As per Intent Market Research, the Online Clothing Rental Market was valued at USD 1.7 Billion in 2024-e and will surpass USD 4.3 Billion by 2030; growing at a CAGR of 16.9% during 2025-2030.

The online clothing rental market has witnessed significant growth in recent years, driven by changing consumer preferences, the rise of the sharing economy, and increased awareness of sustainable fashion. With consumers increasingly opting for experiences over ownership, online clothing rental platforms offer a convenient and cost-effective solution for accessing high-quality, trendy garments without the need for long-term commitment. This shift is particularly prevalent among fashion-conscious individuals who wish to wear designer or high-end clothing for special occasions without the hefty price tag.

The market is poised for continued expansion, fueled by the increasing adoption of digital platforms and mobile applications, which make renting clothing more accessible than ever before. Additionally, as environmental sustainability becomes a key factor in consumer decision-making, clothing rental services offer a more eco-friendly alternative to traditional retail by promoting the reuse and recycling of garments. With growing awareness around these benefits, the online clothing rental market is attracting a diverse range of customers, from everyday wear to designer and party attire, across various demographics.

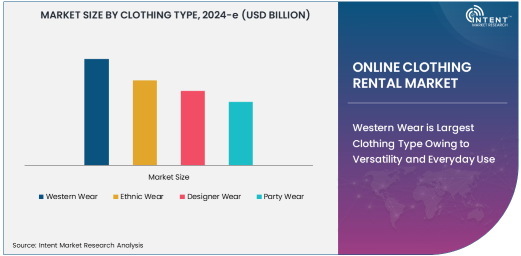

Western Wear is Largest Clothing Type Owing to Versatility and Everyday Use

Among the various clothing types offered in the online clothing rental market, Western wear stands as the largest segment due to its versatility and widespread use in everyday life. Western attire, which includes casual, business, and semi-formal wear, is commonly rented for both professional and casual occasions. With changing work cultures, especially the rise of remote work and hybrid models, there is an increasing demand for comfortable yet stylish clothing, which has driven the popularity of renting western wear.

The appeal of Western wear also stems from its ability to cater to a wide range of events, from office meetings to social gatherings, making it a go-to choice for many customers. Additionally, the growing trend of fast fashion, which often results in an excess of clothing, is encouraging consumers to opt for rentals as a more sustainable alternative. As a result, the Western wear segment remains dominant in the online clothing rental market, with significant demand from both men and women.

Women are Largest End-User Segment Owing to Fashion Consciousness and Occasional Rentals

Women represent the largest end-user segment in the online clothing rental market, driven by their higher spending on fashion and the increasing desire for variety in their wardrobes. Women often rent clothing for a variety of occasions, including parties, weddings, and special events, where wearing something unique and fashionable is of significant importance. Renting offers them the opportunity to access high-end designer dresses or trendy outfits for a fraction of the cost of purchasing.

Additionally, women are more likely to embrace sustainable fashion practices, contributing to the popularity of clothing rental services. As they seek flexibility and the latest trends without committing to long-term ownership, online clothing rental platforms have become an attractive option. The convenience of selecting and renting attire online, combined with the allure of wearing premium clothing for special occasions, solidifies women as the largest consumer base for online clothing rentals.

Subscription-Based Business Model is Fastest Growing Owing to Convenience and Cost-Effectiveness

The subscription-based business model is the fastest-growing segment within the online clothing rental market, driven by its ability to offer convenience, flexibility, and cost-effectiveness. In this model, customers pay a fixed monthly fee to receive a set number of garments, which can be swapped or exchanged within a specific period. This recurring revenue model appeals to customers who prefer to have continuous access to fresh styles without the need to constantly make individual rental purchases.

Subscription services offer customers a hassle-free experience by providing regular deliveries of curated outfits that align with their personal style. Additionally, this model caters to consumers who want a wardrobe refresh without the environmental impact of fast fashion. As convenience and sustainable fashion continue to shape consumer preferences, subscription-based rentals are gaining significant traction, making this model the fastest-growing in the market.

Online Platforms are Largest Distribution Channel Owing to Accessibility and Convenience

Online platforms dominate the distribution channel segment of the online clothing rental market due to their accessibility, convenience, and the growing trend of e-commerce. With the widespread use of the internet and smartphones, consumers increasingly turn to online platforms to browse and rent clothing from the comfort of their homes. These platforms offer a wide range of clothing options, detailed product descriptions, and user-friendly interfaces that make it easy for customers to find and rent the attire they need.

The growing adoption of e-commerce, combined with advances in mobile technology, has made online platforms the go-to choice for clothing rental. Customers can conveniently browse through collections, read reviews, and make secure payments, ensuring a seamless experience. The ability to offer delivery and returns directly to customers further enhances the appeal of online platforms. As a result, online platforms remain the largest and most effective distribution channel in the online clothing rental market.

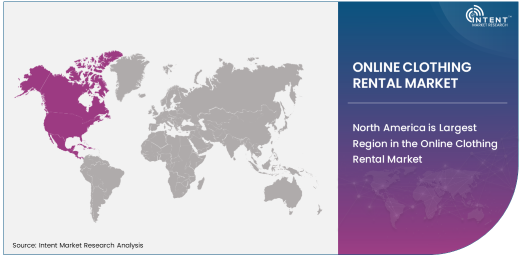

North America is Largest Region in the Online Clothing Rental Market

North America holds the largest share of the online clothing rental market, driven by the high demand for fashion rentals in the United States and Canada. The region benefits from a strong presence of leading rental platforms, increased consumer awareness about the environmental benefits of clothing rentals, and a high degree of fashion consciousness among consumers. In addition, the growing trend of sustainability, combined with the increasing number of eco-conscious consumers, has significantly contributed to the market's expansion.

The ease of access to digital platforms and the growing popularity of subscription-based services further fuel the region's dominance. As consumers continue to embrace fashion rental services for special events and everyday wear, North America is expected to maintain its leadership in the market. With a highly developed e-commerce infrastructure and strong consumer demand, the region remains the largest and most mature market for online clothing rentals.

Leading Companies and Competitive Landscape

Leading players in the online clothing rental market include Rent the Runway, Le Tote, HURR Collective, GlamCorner, and MyWardrobeHQ. These companies offer diverse clothing rental options, ranging from casual wear to high-end designer dresses, catering to various consumer needs. Rent the Runway, for example, has established a strong brand presence with its subscription-based service, offering customers the option to rent clothing for both everyday use and special events.

The competitive landscape is marked by a mix of established rental platforms and newer entrants offering unique value propositions, such as sustainable fashion and personalized styling. These companies differentiate themselves through customer experience, variety of offerings, and the flexibility of rental models. As the market continues to grow, innovation in rental models, enhanced customer service, and technology-driven solutions like virtual try-ons are expected to play a significant role in maintaining competitive advantage.

Recent Developments:

- In December 2024, Rent the Runway launched a luxury designer rental collection in collaboration with top fashion houses.

- In November 2024, GlamCorner expanded its services to include bridal wear rentals across Australia.

- In October 2024, Flyrobe partnered with local designers in India to enhance its ethnic wear rental portfolio.

- In September 2024, HURR Collective introduced a new AI-powered personalization feature for its rental platform.

- In August 2024, Le Tote launched a new subscription tier catering to maternity wear rentals.

List of Leading Companies:

- Rent the Runway

- GlamCorner

- Bag Borrow or Steal

- Flyrobe

- Dress Hire AU

- Style Lend

- Le Tote

- The Mr. & Ms. Collection

- HURR Collective

- Fame & Partners

- Closet in the Cloud

- Wardrobe HQ

- Poshare

- Armoire

- MyWardrobeHQ

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.7 Billion |

|

Forecasted Value (2030) |

USD 4.3 Billion |

|

CAGR (2025 – 2030) |

16.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Online Clothing Rental Market by Clothing Type (Western Wear, Ethnic Wear, Designer Wear, Party Wear), End-User (Men, Women, Kids), Business Model (Subscription-Based, Pay-Per-Use), Distribution Channel (Online Platforms, Mobile Applications, Offline Stores) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Rent the Runway, GlamCorner, Bag Borrow or Steal, Flyrobe, Dress Hire AU, Style Lend, Le Tote, The Mr. & Ms. Collection, HURR Collective, Fame & Partners, Closet in the Cloud, Wardrobe HQ, Poshare, Armoire, MyWardrobeHQ |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Online Clothing Rental Market, by Clothing Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Western Wear |

|

4.2. Ethnic Wear |

|

4.3. Designer Wear |

|

4.4. Party Wear |

|

5. Online Clothing Rental Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Men |

|

5.2. Women |

|

5.3. Kids |

|

6. Online Clothing Rental Market, by Business Model (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Subscription-Based |

|

6.2. Pay-Per-Use |

|

7. Online Clothing Rental Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Platforms |

|

7.2. Mobile Applications |

|

7.3. Offline Stores |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Online Clothing Rental Market, by Clothing Type |

|

8.2.7. North America Online Clothing Rental Market, by End-User |

|

8.2.8. North America Online Clothing Rental Market, by Business Model |

|

8.2.9. North America Online Clothing Rental Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Online Clothing Rental Market, by Clothing Type |

|

8.2.10.1.2. US Online Clothing Rental Market, by End-User |

|

8.2.10.1.3. US Online Clothing Rental Market, by Business Model |

|

8.2.10.1.4. US Online Clothing Rental Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Rent the Runway |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. GlamCorner |

|

10.3. Bag Borrow or Steal |

|

10.4. Flyrobe |

|

10.5. Dress Hire AU |

|

10.6. Style Lend |

|

10.7. Le Tote |

|

10.8. The Mr. & Ms. Collection |

|

10.9. HURR Collective |

|

10.10. Fame & Partners |

|

10.11. Closet in the Cloud |

|

10.12. Wardrobe HQ |

|

10.13. Poshare |

|

10.14. Armoire |

|

10.15. MyWardrobeHQ |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Online Clothing Rental Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Online Clothing Rental Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Online Clothing Rental Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA