As per Intent Market Research, the Ophthalmic Ultrasound Imaging Systems Market was valued at USD 512.2 million in 2024-e and will surpass USD 819.3 million by 2030; growing at a CAGR of 8.1% during 2025 - 2030.

The ophthalmic ultrasound imaging systems market is witnessing significant growth, driven by the increasing prevalence of eye disorders and the need for advanced diagnostic tools in ophthalmology. Ultrasound imaging plays a crucial role in providing high-resolution, non-invasive imaging of the eye's internal structures, which aids in the diagnosis and management of various ocular conditions, including cataracts, retinal diseases, glaucoma, and ocular tumors. The ongoing advancements in ultrasound technology, such as higher resolution imaging, portability, and enhanced diagnostic capabilities, are also contributing to the growing adoption of ophthalmic ultrasound systems.

As the aging population increases globally, the demand for diagnostic solutions in ophthalmology is expected to rise. Additionally, the increasing focus on early detection and preventive care in ophthalmology has led to the widespread adoption of ultrasound imaging systems, as they are essential for pre-surgical assessment, monitoring of ocular conditions, and post-operative evaluation. Furthermore, the growing trend towards minimally invasive surgical procedures in ophthalmology is boosting the demand for accurate and real-time imaging during surgery, where ultrasound systems play a key role.

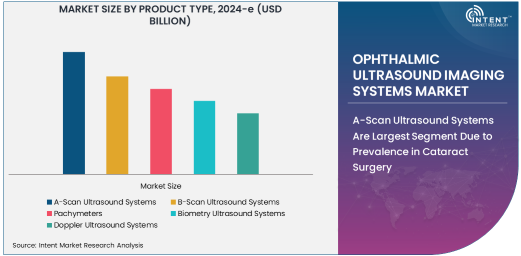

A-Scan Ultrasound Systems Are Largest Segment Due to Prevalence in Cataract Surgery

A-Scan ultrasound systems are the largest segment in the ophthalmic ultrasound imaging systems market, owing to their wide application in cataract surgery and other routine ocular procedures. A-Scan systems are primarily used to measure the eye's axial length, which is a critical parameter in determining the correct intraocular lens (IOL) power for cataract surgery. Cataract surgery is one of the most common surgical procedures worldwide, and the need for accurate measurement of the eye’s internal structures during this procedure has made A-Scan systems indispensable in ophthalmology.

These systems are favored for their simplicity, accuracy, and cost-effectiveness, especially in cataract surgeries where precise measurements are critical for ensuring optimal visual outcomes. As cataract surgeries continue to rise globally, particularly with the aging population, the demand for A-Scan ultrasound systems is expected to remain strong. The ability of A-Scan systems to provide reliable data for IOL selection and their role in enhancing the accuracy of cataract surgery are key factors driving the growth of this segment in the ophthalmic ultrasound market.

Ophthalmic Ultrasound Imaging Systems Used Across Various Applications

Ophthalmic ultrasound imaging systems are applied in a wide range of clinical and surgical settings, with several key applications driving their adoption. In cataract surgery, these systems are crucial for measuring the eye’s axial length and determining the appropriate intraocular lens (IOL) power, ensuring successful surgical outcomes. B-Scan and A-Scan systems are commonly used in this context, where precise measurements and accurate imaging are essential.

In addition to cataract surgery, ophthalmic ultrasound imaging systems play a critical role in diagnosing conditions such as retinal disorders, glaucoma, ocular tumors, and vitreous hemorrhages. They are essential in detecting retinal detachment, diabetic retinopathy, and other retinal conditions, helping ophthalmologists assess the severity and plan appropriate interventions. Furthermore, these systems are also used for pre-surgical assessments, where they assist in the evaluation of eye anatomy before conducting surgeries like retinal procedures and glaucoma treatments. As the demand for comprehensive eye care continues to grow, these systems will play an increasingly vital role in the diagnosis and treatment of various ocular conditions.

Hospitals Are Largest End-User Segment Due to High Surgical Volumes

Hospitals remain the largest end-user segment in the ophthalmic ultrasound imaging systems market due to their central role in performing a wide range of diagnostic and surgical procedures. Hospitals are equipped with advanced imaging technologies, including ophthalmic ultrasound systems, which are critical for pre-surgical assessment, diagnosing eye diseases, and guiding surgical interventions. With the high volume of cataract surgeries, retinal surgeries, and other ophthalmic procedures conducted in hospitals, the demand for reliable and accurate imaging systems is substantial.

In addition, hospitals typically have the resources to invest in high-end ultrasound systems with advanced features such as high-resolution imaging and real-time monitoring, which are necessary for complex ophthalmic surgeries. The growing patient population, especially in developed regions, combined with the increasing focus on early diagnosis and preventive care, ensures that hospitals will continue to be the largest consumers of ophthalmic ultrasound imaging systems.

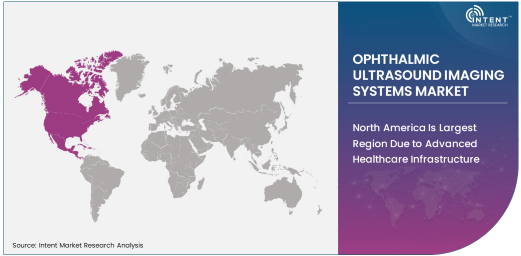

North America Is Largest Region Due to Advanced Healthcare Infrastructure

North America is the largest region in the ophthalmic ultrasound imaging systems market, primarily due to its advanced healthcare infrastructure, high adoption rates of medical technologies, and a large patient population with ocular conditions. The United States, in particular, leads the global market due to its robust healthcare system, a high prevalence of age-related eye diseases, and an established network of ophthalmic clinics and hospitals. North America also benefits from early adoption of innovative technologies, with healthcare providers increasingly investing in state-of-the-art ultrasound systems to enhance diagnostic capabilities and improve patient outcomes.

The region’s strong focus on research and development, particularly in the field of ophthalmology, also plays a significant role in the market's growth. North American hospitals and clinics are equipped with cutting-edge diagnostic tools, including ophthalmic ultrasound imaging systems, which help healthcare professionals provide accurate and timely diagnoses. As the demand for ophthalmic care continues to rise, particularly with an aging population, North America is expected to maintain its dominance in the ophthalmic ultrasound imaging systems market.

Leading Companies and Competitive Landscape

The ophthalmic ultrasound imaging systems market is highly competitive, with key players such as Canon Medical Systems, Nidek Co., Ltd., and Ellex Medical Lasers Limited leading the market. These companies offer a wide range of ultrasound systems, including A-Scan, B-Scan, and Doppler ultrasound systems, designed to meet the diagnostic needs of ophthalmologists. Canon Medical Systems, for example, is known for its advanced imaging solutions, including high-resolution ultrasound devices that are commonly used in cataract and retinal surgeries. Similarly, Nidek Co., Ltd. offers a broad portfolio of ophthalmic diagnostic equipment, including ultrasound systems, which are widely adopted in both hospitals and ophthalmic clinics.

The competitive landscape of the ophthalmic ultrasound imaging systems market is marked by continuous innovation and product development. Companies are focusing on enhancing the imaging capabilities, portability, and ease of use of their ultrasound systems to cater to the growing demand for non-invasive, high-quality diagnostic tools. Strategic partnerships, acquisitions, and collaborations are common in this market, as companies seek to strengthen their product offerings and expand their global presence. As the demand for advanced ophthalmic diagnostic solutions increases, the competitive dynamics in the ophthalmic ultrasound imaging systems market will continue to evolve.

List of Leading Companies:

- Alcon Inc.

- Bausch + Lomb

- Carl Zeiss Meditec AG

- Nidek Co. Ltd.

- Optos PLC

- Topcon Corporation

- Heidelberg Engineering GmbH

- Canon Inc.

- Reichert Technologies

- Hitachi Ltd.

- Siemens Healthineers

- Fujifilm Holdings Corporation

- American Medical Systems

- Luneau Technology Group

- US Ophthalmic LLC

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 512.2 million |

|

Forecasted Value (2030) |

USD 819.3 million |

|

CAGR (2025 – 2030) |

8.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Ophthalmic Ultrasound Imaging Systems Market By Product Type (A-Scan Ultrasound Systems, B-Scan Ultrasound Systems, Pachymeters, Biometry Ultrasound Systems, Doppler Ultrasound Systems), By Application (Cataract Surgery, Retinal Surgery, Glaucoma Diagnosis, Ocular Tumor Detection, Pre-Surgical Assessment), By End-User (Hospitals, Ophthalmic Clinics, Eye Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Alcon Inc., Bausch + Lomb, Carl Zeiss Meditec AG, Nidek Co. Ltd., Optos PLC, Topcon Corporation, Heidelberg Engineering GmbH, Canon Inc., Reichert Technologies, Hitachi Ltd., Siemens Healthineers, Fujifilm Holdings Corporation, American Medical Systems, Luneau Technology Group, US Ophthalmic LLC |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Ophthalmic Ultrasound Imaging Systems Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. A-Scan Ultrasound Systems |

|

4.2. B-Scan Ultrasound Systems |

|

4.3. Pachymeters |

|

4.4. Biometry Ultrasound Systems |

|

4.5. Doppler Ultrasound Systems |

|

5. Ophthalmic Ultrasound Imaging Systems Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cataract Surgery |

|

5.2. Retinal Surgery |

|

5.3. Glaucoma Diagnosis |

|

5.4. Ocular Tumor Detection |

|

5.5. Pre-Surgical Assessment |

|

6. Ophthalmic Ultrasound Imaging Systems Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ophthalmic Clinics |

|

6.3. Eye Centers |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Ophthalmic Ultrasound Imaging Systems Market, by Product Type |

|

7.2.7. North America Ophthalmic Ultrasound Imaging Systems Market, by Application |

|

7.2.8. North America Ophthalmic Ultrasound Imaging Systems Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Ophthalmic Ultrasound Imaging Systems Market, by Product Type |

|

7.2.9.1.2. US Ophthalmic Ultrasound Imaging Systems Market, by Application |

|

7.2.9.1.3. US Ophthalmic Ultrasound Imaging Systems Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Alcon Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bausch + Lomb |

|

9.3. Carl Zeiss Meditec AG |

|

9.4. Nidek Co. Ltd. |

|

9.5. Optos PLC |

|

9.6. Topcon Corporation |

|

9.7. Heidelberg Engineering GmbH |

|

9.8. Canon Inc. |

|

9.9. Reichert Technologies |

|

9.10. Hitachi Ltd. |

|

9.11. Siemens Healthineers |

|

9.12. Fujifilm Holdings Corporation |

|

9.13. American Medical Systems |

|

9.14. Luneau Technology Group |

|

9.15. US Ophthalmic LLC |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Ophthalmic Ultrasound Imaging Systems Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Ophthalmic Ultrasound Imaging Systems Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Ophthalmic Ultrasound Imaging Systems Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA