As per Intent Market Research, the Nutritional Food and Drink Market was valued at USD 200.7 billion in 2023 and will surpass USD 301.4 billion by 2030; growing at a CAGR of 6.0% during 2024 - 2030.

The Nutritional Food and Drink market is experiencing strong growth, driven by increasing health-consciousness among consumers and a shift towards functional foods that offer specific health benefits. The demand for products that support overall well-being, enhance immunity, and promote weight management has surged, fueled by growing awareness of the importance of nutrition in preventing lifestyle-related diseases. As a result, both the food and beverage segments are increasingly incorporating health-focused ingredients and formulations, catering to consumers seeking to enhance their diet with targeted nutritional benefits. This market expansion is further supported by an increasing preference for plant-based, organic, and fortified products.

With the rise of wellness trends, consumers are placing greater emphasis on the health benefits of food and drink, such as immunity-boosting and digestive health. These trends are shaping the product innovation landscape, with manufacturers focusing on functional foods and beverages that cater to specific health concerns. As distribution channels expand, including online retail and pharmacies, the availability of these products has increased, further driving their adoption among a broader consumer base. Additionally, the market is expected to continue growing as consumers increasingly demand products that align with their health and wellness goals.

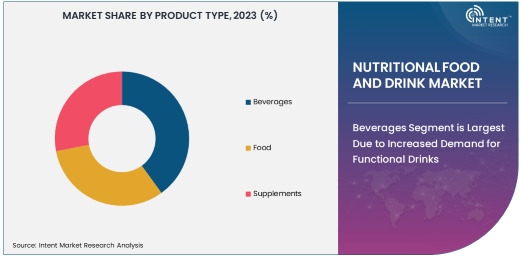

Beverages Segment is Largest Due to Increased Demand for Functional Drinks

The beverages segment holds the largest share in the Nutritional Food and Drink market, primarily driven by the growing popularity of functional drinks that offer targeted health benefits. Consumers are increasingly opting for beverages that not only quench their thirst but also deliver added nutritional value, such as beverages that aid in weight management, promote digestive health, or boost immunity. Functional beverages such as smoothies, protein shakes, energy drinks, and fortified waters are becoming essential components of a health-conscious lifestyle. These drinks are often enriched with vitamins, minerals, probiotics, and other beneficial ingredients, catering to a wide range of consumer preferences.

The demand for functional beverages is particularly high in markets where consumers are prioritizing convenience without compromising on their health needs. In addition to traditional retail, the rise of e-commerce and online grocery platforms has further amplified the accessibility of these products, contributing to the segment’s growth. With increasing health awareness and the trend toward personalized nutrition, the beverage segment is expected to continue expanding, offering ample opportunities for innovation in terms of product formulations and packaging.

Weight Management Health Benefit is Largest as Consumers Seek Healthier Lifestyles

The weight management health benefit is the largest segment in the Nutritional Food and Drink market, as consumers continue to seek healthier options to maintain or lose weight. This segment includes products such as low-calorie foods, protein-rich snacks, and beverages designed to support metabolism, reduce fat, and promote satiety. The increasing prevalence of obesity and related health issues, such as diabetes and heart disease, has driven the demand for weight management solutions that help individuals maintain a balanced lifestyle.

As more consumers adopt healthier eating habits, they are turning to functional foods and beverages that aid in weight control, which is expected to further fuel the growth of this segment. Products that offer weight management benefits are increasingly incorporating natural ingredients, such as fiber, protein, and plant-based extracts, to meet consumer preferences for clean-label, low-sugar, and high-protein options. The weight management health benefit is projected to maintain its dominance in the market as the focus on preventive health and wellness continues to intensify.

Immunity Boost Health Benefit is Fastest Growing Due to Health Concerns

The immunity boost health benefit is the fastest growing segment in the Nutritional Food and Drink market, primarily driven by heightened consumer awareness of the importance of immune health, particularly in the wake of the COVID-19 pandemic. Consumers are increasingly seeking foods and beverages fortified with vitamins, minerals, and antioxidants that help strengthen the immune system and improve overall health. Products enriched with ingredients such as vitamin C, zinc, and probiotics are gaining popularity, as they are known to support immune function and promote general well-being.

The rising demand for immunity-boosting products is influencing product development, with manufacturers offering a wide variety of options, from immune-boosting juices and functional snacks to supplements and fortified beverages. As health concerns continue to rise globally, especially in response to ongoing health crises, the immunity-boost segment is expected to see continued expansion. This growth is further supported by the increasing preference for natural and plant-based ingredients that consumers perceive as more effective and safer in supporting immune health.

Online Retail is Fastest Growing Distribution Channel Due to Convenience

The online retail distribution channel is the fastest growing in the Nutritional Food and Drink market, driven by the increasing preference for online shopping, particularly in the wake of the COVID-19 pandemic. Consumers are turning to e-commerce platforms to purchase nutritional foods and drinks due to the convenience, wide product selection, and doorstep delivery. Online retail offers consumers the ability to easily compare products, read reviews, and access a variety of health-focused options that may not be available at local stores.

As digital penetration continues to increase globally, online platforms are playing an increasingly important role in the market’s growth. Furthermore, the rise of health and wellness influencers on social media and digital health platforms is driving consumer awareness and encouraging online purchasing. As a result, online retail is poised to maintain its rapid growth, offering a significant opportunity for manufacturers and distributors to reach a wider consumer base.

North America is Largest Region Owing to Strong Health and Wellness Focus

North America is the largest region in the Nutritional Food and Drink market, owing to the strong health and wellness focus among consumers in the United States and Canada. The region is home to a well-established market for functional foods and beverages, with consumers increasingly seeking products that promote overall well-being, boost immunity, and support weight management. High disposable incomes, coupled with a growing awareness of the benefits of nutrition, have made North America a key market for the development and adoption of nutritional food and drink products.

The region also benefits from a robust retail infrastructure, including supermarkets, hypermarkets, and a rapidly growing online retail segment. The increasing prevalence of lifestyle-related health issues, such as obesity and diabetes, has prompted consumers to seek out healthier alternatives, further fueling the demand for functional foods and beverages. North America’s strong regulatory environment and advancements in product innovation make it an attractive market for both established and emerging players in the nutritional food and drink space.

Competitive Landscape and Leading Companies

The Nutritional Food and Drink market is highly competitive, with numerous global and regional players vying for market share. Leading companies in this market include Nestlé S.A., PepsiCo, Inc., Danone, The Coca-Cola Company, and Abbott Laboratories. These companies are continually innovating to meet the growing demand for health-focused products, investing in research and development to enhance their offerings. Additionally, the market is seeing an increasing presence of smaller, health-focused brands that specialize in plant-based, organic, and functional products, catering to the growing segment of health-conscious consumers.

The competitive landscape is also shaped by changing consumer preferences and trends, such as clean-label products, plant-based options, and functional ingredients. Companies are investing in marketing strategies to educate consumers about the benefits of their products while expanding their distribution channels to reach a broader audience. As demand for nutritional food and drink products continues to rise, the market is expected to remain dynamic, with innovation and consumer trends playing a key role in shaping the competitive landscape.

Recent Developments:

- In November 2024, Nestlé S.A. launched a new line of plant-based nutritional beverages aimed at improving immune health.

- In October 2024, PepsiCo announced the acquisition of a leading functional beverage startup to expand its health-focused drink portfolio.

- In September 2024, Danone S.A. introduced a new range of probiotic-rich foods designed to enhance digestive health.

- In August 2024, Abbott Laboratories unveiled a new protein supplement specifically formulated for elderly adults to support muscle health.

- In July 2024, The Kraft Heinz Company expanded its nutritional food line with products focused on improving cognitive function and brain health.

List of Leading Companies:

- Nestlé S.A.

- PepsiCo, Inc.

- Danone S.A.

- Coca-Cola Company

- General Mills, Inc.

- Kellogg Company

- Abbott Laboratories

- The Kraft Heinz Company

- GlaxoSmithKline PLC

- Unilever

- Herbalife Nutrition Ltd.

- Mars, Inc.

- Reckitt Benckiser Group plc

- Johnson & Johnson

- Amway

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 200.7 billion |

|

Forecasted Value (2030) |

USD 301.4 billion |

|

CAGR (2024 – 2030) |

6.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Nutritional Food and Drink Market By Product Type (Beverages, Food, Supplements), By Health Benefit (Weight Management, Immunity Boost, Digestive Health, Cognitive Function, Bone and Joint Health), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Pharmacies/Drugstores) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Nestlé S.A., PepsiCo, Inc., Danone S.A., Coca-Cola Company, General Mills, Inc., Kellogg Company, Abbott Laboratories, The Kraft Heinz Company, GlaxoSmithKline PLC, Unilever, Herbalife Nutrition Ltd., Mars, Inc., Reckitt Benckiser Group plc, Johnson & Johnson, Amway |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Nutritional Food and Drink Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Beverages |

|

4.2. Food |

|

4.3. Supplements |

|

5. Nutritional Food and Drink Market, by Health Benefit (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Weight Management |

|

5.2. Immunity Boost |

|

5.3. Digestive Health |

|

5.4. Cognitive Function |

|

5.5. Bone and Joint Health |

|

5.6. Others |

|

6. Nutritional Food and Drink Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Supermarkets/Hypermarkets |

|

6.2. Convenience Stores |

|

6.3. Online Retail |

|

6.4. Pharmacies/Drugstores |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Nutritional Food and Drink Market, by Product Type |

|

7.2.7. North America Nutritional Food and Drink Market, by Health Benefit |

|

7.2.8. North America Nutritional Food and Drink Market, by Distribution Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Nutritional Food and Drink Market, by Product Type |

|

7.2.9.1.2. US Nutritional Food and Drink Market, by Health Benefit |

|

7.2.9.1.3. US Nutritional Food and Drink Market, by Distribution Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Nestlé S.A. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. PepsiCo, Inc. |

|

9.3. Danone S.A. |

|

9.4. Coca-Cola Company |

|

9.5. General Mills, Inc. |

|

9.6. Kellogg Company |

|

9.7. Abbott Laboratories |

|

9.8. The Kraft Heinz Company |

|

9.9. GlaxoSmithKline PLC |

|

9.10. Unilever |

|

9.11. Herbalife Nutrition Ltd. |

|

9.12. Mars, Inc. |

|

9.13. Reckitt Benckiser Group plc |

|

9.14. Johnson & Johnson |

|

9.15. Amway |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Nutritional Food and Drink Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Nutritional Food and Drink Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Nutritional Food and Drink Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA