As per Intent Market Research, the Online Dermatology Consultation Market was valued at USD 1.2 billion in 2024-e and will surpass USD 3.1 billion by 2030; growing at a CAGR of 16.7% during 2025 - 2030.

The online dermatology consultation market is experiencing significant growth driven by the increasing adoption of telemedicine and advancements in healthcare technology. The demand for online dermatology services has surged due to the convenience of virtual consultations, especially in the wake of the COVID-19 pandemic, which highlighted the need for remote healthcare services. Teleconsultation allows patients to connect with dermatologists from the comfort of their homes, making dermatological care more accessible, particularly in remote areas. Furthermore, the rising awareness of skin conditions, such as acne, psoriasis, and skin cancer, has led to greater utilization of online dermatology services, as patients seek timely advice and treatment options.

The market is further bolstered by technological advancements such as artificial intelligence (AI), machine learning, and image recognition, which enhance the diagnostic capabilities of online dermatology platforms. These technologies enable dermatologists to offer accurate diagnoses and personalized treatment recommendations based on the images and data submitted by patients. The ease of use, accessibility, and cost-effectiveness of online consultations make it an attractive option for both patients and healthcare providers. As more individuals and healthcare institutions embrace digital healthcare solutions, the online dermatology consultation market is expected to continue its upward trajectory, providing patients with greater access to specialized dermatological care.

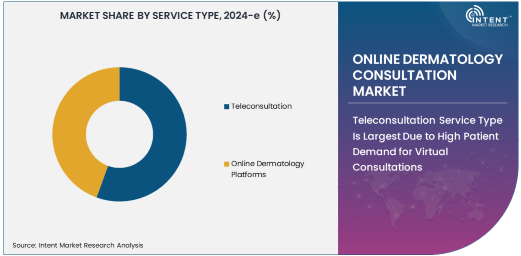

Teleconsultation Service Type Is Largest Due to High Patient Demand for Virtual Consultations

Teleconsultation is the largest service type in the online dermatology consultation market, owing to its ability to facilitate real-time, face-to-face consultations between patients and dermatologists, irrespective of geographic location. With teleconsultation, patients can easily communicate with dermatologists via video, phone, or chat, allowing for the assessment of various skin conditions without needing to visit a clinic in person. This service type has gained significant traction, particularly in urban and rural areas where access to dermatologists may be limited. The convenience, cost-effectiveness, and time-saving benefits of teleconsultation have made it the preferred service for many patients, especially those with busy schedules or limited access to specialized care.

The ability to address a broad range of dermatological concerns through teleconsultation, from common skin conditions to more complex issues, has contributed to its dominance in the market. Furthermore, teleconsultation has become an essential service in the face of healthcare provider shortages and the growing demand for remote healthcare services. As patient preferences continue to shift towards virtual care, teleconsultation will likely remain the leading service type in the online dermatology consultation market.

Artificial Intelligence (AI) Technology Is Largest Technology Segment Due to its Role in Enhancing Diagnostic Accuracy

Artificial intelligence (AI) is the largest technology segment in the online dermatology consultation market, driven by its ability to enhance the accuracy and efficiency of skin condition diagnoses. AI-powered tools are increasingly being integrated into online dermatology platforms to assist dermatologists in analyzing images and providing faster, more accurate diagnoses. AI algorithms can identify patterns in skin images, enabling the detection of conditions such as acne, psoriasis, and even early-stage skin cancer. These capabilities help reduce diagnostic errors and improve patient outcomes by ensuring that dermatologists have access to reliable, data-driven insights.

AI technology is particularly valuable in improving the quality of online consultations, as it can automate image analysis and provide dermatologists with additional information to support their clinical decisions. As AI technology continues to advance, its application in dermatology is expected to grow, making it a key enabler of the online dermatology consultation market. The combination of AI and teleconsultation is transforming the way dermatological care is delivered, leading to more efficient and accurate treatments for patients.

Skin Cancer Detection Is Fastest Growing Application Segment Due to Rising Awareness and Early Detection

Skin cancer detection is the fastest growing application segment in the online dermatology consultation market, fueled by increasing awareness of the importance of early detection and prevention. Skin cancer, particularly melanoma, has become one of the most common types of cancer worldwide, and early detection is critical for improving survival rates. Online dermatology consultations offer a convenient way for individuals to get their skin examined for signs of cancer without having to visit a clinic in person. Through the use of image recognition and AI technology, online dermatology platforms can help identify suspicious moles or lesions that may indicate skin cancer, allowing for early referral to specialists or follow-up screenings.

The rising prevalence of skin cancer, combined with greater public awareness and the convenience of remote consultations, is driving the demand for online skin cancer detection services. As more people seek proactive health management solutions, the market for online dermatology consultations for skin cancer detection is expected to grow rapidly. This segment is expected to continue its upward trend, offering patients timely and potentially life-saving assessments.

Dermatology Clinics Are Largest End-User Segment Due to Their Specialization in Dermatological Care

Dermatology clinics are the largest end-user segment in the online dermatology consultation market due to their specialized focus on treating various skin conditions. These clinics are equipped with the expertise, technology, and infrastructure to offer comprehensive dermatological care, making them ideal providers of online dermatology services. Dermatology clinics have long been the go-to healthcare facilities for individuals seeking treatment for conditions such as acne, eczema, psoriasis, and skin cancer, and their specialization in skin-related issues makes them well-suited to provide remote consultations.

The increasing demand for dermatology services, combined with the growing adoption of telemedicine, has led dermatology clinics to expand their offerings to include online consultations. By offering virtual consultations, these clinics can cater to a wider patient base, including those in remote locations or with limited access to in-person care. As the market for online dermatology consultations continues to grow, dermatology clinics are expected to remain the leading end-user segment, offering specialized services that meet the diverse needs of patients.

North America Is Largest Region Due to Strong Healthcare Infrastructure and Telemedicine Adoption

North America is the largest region in the online dermatology consultation market, owing to its advanced healthcare infrastructure, high levels of telemedicine adoption, and the increasing demand for remote healthcare services. The United States, in particular, has a well-established healthcare system that supports the use of online dermatology platforms and teleconsultation services. The country’s high internet penetration and tech-savvy population also contribute to the widespread acceptance of online healthcare solutions. The COVID-19 pandemic accelerated the adoption of telemedicine in the region, making virtual consultations more mainstream and accessible to a broader range of patients.

Furthermore, North America is home to some of the leading dermatology platforms and telemedicine providers, ensuring that the region remains at the forefront of the online dermatology consultation market. As healthcare providers continue to invest in telehealth technologies and expand their digital offerings, North America is expected to maintain its dominant position in the global market.

Leading Companies and Competitive Landscape

The online dermatology consultation market is highly competitive, with several prominent companies leading the charge in providing teleconsultation services and advanced dermatology platforms. Key players in this space include Teladoc Health, MDTech, and HealthTap, all of which offer online dermatology consultations, leveraging AI and machine learning technologies to enhance the patient experience and improve diagnostic accuracy. These companies are continuously innovating and expanding their service offerings to meet the growing demand for remote dermatology care.

The competitive landscape is characterized by a mix of established healthcare providers, telemedicine startups, and technology-driven companies working to integrate advanced technologies such as AI, image recognition, and machine learning into their platforms. Partnerships between telemedicine providers and dermatology clinics, as well as collaborations with AI and tech companies, are helping to shape the future of online dermatology consultations. As the market grows, competition is expected to intensify, with companies focusing on providing more personalized and efficient services to meet the needs of both patients and healthcare providers.

Recent Developments:

- In December 2024, Teladoc Health, Inc. expanded its virtual dermatology offerings by integrating AI-powered skin analysis tools into its platform.

- In November 2024, MDLive, Inc. announced a partnership with a major healthcare provider to enhance its online dermatology consultation services.

- In October 2024, Zocdoc introduced a new feature for virtual dermatology consultations, allowing real-time video consultations with dermatologists.

- In September 2024, SkinVision launched a new mobile application that combines AI-powered skin scans with dermatology consultations.

- In August 2024, PlushCare expanded its network of dermatologists for online consultations, focusing on expanding access to underserved communities.

List of Leading Companies:

- Teladoc Health, Inc.

- MDLive, Inc.

- DermatologistOnCall

- Doctor on Demand

- HealthTap

- American Well Corporation

- Ro (Roman Health)

- SkinVision

- Dermatology Online

- Zocdoc

- PlushCare

- HealthCareMagic

- Babylon Health

- iCliniq

- LiveHealth Online

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.2 billion |

|

Forecasted Value (2030) |

USD 3.1 billion |

|

CAGR (2025 – 2030) |

16.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Online Dermatology Consultation Market By Service Type (Teleconsultation, Online Dermatology Platforms), By Technology (Artificial Intelligence (AI), Machine Learning, Image Recognition), By Application (Acne Treatment, Psoriasis Treatment, Skin Cancer Detection, General Dermatology), By End-User (Hospitals, Dermatology Clinics, Individual Users) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Teladoc Health, Inc., MDLive, Inc., DermatologistOnCall, Doctor on Demand, HealthTap, American Well Corporation, Ro (Roman Health), SkinVision, Dermatology Online, Zocdoc, PlushCare, HealthCareMagic, Babylon Health, iCliniq, LiveHealth Online |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Online Dermatology Consultation Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Teleconsultation |

|

4.1.1. Video Consultation |

|

4.1.2. Text-Based Consultation |

|

4.2. Online Dermatology Platforms |

|

4.2.1. Mobile-based Platforms |

|

4.2.2. Web-based Platforms |

|

5. Online Dermatology Consultation Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Artificial Intelligence (AI) |

|

5.2. Machine Learning |

|

5.3. Image Recognition |

|

6. Online Dermatology Consultation Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Acne Treatment |

|

6.2. Psoriasis Treatment |

|

6.3. Skin Cancer Detection |

|

6.4. General Dermatology |

|

7. Online Dermatology Consultation Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Dermatology Clinics |

|

7.3. Individual Users |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Online Dermatology Consultation Market, by Service Type |

|

8.2.7. North America Online Dermatology Consultation Market, by Technology |

|

8.2.8. North America Online Dermatology Consultation Market, by Application |

|

8.2.9. North America Online Dermatology Consultation Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Online Dermatology Consultation Market, by Service Type |

|

8.2.10.1.2. US Online Dermatology Consultation Market, by Technology |

|

8.2.10.1.3. US Online Dermatology Consultation Market, by Application |

|

8.2.10.1.4. US Online Dermatology Consultation Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Teladoc Health, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. MDLive, Inc. |

|

10.3. DermatologistOnCall |

|

10.4. Doctor on Demand |

|

10.5. HealthTap |

|

10.6. American Well Corporation |

|

10.7. Ro (Roman Health) |

|

10.8. SkinVision |

|

10.9. Dermatology Online |

|

10.10. Zocdoc |

|

10.11. PlushCare |

|

10.12. HealthCareMagic |

|

10.13. Babylon Health |

|

10.14. iCliniq |

|

10.15. LiveHealth Online |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Online Dermatology Consultation Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Online Dermatology Consultation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Online Dermatology Consultation Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA