As per Intent Market Research, the Organic Apple Sauce Market was valued at USD 3.0 Billion in 2024-e and will surpass USD 4.9 Billion by 2030; growing at a CAGR of 8.8% during 2025-2030.\

The organic apple sauce market has gained significant traction in recent years, driven by a growing consumer preference for healthier, natural, and environmentally sustainable food options. As consumers become more health-conscious and aware of the benefits of organic products, the demand for organic apple sauce has risen, fueled by its perceived health benefits and clean-label appeal. Organic apple sauce, free from artificial preservatives, colors, and sweeteners, has become a popular choice among those seeking to make healthier eating decisions without compromising on flavor or convenience. This trend is particularly prominent among millennials and parents seeking nutritious food options for their families.

The organic food market, as a whole, has experienced steady growth, and apple sauce has become a key segment within this category. As people increasingly adopt organic diets, the market for organic apple sauce is expanding across regions, with new product innovations and packaging formats further driving its growth. Health-conscious consumers, coupled with an increasing number of retail and foodservice outlets offering organic options, are fueling the demand for organic apple sauce. With an ongoing shift toward clean-label products and sustainable sourcing, the market is expected to continue its upward trajectory in the coming years.

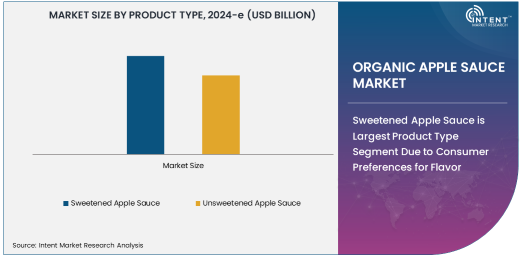

Sweetened Apple Sauce is Largest Product Type Segment Due to Consumer Preferences for Flavor

Sweetened apple sauce is the largest product type segment in the organic apple sauce market, driven by consumer preferences for a sweeter taste in their food products. Many consumers opt for sweetened apple sauce as a snack or dessert due to its pleasant flavor profile, which combines the natural sweetness of apples with added sweeteners. While unsweetened apple sauce is also growing in popularity due to the increasing trend toward low-sugar diets, sweetened varieties continue to dominate the market, particularly in retail and foodservice channels.

Sweetened apple sauce offers a balance between health benefits and indulgence, making it an appealing choice for a wide range of consumers. It is commonly found in jars, pouches, and tetra paks, and is often marketed as a family-friendly product. The addition of sweeteners, typically organic cane sugar or other natural alternatives, enhances the flavor without compromising the organic nature of the product. As more consumers seek convenient and tasty snack options, the demand for sweetened organic apple sauce is expected to remain strong, driving this segment's continued dominance in the market.

Jars Are Largest Packaging Type Segment Due to Tradition and Convenience

Jars are the largest packaging type segment in the organic apple sauce market, due to their long-standing association with food preservation and consumer convenience. Jars are often seen as the most traditional and reliable form of packaging for apple sauce, offering benefits such as extended shelf life, ease of storage, and portability. Consumers are accustomed to purchasing apple sauce in jars, and this packaging format remains a popular choice in both retail stores and foodservice industries.

The jar packaging format is particularly appealing for those purchasing organic apple sauce for household consumption, as it offers a more substantial quantity of product, ideal for family use or for those who consume apple sauce regularly. Additionally, jars provide excellent protection from contaminants and preserve the product's freshness, which is particularly important in the organic food sector, where consumers expect high-quality, unaltered products. As a result, jars continue to lead the packaging segment, although other formats such as pouches and tetra paks are gaining traction, especially in on-the-go snacking.

Online Retailers Are Fastest Growing Distribution Channel Due to E-Commerce Growth

Online retailers are the fastest-growing distribution channel in the organic apple sauce market, driven by the rapid expansion of e-commerce and the increasing preference for online shopping. The convenience of ordering products from the comfort of home, along with the ability to compare prices and read reviews, has made online platforms the go-to option for many consumers. As consumers seek healthier and organic food options, the availability of organic apple sauce through online retailers provides them with greater access to a wide variety of products, brands, and packaging options.

E-commerce platforms like Amazon, Walmart, and specialized online organic food stores have capitalized on the growing demand for organic apple sauce, offering a convenient shopping experience and the ability to deliver directly to consumers' doorsteps. This distribution channel's rapid growth is further fueled by the increasing use of mobile apps and the rise of subscription-based models, making it easier for consumers to reorder their favorite organic products. As the trend toward online shopping continues to expand, online retailers are expected to remain the fastest-growing distribution channel for organic apple sauce.

Retail Consumers Are Largest End-User Industry Segment Due to Demand for Convenience and Healthier Snacks

Retail consumers represent the largest end-user industry segment in the organic apple sauce market, as demand for convenient, healthy, and organic food options continues to grow. Consumers, particularly in developed markets, are becoming increasingly health-conscious and are seeking snacks and meals that are both nutritious and easy to consume. Organic apple sauce meets these needs by offering a wholesome, natural product that can be consumed on its own or incorporated into various recipes.

The retail sector is well-positioned to cater to the growing demand for organic products, with supermarkets, health food stores, and specialty organic retailers offering a wide range of organic apple sauce products. Consumers are drawn to the clean-label and preservative-free nature of organic apple sauce, which appeals to those seeking natural alternatives to traditional sugary snacks. Retail outlets continue to serve as the primary distribution channel for organic apple sauce, with an increasing number of consumers purchasing these products as part of their regular grocery shopping.

North America is Largest Region Due to Strong Consumer Demand for Organic Products

North America is the largest region for the organic apple sauce market, driven by strong consumer demand for organic food products, particularly in the United States and Canada. The region has seen significant growth in the organic food sector, with consumers increasingly prioritizing health-conscious choices and sustainability in their purchasing decisions. North American consumers have shown a preference for organic and natural products, which has fueled the growth of organic apple sauce as a popular snack and ingredient.

The presence of well-established organic food retailers and the expansion of e-commerce platforms offering organic products have further contributed to North America's dominance in the market. Additionally, North America’s robust food safety regulations and high standards for organic certification provide consumers with the assurance that the products they purchase meet strict quality and environmental criteria. As the trend toward organic eating continues to gain momentum, North America is expected to remain the largest regional market for organic apple sauce.

Leading Companies and Competitive Landscape

The organic apple sauce market is competitive, with several key players offering a variety of products to meet the growing demand for organic food. Leading companies in the market include Mott’s, Eden Foods, Knudsen, and Santa Cruz Organic, among others. These companies offer a range of organic apple sauce products in various packaging formats, catering to different consumer preferences. To stay competitive, companies are focusing on product innovation, such as introducing new flavors and improving packaging designs to enhance convenience.

The competitive landscape is also characterized by the growing trend of direct-to-consumer sales through online channels, with many companies expanding their e-commerce presence to reach a wider audience. As the demand for organic products continues to rise, companies in the organic apple sauce market are expected to invest in research and development to meet evolving consumer preferences, such as reduced sugar content or eco-friendly packaging. With increasing consumer awareness of health and sustainability, the competitive environment will likely continue to evolve, with companies differentiating themselves through product quality, innovation, and branding.

Recent Developments:

- In December 2024, Mott’s LLP introduced a new line of organic apple sauce pouches aimed at on-the-go consumers.

- In November 2024, Gerber launched an organic apple sauce product designed for infants, expanding its organic food range.

- In October 2024, The Hain Celestial Group announced plans to increase its production of organic fruit-based snacks, including apple sauce.

- In September 2024, Santa Cruz Organic expanded its product offerings to include new flavor combinations in its organic apple sauce line.

- In August 2024, Whole Foods Market reported a significant increase in the demand for organic apple sauces, particularly those with no added sugar.

List of Leading Companies:

- Mott's LLP

- Materne North America Corp.

- Del Monte Foods, Inc.

- Eden Foods Inc.

- The Hain Celestial Group, Inc.

- Knouse Foods Cooperative, Inc.

- R.W. Knudsen Family

- Santa Cruz Organic

- California Organic Growers

- Gerber Products Company (Nestlé)

- The Kraft Heinz Company

- Tropicana Products, Inc.

- Sprout Organic Foods

- Happy Baby Organic

- Whole Foods Market

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.0 Billion |

|

Forecasted Value (2030) |

USD 4.9 Billion |

|

CAGR (2025 – 2030) |

8.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Organic Apple Sauce Market by Product Type (Sweetened Apple Sauce, Unsweetened Apple Sauce), Packaging Type (Jars, Pouches, Tetra Paks), Distribution Channel (Online Retailers, Retail Stores, Supermarkets & Hypermarkets), End-User Industry (Retail Consumers, Foodservice Industry) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Mott's LLP, Materne North America Corp., Del Monte Foods, Inc., Eden Foods Inc., The Hain Celestial Group, Inc., Knouse Foods Cooperative, Inc., R.W. Knudsen Family, Santa Cruz Organic, California Organic Growers, Gerber Products Company (Nestlé), The Kraft Heinz Company, Tropicana Products, Inc., Sprout Organic Foods, Happy Baby Organic, Whole Foods Market |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Organic Apple Sauce Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Sweetened Apple Sauce |

|

4.2. Unsweetened Apple Sauce |

|

5. Organic Apple Sauce Market, by Packaging Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Jars |

|

5.2. Pouches |

|

5.3. Tetra Paks |

|

6. Organic Apple Sauce Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Online Retailers |

|

6.2. Retail Stores |

|

6.3. Supermarkets & Hypermarkets |

|

7. Organic Apple Sauce Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Retail Consumers |

|

7.2. Foodservice Industry |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Organic Apple Sauce Market, by Product Type |

|

8.2.7. North America Organic Apple Sauce Market, by Packaging Type |

|

8.2.8. North America Organic Apple Sauce Market, by Distribution Channel |

|

8.2.9. North America Organic Apple Sauce Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Organic Apple Sauce Market, by Product Type |

|

8.2.10.1.2. US Organic Apple Sauce Market, by Packaging Type |

|

8.2.10.1.3. US Organic Apple Sauce Market, by Distribution Channel |

|

8.2.10.1.4. US Organic Apple Sauce Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Mott's LLP |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Materne North America Corp. |

|

10.3. Del Monte Foods, Inc. |

|

10.4. Eden Foods Inc. |

|

10.5. The Hain Celestial Group, Inc. |

|

10.6. Knouse Foods Cooperative, Inc. |

|

10.7. R.W. Knudsen Family |

|

10.8. Santa Cruz Organic |

|

10.9. California Organic Growers |

|

10.10. Gerber Products Company (Nestlé) |

|

10.11. The Kraft Heinz Company |

|

10.12. Tropicana Products, Inc. |

|

10.13. Sprout Organic Foods |

|

10.14. Happy Baby Organic |

|

10.15. Whole Foods Market |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Organic Apple Sauce Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Organic Apple Sauce Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Organic Apple Sauce Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA