As per Intent Market Research, the Operational Predictive Maintenance Market was valued at USD 6.7 Billion in 2024-e and will surpass USD 22.5 Billion by 2030; growing at a CAGR of 22.5% during 2025-2030.

The operational predictive maintenance market is experiencing robust growth, fueled by the widespread adoption of advanced technologies such as IoT (Internet of Things), Artificial Intelligence (AI), Machine Learning (ML), and predictive analytics. Predictive maintenance allows businesses to predict when equipment failures might occur and take corrective actions before a breakdown happens, significantly reducing maintenance costs, downtime, and increasing the operational efficiency of industrial processes. This has become especially important in industries like manufacturing, energy, and automotive, where equipment failure can lead to substantial financial losses.

Incorporating technologies like AI and ML, predictive maintenance solutions can analyze vast amounts of data collected from IoT sensors in real time, offering deeper insights into the health of machinery and the operational environment. As industries increasingly digitize their operations, the demand for predictive maintenance is expected to rise rapidly, providing companies with the opportunity to optimize performance and ensure continuous productivity without costly disruptions.

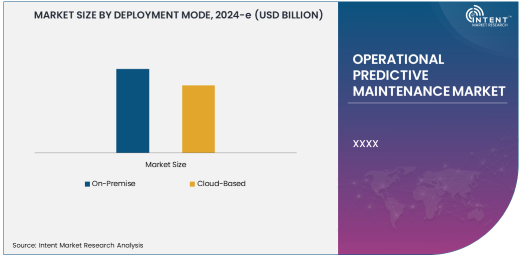

Cloud-Based Deployment Driving Market Expansion

Cloud-based deployment is gaining significant traction in the operational predictive maintenance market due to its scalability, flexibility, and cost-effectiveness. Cloud platforms enable organizations to store large volumes of data generated by equipment sensors, analyze this data through advanced predictive algorithms, and predict potential failures without needing extensive on-premise infrastructure. Cloud-based solutions allow for remote monitoring and maintenance, reducing the need for on-site support, which is especially valuable for organizations with multiple locations or remote assets.

Cloud-based predictive maintenance also enables seamless integration with existing enterprise systems, making it easier for businesses to adopt these solutions without disrupting their operations. Moreover, the cost savings from reducing the need for extensive IT infrastructure and personnel make cloud-based solutions an attractive option, particularly for small and medium-sized enterprises (SMEs). The growing trend of digital transformation in industries worldwide further supports the dominance of cloud-based deployment in the predictive maintenance market.

IoT Technology Powers Operational Predictive Maintenance

IoT (Internet of Things) is the leading technology driving the growth of the operational predictive maintenance market. IoT devices such as sensors and monitoring systems collect real-time data from equipment and machinery, providing critical insights into their operational status. By continuously monitoring equipment health, IoT-enabled solutions can detect anomalies or inefficiencies that could lead to equipment failure, enabling organizations to perform maintenance proactively.

The combination of IoT with AI and ML creates a powerful ecosystem for predictive maintenance, as these technologies work together to analyze the data and predict when and where failures are likely to occur. This allows for more precise and accurate predictions, ultimately leading to enhanced productivity, reduced maintenance costs, and optimized equipment lifecycles. As IoT technology continues to evolve, it will further enhance the capabilities and effectiveness of predictive maintenance solutions across industries.

Hardware Component Dominates Predictive Maintenance Solutions

Hardware is a critical component of operational predictive maintenance solutions. The hardware includes sensors, monitoring devices, and data acquisition systems, which play a key role in collecting real-time data from machinery. These sensors capture important parameters such as temperature, vibration, pressure, and speed, which are essential for identifying potential issues and predicting when maintenance is required. The accuracy of these sensors is paramount to ensuring the effectiveness of predictive maintenance.

As the demand for IoT-based solutions grows, the hardware component of predictive maintenance is becoming increasingly sophisticated. Advances in sensor technology, such as wireless sensors and sensors capable of measuring multiple parameters, are improving the accuracy and reliability of predictive maintenance systems. The integration of these hardware components with software solutions for data analysis further enhances the predictive capabilities, enabling organizations to reduce downtime and prevent costly equipment failures.

Manufacturing Industry Dominates the Market

The manufacturing industry is the largest end-user of operational predictive maintenance solutions. In manufacturing, unplanned downtime can have significant financial implications due to the high cost of halting production. Predictive maintenance allows manufacturers to keep their operations running smoothly by predicting and preventing equipment failures before they happen. This is particularly important in industries with complex machinery, where even minor disruptions can result in major delays and financial losses.

Manufacturers are increasingly adopting predictive maintenance technologies to improve their efficiency, reduce operating costs, and extend the lifespan of their equipment. By leveraging IoT-enabled sensors and AI-driven analytics, manufacturers can ensure that their production lines are operating at optimal performance and minimize unplanned downtime. The manufacturing industry's heavy reliance on machinery and the growing demand for automation and digitization are key drivers behind the sector's dominance in the predictive maintenance market.

North America Leads the Operational Predictive Maintenance Market

North America is the leading region in the operational predictive maintenance market, driven by the widespread adoption of advanced technologies and the presence of key industry players. The region, particularly the United States, is home to a large number of manufacturing, energy, and automotive companies that are heavily investing in predictive maintenance solutions to optimize operations and reduce maintenance costs. The robust industrial infrastructure, along with the growing focus on digital transformation, positions North America as the largest market for predictive maintenance solutions.

In addition to the strong demand from end-user industries, North America benefits from the presence of major technology companies and solution providers, such as General Electric (GE), Siemens, and Honeywell, who are offering advanced predictive maintenance solutions. The growing focus on IoT and AI integration across industries in North America is expected to further accelerate the growth of predictive maintenance technologies in the region.

Competitive Landscape

The operational predictive maintenance market is highly competitive, with several key players providing cutting-edge solutions across various industries. Leading companies include General Electric (GE), Siemens AG, Honeywell, Schneider Electric, and IBM, all of which offer comprehensive predictive maintenance solutions integrating IoT, AI, and machine learning technologies. These companies are focused on expanding their product portfolios, enhancing data analytics capabilities, and increasing their presence in emerging markets to capitalize on the growing demand for predictive maintenance.

Emerging players in the market are also leveraging innovation and technological advancements to differentiate themselves. Companies are increasingly integrating real-time monitoring systems, advanced predictive algorithms, and cloud-based platforms to enhance the accuracy and efficiency of their solutions. As the market evolves, partnerships and collaborations between technology providers and end-user industries will play a crucial role in driving the adoption of predictive maintenance solutions.

Recent Developments:

- In December 2024, Siemens AG expanded its predictive maintenance offerings with a new software platform that integrates AI to improve asset performance.

- In November 2024, General Electric (GE) announced an upgrade to its Predix-based predictive maintenance platform, enabling better asset monitoring and predictive analytics.

- In October 2024, Honeywell International Inc. launched an advanced IoT-based predictive maintenance solution targeting the oil and gas industry.

- In September 2024, Rockwell Automation introduced a new machine learning-driven predictive maintenance tool aimed at reducing unplanned downtime in manufacturing.

- In August 2024, Emerson Electric Co. partnered with an AI startup to enhance its predictive maintenance capabilities across energy and utility sectors.

List of Leading Companies:

- Siemens AG

- General Electric (GE)

- Honeywell International Inc.

- Schneider Electric

- Rockwell Automation

- IBM Corporation

- Emerson Electric Co.

- Bosch Group

- Mitsubishi Electric Corporation

- ABB Ltd.

- Fluke Corporation

- Uptake Technologies

- Parker Hannifin Corporation

- SKF Group

- Yokogawa Electric Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 6.7 Billion |

|

Forecasted Value (2030) |

USD 22.5 Billion |

|

CAGR (2025 – 2030) |

22.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Operational Predictive Maintenance Market by Deployment Mode (On-Premise, Cloud-Based), Component (Hardware, Software), End-User Industry (Manufacturing, Energy & Utilities, Automotive, Aerospace & Defense, Oil & Gas, Healthcare), Technology (IoT, AI, ML, Predictive Analytics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Siemens AG, General Electric (GE), Honeywell International Inc., Schneider Electric, Rockwell Automation, IBM Corporation, Emerson Electric Co., Bosch Group, Mitsubishi Electric Corporation, ABB Ltd., Fluke Corporation, Uptake Technologies, Parker Hannifin Corporation, SKF Group, Yokogawa Electric Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Operational Predictive Maintenance Market, by Deployment Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. On-Premise |

|

4.2. Cloud-Based |

|

5. Operational Predictive Maintenance Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hardware |

|

5.2. Software |

|

6. Operational Predictive Maintenance Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Manufacturing |

|

6.2. Energy & Utilities |

|

6.3. Automotive |

|

6.4. Aerospace & Defense |

|

6.5. Oil & Gas |

|

6.6. Healthcare |

|

7. Operational Predictive Maintenance Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. IoT (Internet of Things) |

|

7.2. Artificial Intelligence (AI) |

|

7.3. Machine Learning (ML) |

|

7.4. Predictive Analytics |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Operational Predictive Maintenance Market, by Deployment Mode |

|

8.2.7. North America Operational Predictive Maintenance Market, by Component |

|

8.2.8. North America Operational Predictive Maintenance Market, by End-User Industry |

|

8.2.9. North America Operational Predictive Maintenance Market, by Technology |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Operational Predictive Maintenance Market, by Deployment Mode |

|

8.2.10.1.2. US Operational Predictive Maintenance Market, by Component |

|

8.2.10.1.3. US Operational Predictive Maintenance Market, by End-User Industry |

|

8.2.10.1.4. US Operational Predictive Maintenance Market, by Technology |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Siemens AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. General Electric (GE) |

|

10.3. Honeywell International Inc. |

|

10.4. Schneider Electric |

|

10.5. Rockwell Automation |

|

10.6. IBM Corporation |

|

10.7. Emerson Electric Co. |

|

10.8. Bosch Group |

|

10.9. Mitsubishi Electric Corporation |

|

10.10. ABB Ltd. |

|

10.11. Fluke Corporation |

|

10.12. Uptake Technologies |

|

10.13. Parker Hannifin Corporation |

|

10.14. SKF Group |

|

10.15. Yokogawa Electric Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Operational Predictive Maintenance Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Operational Predictive Maintenance Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Operational Predictive Maintenance Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA