As per Intent Market Research, the ORC Industrial Waste Heat To Power Market was valued at USD 3.0 Billion in 2024-e and will surpass USD 6.5 Billion by 2030; growing at a CAGR of 14.1% during 2025-2030.

The ORC (Organic Rankine Cycle) industrial waste heat to power market has witnessed steady growth due to the increasing need for energy efficiency and the growing emphasis on sustainability in industrial operations. ORC systems capture low-temperature waste heat and convert it into electricity, making them a popular choice in industries aiming to reduce energy wastage and greenhouse gas emissions. As industries face rising energy costs and stringent environmental regulations, adopting waste heat recovery technologies has become a strategic priority.

Governments and regulatory bodies worldwide are promoting the adoption of waste heat recovery systems through incentives and policies aimed at reducing carbon footprints. This, coupled with advancements in ORC technology that enhance system efficiency and reduce costs, has contributed to the growing adoption of ORC systems across diverse industries. The market is expected to expand further as industries increasingly prioritize energy recovery and the transition to sustainable energy sources.

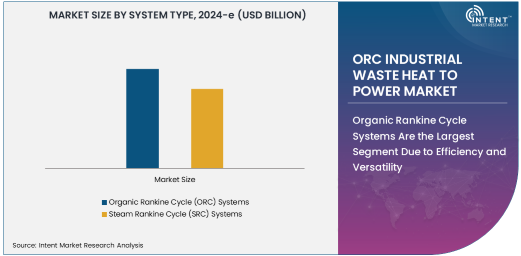

Organic Rankine Cycle Systems Are the Largest Segment Due to Efficiency and Versatility

Organic Rankine Cycle (ORC) systems dominate the market due to their superior efficiency and adaptability across a variety of heat sources. ORC systems use organic fluids with lower boiling points than water, enabling the recovery of waste heat from low-temperature sources that are typically unusable by traditional systems. These systems are particularly effective in industries like manufacturing, oil & gas, and power generation, where waste heat is abundant and energy efficiency is crucial.

The ability of ORC systems to integrate with diverse heat sources such as geothermal energy, biomass combustion, and industrial waste heat has further strengthened their appeal. Moreover, their compact design, low maintenance requirements, and ability to operate autonomously make them a preferred choice for industrial applications. As industries continue to focus on reducing operational costs and emissions, ORC systems are expected to maintain their dominance in the market.

Waste Heat from Industrial Processes is the Largest Heat Source Segment Due to Prevalence

Waste heat from industrial processes represents the largest heat source segment in the market, driven by the significant volume of heat energy that goes unused in industries such as manufacturing, chemical processing, and metal production. Industrial processes such as furnaces, kilns, and engines often produce large amounts of low-grade waste heat, which can be effectively harnessed by ORC systems to generate electricity.

This segment's dominance is supported by the global trend of industrial decarbonization, where industries are adopting waste heat recovery technologies to meet sustainability goals and comply with environmental regulations. The economic benefits of recovering waste heat—reducing energy costs and improving operational efficiency—are also key factors driving the adoption of ORC systems for this heat source. As industries continue to focus on energy optimization, this segment is expected to remain the largest contributor.

1 MW to 5 MW Capacity Segment is Fastest Growing Due to Flexibility and Demand from Mid-Sized Industries

The 1 MW to 5 MW capacity segment is the fastest-growing capacity category, driven by its suitability for mid-sized industrial operations and the increasing adoption of distributed power generation systems. ORC systems in this capacity range offer an optimal balance between cost-effectiveness and power output, making them attractive to industries such as food & beverage, chemical processing, and pulp & paper.

The scalability and flexibility of ORC systems in this range allow businesses to customize solutions to meet their specific energy needs without significant capital investment. Furthermore, advancements in modular ORC technology have made these systems easier to install and integrate into existing operations, accelerating their adoption. As mid-sized industries focus on improving energy efficiency and meeting sustainability targets, the 1 MW to 5 MW capacity segment is expected to experience rapid growth.

Liquid-Based Organic Rankine Cycle Systems Dominate Due to Operational Efficiency

Liquid-based ORC systems, which utilize liquid organic fluids for heat transfer, dominate the form segment due to their operational efficiency and compatibility with a wide range of heat sources. These systems offer higher thermal stability, improved heat transfer capabilities, and reduced operational complexities, making them the preferred choice for industrial applications. Liquid-based systems are particularly effective in high-heat applications such as waste heat recovery from furnaces and boilers, ensuring consistent and reliable power generation.

As industries prioritize efficiency and operational reliability, liquid-based ORC systems are poised to maintain their leadership in the form segment. Their ability to maximize energy recovery while minimizing system downtime further strengthens their position in the market.

North America is the Largest Region Due to Industrial Activity and Regulatory Support

North America leads the ORC industrial waste heat to power market, driven by its well-established industrial base and supportive regulatory framework. The United States, in particular, has seen significant adoption of waste heat recovery systems, supported by stringent environmental regulations and government incentives promoting energy efficiency. Industries in this region are increasingly turning to ORC systems to reduce energy costs and comply with emission reduction targets.

The high level of awareness about sustainable energy practices, coupled with the presence of key market players, has further solidified North America's position as the largest regional market. With ongoing investments in industrial energy optimization and the adoption of advanced technologies, the region is expected to maintain its dominance in the coming years.

Leading Companies and Competitive Landscape

The ORC industrial waste heat to power market is highly competitive, with key players focusing on technological advancements and strategic partnerships to strengthen their market position. Leading companies such as Turboden S.p.A., Ormat Technologies, and Enogia are at the forefront of innovation, offering customized ORC solutions for various industrial applications.

These companies are also investing in research and development to improve system efficiency and reduce costs, making ORC technology more accessible to a broader range of industries. The competitive landscape is characterized by collaborations between technology providers and industrial operators, as well as the growing presence of regional players catering to specific markets. As the demand for energy-efficient and sustainable solutions continues to rise, the competition in this market is expected to intensify.

Recent Developments:

- In December 2024, Ormat Technologies, Inc. expanded its ORC solutions to include integrated waste heat recovery systems for petrochemical plants.

- In November 2024, Siemens AG announced a new ORC-based waste heat recovery project for a large manufacturing facility in Europe.

- In October 2024, General Electric (GE) launched a new ORC waste heat recovery system tailored for chemical processing industries.

- In September 2024, Turboden S.r.l. introduced an advanced radial turbine expander for industrial-scale ORC applications.

- In August 2024, Exergy International S.r.l. signed a strategic partnership with a global food processing company to implement ORC systems for waste heat recovery.

List of Leading Companies:

- Ormat Technologies, Inc.

- Siemens AG

- General Electric Company (GE)

- MAN Energy Solutions

- Turboden S.r.l.

- Exergy International S.r.l.

- Engeco S.p.A.

- Kaishan Compressor Co., Ltd.

- Caterpillar Inc.

- ElectraTherm, Inc.

- Liebherr Group

- Abengoa S.A.

- Heat Mining Co., Ltd.

- Enel Green Power S.p.A.

- Wärtsilä Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.3 Billion |

|

Forecasted Value (2030) |

USD 8.0 Billion |

|

CAGR (2025 – 2030) |

10.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

ORC Industrial Waste Heat To Power Market by Type (Scroll Expander, Screw Expander, Radial Turbine Expander), Application (Industrial Waste Heat Recovery, Combined Heat and Power (CHP) Systems), End-User Industry (Manufacturing, Petrochemicals & Refining, Chemical Processing, Oil & Gas, Food & Beverage Processing, Metal & Mining |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Ormat Technologies, Inc., Siemens AG, General Electric Company (GE), MAN Energy Solutions, Turboden S.r.l., Exergy International S.r.l., Engeco S.p.A., Kaishan Compressor Co., Ltd., Caterpillar Inc., ElectraTherm, Inc., Liebherr Group, Abengoa S.A., Heat Mining Co., Ltd., Enel Green Power S.p.A., Wärtsilä Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. ORC Industrial Waste Heat To Power Market, by System Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Organic Rankine Cycle (ORC) Systems |

|

4.2. Steam Rankine Cycle (SRC) Systems |

|

5. ORC Industrial Waste Heat To Power Market, by Heat Source (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Waste Heat from Industrial Processes |

|

5.2. Geothermal Heat |

|

5.3. Biomass Combustion |

|

5.4. Solar Thermal Energy |

|

6. ORC Industrial Waste Heat To Power Market, by Capacity (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Less than 1 MW |

|

6.2. 1 MW to 5 MW |

|

6.3. More than 5 MW |

|

7. ORC Industrial Waste Heat To Power Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Manufacturing |

|

7.2. Oil & Gas |

|

7.3. Chemical Industry |

|

7.4. Power Generation |

|

7.5. Food & Beverage |

|

7.6. Pulp & Paper |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America ORC Industrial Waste Heat To Power Market, by System Type |

|

8.2.7. North America ORC Industrial Waste Heat To Power Market, by Heat Source |

|

8.2.8. North America ORC Industrial Waste Heat To Power Market, by Capacity |

|

8.2.9. North America ORC Industrial Waste Heat To Power Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US ORC Industrial Waste Heat To Power Market, by System Type |

|

8.2.10.1.2. US ORC Industrial Waste Heat To Power Market, by Heat Source |

|

8.2.10.1.3. US ORC Industrial Waste Heat To Power Market, by Capacity |

|

8.2.10.1.4. US ORC Industrial Waste Heat To Power Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Turboden S.p.A. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Exergy S.p.A. |

|

10.3. Enogia |

|

10.4. Ormat Technologies, Inc. |

|

10.5. ABB Ltd. |

|

10.6. GE Power |

|

10.7. Siemens Energy |

|

10.8. Kawasaki Heavy Industries, Ltd. |

|

10.9. Dürr Group |

|

10.10. ElectraTherm, Inc. |

|

10.11. Climeon AB |

|

10.12. Atlas Copco AB |

|

10.13. Bosch Industriekessel GmbH |

|

10.14. Mitsubishi Heavy Industries, Ltd. |

|

10.15. Kelvion Holding GmbH |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the ORC Industrial Waste Heat To Power Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the ORC Industrial Waste Heat To Power Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the ORC Industrial Waste Heat To Power Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA