As per Intent Market Research, the Nasal Splints Market was valued at USD 3.0 Billion in 2024-e and will surpass USD 5.2 Billion by 2030; growing at a CAGR of 9.8% during 2025 - 2030.

The nasal splints market is witnessing steady growth due to the increasing number of nasal surgeries, including rhinoplasty, septoplasty, and other nasal procedures. Nasal splints play a crucial role in post-surgical care, helping to maintain the shape and stability of the nasal passages while ensuring the proper healing of tissues. These devices are typically used to prevent the collapse of nasal structures after surgery, and their growing use is closely tied to the rise in both cosmetic and medical procedures related to nasal and sinus conditions. The market is expected to expand further as the demand for minimally invasive surgeries and efficient recovery options increases.

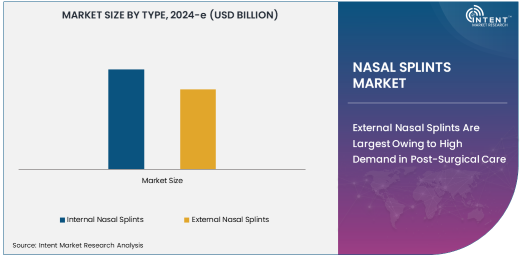

Nasal splints are available in various materials, including silicone, plastic, and biodegradable materials, and are tailored to suit different types of nasal surgeries. Additionally, the market is segmented by the type of splint, with both internal and external nasal splints playing important roles in recovery. Internal nasal splints are inserted inside the nostrils to stabilize the nasal septum, while external nasal splints are applied externally to provide support to the nose's structure. The increasing prevalence of nasal surgeries and advancements in nasal splint designs are driving market growth, alongside the expanding adoption of more patient-friendly, biocompatible materials.

External Nasal Splints Are Largest Owing to High Demand in Post-Surgical Care

External nasal splints are the largest segment in the nasal splints market due to their widespread use in post-surgical care for patients undergoing rhinoplasty and other nasal surgeries. External splints provide crucial external support to the nose, helping to maintain the desired shape and prevent dislocation during the healing process. These splints are typically applied to the outside of the nose and are designed to provide gentle compression while also protecting the nose from external trauma during the recovery period.

External nasal splints are preferred for their ease of use, comfort, and effectiveness in ensuring that the nasal structure remains stable after surgery. Additionally, external splints are relatively easy to apply and remove, which makes them a popular choice for both surgeons and patients. The growing demand for cosmetic nasal surgeries, combined with the increasing awareness of the benefits of using external splints for optimal recovery, ensures that this segment remains the largest in the market.

Silicone Material Is Leading the Market Due to Comfort and Biocompatibility

Silicone is the leading material used in the production of nasal splints, owing to its comfort, flexibility, and biocompatibility. Silicone nasal splints are widely preferred for both internal and external use due to their ability to conform to the shape of the nasal passage without causing irritation or discomfort. The material's flexibility and softness make it an ideal choice for post-surgical care, as it minimizes the risk of tissue damage and promotes a smooth recovery process. Silicone nasal splints also have an advantage in terms of durability, as they can withstand the pressure and stress exerted during the healing period.

Furthermore, silicone is a non-reactive material, which reduces the risk of allergic reactions and ensures patient safety. As patient comfort and safety are paramount in post-surgical care, silicone remains the material of choice for many healthcare providers. The combination of biocompatibility, ease of use, and long-lasting effectiveness is driving the continued dominance of silicone in the nasal splints market.

Hospitals and Clinics Lead the End-Use Segment Due to High Procedure Volumes

Hospitals and clinics account for the largest end-use segment in the nasal splints market, as these healthcare facilities are the primary settings for nasal surgeries. Hospitals and clinics perform a high volume of surgeries, including rhinoplasty, septoplasty, and nasal fracture repairs, all of which require the use of nasal splints to aid in recovery. These facilities are equipped with the necessary expertise and resources to provide comprehensive post-surgical care, including the application of nasal splints.

Moreover, the high patient volumes in hospitals and clinics make them the primary consumers of nasal splints. With the growing trend of nasal surgeries being performed in these settings, the demand for nasal splints continues to rise. As hospitals and clinics adopt advanced surgical techniques and prioritize patient recovery, they will remain the largest end-use segment in the nasal splints market.

North America Is Largest Region Owing to Advanced Healthcare Systems

North America is the largest region in the nasal splints market, driven by its advanced healthcare infrastructure, high surgical procedure volumes, and increasing awareness of nasal surgeries. The United States, in particular, is a major contributor to the market due to the widespread popularity of rhinoplasty and other cosmetic and medical nasal procedures. North American hospitals and clinics are equipped with cutting-edge technologies and offer a wide range of surgical services, increasing the demand for nasal splints in post-surgical care.

Additionally, the high rate of healthcare spending in North America enables patients to access the latest medical devices, including nasal splints, which further boosts the market's growth. The adoption of advanced materials, such as silicone and biodegradable materials, also contributes to the region's dominance in the market. As the trend toward aesthetic and reconstructive nasal surgeries continues to rise, North America is expected to maintain its position as the largest regional market for nasal splints.

Leading Companies and Competitive Landscape

The nasal splints market is highly competitive, with several key players offering innovative solutions in terms of design, material, and functionality. Prominent companies such as Medtronic, Smith & Nephew, and Johnson & Johnson are leading the market with their diverse range of nasal splints for post-surgical care. These companies focus on research and development to create more comfortable, effective, and biocompatible nasal splints, driving market growth.

In addition to large multinational companies, there are also regional players that specialize in nasal splints and other related devices. As the demand for cosmetic nasal surgeries grows, the competitive landscape will continue to evolve, with companies focusing on improving product quality, patient comfort, and reducing recovery times. The collaboration between healthcare providers and manufacturers is essential in ensuring that nasal splints meet the needs of both patients and surgeons, further shaping the competitive dynamics of the market.

Recent Developments:

- Medtronic introduced a new line of biodegradable nasal splints, enhancing patient comfort and reducing the need for follow-up procedures.

- Smith & Nephew launched an innovative nasal splint designed for use in both internal and external applications post-surgery, with improved healing support.

- Boston Scientific announced a partnership with an ENT surgical center to improve the post-operative use of their advanced nasal splint technology.

- B. Braun Melsungen developed a new silicone-based nasal splint aimed at enhancing airflow and reducing discomfort for patients after sinus surgery.

- Zimmer Biomet received FDA clearance for its new range of nasal splints designed for use in rhinoplasty surgeries, improving post-surgery recovery times.

List of Leading Companies:

- Medtronic PLC

- Stryker Corporation

- Johnson & Johnson

- Smith & Nephew plc

- Boston Scientific Corporation

- ConvaTec Group PLC

- Mölnlycke Health Care AB

- B. Braun Melsungen AG

- Zimmer Biomet

- DeRoyal Industries

- Olympus Corporation

- 3M Health Care

- KLS Martin Group

- Integra LifeSciences

- Medline Industries, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.0 Billion |

|

Forecasted Value (2030) |

USD 5.2 Billion |

|

CAGR (2025 – 2030) |

9.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Nasal Splints Market by Type (Internal Nasal Splints, External Nasal Splints); Material (Silicone, Plastic, Biodegradable Materials); End-Use (Hospitals and Clinics, Ambulatory Surgical Centers) and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic PLC, Stryker Corporation, Johnson & Johnson, Smith & Nephew plc, Boston Scientific Corporation, ConvaTec Group PLC, B. Braun Melsungen AG, Zimmer Biomet, DeRoyal Industries, Olympus Corporation, 3M Health Care, KLS Martin Group, Medline Industries, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Nasal Splints Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Internal Nasal Splints |

|

4.2. External Nasal Splints |

|

5. Nasal Splints Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Silicone |

|

5.2. Plastic |

|

5.3. Biodegradable Materials |

|

6. Nasal Splints Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals and Clinics |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Nasal Splints Market, by Type |

|

7.2.7. North America Nasal Splints Market, by Material |

|

7.2.8. North America Nasal Splints Market, by End-Use |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Nasal Splints Market, by Type |

|

7.2.9.1.2. US Nasal Splints Market, by Material |

|

7.2.9.1.3. US Nasal Splints Market, by End-Use |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Medtronic PLC |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Stryker Corporation |

|

9.3. Johnson & Johnson |

|

9.4. Smith & Nephew plc |

|

9.5. Boston Scientific Corporation |

|

9.6. ConvaTec Group PLC |

|

9.7. Mölnlycke Health Care AB |

|

9.8. B. Braun Melsungen AG |

|

9.9. Zimmer Biomet |

|

9.10. DeRoyal Industries |

|

9.11. Olympus Corporation |

|

9.12. 3M Health Care |

|

9.13. KLS Martin Group |

|

9.14. Integra LifeSciences |

|

9.15. Medline Industries, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Nasal Splints Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Nasal Splints Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Nasal Splints Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA