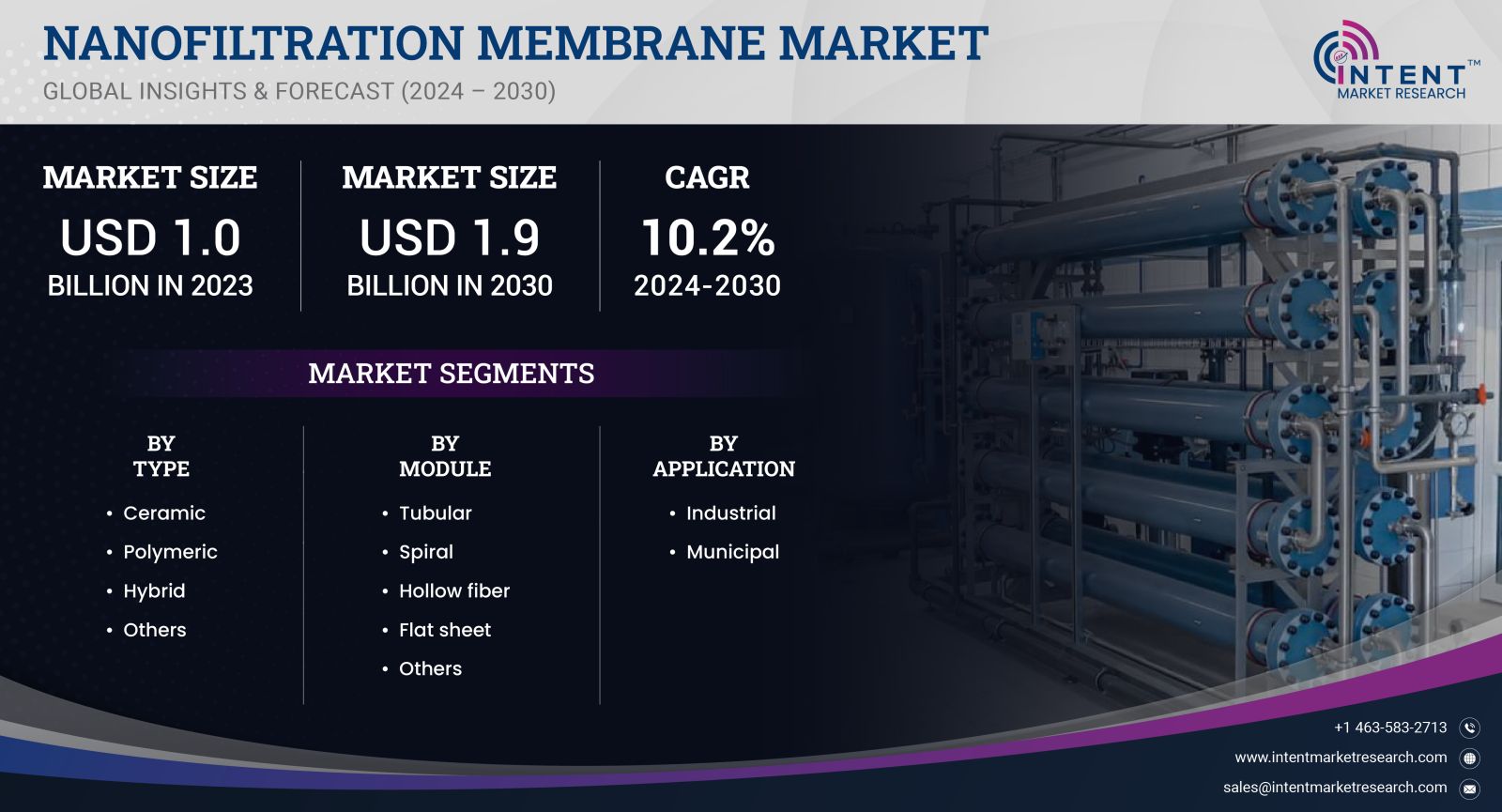

As per Intent Market Research, the Nanofiltration Membrane Market was valued at USD 1.0 billion in 2023-e and will surpass USD 1.9 billion by 2030; growing at a CAGR of 10.2% during 2024 - 2030.

The Nanofiltration Membrane Market is witnessing robust growth, fueled by the rising demand for water purification and separation technologies across various industries. Nanofiltration membranes are semi-permeable membranes that fall between microfiltration and reverse osmosis, effectively removing divalent and larger monovalent ions while allowing smaller ions and water to pass through. This unique ability makes them highly desirable for applications in water treatment, food and beverage processing, and pharmaceuticals, among others. As water scarcity and environmental regulations intensify globally, the adoption of nanofiltration technology is becoming increasingly critical for achieving sustainable water management.

Factors such as increasing awareness of water quality issues, the need for advanced wastewater treatment solutions, and the push for efficient water reuse are contributing to this growth. Furthermore, advancements in membrane materials and technologies are expanding the application scope of nanofiltration membranes, creating substantial opportunities for manufacturers and end-users alike.

Water Treatment Segment is Largest Owing to Rising Demand for Clean Water

The water treatment segment is the largest application area within the nanofiltration membrane market, driven by the increasing need for clean and safe drinking water globally. Municipalities and industries are investing in advanced water treatment technologies to meet stringent water quality standards and to ensure sustainable water supply. Nanofiltration membranes play a pivotal role in removing contaminants, such as organic compounds and hardness, while allowing essential minerals to pass through, making them ideal for potable water production.

The rising global population, coupled with rapid urbanization and industrialization, is further straining water resources, leading to a higher demand for efficient water treatment solutions. In many regions, particularly in developing countries, the lack of access to clean water sources underscores the urgency for innovative water treatment technologies. As regulatory pressures increase and consumers become more conscious of water quality, the demand for nanofiltration systems in water treatment is expected to remain strong, solidifying its position as the largest segment in the market.

Food and Beverage Segment is Fastest Growing Owing to Demand for Quality Control

The food and beverage segment is recognized as the fastest-growing application area for nanofiltration membranes, driven by the increasing emphasis on quality control and product consistency. In this sector, nanofiltration is utilized for processes such as concentration, demineralization, and microbial reduction, which are crucial for maintaining the quality of beverages and food products. The ability of nanofiltration membranes to selectively retain specific components while allowing others to pass through makes them invaluable in applications ranging from dairy processing to fruit juice concentration.

As consumer preferences shift towards healthier and more natural products, food and beverage manufacturers are adopting innovative processing technologies to enhance product appeal. The growing trend of clean labeling and transparency in ingredient sourcing is driving the demand for advanced separation technologies like nanofiltration. Moreover, the increasing focus on sustainability within the food industry is encouraging manufacturers to implement efficient processing methods that minimize waste and energy consumption. As a result, the food and beverage segment is expected to witness significant growth in the nanofiltration membrane market.

Pharmaceuticals Segment is Largest Owing to Stringent Regulatory Requirements

The pharmaceuticals segment holds a substantial share of the nanofiltration membrane market, largely due to the stringent regulatory requirements surrounding drug manufacturing and formulation. Nanofiltration membranes are employed in the pharmaceutical industry for various applications, including the purification of active pharmaceutical ingredients (APIs), the removal of endotoxins, and the concentration of formulations. The high efficiency of nanofiltration in removing unwanted particles while preserving the integrity of the desired compounds makes it a critical technology in pharmaceutical production.

As the pharmaceutical industry continues to evolve, with an increasing focus on biopharmaceuticals and complex drug formulations, the demand for reliable and efficient purification technologies is rising. Furthermore, the ongoing development of novel therapies and personalized medicine approaches necessitates advanced filtration solutions to ensure the safety and efficacy of pharmaceutical products. Consequently, the pharmaceuticals segment is expected to maintain a strong presence in the nanofiltration membrane market, driven by its pivotal role in ensuring compliance with health and safety regulations.

Asia-Pacific is Fastest Growing Region Owing to Industrialization and Urbanization

The Asia-Pacific region is anticipated to be the fastest-growing market for nanofiltration membranes, primarily due to rapid industrialization and urbanization. Countries such as China and India are experiencing significant economic growth, leading to increased investment in infrastructure and water treatment facilities. The growing population in urban areas is further intensifying the demand for clean water and effective wastewater treatment solutions, creating substantial opportunities for nanofiltration technologies.

Additionally, the region's expanding food and beverage industry is propelling the adoption of nanofiltration membranes for quality control and product enhancement. As consumer preferences shift towards safer and healthier food options, manufacturers are increasingly leveraging advanced filtration technologies to meet regulatory standards and consumer expectations. Moreover, the government initiatives aimed at improving water quality and sustainability are driving the growth of the nanofiltration membrane market in Asia-Pacific, making it a key region for future developments.

North America is Largest Region Owing to Advanced Infrastructure

North America remains the largest market for nanofiltration membranes, largely due to its advanced infrastructure and established water treatment practices. The United States and Canada are at the forefront of adopting innovative water purification technologies to address the challenges of water quality and scarcity. The strong regulatory framework in North America emphasizes the need for effective filtration solutions, making nanofiltration membranes a preferred choice for water treatment applications.

In the pharmaceutical and food and beverage industries, North America is also witnessing robust growth in the demand for nanofiltration technologies. The focus on product safety, quality assurance, and compliance with health regulations is driving investments in advanced separation technologies. As sustainability initiatives gain traction and consumer awareness of environmental issues rises, the demand for efficient water treatment and processing solutions is expected to propel the growth of the nanofiltration membrane market in North America.

Top 10 Companies and Competitive Landscape

The nanofiltration membrane market is characterized by a competitive landscape featuring a mix of established players and emerging companies. Key companies operating in the nanofiltration membrane market include:

- Dow Inc.

- Koch Membrane Systems, Inc.

- Hydranautics (A Nitto Group Company)

- Parker Hannifin Corporation

- Toray Industries, Inc.

- Suez Water Technologies & Solutions

- Membrana (A division of Evonik Industries AG)

- Synder Filtration, Inc.

- GE Water & Process Technologies (Now part of Suez)

- Lenntech B.V.

These companies are engaged in various strategies, including product innovation, technological advancements, and strategic partnerships to enhance their market presence. The competitive landscape is marked by ongoing research and development efforts aimed at improving membrane performance and expanding application areas. Moreover, the focus on sustainability and environmental regulations is driving manufacturers to develop eco-friendly and efficient filtration solutions. As the nanofiltration membrane market continues to evolve, companies that invest in innovation and respond to market needs are poised for success in this dynamic industry.

Report Objectives

The report will help you answer some of the most critical questions in the Nanofiltration Membrane Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the nanofiltration membrane market?

- What is the size of the nanofiltration membrane market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.0 billion |

|

Forecasted Value (2030) |

USD 1.9 billion |

|

CAGR (2024-2030) |

10.2% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Nanofiltration Membrane Market By Type (Ceramic, Polymeric, Hybrid), By Module (Spiral, Hollow Fiber, Tubular, Flat Sheet), By Application (Industrial, Municipal) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Nanofiltration Membrane Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Ceramic |

|

4.2.Polymeric |

|

4.3.Hybrid |

|

4.4.Others |

|

5.Nanofiltration Membrane Market, by Module (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Tubular |

|

5.2.Spiral |

|

5.3.Hollow fiber |

|

5.4.Flat sheet |

|

5.5.Others |

|

6.Nanofiltration Membrane Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Industrial |

|

6.2.Municipal |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Nanofiltration Membrane Market, by Type |

|

7.2.7.North America Nanofiltration Membrane Market, by Module |

|

7.2.8.North America Nanofiltration Membrane Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Nanofiltration Membrane Market, by Type |

|

7.3.1.2.US Nanofiltration Membrane Market, by Module |

|

7.3.1.3.US Nanofiltration Membrane Market, by Application |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.DuPont |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Toray Industries |

|

9.3.Veolia |

|

9.4.Alfa Laval |

|

9.5.NX Filtration |

|

9.6.Inopor |

|

9.7.Hyflux |

|

9.8.Applied Membrane |

|

9.9.Argonide |

|

9.10.Vontron |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Nanofiltration Membrane Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the nanofiltration membrane Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the nanofiltration membrane ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the nanofiltration membrane market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA