As per Intent Market Research, the Natural Antioxidants Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 1.7 Billion by 2030; growing at a CAGR of 7.4% during 2025-2030.

The global natural antioxidants market is experiencing rapid growth as consumers and manufacturers alike increasingly turn to natural alternatives for improving product shelf life, enhancing health benefits, and maintaining nutritional integrity. Antioxidants are essential in combating oxidative stress and preventing damage from free radicals, which is a leading cause of aging and various chronic diseases. With rising awareness of these health benefits, there has been a marked increase in the demand for natural antioxidants, particularly from the food and beverage industry, pharmaceuticals, and personal care sectors. Consumers are shifting away from synthetic additives in favor of more natural, sustainable options, further accelerating market growth.

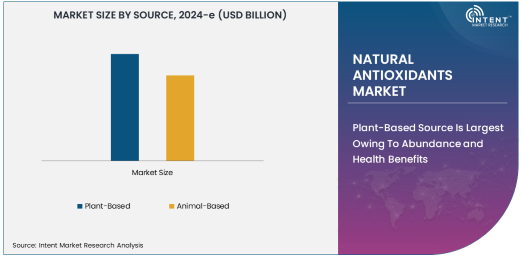

The market is segmented based on source, product type, form, application, end-user, and distribution channel. The key sources of natural antioxidants include plant-based and animal-based ingredients, with plant-based antioxidants holding the largest share of the market due to their abundance and versatility. The market also features a diverse range of product types, such as essential oils, herbal extracts, and fruits and vegetables, all of which provide unique antioxidant properties. As the demand for clean-label products grows, natural antioxidants are finding widespread application across multiple industries, with the food and beverage sector being the largest contributor to market growth.

Plant-Based Source is Largest Owing to Abundance and Health Benefits

The plant-based source segment is the largest in the natural antioxidants market, primarily due to the widespread availability and numerous health benefits associated with plant-derived antioxidants. Plants, including fruits, vegetables, herbs, and spices, are rich in compounds such as polyphenols, flavonoids, and carotenoids, all of which possess powerful antioxidant properties. These antioxidants help protect cells from oxidative stress, which is crucial in preventing various chronic conditions and aging-related diseases. As consumers become more health-conscious, the demand for plant-based ingredients is growing, with antioxidants derived from plants being increasingly incorporated into dietary supplements, functional foods, and beverages.

Moreover, plant-based antioxidants are preferred for their natural origins and sustainability, aligning with current consumer trends towards plant-based diets and eco-friendly products. The versatility of plant-based sources allows for their use in a wide variety of applications, including in food preservation, enhancing product shelf life, and improving the nutritional profile of processed foods. The growing interest in holistic health and wellness, combined with the abundant supply of plant-based antioxidants, ensures the continued dominance of this source segment in the natural antioxidants market.

Herbal Extracts Product Type is Fastest Growing Due to Health Benefits

The herbal extracts product type is the fastest growing segment within the natural antioxidants market, driven by the increasing consumer interest in herbal remedies and functional foods. Herbal extracts are derived from plants known for their antioxidant properties, including herbs such as green tea, turmeric, ginger, and rosemary. These extracts contain bioactive compounds that help neutralize free radicals and protect against oxidative damage. Herbal extracts are particularly valued in the wellness and dietary supplement sectors, where consumers seek natural alternatives to synthetic antioxidant solutions.

The health benefits of herbal extracts, which include anti-inflammatory, anti-aging, and immune-boosting properties, have made them popular among health-conscious consumers. This demand has translated into increased use in pharmaceuticals, cosmetics, and food and beverage products. Additionally, herbal extracts are often perceived as safer and more effective due to their centuries-old use in traditional medicine, contributing to the growing preference for these ingredients. As interest in herbal-based solutions continues to rise, herbal extracts are expected to remain the fastest-growing product type in the natural antioxidants market.

Liquid Form is Largest Due to Versatility and Ease of Use

The liquid form of natural antioxidants is the largest sub-segment within the market, primarily due to its versatility and ease of use in various applications. Liquid antioxidants are easier to incorporate into products, particularly in the food and beverage industry, where they can be directly added to beverages, sauces, and other liquid formulations. The liquid form is also favored in the cosmetics and pharmaceutical industries, where it is essential to create smooth formulations and ensure quick absorption in skincare products or supplements.

In addition, liquid antioxidants often offer more rapid bioavailability compared to powders, allowing for faster absorption and a more immediate effect, which is an attractive feature for consumers. The ability to easily dose and integrate liquid antioxidants into both consumer products and industrial applications has contributed to the widespread adoption of this form. As the demand for natural antioxidant solutions in food, health, and personal care products continues to grow, the liquid form is expected to maintain its position as the dominant format in the market.

Food and Beverages Application is Largest Due to Health-Conscious Consumer Trends

The food and beverages application is the largest segment in the natural antioxidants market, driven by the increasing demand for functional and health-enhancing products. Natural antioxidants play a crucial role in preserving food quality, enhancing flavor, and prolonging shelf life, all while offering added health benefits. The growing consumer preference for clean-label products and natural preservatives has led to a surge in the use of antioxidants derived from plant-based sources in the food and beverage sector. From fruit juices and smoothies to packaged snacks and health drinks, antioxidants are being widely incorporated to enhance the nutritional profile of products and appeal to health-conscious consumers.

Moreover, natural antioxidants are also gaining popularity in functional foods that target specific health benefits, such as immune support, anti-aging, and improved heart health. As consumers continue to seek healthier alternatives to conventional foods and beverages, the demand for natural antioxidants is expected to remain strong, making food and beverages the largest application segment in the market.

Pharmaceutical Companies End-User is Fastest Growing Due to Rising Health Awareness

The pharmaceutical companies segment is the fastest growing end-user in the natural antioxidants market, driven by the increasing demand for natural supplements and medications that combat oxidative stress and support overall health. Antioxidants are widely used in the pharmaceutical industry for their protective effects against chronic diseases, including cardiovascular diseases, cancer, and diabetes. As consumers become more proactive about their health, there is a rising demand for pharmaceutical products containing natural antioxidants derived from plants, herbs, and fruits.

Additionally, antioxidants are gaining popularity in the development of functional and preventive health supplements, with a growing number of consumers seeking natural solutions to enhance immunity, reduce inflammation, and slow aging. The shift towards preventive healthcare and the growing acceptance of natural and herbal remedies are expected to sustain the rapid growth of the pharmaceutical segment, making it the fastest-growing end-user in the natural antioxidants market.

Direct Sales Distribution Channel Is Largest Due to B2B Demand

The direct sales distribution channel is the largest in the natural antioxidants market, driven by business-to-business (B2B) demand, particularly from food manufacturers, pharmaceutical companies, and cosmetics producers. This channel allows manufacturers to establish long-term relationships with suppliers and ensure the direct procurement of high-quality ingredients. Direct sales are particularly crucial in industries where bulk purchases and customized formulations are required, such as in the food and beverage and pharmaceutical sectors. Furthermore, the direct sales model enables greater transparency, ensuring that customers receive products that meet their specific quality and regulatory requirements.

The ability to negotiate bulk pricing and streamline the supply chain makes direct sales the preferred distribution method for large-scale industrial users. This distribution model also supports the increasing demand for tailored antioxidant solutions and facilitates efficient delivery to manufacturing plants. As industries continue to adopt natural antioxidants in their formulations, the direct sales distribution channel is expected to remain the dominant method for reaching key end-users.

North America Is Largest Region Owing to Strong Demand for Functional Ingredients

North America is the largest region in the natural antioxidants market, driven by strong consumer demand for health-enhancing and functional ingredients in food, beverages, pharmaceuticals, and personal care products. The region's health-conscious population, particularly in the United States and Canada, is increasingly turning to natural antioxidants as part of their overall wellness regimen. The growing interest in clean-label products, combined with a strong preference for natural and organic ingredients, has positioned North America as a leader in the global market.

The presence of well-established food manufacturers, pharmaceutical companies, and cosmetic brands that are integrating natural antioxidants into their products further bolsters the region's dominance. Additionally, North America's advanced regulatory frameworks, which ensure product safety and transparency, have helped boost consumer confidence in natural antioxidant products. As the demand for functional and preventative health products continues to rise, North America is expected to remain the largest market for natural antioxidants in the coming years.

Leading Companies and Competitive Landscape

The natural antioxidants market is highly competitive, with key players striving to expand their market share through innovation, sustainability, and strategic acquisitions. Leading companies include DSM, Archer Daniels Midland Company, Naturex (Givaudan), and BASF, all of which offer a broad range of natural antioxidant products derived from plant-based and animal-based sources. These companies are focused on enhancing the efficacy and bioavailability of their antioxidant solutions, meeting the growing demand for clean-label, natural products.

The competitive landscape is also shaped by smaller, specialized companies that focus on specific antioxidant types, such as herbal extracts or essential oils. With the increasing demand for health-enhancing products, companies are investing heavily in research and development to create novel antioxidant solutions. Additionally, sustainability and transparency have become key differentiators, with companies focusing on sourcing ingredients responsibly and offering products with clear labeling. As the market continues to expand, the competition is expected to intensify, with both established players and new entrants pushing the boundaries of innovation to meet evolving consumer preferences.

Recent Developments:

- In December 2024, Cargill launched a new line of natural antioxidants derived from plant-based sources to help reduce oxidation in processed food products.

- In November 2024, BASF announced the introduction of a new range of natural antioxidants for the cosmetics industry, focusing on anti-aging properties.

- In October 2024, DSM Nutritional Products expanded its portfolio of natural antioxidants with the launch of a new range of plant-based antioxidants for supplements.

- In September 2024, Kemin Industries developed a new natural antioxidant derived from rosemary extract, designed to enhance the shelf life of food products.

- In August 2024, Evonik Industries entered into a partnership with a leading cosmetic company to offer a natural antioxidant solution aimed at improving skin health.

List of Leading Companies:

- Cargill, Incorporated

- BASF SE

- ADM (Archer Daniels Midland)

- DSM Nutritional Products

- Kemin Industries, Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Archer Daniels Midland Company (ADM)

- Naturex SA (Givaudan)

- Tata & Sons Pvt. Ltd.

- Herboveda India Pvt. Ltd.

- Frutarom Industries Ltd. (International Flavors & Fragrances)

- Sabinsa Corporation

- PLT Health Solutions, Inc.

- Alland & Robert

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 1.7 Billion |

|

CAGR (2025 – 2030) |

7.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Natural Antioxidants Market by Source (Plant-Based, Animal-Based), Product Type (Essential Oils, Herbal Extracts, Fruits and Vegetables, Spices and Herbs), Form (Powder, Liquid), Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Animal Feed), End-User (Food Manufacturers, Pharmaceutical Companies, Cosmetics & Personal Care, Animal Feed Manufacturers), Distribution Channel (Direct Sales, Retail Stores, Online Retailers, Distributors) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Cargill, Incorporated, BASF SE, ADM (Archer Daniels Midland), DSM Nutritional Products, Kemin Industries, Inc., DuPont de Nemours, Inc., Evonik Industries AG, Archer Daniels Midland Company (ADM), Naturex SA (Givaudan), Tata & Sons Pvt. Ltd., Herboveda India Pvt. Ltd., Frutarom Industries Ltd. (International Flavors & Fragrances), Sabinsa Corporation, PLT Health Solutions, Inc., Alland & Robert |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Natural Antioxidants Market, by Source (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Plant-Based |

|

4.2. Animal-Based |

|

5. Natural Antioxidants Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Essential Oils |

|

5.2. Herbal Extracts |

|

5.3. Fruits and Vegetables |

|

5.4. Spices and Herbs |

|

6. Natural Antioxidants Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Powder |

|

6.2. Liquid |

|

7. Natural Antioxidants Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Food and Beverages |

|

7.2. Pharmaceuticals |

|

7.3. Cosmetics and Personal Care |

|

7.4. Animal Feed |

|

8. Natural Antioxidants Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Food Manufacturers |

|

8.2. Pharmaceutical Companies |

|

8.3. Cosmetics & Personal Care |

|

8.4. Animal Feed Manufacturers |

|

9. Natural Antioxidants Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Direct Sales |

|

9.2. Retail Stores |

|

9.3. Online Retailers |

|

9.4. Distributors |

|

10. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

10.1. Regional Overview |

|

10.2. North America |

|

10.2.1. Regional Trends & Growth Drivers |

|

10.2.2. Barriers & Challenges |

|

10.2.3. Opportunities |

|

10.2.4. Factor Impact Analysis |

|

10.2.5. Technology Trends |

|

10.2.6. North America Natural Antioxidants Market, by Source |

|

10.2.7. North America Natural Antioxidants Market, by Product Type |

|

10.2.8. North America Natural Antioxidants Market, by Form |

|

10.2.9. North America Natural Antioxidants Market, by Application |

|

10.2.10. North America Natural Antioxidants Market, by End-User |

|

10.2.11. North America Natural Antioxidants Market, by Distribution Channel |

|

10.2.12. By Country |

|

10.2.12.1. US |

|

10.2.12.1.1. US Natural Antioxidants Market, by Source |

|

10.2.12.1.2. US Natural Antioxidants Market, by Product Type |

|

10.2.12.1.3. US Natural Antioxidants Market, by Form |

|

10.2.12.1.4. US Natural Antioxidants Market, by Application |

|

10.2.12.1.5. US Natural Antioxidants Market, by End-User |

|

10.2.12.1.6. US Natural Antioxidants Market, by Distribution Channel |

|

10.2.12.2. Canada |

|

10.2.12.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

10.3. Europe |

|

10.4. Asia-Pacific |

|

10.5. Latin America |

|

10.6. Middle East & Africa |

|

11. Competitive Landscape |

|

11.1. Overview of the Key Players |

|

11.2. Competitive Ecosystem |

|

11.2.1. Level of Fragmentation |

|

11.2.2. Market Consolidation |

|

11.2.3. Product Innovation |

|

11.3. Company Share Analysis |

|

11.4. Company Benchmarking Matrix |

|

11.4.1. Strategic Overview |

|

11.4.2. Product Innovations |

|

11.5. Start-up Ecosystem |

|

11.6. Strategic Competitive Insights/ Customer Imperatives |

|

11.7. ESG Matrix/ Sustainability Matrix |

|

11.8. Manufacturing Network |

|

11.8.1. Locations |

|

11.8.2. Supply Chain and Logistics |

|

11.8.3. Product Flexibility/Customization |

|

11.8.4. Digital Transformation and Connectivity |

|

11.8.5. Environmental and Regulatory Compliance |

|

11.9. Technology Readiness Level Matrix |

|

11.10. Technology Maturity Curve |

|

11.11. Buying Criteria |

|

12. Company Profiles |

|

12.1. Cargill, Incorporated |

|

12.1.1. Company Overview |

|

12.1.2. Company Financials |

|

12.1.3. Product/Service Portfolio |

|

12.1.4. Recent Developments |

|

12.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

12.2. BASF SE |

|

12.3. ADM (Archer Daniels Midland) |

|

12.4. DSM Nutritional Products |

|

12.5. Kemin Industries, Inc. |

|

12.6. DuPont de Nemours, Inc. |

|

12.7. Evonik Industries AG |

|

12.8. Archer Daniels Midland Company (ADM) |

|

12.9. Naturex SA (Givaudan) |

|

12.10. Tata & Sons Pvt. Ltd. |

|

12.11. Herboveda India Pvt. Ltd. |

|

12.12. Frutarom Industries Ltd. (International Flavors & Fragrances) |

|

12.13. Sabinsa Corporation |

|

12.14. PLT Health Solutions, Inc. |

|

12.15. Alland & Robert |

|

13. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Natural Antioxidants Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Natural Antioxidants Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Natural Antioxidants Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA