As per Intent Market Research, the Optogenetics Actuators and Sensors Market was valued at USD 2.0 Billion in 2024-e and will surpass USD 5.6 Billion by 2030; growing at a CAGR of 18.5% during 2025-2030.

The optogenetics actuators and sensors market is a rapidly growing segment within the field of biotechnology, primarily driven by advancements in neuroscience and cellular biology. Optogenetics involves the use of light to control cells within living tissue, typically neurons, that have been genetically modified to express light-sensitive proteins. This approach has revolutionized neuroscience research by enabling precise control over cellular activity, facilitating breakthroughs in understanding the brain, developing new therapies, and restoring vision. The market for actuators and sensors, which are integral components in optogenetic applications, is expanding as the demand for optogenetic therapies, especially for neurological disorders, vision restoration, and cardiovascular applications, increases.

The growing number of research studies and clinical trials using optogenetics to treat neurological disorders such as Parkinson’s disease, epilepsy, and depression, as well as advancements in vision restoration for patients suffering from blindness, are major factors contributing to the market’s expansion. With significant potential in personalized medicine and therapeutic interventions, optogenetics is poised to become a transformative technology in the biomedical field, driving the growth of actuators and sensors that facilitate light-based control of biological systems.

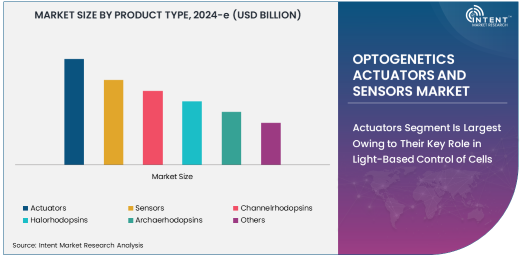

Actuators Segment Is Largest Owing to Their Key Role in Light-Based Control of Cells

The actuators segment is the largest within the optogenetics market, owing to their essential role in controlling cellular activity through light stimulation. Actuators are proteins or proteins with light-responsive properties, such as channelrhodopsins, halorhodopsins, and archaerhodopsins, which allow precise control of ion channels within cells upon exposure to light. These proteins are critical in optogenetic research as they enable researchers to control neuronal firing, regulate brain activity, and study complex neural circuits in real time. Actuators are also used in therapies aimed at restoring vision or treating neurological disorders, making them indispensable in the growing optogenetic landscape.

The increased focus on optogenetic therapies in clinical trials for treating various neurological conditions, coupled with the demand for more advanced actuators that offer better specificity, efficiency, and tissue penetration, is further driving growth in this segment. As optogenetic interventions evolve from research to therapeutic applications, actuators are becoming increasingly sophisticated, offering improved control over targeted cellular activity, which enhances the potential of optogenetic treatments. This makes the actuators segment a pivotal component in the overall growth of the optogenetics actuators and sensors market.

Sensors Segment Is Fastest Growing Owing to Advances in Real-Time Monitoring and Feedback Mechanisms

The sensors segment is the fastest growing within the optogenetics market, driven by the increasing need for real-time monitoring and feedback in optogenetic research and therapies. Sensors in optogenetics are used to monitor the effects of light-based control on cellular activity and enable the precise tracking of physiological changes during experiments or treatments. As optogenetics transitions from laboratory research to clinical applications, the demand for sensors that can provide accurate, continuous monitoring of cellular responses is rapidly increasing.

Technological advancements, such as the development of highly sensitive and non-invasive sensors, have fueled the growth of this segment. These sensors are critical in applications like vision restoration, where they help monitor retinal responses to optogenetic treatments, and in neurological research, where they provide feedback on neuronal activity. With increasing focus on personalized medicine and real-time therapeutic interventions, sensors are becoming more sophisticated, incorporating elements like miniaturization and wireless capabilities, which further propels their adoption and growth. As optogenetic therapies evolve, the need for advanced sensors to enable personalized, real-time adjustments in treatments is expected to continue driving market expansion in the sensors segment.

Neurological Research Is Largest Application Due to Growing Focus on Brain Disorders

Neurological research is the largest application within the optogenetics actuators and sensors market, primarily due to the increasing use of optogenetics in studying brain disorders. The ability to precisely control neuronal activity with light has revolutionized the study of neurological conditions such as Parkinson's disease, epilepsy, and Alzheimer's disease. By controlling specific brain circuits, researchers are able to better understand the underlying mechanisms of these diseases and test potential therapeutic approaches in real time. The growing focus on neuroscience and the use of optogenetic tools to map brain activity and identify novel treatment strategies is driving the expansion of the market in this application.

Additionally, the application of optogenetics in neurological research is being bolstered by the increasing availability of genetically modified animals and advanced imaging technologies, which enable more accurate and detailed investigations into brain function. As research continues to deepen our understanding of the brain, the demand for optogenetics tools, particularly actuators and sensors, is expected to grow significantly. This makes neurological research the largest application in the market, with substantial funding and advancements being channeled into this area.

North America Is Largest Region Owing to Strong Research Infrastructure and Investment

North America is the largest region in the optogenetics actuators and sensors market, driven by the region's strong research infrastructure and significant investment in biomedical research. The United States, in particular, is a leader in neuroscience research, with numerous academic and research institutions conducting cutting-edge optogenetic studies. The presence of major biotechnology companies, research labs, and funding bodies that support innovation in optogenetics further strengthens North America's position in the market.

In addition to academic research, North America is also a hub for clinical trials involving optogenetic therapies for neurological disorders and vision restoration. The region's advanced healthcare systems and strong regulatory frameworks have created a conducive environment for the development and commercialization of optogenetic technologies. As optogenetic therapies move closer to becoming mainstream treatments, North America is expected to maintain its dominance in the market, attracting continued investments in both research and product development.

Leading Companies and Competitive Landscape

The optogenetics actuators and sensors market is competitive, with several key players driving innovation and advancing the development of optogenetic tools. Leading companies in this space include KeyGene, Inc., Thorlabs, Inc., LUMICKS, and Gensight Biologics. These companies focus on providing high-quality actuators, sensors, and optogenetic equipment to academic researchers, biotech firms, and healthcare institutions. To maintain their competitive edge, these companies are heavily investing in research and development to improve the efficiency, specificity, and ease of use of optogenetic tools.

The competitive landscape is also shaped by strategic collaborations, partnerships, and mergers, as companies seek to enhance their product offerings and expand their market reach. As the optogenetics market matures, companies are looking to differentiate themselves by developing more advanced technologies, such as miniaturized actuators and sensors, and expanding their capabilities in clinical applications. The growing demand for optogenetic therapies and research tools ensures a dynamic and competitive market, with new entrants bringing novel solutions to the forefront.

Recent Developments:

- Illumina, Inc. launched a new optogenetics system for enhanced gene editing, offering precise control over cell activities for clinical and research applications.

- CRISPR Therapeutics developed an optogenetic actuator device to aid in gene therapy applications for treating neurological disorders, paving the way for new treatment options.

- Circuit Therapeutics introduced a groundbreaking optogenetic therapy platform aimed at treating vision loss by restoring photoreceptor activity in the retina.

- GenSight Biologics announced clinical trials for their optogenetic therapy designed to restore sight in individuals with retinal diseases, utilizing light-sensitive proteins.

- Thorlabs, Inc. launched a new series of optogenetics sensors for monitoring neural activities with high sensitivity, improving accuracy in research and therapeutic applications.

List of Leading Companies:

- Illumina, Inc.

- Thorlabs, Inc.

- Optogenix

- CRISPR Therapeutics

- Circuit Therapeutics

- Chronos Therapeutics

- GenSight Biologics

- BioAxial

- FHC, Inc.

- Bionomics Limited

- Juno Therapeutics, Inc.

- Bluebird Bio, Inc.

- Arch Therapeutics, Inc.

- Alnylam Pharmaceuticals, Inc.

- Oligo Therapeutics

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.0 Billion |

|

Forecasted Value (2030) |

USD 5.6 Billion |

|

CAGR (2025 – 2030) |

18.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Optogenetics Actuators and Sensors Market By Product Type (Actuators, Sensors), By Technology (Channelrhodopsins, Halorhodopsins, Archaerhodopsins), By Application (Neurological Research, Optogenetic Therapy, Vision Restoration, Cardiovascular), and By End-User Industry (Academic & Research Institutes, Biotechnology, Pharmaceuticals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Illumina, Inc., Thorlabs, Inc., Optogenix, CRISPR Therapeutics, Circuit Therapeutics, Chronos Therapeutics, GenSight Biologics, BioAxial, FHC, Inc., Bionomics Limited, Juno Therapeutics, Inc., Bluebird Bio, Inc., Arch Therapeutics, Inc., Alnylam Pharmaceuticals, Inc., Oligo Therapeutics |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Optogenetics Actuators and Sensors Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Actuators |

|

4.2. Sensors |

|

5. Optogenetics Actuators and Sensors Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Channelrhodopsins |

|

5.2. Halorhodopsins |

|

5.3. Archaerhodopsins |

|

5.4. Others |

|

6. Optogenetics Actuators and Sensors Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Neurological Research |

|

6.2. Optogenetic Therapy |

|

6.3. Vision Restoration |

|

6.4. Cardiovascular |

|

6.5. Others |

|

7. Optogenetics Actuators and Sensors Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Academic & Research Institutes |

|

7.2. Biotechnology |

|

7.3. Pharmaceuticals |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Optogenetics Actuators and Sensors Market, by Product Type |

|

8.2.7. North America Optogenetics Actuators and Sensors Market, by Technology |

|

8.2.8. North America Optogenetics Actuators and Sensors Market, by Application |

|

8.2.9. North America Optogenetics Actuators and Sensors Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Optogenetics Actuators and Sensors Market, by Product Type |

|

8.2.10.1.2. US Optogenetics Actuators and Sensors Market, by Technology |

|

8.2.10.1.3. US Optogenetics Actuators and Sensors Market, by Application |

|

8.2.10.1.4. US Optogenetics Actuators and Sensors Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Illumina, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Thorlabs, Inc. |

|

10.3. Optogenix |

|

10.4. CRISPR Therapeutics |

|

10.5. Circuit Therapeutics |

|

10.6. Chronos Therapeutics |

|

10.7. GenSight Biologics |

|

10.8. BioAxial |

|

10.9. FHC, Inc. |

|

10.10. Bionomics Limited |

|

10.11. Juno Therapeutics, Inc. |

|

10.12. Bluebird Bio, Inc. |

|

10.13. Arch Therapeutics, Inc. |

|

10.14. Alnylam Pharmaceuticals, Inc. |

|

10.15. Oligo Therapeutics |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Optogenetics Actuators and Sensors Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Optogenetics Actuators and Sensors Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Optogenetics Actuators and Sensors Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA