As per Intent Market Research, the Ophthalmic Refractometer Market was valued at USD 0.4 billion in 2024-e and will surpass USD 0.7 billion by 2030; growing at a CAGR of 9.6% during 2025 - 2030.

The ophthalmic refractometer market has seen substantial growth in recent years, driven by the rising demand for accurate eye refraction testing, cataract diagnosis, and other essential vision assessments. These devices play a pivotal role in helping ophthalmologists and optometrists determine refractive errors such as myopia, hyperopia, and astigmatism, which are among the most common eye conditions worldwide. As global awareness of eye health continues to rise, refractometers are becoming indispensable tools in both routine vision screenings and more specialized diagnostic applications.

Technological advancements in ophthalmic refractometers, such as the development of automated and digital refractometers, have contributed significantly to market growth. These innovations offer greater precision and faster results, thus enhancing diagnostic workflows. With the increasing prevalence of age-related eye diseases and an expanding aging population, the demand for refractometers is expected to continue to rise. In addition, the growing trend toward preventative care and early detection of vision issues has further fueled the adoption of these devices, making them an essential part of modern ophthalmic practices.

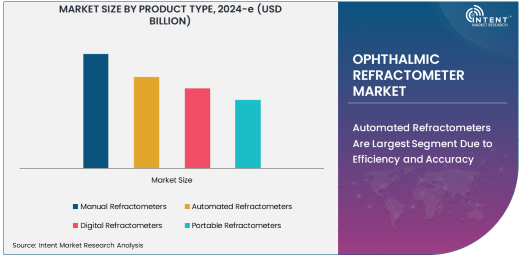

Automated Refractometers Are Largest Segment Due to Efficiency and Accuracy

Automated refractometers hold the largest market share within the ophthalmic refractometer market, primarily due to their efficiency, ease of use, and ability to provide highly accurate measurements. These devices automate the process of determining refractive errors, reducing human error and the time required for each test. Automated refractometers are particularly popular in clinical settings where high patient throughput is necessary, such as in hospitals and ophthalmic clinics. Their ability to provide quick and reliable results makes them ideal for routine eye exams, particularly in busy healthcare environments.

The advantages of automated refractometers are particularly evident in large-scale diagnostic applications, such as pre-surgical screening and routine eye refraction testing. These devices ensure that patients receive accurate readings with minimal discomfort, which is crucial in a clinical setting. The growing demand for efficiency and accuracy in eye examinations has driven the widespread adoption of automated refractometers, and this trend is expected to continue as technological improvements further enhance their capabilities. As a result, automated refractometers remain the dominant segment in the ophthalmic refractometer market.

Digital Refractometers Are Fastest Growing Segment Due to Technological Advancements

Digital refractometers represent the fastest-growing segment in the ophthalmic refractometer market, driven by advancements in digital technology and the increasing demand for precise diagnostic tools. These refractometers offer superior data accuracy, advanced user interfaces, and the ability to store and analyze patient data electronically. As digital technology becomes more embedded in healthcare, digital refractometers are becoming increasingly popular for use in both clinical settings and specialized optometry practices.

The transition from traditional analog refractometers to digital models offers numerous advantages, including the ability to perform more complex diagnostics and provide real-time results. Digital refractometers also allow for seamless integration with electronic health record (EHR) systems, streamlining patient care workflows. As healthcare providers and ophthalmologists seek ways to enhance the accuracy and efficiency of eye exams, digital refractometers are rapidly gaining traction. This segment is expected to continue its upward trajectory as more innovations emerge, such as the inclusion of artificial intelligence (AI) capabilities to enhance diagnostic accuracy.

Hospitals Are Largest End-User Segment Due to High Volume of Eye Care Procedures

Hospitals are the largest end-user segment in the ophthalmic refractometer market, largely due to their central role in conducting high volumes of diagnostic and surgical procedures related to eye health. Hospitals are equipped with a range of advanced medical equipment, including refractometers, to address the needs of a diverse patient population. These institutions are equipped to provide comprehensive eye care, from routine refraction testing to more specialized procedures such as cataract and glaucoma diagnoses.

Hospitals often require refractometers for pre-surgical screening, cataract diagnoses, and general eye refraction testing, which drives the demand for reliable and efficient instruments. The ability to conduct quick and accurate eye exams using automated or digital refractometers is essential in a hospital setting, where large numbers of patients require timely care. As the global prevalence of eye conditions increases, particularly in aging populations, hospitals will remain the primary consumers of ophthalmic refractometers, contributing to the market's continued growth.

North America Is Largest Region Due to Advanced Healthcare Infrastructure and Adoption of Technology

North America holds the largest share of the ophthalmic refractometer market, driven by the region's advanced healthcare infrastructure, high healthcare spending, and widespread adoption of cutting-edge medical technologies. The U.S. and Canada have a large number of well-established hospitals, ophthalmic clinics, and optometry practices that are equipped with the latest refractometers to meet the growing demand for eye care. Additionally, the region's focus on preventative healthcare and early detection of vision-related issues has further fueled the adoption of refractometers.

The strong reimbursement policies in North America, along with increasing investments in ophthalmic research and technology, have contributed to the market's growth in the region. Moreover, the aging population in North America is leading to higher incidences of age-related vision conditions, such as presbyopia, cataracts, and macular degeneration, which further increases the demand for refractometers. As technology continues to advance, North America is expected to maintain its dominance in the ophthalmic refractometer market, with continued growth driven by innovations in digital and automated refractometer technologies.

Leading Companies and Competitive Landscape

The ophthalmic refractometer market is competitive, with key players such as Topcon Corporation, Nidek Co., Ltd., and Haag-Streit AG leading the way. These companies are renowned for their high-quality refractometers, which are widely used in both clinical and hospital settings. Topcon, in particular, has made significant strides in the automated refractometer market, offering advanced solutions that combine efficiency with high-precision measurements. Nidek Co. and Haag-Streit are also known for their innovative digital and automated refractometers, which cater to the growing demand for accurate and reliable diagnostic tools in ophthalmology.

The competitive landscape of the ophthalmic refractometer market is characterized by continuous innovation, with companies focusing on integrating advanced technologies such as digital imaging, AI, and machine learning into their refractometers to improve diagnostic capabilities. Strategic collaborations, partnerships, and acquisitions are also common, as companies aim to expand their product portfolios and strengthen their market presence. As the market continues to evolve, the leading players will remain focused on enhancing their product offerings to meet the growing demands of ophthalmic professionals and improve patient outcomes.

Recent Developments:

- In December 2024, Canon Inc. launched a new digital refractometer offering faster, more accurate readings for optometrists.

- In November 2024, Nidek Co. Ltd. unveiled an automated refractometer with enhanced features for cataract diagnosis and vision correction.

- In October 2024, Topcon Corporation introduced a portable refractometer for easy use in remote areas and small clinics.

- In September 2024, Marco Ophthalmic announced the release of a new automated refractometer with advanced connectivity options for seamless data transfer.

- In August 2024, Visionix introduced a new, compact ophthalmic refractometer designed for both office and mobile eye care services.

List of Leading Companies:

- Canon Inc.

- Nidek Co. Ltd.

- Topcon Corporation

- Carl Zeiss Meditec AG

- Reichert Technologies

- Marco Ophthalmic

- Visionix

- Optovue Inc.

- Oculus Optikgeräte GmbH

- Haag-Streit AG

- Optometry Equipment Ltd.

- EyeQue Corporation

- Luneau Technology Group

- AEA Technologies Inc.

- Shenzhen Kejian Hi-Tech Co. Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.4 billion |

|

Forecasted Value (2030) |

USD 0.7 billion |

|

CAGR (2025 – 2030) |

9.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Ophthalmic Refractometer Market By Product Type (Manual Refractometers, Automated Refractometers, Digital Refractometers, Portable Refractometers), By End-User (Hospitals, Ophthalmic Clinics, Optometrists), By Application (Eye Refraction Testing, Cataract Diagnosis, Glaucoma Diagnosis, Vision Correction Diagnosis, Pre-Surgical Screening) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Canon Inc., Nidek Co. Ltd., Topcon Corporation, Carl Zeiss Meditec AG, Reichert Technologies, Marco Ophthalmic, Visionix, Optovue Inc., Oculus Optikgeräte GmbH, Haag-Streit AG, Optometry Equipment Ltd., EyeQue Corporation, Luneau Technology Group, AEA Technologies Inc., Shenzhen Kejian Hi-Tech Co. Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Ophthalmic Refractometer Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Manual Refractometers |

|

4.2. Automated Refractometers |

|

4.3. Digital Refractometers |

|

4.4. Portable Refractometers |

|

5. Ophthalmic Refractometer Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Ophthalmic Clinics |

|

5.3. Optometrists |

|

6. Ophthalmic Refractometer Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Eye Refraction Testing |

|

6.2. Cataract Diagnosis |

|

6.3. Glaucoma Diagnosis |

|

6.4. Vision Correction Diagnosis |

|

6.5. Pre-Surgical Screening |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Ophthalmic Refractometer Market, by Product Type |

|

7.2.7. North America Ophthalmic Refractometer Market, by End-User |

|

7.2.8. North America Ophthalmic Refractometer Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Ophthalmic Refractometer Market, by Product Type |

|

7.2.9.1.2. US Ophthalmic Refractometer Market, by End-User |

|

7.2.9.1.3. US Ophthalmic Refractometer Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Canon Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Nidek Co. Ltd. |

|

9.3. Topcon Corporation |

|

9.4. Carl Zeiss Meditec AG |

|

9.5. Reichert Technologies |

|

9.6. Marco Ophthalmic |

|

9.7. Visionix |

|

9.8. Optovue Inc. |

|

9.9. Oculus Optikgeräte GmbH |

|

9.10. Haag-Streit AG |

|

9.11. Optometry Equipment Ltd. |

|

9.12. EyeQue Corporation |

|

9.13. Luneau Technology Group |

|

9.14. AEA Technologies Inc. |

|

9.15. Shenzhen Kejian Hi-Tech Co. Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Ophthalmic Refractometer Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Ophthalmic Refractometer Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Ophthalmic Refractometer Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA