers will remain the dominant distribution channel in the organic personal care market.

North America is Largest Region Owing to High Consumer Awareness and Spending Power

North America is the largest region in the organic personal care products market, primarily driven by the high consumer awareness about the benefits of organic ingredients and the spending power of consumers in the United States and Canada. The region is home to a significant number of organic personal care brands, which have garnered strong customer loyalty due to their focus on product safety, sustainability, and natural formulations. In addition, the increasing demand for clean beauty and environmentally conscious products is boosting market growth in North America.

Consumers in North America are highly invested in the health and wellness sector, with a strong inclination toward natural and organic products. This, combined with a growing trend toward sustainable living, has created a fertile market for organic personal care products. As a result, North America remains the largest region, with significant demand for organic skin care, hair care, and cosmetics products from both established brands and new market entrants.

Leading Companies and Competitive Landscape

Leading companies in the organic personal care products market include The Estée Lauder Companies, L'Oréal, Weleda, Tata Harper, and Burt’s Bees. These companies have established strong market presences by offering a diverse range of organic products that cater to a variety of consumer needs, from skin care to hair care and cosmetics. They have focused on delivering high-quality, effective products made from certified organic ingredients while maintaining a commitment to sustainability and ethical sourcing.

The competitive landscape of the organic personal care market is highly fragmented, with both established multinational corporations and smaller, niche brands competing for market share. In addition to large players, emerging brands that focus on innovation, clean beauty, and sustainable production are gaining traction, contributing to the market's dynamic nature. As consumer preferences continue to evolve toward transparency and environmental responsibility, companies are focusing on product innovation, ingredient transparency, and eco-friendly packaging to maintain a competitive edge.

Recent Developments:

- In December 2024, L'Oréal expanded its organic product line with new eco-friendly packaging.

- In November 2024, The Estée Lauder Companies launched a vegan skincare collection under its Aveda brand.

- In October 2024, Burt's Bees announced a new line of organic oral care products.

- In September 2024, Weleda introduced a range of organic skincare products using sustainably sourced ingredients.

- In August 2024, The Body Shop rolled out a new cruelty-free and organic cosmetics line in European markets.

List of Leading Companies:

- L'Oréal Group

- The Estée Lauder Companies Inc.

- Procter & Gamble Co.

- Weleda AG

- Burt's Bees

- Aveda (Estée Lauder)

- Dr. Hauschka

- Kiehl's

- The Body Shop

- Avalon Organics

- Neutrogena (Johnson & Johnson)

- Shiseido Co., Ltd.

- RMS Beauty

- 100% Pure

- Tata Harper Skincare

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 12.5 Billion |

|

Forecasted Value (2030) |

USD 24.9 Billion |

|

CAGR (2025 – 2030) |

12.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Organic Personal Care Products Market by Product Type (Skin Care, Hair Care, Oral Care, Cosmetics & Make-Up, Fragrances, Deodorants), Formulation (Creams & Lotions, Oils & Serums, Balms & Butters, Sprays), End-User (Women, Men, Unisex), Distribution Channel (Online Retailers, Retail Stores, Supermarkets & Hypermarkets, Direct Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

L'Oréal Group, The Estée Lauder Companies Inc., Procter & Gamble Co., Weleda AG, Burt's Bees, Aveda (Estée Lauder), Dr. Hauschka, Kiehl's, The Body Shop, Avalon Organics, Neutrogena (Johnson & Johnson), Shiseido Co., Ltd., RMS Beauty, 100% Pure, Tata Harper Skincare |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Organic Personal Care Products Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Skin Care |

|

4.2. Hair Care |

|

4.3. Oral Care |

|

4.4. Cosmetics & Make-Up |

|

4.5. Fragrances |

|

4.6. Deodorants |

|

5. Organic Personal Care Products Market, by Formulation (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Creams & Lotions |

|

5.2. Oils & Serums |

|

5.3. Balms & Butters |

|

5.4. Sprays |

|

6. Organic Personal Care Products Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Women |

|

6.2. Men |

|

6.3. Unisex |

|

7. Organic Personal Care Products Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retailers |

|

7.2. Retail Stores |

|

7.3. Supermarkets & Hypermarkets |

|

7.4. Direct Sales |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Organic Personal Care Products Market, by Product Type |

|

8.2.7. North America Organic Personal Care Products Market, by Formulation |

|

8.2.8. North America Organic Personal Care Products Market, by End-User |

|

8.2.9. North America Organic Personal Care Products Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Organic Personal Care Products Market, by Product Type |

|

8.2.10.1.2. US Organic Personal Care Products Market, by Formulation |

|

8.2.10.1.3. US Organic Personal Care Products Market, by End-User |

|

8.2.10.1.4. US Organic Personal Care Products Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. L'Oréal Group |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. The Estée Lauder Companies Inc. |

|

10.3. Procter & Gamble Co. |

|

10.4. Weleda AG |

|

10.5. Burt's Bees |

|

10.6. Aveda (Estée Lauder) |

|

10.7. Dr. Hauschka |

|

10.8. Kiehl's |

|

10.9. The Body Shop |

|

10.10. Avalon Organics |

|

10.11. Neutrogena (Johnson & Johnson) |

|

10.12. Shiseido Co., Ltd. |

|

10.13. RMS Beauty |

|

10.14. 100% Pure |

|

10.15. Tata Harper Skincare |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Organic Personal Care Products Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Organic Personal Care Products Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Organic Personal Care Products Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA