As per Intent Market Research, the Naloxone Market was valued at USD 1.3 billion in 2024-e and will surpass USD 2.6 billion by 2030; growing at a CAGR of 12.2% during 2025 - 2030.

The Naloxone market has seen substantial growth due to the rising opioid overdose crisis worldwide. Naloxone, an opioid antagonist, is a life-saving medication used to reverse the effects of opioid overdose, including respiratory depression. Its demand has surged in recent years, driven by government initiatives to combat the opioid epidemic, increased awareness, and expanded access to the drug. With a variety of product forms and applications, the Naloxone market is diverse, with key players in the pharmaceutical industry working to make the medication more accessible to the public.

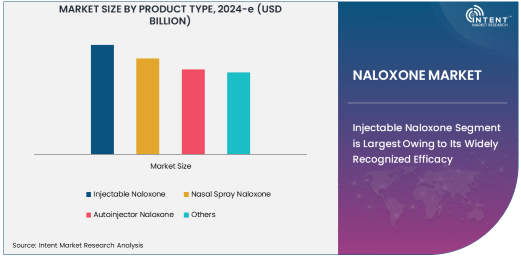

Injectable Naloxone Segment is Largest Owing to Its Widely Recognized Efficacy

The injectable Naloxone segment dominates the market, accounting for a significant share due to its widespread use in emergency medical settings. Injectable Naloxone is commonly administered by healthcare providers, emergency responders, and in hospitals to quickly reverse opioid overdoses. The segment's popularity is attributed to its proven effectiveness and rapid onset of action, making it the preferred choice in clinical and emergency situations. Hospitals and emergency medical services (EMS) are the primary end-users of injectable Naloxone, as it allows for controlled administration in critical overdose situations.

The ease of use and reliability of injectable Naloxone have positioned it as the go-to option in preventing overdose-related fatalities. Additionally, with the increasing availability of Naloxone through public health initiatives, its accessibility is expected to continue growing, further cementing its position as the largest product type in the market. As opioid overdose deaths remain a key global issue, injectable Naloxone's role in combating the crisis is more critical than ever.

Emergency Medical Services (EMS) Segment is Fastest Growing Owing to Increased Demand for Immediate Overdose Intervention

The Emergency Medical Services (EMS) segment is the fastest-growing end-user group in the Naloxone market. As opioid overdoses continue to rise, EMS responders are increasingly required to carry Naloxone as part of their first-responder toolkit. This trend is particularly prevalent in North America, where the opioid epidemic has reached alarming levels. EMS professionals are often the first to arrive at overdose scenes, and their ability to administer Naloxone quickly can be the difference between life and death.

The rise in opioid-related overdoses and the push for broader accessibility of Naloxone have fueled the EMS segment's growth. Governments and local authorities are also providing EMS teams with training and resources to improve overdose outcomes. This expansion of Naloxone use in EMS is expected to continue as overdose rates remain high, making it one of the most significant contributors to the market's growth.

Offline Sales Segment is Largest Owing to Established Retail Infrastructure

The offline sales segment, which includes sales through pharmacies, clinics, and hospitals, is the largest distribution channel for Naloxone. This channel benefits from established retail infrastructure and a strong healthcare system that allows for widespread distribution. Traditional brick-and-mortar pharmacies and hospitals are primary points of access for individuals seeking Naloxone, especially in emergency situations.

Offline distribution is particularly significant because many regions still rely on physical pharmacies for prescription medications, and Naloxone is often dispensed in urgent care settings. In addition, public health programs and community outreach initiatives have ensured that Naloxone is available in pharmacies, helping to reduce barriers to access. While online sales are growing, the offline channel remains dominant due to the immediate need for Naloxone in emergency situations and its widespread availability in clinics and pharmacies.

Opioid Overdose Treatment Application is Largest Owing to Urgent Need for Reversal

The opioid overdose treatment application holds the largest share in the Naloxone market. Naloxone is primarily used to reverse the life-threatening effects of opioid overdoses, which can lead to respiratory failure and death if not treated promptly. As opioid abuse remains a global crisis, the demand for Naloxone as a critical overdose intervention is substantial. The availability of Naloxone in various forms, including injectable, nasal spray, and autoinjector, further supports its widespread use in reversing overdoses.

Governments and public health agencies are increasingly distributing Naloxone to at-risk populations and emergency responders. This focus on overdose reversal, coupled with efforts to make Naloxone more accessible, has driven the growth of this application segment. Given the ongoing opioid epidemic, the opioid overdose treatment application is expected to remain the largest and most significant driver in the Naloxone market.

North America Region is Largest Market Owing to High Opioid Overdose Rates

North America is the largest region in the Naloxone market, primarily due to the high prevalence of opioid abuse and overdose in the United States and Canada. The opioid epidemic in North America has led to a heightened demand for Naloxone as a life-saving intervention. In response, governments, healthcare providers, and emergency medical services have worked to increase access to Naloxone, including initiatives to distribute the drug in public spaces and through pharmacies.

The large-scale efforts to combat the opioid crisis in North America have significantly contributed to the region's dominance in the Naloxone market. Moreover, continued policy support and public health campaigns aimed at reducing overdose fatalities are expected to sustain the demand for Naloxone, further solidifying North America's position as the largest market for the drug.

Competitive Landscape and Leading Companies

The Naloxone market is highly competitive, with several key players leading the industry. Companies such as Hikma Pharmaceuticals, Amgen Inc., Mylan N.V., and Teva Pharmaceutical Industries Ltd. dominate the market with their comprehensive portfolios of Naloxone products. These companies offer a range of Naloxone formulations, including injectable, nasal sprays, and autoinjectors, to cater to various end-user needs.

The competitive landscape is influenced by factors such as product innovation, regulatory approvals, pricing strategies, and partnerships with healthcare organizations to improve drug accessibility. Leading companies are also focusing on expanding their reach in underserved regions and enhancing distribution channels to drive market growth. As the opioid crisis continues, these companies are likely to play a pivotal role in shaping the future of the Naloxone market, with further investments in research, partnerships, and geographic expansion.

Recent Developments:

- Hikma Pharmaceuticals has expanded its portfolio by launching a generic version of Naloxone injectable for the treatment of opioid overdose, providing an affordable alternative to branded products.

- Teva Pharmaceuticals announced the FDA approval of its Naloxone nasal spray, offering a convenient, non-invasive option to address opioid overdoses in emergency situations.

- Mylan N.V. entered into a strategic partnership with Adapt Pharma to increase the distribution of Naloxone nasal spray in the United States, aiming to make overdose reversal treatments more widely available.

- Pfizer Inc. committed to enhancing its distribution of Naloxone through public health programs and expanded pharmacy access, with the goal of addressing the opioid epidemic in North America.

List of Leading Companies:

- Hikma Pharmaceuticals

- Amgen Inc.

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Indivior Plc

- Johnson & Johnson

- Adapt Pharma

- Sandoz (Novartis)

- Mallinckrodt Pharmaceuticals

- Opiant Pharmaceuticals

- Insys Therapeutics

- Eli Lilly and Company

- AstraZeneca

- Pfizer Inc.

- Alkermes Plc

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.3 Billion |

|

Forecasted Value (2030) |

USD 2.6 Billion |

|

CAGR (2025 – 2030) |

12.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Naloxone Market By Product Type (Injectable Naloxone, Nasal Spray Naloxone, Autoinjector Naloxone), By End-User (Hospitals, Emergency Medical Services, Retail Pharmacies, Homecare), By Distribution Channel (Online Sales, Offline Sales, Hospitals & Clinics), By Application (Opioid Overdose Treatment, Pain Management, Alcoholism Treatment) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Hikma Pharmaceuticals, Amgen Inc., Mylan N.V., Teva Pharmaceutical Industries Ltd., Indivior Plc, Johnson & Johnson, Adapt Pharma, Sandoz (Novartis), Mallinckrodt Pharmaceuticals, Opiant Pharmaceuticals, Insys Therapeutics, Eli Lilly and Company, AstraZeneca, Pfizer Inc., Alkermes Plc |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Naloxone Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Injectable Naloxone |

|

4.2. Nasal Spray Naloxone |

|

4.3. Autoinjector Naloxone |

|

4.4. Others |

|

5. Naloxone Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Hospitals |

|

5.2. Emergency Medical Services (EMS) |

|

5.3. Retail Pharmacies |

|

5.4. Homecare |

|

6. Naloxone Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Online Sales |

|

6.2. Offline Sales (Pharmacies, Clinics) |

|

6.3. Hospitals & Clinics |

|

7. Naloxone Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Opioid Overdose Treatment |

|

7.2. Pain Management |

|

7.3. Alcoholism Treatment |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Naloxone Market, by Product Type |

|

8.2.7. North America Naloxone Market, by End-User |

|

8.2.8. North America Naloxone Market, by Distribution Channel |

|

8.2.9. North America Naloxone Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Naloxone Market, by Product Type |

|

8.2.10.1.2. US Naloxone Market, by End-User |

|

8.2.10.1.3. US Naloxone Market, by Distribution Channel |

|

8.2.10.1.4. US Naloxone Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Hikma Pharmaceuticals |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Amgen Inc. |

|

10.3. Mylan N.V. |

|

10.4. Teva Pharmaceutical Industries Ltd. |

|

10.5. Indivior Plc |

|

10.6. Johnson & Johnson |

|

10.7. Adapt Pharma |

|

10.8. Sandoz (Novartis) |

|

10.9. Mallinckrodt Pharmaceuticals |

|

10.10. Opiant Pharmaceuticals |

|

10.11. Insys Therapeutics |

|

10.12. Eli Lilly and Company |

|

10.13. AstraZeneca |

|

10.14. Pfizer Inc. |

|

10.15. Alkermes Plc |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Naloxone Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Naloxone Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Naloxone Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA