As per Intent Market Research, the Nasal Vaccines Market was valued at USD 1.4 Billion in 2024-e and will surpass USD 2.6 Billion by 2030; growing at a CAGR of 11.0% during 2025 - 2030.

The nasal vaccines market is experiencing significant growth as innovations in vaccine delivery systems drive new solutions to address a range of respiratory infections. Nasal vaccines are gaining traction due to their non-invasive nature, ease of administration, and ability to stimulate both systemic and mucosal immunity. These vaccines are particularly appealing for the prevention of respiratory diseases such as influenza, COVID-19, and respiratory syncytial virus (RSV), where traditional injection-based vaccines may not always provide the ideal delivery method. The convenience and effectiveness of nasal vaccines make them a promising solution for mass immunization, especially in the context of pandemics and seasonal outbreaks.

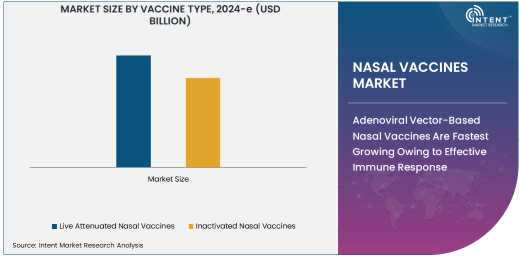

The market is segmented by vaccine type, technology, indication, and end-use industry. Nasal vaccines utilize various types of technologies, including adenoviral vector-based, mRNA-based, and protein subunit-based, to deliver targeted immune responses. With the increasing demand for faster, more effective vaccine solutions, the nasal vaccines market is poised to expand rapidly. The rise of novel respiratory diseases and the growing interest in more accessible vaccine delivery methods are key drivers of market growth, as they offer both clinical and public health benefits.

Adenoviral Vector-Based Nasal Vaccines Are Fastest Growing Owing to Effective Immune Response

Adenoviral vector-based nasal vaccines represent the fastest growing segment in the nasal vaccines market. These vaccines use an adenovirus as a delivery vehicle to introduce genetic material from a pathogen into the body, prompting the immune system to recognize and respond to the pathogen. Adenoviral vector-based vaccines are particularly advantageous in stimulating both systemic and mucosal immunity, which is crucial for preventing respiratory infections. They have shown significant promise in trials for diseases like influenza and COVID-19, offering strong protection with fewer doses compared to traditional methods.

The increasing adoption of adenoviral vector-based nasal vaccines is largely due to their demonstrated efficacy and ability to generate a robust immune response, especially against respiratory pathogens. Moreover, the ease of delivery and ability to trigger immunity in both the upper and lower respiratory tract makes these vaccines ideal for combating respiratory infections. As the need for quick and efficient vaccination solutions continues to rise, particularly in response to global health crises like the COVID-19 pandemic, adenoviral vector-based nasal vaccines are expected to experience rapid market growth.

mRNA-Based Nasal Vaccines Gaining Momentum in the Wake of COVID-19

mRNA-based nasal vaccines are emerging as a promising alternative for respiratory diseases, particularly in the wake of the COVID-19 pandemic. mRNA vaccines, which contain messenger RNA that instructs cells to produce a protein similar to that of a virus, have been shown to be highly effective in preventing infection and can be quickly modified to address new strains of viruses. When adapted for nasal delivery, mRNA vaccines can provide an added layer of immune protection by stimulating both systemic and mucosal immunity. This delivery method is particularly advantageous for respiratory infections, where immunity at the mucosal surface is essential for effective protection.

The success of mRNA vaccines in COVID-19 has accelerated interest in this technology for other respiratory diseases such as influenza and RSV. Researchers and healthcare providers are increasingly exploring the potential of mRNA-based nasal vaccines due to their flexibility in rapidly responding to emerging infectious diseases. As these vaccines prove to be not only effective but also feasible in terms of production and distribution, mRNA-based nasal vaccines are expected to gain significant traction in the nasal vaccines market in the coming years.

Influenza Remains the Leading Indication for Nasal Vaccines

Influenza is the largest indication for nasal vaccines, as seasonal outbreaks of the flu continue to affect millions of people worldwide. Nasal vaccines, particularly those targeting influenza, offer a more convenient and less invasive alternative to traditional flu shots, which has led to their widespread adoption. The ability to administer vaccines via the nasal route increases patient compliance, as many individuals are reluctant to receive injections. This convenience is especially significant in the context of mass vaccination campaigns aimed at preventing seasonal flu outbreaks.

Nasal vaccines for influenza are not only effective in reducing the severity of the disease but also in providing protection against multiple strains of the flu virus, which often undergoes significant mutations. As influenza remains a major global health concern, the demand for nasal vaccines targeting this virus is expected to continue to grow, driving further innovation in nasal vaccine technologies and expanding their use in public health initiatives.

Hospitals Lead the End-Use Segment for Nasal Vaccines

Hospitals are the largest end-use segment for nasal vaccines, as they play a central role in administering vaccines to patients. Hospitals are key providers of vaccination services, particularly for vulnerable populations such as the elderly, children, and individuals with underlying health conditions. With the rising demand for flu and COVID-19 vaccinations, hospitals have become primary distribution points for nasal vaccines, ensuring that patients receive timely and effective immunization against respiratory infections.

Hospitals also benefit from the increasing adoption of nasal vaccines due to their ability to facilitate faster and more efficient vaccination procedures. In addition to routine immunization, hospitals are actively engaged in administering vaccines during outbreaks and pandemics, further boosting the demand for nasal vaccines. As hospitals continue to enhance their vaccination strategies and expand their vaccine offerings, they will remain a dominant segment in the nasal vaccines market.

North America Is Largest Region Owing to High Vaccination Rates and Healthcare Infrastructure

North America is the largest region in the nasal vaccines market, driven by robust healthcare infrastructure, high vaccination rates, and the increasing prevalence of respiratory infections such as influenza and COVID-19. The United States, in particular, plays a pivotal role in the market, with widespread adoption of vaccines for public health initiatives and easy access to advanced medical technologies. The rapid rollout of COVID-19 vaccines, including nasal vaccines, has further solidified North America’s dominance in this market.

The region’s well-established healthcare systems and public health campaigns make it an ideal environment for the distribution and administration of nasal vaccines. Additionally, the high level of research and development in North America, especially in biotechnology and vaccine development, continues to drive innovation in the nasal vaccines market. As the region maintains its focus on improving immunization coverage and reducing the burden of respiratory diseases, North America will continue to be the largest market for nasal vaccines.

Leading Companies and Competitive Landscape

The nasal vaccines market is characterized by the presence of several key players and ongoing research and development activities. Leading companies such as AstraZeneca, Pfizer, Sanofi, and Moderna are at the forefront of developing and commercializing nasal vaccine solutions. These companies are leveraging their expertise in vaccine technology, including adenoviral vector and mRNA-based platforms, to create innovative nasal vaccines for respiratory diseases like influenza and COVID-19.

The competitive landscape is also shaped by collaborations between pharmaceutical companies, research institutions, and government agencies. As the market continues to evolve, companies are focusing on enhancing vaccine efficacy, ensuring ease of administration, and expanding production capabilities. With the rising demand for respiratory vaccines and the potential for nasal vaccines to revolutionize the immunization process, the competitive dynamics in this market will remain highly competitive and innovation-driven.

Recent Developments:

- Sanofi and GSK announced the successful clinical trial results for their combined nasal vaccine for COVID-19 and influenza, aiming for a global rollout by late 2024.

- Inovio Pharmaceuticals revealed a new nasal COVID-19 vaccine candidate that has shown promising immune response data in early-stage clinical trials.

- Merck & Co. launched a new nasal flu vaccine aimed at providing enhanced protection against seasonal influenza, particularly for high-risk populations.

- Pfizer Inc. partnered with Codagenix, Inc. to develop an intranasal flu vaccine that provides a faster and more efficient immune response compared to traditional injectable flu vaccines.

- AstraZeneca introduced a new RSV nasal vaccine, designed to provide immunity to infants and elderly populations against respiratory syncytial virus.

List of Leading Companies:

- Sanofi

- Pfizer Inc.

- AstraZeneca

- GlaxoSmithKline

- Johnson & Johnson

- Merck & Co.

- Novavax

- Bayer AG

- AbbVie Inc.

- Inovio Pharmaceuticals

- MedImmune LLC

- Vaxine Pty Ltd

- EpiVax, Inc.

- Valneva SE

- Codagenix, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.4 Billion |

|

Forecasted Value (2030) |

USD 2.6 Billion |

|

CAGR (2025 – 2030) |

11.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Nasal Vaccines Market by Vaccine Type (Live Attenuated Nasal Vaccines, Inactivated Nasal Vaccines), Technology (Adenoviral Vector-Based Nasal Vaccines, mRNA-Based Nasal Vaccines, Protein Subunit-Based Nasal Vaccines), Indication (Influenza, COVID-19, Respiratory Syncytial Virus) and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sanofi, Pfizer Inc., AstraZeneca, GlaxoSmithKline, Johnson & Johnson, Merck & Co., Bayer AG, AbbVie Inc., Inovio Pharmaceuticals, MedImmune LLC, Vaxine Pty Ltd, EpiVax, Inc., Codagenix, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Nasal Vaccines Market, by Vaccine Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Live Attenuated Nasal Vaccines |

|

4.2. Inactivated Nasal Vaccines |

|

5. Nasal Vaccines Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Adenoviral Vector-Based Nasal Vaccines |

|

5.2. mRNA-Based Nasal Vaccines |

|

5.3. Protein Subunit-Based Nasal Vaccines |

|

6. Nasal Vaccines Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Influenza |

|

6.2. COVID-19 |

|

6.3. Respiratory Syncytial Virus (RSV) |

|

6.4. Other Respiratory Infections |

|

7. Nasal Vaccines Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Clinics |

|

7.3. Pharmacies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Nasal Vaccines Market, by Vaccine Type |

|

8.2.7. North America Nasal Vaccines Market, by Technology |

|

8.2.8. North America Nasal Vaccines Market, by Indication |

|

8.2.9. North America Nasal Vaccines Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Nasal Vaccines Market, by Vaccine Type |

|

8.2.10.1.2. US Nasal Vaccines Market, by Technology |

|

8.2.10.1.3. US Nasal Vaccines Market, by Indication |

|

8.2.10.1.4. US Nasal Vaccines Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Sanofi |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Pfizer Inc. |

|

10.3. AstraZeneca |

|

10.4. GlaxoSmithKline |

|

10.5. Johnson & Johnson |

|

10.6. Merck & Co. |

|

10.7. Novavax |

|

10.8. Bayer AG |

|

10.9. AbbVie Inc. |

|

10.10. Inovio Pharmaceuticals |

|

10.11. MedImmune LLC |

|

10.12. Vaxine Pty Ltd |

|

10.13. EpiVax, Inc. |

|

10.14. Valneva SE |

|

10.15. Codagenix, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Nasal Vaccines Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Nasal Vaccines Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Nasal Vaccines Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA