As per Intent Market Research, the Online Food Delivery Services Market was valued at USD 222.0 Billion in 2024-e and will surpass USD 426.2 Billion by 2030; growing at a CAGR of 11.5% during 2025-2030.

The online food delivery services market has seen remarkable growth in recent years, driven by technological advancements, changing consumer lifestyles, and the increasing demand for convenience. The market allows consumers to order food from a wide range of restaurants via online platforms or mobile apps, with delivery or takeaway options. The rise in smartphone usage, paired with improved internet connectivity and digital payment solutions, has further fueled the popularity of online food delivery. As more consumers seek hassle-free and timely food delivery options, the market has become a significant part of the global food service industry.

Moreover, the growing trend of food personalization, coupled with busy lifestyles and the desire for convenience, is pushing the demand for online food services to new heights. Factors such as the expansion of food delivery platforms, the introduction of subscription-based models, and a rise in cloud kitchens have also played a vital role in the expansion of this market. With a diverse range of services available, from fast food to gourmet meals, the online food delivery market continues to evolve, creating new opportunities for businesses and redefining the food consumption experience for millions worldwide.

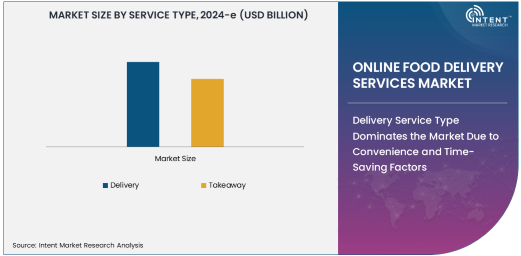

Delivery Service Type Dominates the Market Due to Convenience and Time-Saving Factors

The delivery service type dominates the online food delivery services market due to the unmatched convenience it offers to consumers. With delivery services, consumers can enjoy a broad variety of meals from local and international restaurants, delivered directly to their doorstep, all without leaving their homes. This convenience is particularly appealing to busy professionals, families, and consumers seeking convenience or those who prefer to avoid cooking.

The demand for food delivery has surged with the increasing number of consumers opting for time-saving and hassle-free solutions. Consumers appreciate the ability to choose from various cuisine types and restaurants, delivered on-demand. The COVID-19 pandemic accelerated this shift, as social distancing measures and restrictions led many to rely on delivery services. As consumer habits continue to prioritize convenience, delivery services will maintain their position as the largest segment in the market.

Mobile Apps Are Fastest Growing Platform Type Due to Increased Smartphone Penetration

Mobile apps are the fastest-growing platform type in the online food delivery services market, owing to the increasing penetration of smartphones and the growing reliance on mobile-based solutions. Mobile apps provide an intuitive and user-friendly interface, enabling consumers to easily browse menus, track deliveries in real-time, and make payments directly from their smartphones. These apps are often integrated with loyalty programs, promotional offers, and personalized recommendations, further enhancing the customer experience.

The rise of food delivery apps such as Uber Eats, DoorDash, and Grubhub has transformed the food service industry, providing consumers with greater convenience and flexibility in ordering food. With the ability to access a wide range of restaurants and delivery options, mobile apps have become the preferred choice for consumers seeking on-the-go solutions. As smartphone usage continues to rise, mobile apps are expected to remain the fastest-growing platform for food delivery services, increasingly replacing traditional methods of ordering via phone calls or websites.

Cash on Delivery is Largest Payment Mode Segment Due to Consumer Preference for Payment Flexibility

Cash on delivery (COD) is the largest payment mode segment in the online food delivery services market, particularly in emerging markets where digital payment adoption is still growing. Despite the rise of online payment methods, a significant portion of consumers still prefers to pay for food delivery with cash upon receipt. This payment method offers consumers a sense of security and convenience, as they do not need to share credit card information online, which can be a concern for some customers.

The COD option is especially popular in regions with lower banking penetration or where consumers are less familiar with digital payment systems. However, as digital payment methods gain traction and as online security continues to improve, there is an increasing shift towards cashless payment options. Despite this trend, COD remains the largest payment mode for online food delivery services, particularly in regions with a preference for traditional payment methods.

Fast Food is Largest Cuisine Type Segment Due to Popularity and Quick Service

Fast food is the largest cuisine type segment in the online food delivery services market, driven by its widespread popularity, affordability, and quick service. Fast food chains are well-established in both developed and developing countries, offering a wide variety of meals that cater to diverse tastes. With options ranging from burgers and pizzas to fried chicken and sandwiches, fast food is the go-to choice for consumers looking for quick and convenient meals.

The demand for fast food delivery has been fueled by consumer preferences for cost-effective, familiar, and easily accessible meals. Fast food restaurants have invested heavily in optimizing their delivery processes to meet consumer expectations for speed and efficiency. The extensive menu offerings and the ability to serve food quickly make fast food the dominant segment in the online food delivery market, ensuring its continued growth and market share.

Individual Consumers Are Largest End-User Segment Due to Increased Demand for Convenience

Individual consumers make up the largest end-user segment in the online food delivery services market, driven by the growing demand for convenience, personalized meal choices, and the ease of ordering food from a variety of restaurants. Busy lifestyles, along with the rise in working professionals and urbanization, have contributed to an increasing preference for food delivery services. Consumers appreciate the ability to access a wide range of food choices, delivered quickly to their doorstep.

The preference for food delivery among individual consumers has been further accelerated by changing consumer behaviors, with people prioritizing convenience and time-saving solutions. The availability of diverse meal options—from fast food to ethnic cuisines—adds to the attractiveness of online food delivery platforms. As individual consumers continue to embrace the convenience of home-delivered meals, they will remain the largest end-user segment in the market.

Asia-Pacific is Fastest Growing Region Due to Rapid Urbanization and Increased Digitalization

The Asia-Pacific (APAC) region is the fastest-growing market for online food delivery services, driven by rapid urbanization, increasing smartphone penetration, and the rising adoption of digital payment methods. With a large and growing middle class, countries like China, India, and Southeast Asian nations are witnessing a surge in demand for food delivery services. As urban centers expand and lifestyles become more fast-paced, consumers are increasingly turning to online food platforms for their convenience and variety.

The rapid growth of mobile internet usage in APAC has further fueled the adoption of food delivery apps, with consumers seeking fast and affordable meal options. Additionally, the increasing disposable income and changing consumer preferences towards dining experiences are contributing to the rise in demand for online food delivery services. The APAC region's fast-paced urbanization and increasing reliance on technology make it the fastest-growing region in the global online food delivery services market.

Leading Companies and Competitive Landscape

The online food delivery services market is highly competitive, with several global and regional players leading the charge in this rapidly expanding sector. Key players include Uber Eats, DoorDash, Grubhub, Zomato, Swiggy, and Deliveroo. These companies have established robust platforms that allow users to easily order food, track deliveries, and make payments online. Their success has been driven by continuous innovation, strategic partnerships with restaurants, and the development of user-friendly mobile apps.

In addition to global giants, regional players like Just Eat (Europe) and Foodpanda (Asia) continue to make significant strides in their respective markets. These companies are focusing on customer experience, faster delivery times, and expanding their service offerings to stay competitive. The market is seeing increasing investments in technology, including AI for personalized recommendations and logistics optimization, to maintain a competitive edge. As the market continues to grow, the competitive landscape will remain dynamic, with companies focusing on enhancing their delivery networks, improving user engagement, and expanding into new geographic areas.

Recent Developments:

- In December 2024, Uber Eats expanded its delivery network in suburban areas across the U.S. to cater to growing demand for food delivery in non-urban areas.

- In November 2024, DoorDash launched a subscription model for free deliveries for frequent users in key cities across North America.

- In October 2024, Grubhub partnered with local grocery stores to offer an expanded range of products, beyond restaurant meals, for delivery.

- In September 2024, Just Eat Takeaway integrated AI-powered recommendations for users to personalize meal choices and improve customer experience.

- In August 2024, Swiggy launched a new feature allowing customers to track their deliveries in real-time for enhanced transparency.

List of Leading Companies:

- Uber Eats

- DoorDash

- Grubhub

- Just Eat Takeaway

- Deliveroo

- Zomato

- Swiggy

- Foodpanda

- Postmates

- Domino's Pizza, Inc.

- Papa John's Pizza

- Delivery Hero

- Takeaway.com

- Rappi

- Glovo

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 222.0 Billion |

|

Forecasted Value (2030) |

USD 426.2 Billion |

|

CAGR (2025 – 2030) |

11.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Online Food Delivery Services Market by Service Type (Delivery, Takeaway), Platform Type (Online Platforms, Mobile Apps), Payment Mode (Cash on Delivery, Online Payment), End-User (Individual Consumers, Corporate Clients), Cuisine Type (Fast Food, Chinese, Indian, Italian, Others) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Uber Eats, DoorDash, Grubhub, Just Eat Takeaway, Deliveroo, Zomato, Swiggy, Foodpanda, Postmates, Domino's Pizza, Inc., Papa John's Pizza, Delivery Hero, Takeaway.com, Rappi, Glovo |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Online Food Delivery Services Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Delivery |

|

4.2. Takeaway |

|

5. Online Food Delivery Services Market, by Platform Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Online Platforms |

|

5.2. Mobile Apps |

|

6. Online Food Delivery Services Market, by Payment Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Cash on Delivery |

|

6.2. Online Payment |

|

7. Online Food Delivery Services Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Individual Consumers |

|

7.2. Corporate Clients |

|

8. Online Food Delivery Services Market, by Cuisine Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Fast Food |

|

8.2. Chinese |

|

8.3. Indian |

|

8.4. Italian |

|

8.5. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Online Food Delivery Services Market, by Service Type |

|

9.2.7. North America Online Food Delivery Services Market, by Platform Type |

|

9.2.8. North America Online Food Delivery Services Market, by Payment Mode |

|

9.2.9. North America Online Food Delivery Services Market, by End-User |

|

9.2.10. North America Online Food Delivery Services Market, by Cuisine Type |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Online Food Delivery Services Market, by Service Type |

|

9.2.11.1.2. US Online Food Delivery Services Market, by Platform Type |

|

9.2.11.1.3. US Online Food Delivery Services Market, by Payment Mode |

|

9.2.11.1.4. US Online Food Delivery Services Market, by End-User |

|

9.2.11.1.5. US Online Food Delivery Services Market, by Cuisine Type |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Uber Eats |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. DoorDash |

|

11.3. Grubhub |

|

11.4. Just Eat Takeaway |

|

11.5. Deliveroo |

|

11.6. Zomato |

|

11.7. Swiggy |

|

11.8. Foodpanda |

|

11.9. Postmates |

|

11.10. Domino's Pizza, Inc. |

|

11.11. Papa John's Pizza |

|

11.12. Delivery Hero |

|

11.13. Takeaway.com |

|

11.14. Rappi |

|

11.15. Glovo |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Online Food Delivery Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Online Food Delivery Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Online Food Delivery Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA