As per Intent Market Research, the Online Takeaway Food Market was valued at USD 97.1 Billion in 2024-e and will surpass USD 146.5 Billion by 2030; growing at a CAGR of 7.1% during 2025-2030.

The online takeaway food market has seen substantial growth, driven by changing consumer lifestyles and the increased demand for convenience. With the rise of digital platforms and mobile applications, consumers now have easy access to a wide range of takeaway food options, enabling them to order from their favorite restaurants or cloud kitchens without leaving the comfort of their homes. The growing adoption of mobile technologies, along with the increasing popularity of food delivery services, is shaping the future of the takeaway food industry. As more consumers turn to online platforms for meal options, the market for online takeaway services continues to thrive.

The rise in disposable incomes, the busy lifestyles of urban populations, and the increasing preference for eating out without the hassle of dining in are contributing to the market's growth. Furthermore, the ongoing digital transformation of the foodservice industry has enabled restaurants and cloud kitchens to reach a broader audience, facilitating a more efficient and seamless ordering process. As consumer demand for speed and convenience grows, online takeaway services are expected to remain a popular and expanding segment in the broader online food delivery market.

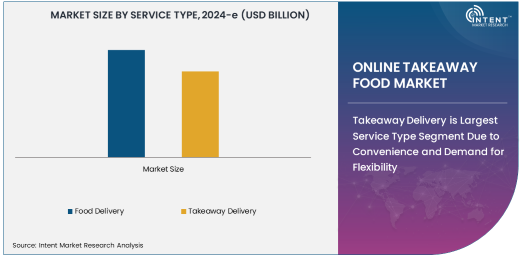

Takeaway Delivery is Largest Service Type Segment Due to Convenience and Demand for Flexibility

Takeaway delivery is the largest service type segment in the online takeaway food market, driven by the increasing demand for convenience and flexibility. Takeaway delivery allows customers to place orders remotely through online platforms or mobile applications and have their food delivered to their location, offering a seamless and efficient dining experience. The option to have food delivered to one's home, office, or any other location has become highly popular, as consumers seek fast and convenient alternatives to traditional dining.

Takeaway delivery services are particularly favored by busy urban professionals, families, and students, who appreciate the time-saving benefits of having meals delivered directly to them. The availability of a wide range of cuisines through online platforms and mobile applications has further fueled the demand for takeaway services. As technology continues to evolve, takeaway delivery services are expected to remain the dominant force in the market, offering consumers greater choice and flexibility while driving growth in the online takeaway food market.

Cloud Kitchens are Fastest Growing End-User Industry Segment Due to Cost-Efficiency and Increased Demand for Delivery

Cloud kitchens are the fastest-growing end-user industry segment in the online takeaway food market, driven by their cost-efficiency, scalability, and ability to meet the growing demand for delivery-focused operations. Cloud kitchens, also known as ghost kitchens or virtual kitchens, are facilities that prepare food exclusively for delivery and takeaway orders. These kitchens typically operate without a physical dining space, allowing operators to save on overhead costs associated with traditional restaurant operations, such as rent and utilities.

Cloud kitchens are particularly well-positioned to take advantage of the growing trend toward food delivery, as they are designed specifically to meet the needs of delivery services. By leveraging digital platforms and mobile apps, cloud kitchens can streamline their operations and efficiently manage large volumes of orders. With the rising demand for online food delivery, the cloud kitchen model has gained traction, particularly in urban areas where space is limited and delivery times are critical. As a result, the cloud kitchen segment is expected to see rapid expansion in the coming years, making it the fastest-growing end-user industry in the online takeaway food market.

Online Platforms Are Largest Platform Type Segment Due to Accessibility and User Preferences

Online platforms represent the largest platform type segment in the online takeaway food market, owing to their accessibility and ease of use. Online platforms allow consumers to browse menus, select their meals, and place orders from a variety of restaurants or cloud kitchens, all from the comfort of their computers or mobile devices. These platforms provide a comprehensive, user-friendly experience, offering customers a broad selection of food options and various payment methods.

The widespread adoption of online platforms is further supported by their ability to offer promotions, discounts, and loyalty programs, which incentivize customers to return. Additionally, online platforms often integrate features such as customer reviews, detailed menu descriptions, and real-time order tracking, enhancing the overall user experience. As consumers continue to prefer the convenience of ordering food from online platforms, this segment is expected to maintain its dominance in the online takeaway food market, with more businesses seeking to establish a strong digital presence.

Online Payment is Fastest Growing Payment Mode Segment Due to Digital Transformation and Security

Online payment is the fastest-growing payment mode segment in the online takeaway food market, driven by the digital transformation of the payment landscape and the growing preference for cashless transactions. As mobile payment systems, digital wallets, and online banking solutions become more widespread, consumers are increasingly opting for the convenience and security of online payments when ordering takeaway food. Online payment systems offer consumers a quick and secure method for completing transactions, making the ordering process faster and more efficient.

The rise of digital payment technologies has been further accelerated by the COVID-19 pandemic, which prompted a surge in online ordering and contactless transactions. The convenience of paying for takeaway meals with a few taps on a smartphone has resonated with customers, leading to the growth of this segment. As digital payment platforms continue to evolve and offer enhanced security features, the demand for online payment options in the online takeaway food market is expected to keep growing, making it the fastest-growing payment mode segment.

Asia-Pacific is Largest Region Due to Urbanization and Adoption of Food Delivery Services

The Asia-Pacific (APAC) region is the largest market for online takeaway food services, driven by rapid urbanization, growing disposable incomes, and the widespread adoption of food delivery platforms. Major APAC economies, such as China, India, and Japan, have seen significant growth in the online food delivery market, fueled by a large and tech-savvy consumer base, increasing demand for convenience, and the rise of mobile apps. In particular, cities with dense populations and busy lifestyles are fueling the growth of online takeaway food services.

The APAC region’s dominance is also attributed to the growing preference for diverse cuisines and the rapid digitalization of the foodservice sector. As more consumers turn to online platforms and mobile applications for food ordering, the region is expected to continue to lead the market in terms of both consumer base and market revenue. Additionally, government initiatives and investments in digital infrastructure across countries like China and India are further enhancing the market’s growth prospects in this region.

Leading Companies and Competitive Landscape

The online takeaway food market is highly competitive, with several global and regional players leading the industry. Key companies in the market include Uber Eats, DoorDash, Grubhub, Zomato, Swiggy, and Deliveroo. These companies offer robust platforms and mobile applications that enable consumers to order food from a wide range of restaurants and cloud kitchens. They also provide features like real-time tracking, personalized recommendations, and payment flexibility to enhance the user experience.

To maintain their competitive edge, leading players are focusing on improving delivery times, expanding restaurant partnerships, and investing in innovative technologies such as artificial intelligence and machine learning to optimize the ordering process. The market also sees a rise in regional players who cater to local tastes and preferences, further intensifying competition. With the increasing demand for convenience, speed, and seamless digital experiences, companies in the online takeaway food market are continually evolving their services to stay ahead of the competition.

Recent Developments:

- In December 2024, Grubhub announced the launch of a new feature to streamline the ordering process for takeaway customers.

- In November 2024, Uber Eats partnered with new cloud kitchens to expand its takeaway service offerings across major US cities.

- In October 2024, Deliveroo launched a loyalty program to encourage repeat customers in its takeaway service segment.

- In September 2024, Zomato introduced a quick pickup feature to enhance the takeaway experience for its users in India.

- In August 2024, DoorDash expanded its service to include new restaurant categories, enhancing its takeaway and delivery options.

List of Leading Companies:

- Grubhub Inc.

- DoorDash Inc.

- Uber Eats

- Deliveroo

- Just Eat Takeaway

- Zomato

- Swiggy

- Postmates

- Foodpanda

- Domino’s Pizza

- Papa John’s International, Inc.

- Glovo

- Delivery Hero

- Meituan Dianping

- GoPuff

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 97.1 Billion |

|

Forecasted Value (2030) |

USD 146.5 Billion |

|

CAGR (2025 – 2030) |

7.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Online Takeaway Food Market by Service Type (Food Delivery, Takeaway Delivery), Platform Type (Online Platforms, Mobile Applications), Payment Mode (Online Payment, Cash on Delivery), End-User Industry (Restaurants, Cloud Kitchens) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Grubhub Inc., DoorDash Inc., Uber Eats, Deliveroo, Just Eat Takeaway, Zomato, Swiggy, Postmates, Foodpanda, Domino’s Pizza, Papa John’s International, Inc., Glovo, Delivery Hero, Meituan Dianping, GoPuff |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Online Takeaway Food Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Food Delivery |

|

4.2. Takeaway Delivery |

|

5. Online Takeaway Food Market, by Platform Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Online Platforms |

|

5.2. Mobile Applications |

|

6. Online Takeaway Food Market, by Payment Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Online Payment |

|

6.2. Cash on Delivery |

|

7. Online Takeaway Food Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Restaurants |

|

7.2. Cloud Kitchens |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Online Takeaway Food Market, by Service Type |

|

8.2.7. North America Online Takeaway Food Market, by Platform Type |

|

8.2.8. North America Online Takeaway Food Market, by Payment Mode |

|

8.2.9. North America Online Takeaway Food Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Online Takeaway Food Market, by Service Type |

|

8.2.10.1.2. US Online Takeaway Food Market, by Platform Type |

|

8.2.10.1.3. US Online Takeaway Food Market, by Payment Mode |

|

8.2.10.1.4. US Online Takeaway Food Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Grubhub Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. DoorDash Inc. |

|

10.3. Uber Eats |

|

10.4. Deliveroo |

|

10.5. Just Eat Takeaway |

|

10.6. Zomato |

|

10.7. Swiggy |

|

10.8. Postmates |

|

10.9. Foodpanda |

|

10.10. Domino’s Pizza |

|

10.11. Papa John’s International, Inc. |

|

10.12. Glovo |

|

10.13. Delivery Hero |

|

10.14. Meituan Dianping |

|

10.15. GoPuff |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Online Takeaway Food Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Online Takeaway Food Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Online Takeaway Food Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA