As per Intent Market Research, the Online Car Buying Market was valued at USD 81.9 Billion in 2024-e and will surpass USD 172.4 Billion by 2030; growing at a CAGR of 13.2% during 2025-2030.

The online car buying market has transformed the way consumers purchase vehicles, driven by technological advancements, convenience, and an evolving consumer preference for digital platforms. This shift is fueled by the increasing use of online marketplaces, direct-to-consumer platforms, and online dealerships that provide a seamless, hassle-free car buying experience. Consumers are now able to research, compare, and purchase new, used, or certified pre-owned cars from the comfort of their homes, bypassing the traditional dealership model. This market has seen rapid growth, especially with the growing trend of e-commerce and digitalization across industries. Online car buying platforms offer competitive pricing, detailed vehicle information, and virtual tours, all contributing to a faster and more convenient purchasing process.

The market has also seen an increasing number of fleet operators, leasing companies, and individual consumers turning to online platforms for car purchases, as they offer a range of options and price points. This has led to an enhanced focus on providing personalized services, such as vehicle customization, easy financing options, and home delivery, thereby improving customer satisfaction and further fueling market growth. The rise of online car buying aligns with the broader trend of digitization across consumer markets, making it clear that the industry is poised for continued expansion in the coming years.

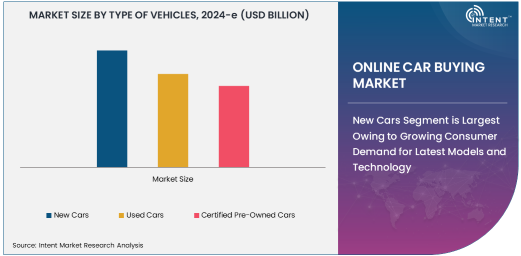

New Cars Segment is Largest Owing to Growing Consumer Demand for Latest Models and Technology

The new cars segment dominates the online car buying market, primarily driven by growing consumer demand for the latest vehicle models, advanced technology, and improved fuel efficiency. With the rise of digital platforms, consumers can now easily compare various models, view specifications, and access customer reviews—all of which help inform their decision-making process when purchasing a new car. The ease of buying new cars online, along with the ability to access a wider inventory than is typically available at traditional dealerships, has made it a preferred choice for many buyers.

New car buyers are particularly attracted to online platforms due to the convenience they offer, from browsing for the latest models to scheduling test drives or arranging home delivery. Additionally, as automakers continue to integrate advanced technologies into their vehicles, such as electric powertrains, autonomous driving features, and enhanced connectivity, the demand for new cars is expected to remain strong in the online space. Manufacturers and dealers alike are enhancing their digital presence to meet this demand, further solidifying the new cars segment's position as the largest in the online car buying market.

Used Cars Segment is Fastest Growing Owing to Affordability and Increased Trust in Online Marketplaces

The used cars segment is the fastest-growing in the online car buying market, driven by the rising preference for affordable vehicles and the increased trust in online platforms for purchasing pre-owned cars. Used cars offer significant cost savings compared to new models, which has made them particularly attractive to budget-conscious consumers. With the growth of online dealerships and third-party marketplaces, buying a used car online has become easier, with transparent pricing, detailed vehicle histories, and the ability to review multiple options quickly.

The growing trust in online platforms has contributed significantly to the rise of the used car segment. Consumers can now access reviews, ratings, and comprehensive information on the condition of the car, which helps reduce the perceived risks traditionally associated with buying a used car. The convenience of shopping for used cars from the comfort of home, combined with better vehicle transparency and financing options, makes this segment highly appealing. The used cars segment is expected to continue its rapid growth as more consumers embrace online purchasing due to the increased affordability and transparency offered by digital platforms.

Direct-to-Consumer Platforms Are Fastest Growing Owing to Personalized Services and Convenience

The direct-to-consumer (DTC) platforms are the fastest-growing sales channel within the online car buying market, driven by their ability to offer personalized services and a more direct, transparent purchasing experience. Companies that operate DTC platforms, such as Tesla and Carvana, have revolutionized the car buying process by eliminating traditional intermediaries like dealerships, allowing consumers to buy vehicles directly from the manufacturer or platform. This model offers significant advantages, including better pricing, more control over the buying process, and increased convenience.

DTC platforms have capitalized on the growing trend of consumers seeking more control over their purchases, offering tailored financing options, vehicle customization, and home delivery. The ability to shop for a car online without needing to visit a dealership and negotiate prices has proven particularly appealing. This trend is expected to continue, with more manufacturers and sellers adopting DTC strategies to capture a larger share of the online car buying market. As more companies enter this space and enhance their offerings, the DTC sales channel will likely become an even more dominant force in the industry.

North America is Largest Region Owing to High Adoption Rates and Established Digital Infrastructure

North America is the largest region in the online car buying market, driven by high adoption rates of e-commerce, widespread internet access, and a strong digital infrastructure. The United States, in particular, has seen the growth of several leading online car buying platforms such as Carvana, Vroom, and Shift, which have helped normalize the idea of buying a car online. These platforms have gained significant traction due to the convenience they offer, alongside competitive pricing and easy financing options. Furthermore, North America has a well-developed automotive market with a high rate of vehicle ownership, which contributes to the region's dominance in the online car buying space.

The success of online car buying platforms in North America is also bolstered by the increasing comfort of consumers with digital transactions, as well as the convenience of home delivery and at-home test drives. The COVID-19 pandemic accelerated the shift to online car buying, and these trends have continued post-pandemic. With a strong economic foundation and increasing demand for both new and used cars, North America is expected to maintain its position as the largest region in the online car buying market.

Competitive Landscape and Key Players

The online car buying market is highly competitive, with numerous players across different segments offering a range of services to consumers. Key companies include Carvana, Vroom, AutoTrader, Shift, and traditional automotive manufacturers like Tesla, which operate direct-to-consumer platforms. These companies are investing heavily in technology, logistics, and customer service to differentiate themselves and meet the growing consumer demand for convenient, transparent, and flexible car buying experiences.

The competitive landscape is marked by continuous innovation, with companies striving to improve user experiences through advanced features such as virtual car tours, augmented reality tools, and better vehicle inspection capabilities. Additionally, there is a strong emphasis on expanding vehicle inventories, offering competitive financing options, and integrating customer reviews and ratings to build trust with consumers. As the market continues to evolve, both new and established players will need to adapt to changing consumer preferences and technological advancements to stay competitive in the dynamic online car buying space.

Recent Developments:

- Carvana launched a new feature allowing customers to complete the entire car-buying process online, from vehicle selection to financing and delivery.

- Vroom introduced a trade-in program for customers to seamlessly sell their used cars online while purchasing a new vehicle.

- TrueCar partnered with multiple manufacturers to offer exclusive online car buying discounts directly through its platform.

- Shift Technologies announced a strategic partnership with major automakers to expand its online inventory for pre-owned cars.

- CarMax launched a virtual showroom, allowing customers to explore and buy cars entirely online, with home delivery options.

List of Leading Companies:

- Carvana

- AutoTrader

- Vroom

- TrueCar

- Shift Technologies

- Cars24

- OLX Autos

- CarGurus

- Beepi (acquired by Fair)

- AutoNation

- Lithia Motors

- Group 1 Automotive

- CarMax

- DriveTime Automotive

- Edmunds

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 81.9 Billion |

|

Forecasted Value (2030) |

USD 172.4 Billion |

|

CAGR (2025 – 2030) |

13.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Online Car Buying Market By Type of Vehicles (New Cars, Used Cars, Certified Pre-Owned Cars), By Sales Channel (Online Dealerships, Direct-to-Consumer Platforms, Third-Party Marketplaces), and By End-Use Industry (Individual Consumers, Fleet Operators, Leasing Companies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Carvana, AutoTrader, Vroom, TrueCar, Shift Technologies, Cars24, OLX Autos, CarGurus, Beepi (acquired by Fair), AutoNation, Lithia Motors, Group 1 Automotive, CarMax, DriveTime Automotive, Edmunds |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Online Car Buying Market, by Type of Vehicles (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. New Cars |

|

4.2. Used Cars |

|

4.3. Certified Pre-Owned Cars |

|

5. Online Car Buying Market, by Sales Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Online Dealerships |

|

5.2. Direct-to-Consumer Platforms |

|

5.3. Third-Party Marketplaces |

|

6. Online Car Buying Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Individual Consumers |

|

6.2. Fleet Operators |

|

6.3. Leasing Companies |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Online Car Buying Market, by Type of Vehicles |

|

7.2.7. North America Online Car Buying Market, by Sales Channel |

|

7.2.8. North America Online Car Buying Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Online Car Buying Market, by Type of Vehicles |

|

7.2.9.1.2. US Online Car Buying Market, by Sales Channel |

|

7.2.9.1.3. US Online Car Buying Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Carvana |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. AutoTrader |

|

9.3. Vroom |

|

9.4. TrueCar |

|

9.5. Shift Technologies |

|

9.6. Cars24 |

|

9.7. OLX Autos |

|

9.8. CarGurus |

|

9.9. Beepi (acquired by Fair) |

|

9.10. AutoNation |

|

9.11. Lithia Motors |

|

9.12. Group 1 Automotive |

|

9.13. CarMax |

|

9.14. DriveTime Automotive |

|

9.15. Edmunds |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Online Car Buying Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Online Car Buying Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Online Car Buying Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA