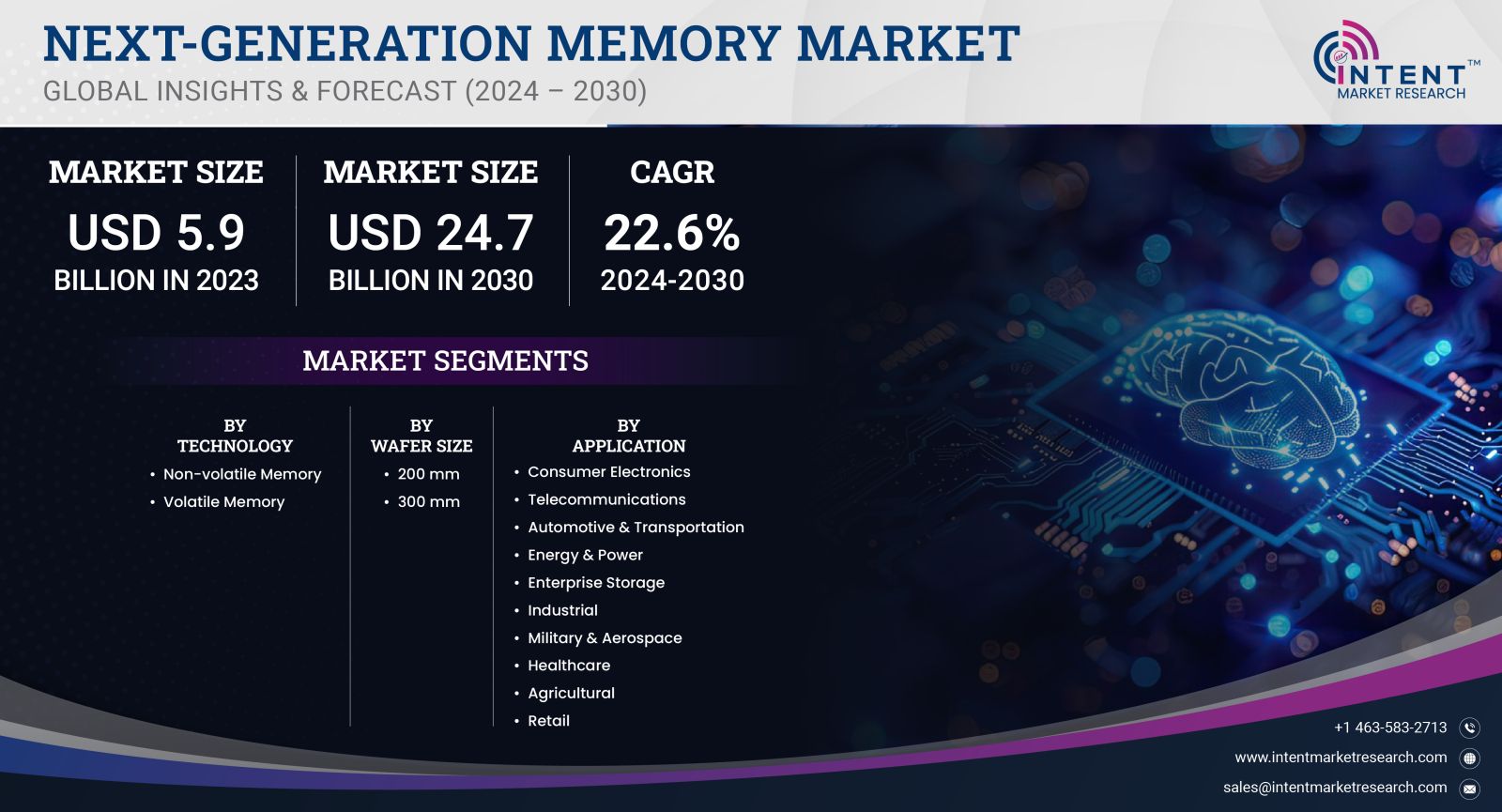

As per Intent Market Research, the Next-Generation Memory Market was valued at USD 5.9 billion in 2023 and will surpass USD 24.7 billion by 2030; growing at a CAGR of 22.6% during 2024 - 2030.

The Next-Generation Memory market is at the forefront of technological innovation, driven by the need for enhanced performance, speed, and energy efficiency in data storage solutions. As digital transformation accelerates across industries, traditional memory technologies such as DRAM and NAND flash are increasingly challenged by the growing demands for higher bandwidth, lower latency, and increased storage capacity. Next-generation memory technologies, including 3D NAND, MRAM (Magnetoresistive Random Access Memory), and PCM (Phase Change Memory), are emerging to meet these requirements, offering significant advantages over conventional memory solutions.This growth is fueled by the proliferation of advanced computing applications, such as artificial intelligence, machine learning, and big data analytics.

3D NAND Segment is Largest Owing to Increasing Demand for High-Capacity Storage

The 3D NAND segment is the largest within the Next-Generation Memory market, primarily driven by the increasing demand for high-capacity storage solutions in consumer electronics, data centers, and enterprise applications. 3D NAND technology offers significant advantages over traditional 2D NAND, including higher storage density, improved performance, and enhanced endurance. As data generation continues to escalate, fueled by trends such as cloud computing and IoT, the need for efficient and scalable storage solutions is more critical than ever. 3D NAND enables manufacturers to produce larger capacity drives in a smaller footprint, making it ideal for a wide range of applications.

Moreover, the growing adoption of 3D NAND in mobile devices, laptops, and SSDs (Solid State Drives) further solidifies its position as the largest segment in the market. As consumers and businesses increasingly prioritize speed and performance in their devices, 3D NAND technology is becoming the preferred choice for next-generation storage solutions. The continuous advancements in 3D NAND technology, including multi-layer stacking and improved manufacturing processes, ensure its dominance in the market, as manufacturers seek to meet the ever-growing demands for data storage.

MRAM Segment is Fastest Growing Owing to Low Power Consumption and High Speed

The MRAM (Magnetoresistive Random Access Memory) segment is recognized as the fastest-growing area within the Next-Generation Memory market, largely due to its unique combination of high speed, low power consumption, and non-volatility. MRAM technology is gaining traction in applications where performance and energy efficiency are paramount, such as automotive, telecommunications, and data centers. As the demand for fast and reliable memory solutions continues to rise, MRAM is positioned to capitalize on this trend, offering a compelling alternative to traditional memory technologies like DRAM and Flash.

Furthermore, the increasing emphasis on energy-efficient solutions across industries is driving the adoption of MRAM. Its ability to retain data without power and provide fast access times makes it an attractive choice for modern computing applications. The ongoing advancements in MRAM technology, including the development of spin-transfer torque (STT) MRAM, are expected to enhance its performance and broaden its application scope. As a result, the MRAM segment is anticipated to experience significant growth in the Next-Generation Memory market, driven by the pursuit of faster, more efficient, and reliable memory solutions.

Phase Change Memory (PCM) Segment is Largest Owing to Versatility in Applications

The Phase Change Memory (PCM) segment is significant within the Next-Generation Memory market, characterized by its versatility and potential for high performance across various applications. PCM technology leverages the unique properties of phase change materials to store data, enabling faster access times and greater endurance compared to traditional memory solutions. As the demand for flexible memory solutions grows, PCM is becoming an attractive option for applications in embedded systems, automotive, and industrial sectors.

Moreover, the ability of PCM to bridge the gap between volatile and non-volatile memory makes it a suitable candidate for a wide range of use cases, including cache memory, data storage, and computational memory. The ongoing research and development efforts in PCM technology are expected to yield significant advancements, further enhancing its performance and cost-effectiveness. As industries seek more adaptable and efficient memory solutions, the PCM segment is poised to play a crucial role in the evolution of the Next-Generation Memory market.

Emerging Non-Volatile Memory (NVM) Segment is Fastest Growing Owing to Technological Innovations

The emerging non-volatile memory (NVM) segment is experiencing rapid growth within the Next-Generation Memory market, primarily driven by ongoing technological innovations and the increasing demand for efficient storage solutions. NVM technologies encompass a wide range of memory solutions, including Flash, MRAM, and PCM, that retain data without the need for power. As industries embrace the benefits of NVM for their computing needs, the demand for these technologies is on the rise, particularly in applications such as edge computing, IoT devices, and automotive systems.

The advantages of NVM technologies, including low power consumption, high speed, and endurance, make them an ideal choice for modern computing architectures that require reliable data storage. As advancements in NVM technology continue to emerge, enabling new applications and improving performance, this segment is expected to witness substantial growth. The increasing focus on energy-efficient and high-performance memory solutions positions the emerging NVM segment as a significant contributor to the Next-Generation Memory market.

Fastest Growing Region in the Next-Generation Memory Market: Asia-Pacific

The Asia-Pacific region is identified as the fastest-growing market for Next-Generation Memory, driven by rapid advancements in technology and significant investments in semiconductor manufacturing. Countries such as China, Japan, South Korea, and Taiwan are at the forefront of memory technology development, hosting numerous leading memory manufacturers and technology firms. The growing demand for high-performance memory solutions in consumer electronics, automotive, and data center applications is propelling the market in this region.

Moreover, the emphasis on research and development and the establishment of innovation hubs further contribute to the growth of the Next-Generation Memory market in Asia-Pacific. As the region continues to lead in technological advancements and production capabilities, it is expected to maintain its status as a key player in the global Next-Generation Memory market, driving innovation and growth in the years to come.

Competitive Landscape of the Next-Generation Memory Market

The competitive landscape of the Next-Generation Memory market is characterized by the presence of several key players that are driving innovation and technological advancements in memory solutions. Among the top companies in this space are:

- Samsung Electronics Co., Ltd.: A global leader in memory technology, Samsung is known for its innovative solutions in DRAM, NAND, and next-generation memory products.

- Micron Technology, Inc.: Micron specializes in memory and storage solutions, offering a wide range of products, including DRAM, NAND, and emerging memory technologies.

- SK Hynix Inc.: SK Hynix is a major player in the semiconductor industry, focusing on memory solutions such as DRAM and NAND, with ongoing investments in next-generation technologies.

- Intel Corporation: Intel is a leading technology company that develops innovative memory solutions, including Optane technology and collaborations in next-generation memory research.

- Western Digital Corporation: Western Digital focuses on data storage solutions, including NAND flash and emerging memory technologies, catering to diverse market needs.

- Toshiba Memory Corporation: Toshiba is known for its advancements in NAND flash memory technology and is actively involved in the development of next-generation memory solutions.

- NXP Semiconductors N.V.: NXP specializes in automotive and embedded memory solutions, focusing on innovative memory technologies that cater to modern applications.

- Infineon Technologies AG: Infineon offers a range of memory solutions, including non-volatile memory technologies, with a strong focus on automotive and industrial applications.

- STMicroelectronics N.V.: STMicroelectronics develops innovative memory solutions for a variety of applications, including automotive, industrial, and consumer electronics.

- Renesas Electronics Corporation: Renesas specializes in embedded memory solutions and is actively involved in the development of next-generation memory technologies.

The competitive landscape is characterized by continuous innovation, strategic partnerships, and collaborations aimed at enhancing product offerings and expanding market reach. Companies are increasingly investing in research and development to improve memory performance, efficiency, and reliability. As the Next-Generation Memory market continues to grow, the competitive dynamics will likely shift, with emerging players also carving out significant market share and contributing to the evolution of memory technologies.

Report Objectives:

The report will help you answer some of the most critical questions in the Next-Generation Memory Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the next-generation memory market?

- What is the size of the next-generation memory market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 5.9 billion |

|

Forecasted Value (2030) |

USD 24.7 billion |

|

CAGR (2024-2030) |

22.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Next-Generation Memory Market By Technology (Non-Volatile Memory (Magneto-Resistive Randon-Access Memory (MRAM), Ferroelectric RAM (FRAM)), Volatile Memory (Hybrid Memory Cube (HMC), High-Bandwidth Memory (HBM)), By Wafer Size (200 mm, 300 mm), By Application (Consumer Electronics, Enterprise Storage, Automotive & Transportation, Military & Aerospace, Industrial, Telecommunications, Energy & Power, Healthcare, Agricultural, Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Next-Generation Memory Market, by Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Non-volatile Memory |

|

4.1.1.Magneto-resistive Randon-Access Memory (MRAM) |

|

4.1.2.Ferroelectric RAM (FRAM) |

|

4.1.3.Resistive Random-Access Memory (RERAM)/Conductive-Bridging RAM (CBRAM) |

|

4.1.4.3D XPoint |

|

4.1.5.Nano RAM (NRAM) |

|

4.1.6.Others |

|

4.2.Volatile Memory |

|

4.2.1.Hybrid Memory Cube (HMC) |

|

4.2.2.High-Bandwidth Memory (HBM) |

|

5.Next-Generation Memory Market, by Wafer Size (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.200 mm |

|

5.2.300 mm |

|

6.Next-Generation Memory Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Consumer Electronics |

|

6.2.Telecommunications |

|

6.3.Automotive & Transportation |

|

6.4.Energy & Power |

|

6.5.Enterprise Storage |

|

6.6.Industrial |

|

6.7.Military & Aerospace |

|

6.8.Healthcare |

|

6.9.Agricultural |

|

6.10.Retail |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Next-Generation Memory Market, by Technology |

|

7.2.7.North America Next-Generation Memory Market, by Wafer Size |

|

7.2.8.North America Next-Generation Memory Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Next-Generation Memory Market, by Technology |

|

7.3.1.2.US Next-Generation Memory Market, by Wafer Size |

|

7.3.1.3.US Next-Generation Memory Market, by Application |

|

7.3.2.Canada |

|

7.3.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Samsung |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.KIOXIA Holdings |

|

9.3.Micron Technology |

|

9.4.Fujitsu |

|

9.5.Winbond Corporation |

|

9.6.Microchip |

|

9.7.Honeywell |

|

9.8.Infineon Technologies |

|

9.9.Intel |

|

9.10.Viking Technology |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Next-Generation Memory Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the next-generation memory Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the next-generation memory ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the next-generation memory market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA