As per Intent Market Research, the Ophthalmoscopes Market was valued at USD 257.3 million in 2024-e and will surpass USD 367.5 million by 2030; growing at a CAGR of 6.1% during 2025 - 2030.

The ophthalmoscopes market has seen steady growth due to the increasing global prevalence of eye disorders such as glaucoma, cataracts, and retinal diseases, as well as advancements in ophthalmic diagnostic technologies. Ophthalmoscopes are essential diagnostic tools used to examine the interior of the eye, particularly the retina and optic nerve, to detect eye conditions and monitor the progression of diseases. These instruments are widely used in hospitals, ophthalmic clinics, and eye centers to provide accurate diagnoses and facilitate timely treatment.

The market is driven by the growing awareness of eye health, aging populations, and the rising incidence of ocular diseases, including diabetic retinopathy, macular degeneration, and retinal detachment. Furthermore, advancements in ophthalmoscope technologies, such as the integration of LED, xenon, and halogen light sources, have improved the quality of ocular examinations and enhanced diagnostic accuracy. As healthcare systems worldwide continue to prioritize preventative care and early diagnosis of eye conditions, the demand for high-performance ophthalmoscopes is expected to grow, fueling market expansion.

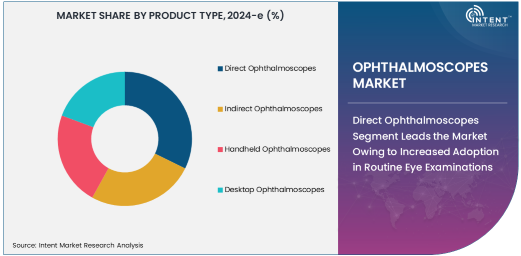

Direct Ophthalmoscopes Segment Leads the Market Owing to Increased Adoption in Routine Eye Examinations

The direct ophthalmoscopes segment is the largest in the market, primarily due to the widespread use of these devices in routine eye exams, particularly for assessing the retina and optic nerve. Direct ophthalmoscopes offer a highly focused, detailed view of the back of the eye, making them a popular choice for ophthalmologists and optometrists conducting basic eye exams. These instruments are valued for their portability, ease of use, and affordability, which make them suitable for use in both clinical settings and primary care environments.

Direct ophthalmoscopes allow healthcare professionals to detect early signs of retinal diseases, including diabetic retinopathy, macular degeneration, and glaucoma. The adoption of direct ophthalmoscopes is also boosted by the increasing demand for early detection of eye conditions, particularly in the aging population, where age-related ocular diseases are more prevalent. Their cost-effectiveness and user-friendly design ensure their continued dominance in the market, especially in settings where routine screenings are essential.

LED Ophthalmoscopes Technology is Fastest Growing Owing to Improved Lighting and Enhanced Visual Clarity

Among the various technologies used in ophthalmoscopes, LED ophthalmoscopes are experiencing the fastest growth in the market. The adoption of LED technology in ophthalmoscopes is primarily driven by its superior advantages over traditional light sources such as halogen and xenon. LED ophthalmoscopes offer brighter, clearer, and more consistent lighting, allowing for better visualization of the retina and other parts of the eye. Additionally, LED lights have a longer lifespan and consume less power compared to other light sources, contributing to cost savings and environmental sustainability.

The improved lighting quality provided by LED ophthalmoscopes enhances diagnostic accuracy by offering better contrast and resolution, which is particularly crucial in the diagnosis of conditions like glaucoma and retinal diseases. The growing preference for LED technology is being fueled by its ability to offer brighter illumination while maintaining a more compact and lightweight design, making these ophthalmoscopes highly suitable for both handheld and desktop versions.

Retina Examination Application is Key to Market Growth Owing to Rising Incidence of Retinal Diseases

The retina examination application dominates the ophthalmic market for ophthalmoscopes, owing to the growing prevalence of retinal diseases such as diabetic retinopathy, macular degeneration, and retinal detachment. Ophthalmoscopes are essential tools for examining the retina and optic nerve, which are crucial for diagnosing and monitoring these conditions. The increasing global incidence of diabetes and other chronic diseases has led to a rise in retinal diseases, thereby increasing the demand for accurate and efficient retinal examinations.

In addition, the increasing awareness of eye health, particularly in aging populations, has also driven the demand for regular retina examinations to detect early signs of disease and prevent vision loss. As retina-related conditions often develop silently and progress gradually, the importance of early diagnosis and monitoring has significantly contributed to the growth of this segment. As a result, retina examinations remain a vital application in the ophthalmoscopes market.

Hospitals End-User Segment Leads the Market Owing to High Demand for Advanced Diagnostic Tools

The hospitals end-user segment holds the largest share in the ophthalmoscopes market, owing to the high demand for advanced diagnostic tools in healthcare facilities. Hospitals are equipped with a wide range of diagnostic equipment to cater to diverse patient needs, and ophthalmoscopes are integral to routine eye examinations, especially for patients with chronic conditions such as diabetes or hypertension, which increase the risk of eye diseases.

Hospitals are also at the forefront of the adoption of advanced ophthalmoscope technologies, including LED and digital ophthalmoscopes, which enhance diagnostic accuracy and allow for better patient care. The integration of ophthalmoscopes into broader ophthalmology departments and multidisciplinary care teams further fuels their use in hospitals. Additionally, hospitals’ focus on providing comprehensive diagnostic services and treating a larger volume of patients increases the demand for ophthalmic diagnostic equipment, solidifying their position as the largest end-user segment.

North America Leads the Market Owing to Technological Advancements and High Healthcare Investments

North America leads the ophthalmoscopes market, owing to the region’s advanced healthcare infrastructure, high healthcare spending, and the adoption of cutting-edge ophthalmic technologies. The United States, in particular, plays a significant role in this market, driven by a well-established healthcare system, increasing prevalence of age-related eye diseases, and a growing focus on eye health awareness. North America’s hospitals, ophthalmic clinics, and eye centers have been early adopters of advanced ophthalmoscopes, including those with LED and digital technologies.

Additionally, the increasing prevalence of diabetes, which is a major contributor to retinal diseases, has led to heightened demand for regular retina examinations in North America. As a result, ophthalmologists in the region are increasingly relying on ophthalmoscopes to monitor and treat patients with diabetic retinopathy and other retinal conditions. The robust healthcare infrastructure and the region’s focus on providing high-quality eye care ensure that North America remains the dominant market for ophthalmoscopes.

Leading Companies and Competitive Landscape

The competitive landscape in the ophthalmoscopes market is marked by the presence of several established players, including Heine Optotechnik, Welch Allyn (Hill-Rom), Nikon, Canon, and Carl Zeiss, among others. These companies are focusing on expanding their product portfolios with innovative ophthalmoscopes that offer enhanced diagnostic features, improved portability, and better image quality. Moreover, strategic collaborations and partnerships with healthcare providers and institutions are key strategies used by these players to increase their market presence.

With the growing preference for LED-based ophthalmoscopes and the rise in demand for digital solutions, companies are investing in research and development to introduce new products with advanced technologies. Furthermore, the market is witnessing a trend towards the integration of digital imaging and telemedicine solutions in ophthalmoscopes, which has the potential to significantly enhance the diagnostic capabilities of these devices. As a result, the competitive landscape will continue to evolve, with companies focusing on differentiation through technological innovation and expanding their offerings to meet the increasing demand for ophthalmic diagnostic solutions.

Recent Developments:

- In December 2024, Welch Allyn launched a new handheld ophthalmoscope with integrated LED technology for improved retinal imaging.

- In November 2024, HEINE Optotechnik unveiled a next-generation indirect ophthalmoscope featuring enhanced light clarity for detailed retinal assessments.

- In October 2024, Topcon Corporation introduced a digital ophthalmoscope that integrates with cloud-based platforms for remote consultations.

- In September 2024, Riester GmbH introduced an upgraded version of their halogen-powered ophthalmoscope with improved ergonomic features.

- In August 2024, NIDEK Co., Ltd. launched an innovative ophthalmoscope designed for high-definition ocular fundus examinations with faster diagnostic capabilities.

List of Leading Companies:

- Welch Allyn (Hill-Rom)

- Carl Zeiss Meditec AG

- HEINE Optotechnik GmbH & Co. KG

- Topcon Corporation

- NIDEK Co., Ltd.

- Riester GmbH

- Keeler Limited

- Optomed Ltd.

- Canon Medical Systems Corporation

- Abbott Laboratories

- Medtronic

- Kowa Company, Ltd.

- Reichert Technologies

- 3Gen LLC

- Volcano Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 257.3 million |

|

Forecasted Value (2030) |

USD 367.5 million |

|

CAGR (2025 – 2030) |

6.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Ophthalmoscopes Market By Product Type (Direct Ophthalmoscopes, Indirect Ophthalmoscopes, Handheld Ophthalmoscopes, Desktop Ophthalmoscopes), By Technology (LED Ophthalmoscopes, Xenon Ophthalmoscopes, Halogen Ophthalmoscopes), By Application (Retina Examination, Glaucoma Diagnosis, Cataract Surgery, Ocular Fundus Examination), By End-User (Hospitals, Ophthalmic Clinics, Eye Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Welch Allyn (Hill-Rom), Carl Zeiss Meditec AG, HEINE Optotechnik GmbH & Co. KG, Topcon Corporation, NIDEK Co., Ltd., Riester GmbH, Keeler Limited, Optomed Ltd., Canon Medical Systems Corporation, Abbott Laboratories, Medtronic, Kowa Company, Ltd., Reichert Technologies, 3Gen LLC, Volcano Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Ophthalmoscopes Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Direct Ophthalmoscopes |

|

4.2. Indirect Ophthalmoscopes |

|

4.3. Handheld Ophthalmoscopes |

|

4.4. Desktop Ophthalmoscopes |

|

5. Ophthalmoscopes Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. LED Ophthalmoscopes |

|

5.2. Xenon Ophthalmoscopes |

|

5.3. Halogen Ophthalmoscopes |

|

6. Ophthalmoscopes Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Retina Examination |

|

6.2. Glaucoma Diagnosis |

|

6.3. Cataract Surgery |

|

6.4. Ocular Fundus Examination |

|

6.5. Others |

|

7. Ophthalmoscopes Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Ophthalmic Clinics |

|

7.3. Eye Centers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Ophthalmoscopes Market, by Product Type |

|

8.2.7. North America Ophthalmoscopes Market, by Technology |

|

8.2.8. North America Ophthalmoscopes Market, by Application |

|

8.2.9. North America Ophthalmoscopes Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Ophthalmoscopes Market, by Product Type |

|

8.2.10.1.2. US Ophthalmoscopes Market, by Technology |

|

8.2.10.1.3. US Ophthalmoscopes Market, by Application |

|

8.2.10.1.4. US Ophthalmoscopes Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Welch Allyn (Hill-Rom) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Carl Zeiss Meditec AG |

|

10.3. HEINE Optotechnik GmbH & Co. KG |

|

10.4. Topcon Corporation |

|

10.5. NIDEK Co., Ltd. |

|

10.6. Riester GmbH |

|

10.7. Keeler Limited |

|

10.8. Optomed Ltd. |

|

10.9. Canon Medical Systems Corporation |

|

10.10. Abbott Laboratories |

|

10.11. Medtronic |

|

10.12. Kowa Company, Ltd. |

|

10.13. Reichert Technologies |

|

10.14. 3Gen LLC |

|

10.15. Volcano Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Ophthalmoscopes Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Ophthalmoscopes Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Ophthalmoscopes Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA