As per Intent Market Research, the Mutual Fund Assets Market was valued at USD 72.4 billion in 2024-e and will surpass USD 110.5 billion by 2030; growing at a CAGR of 7.3% during 2025 - 2030.

The mutual fund assets market is experiencing substantial growth, driven by increasing investor awareness, favorable regulatory environments, and the growing preference for diversified investment strategies. Mutual funds offer individuals and institutional investors a means to access a broad range of asset classes and investment strategies, making them an attractive option for wealth accumulation. The market is also witnessing a shift toward passive investing, with index funds and exchange-traded funds (ETFs) gaining traction due to their lower costs and transparency. Additionally, the rise of online investment platforms has made it easier for retail investors to participate in the mutual fund market.

The increasing number of retail investors, coupled with an expanding middle class globally, is expected to fuel the growth of mutual fund assets in the coming years. More investors are looking for professional management and diversification, particularly in uncertain economic environments, which further contributes to the market's expansion. Furthermore, financial advisors continue to play a key role in recommending mutual fund products to institutional and retail investors, adding to the sustained demand for various types of mutual funds.

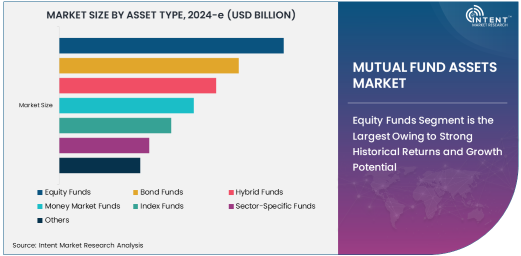

Equity Funds Segment is the Largest Owing to Strong Historical Returns and Growth Potential

Equity funds are the largest segment in the mutual fund assets market, owing to their potential for high returns over the long term. These funds primarily invest in stocks and aim to provide capital appreciation to investors, making them an attractive option for those seeking higher growth potential. Historically, equity funds have outperformed other asset classes, which has fueled their popularity among both retail and institutional investors. As equity markets continue to experience upward growth, equity funds are expected to maintain their dominance in the mutual fund assets market.

The growth of equity funds is also supported by the increasing number of investors looking to build long-term wealth, especially in emerging markets where economic growth prospects are stronger. As a result, equity funds have attracted a significant portion of mutual fund assets, with institutional investors allocating large portions of their portfolios to these funds. Equity funds are also increasingly seen as a way to gain exposure to specific sectors, such as technology, healthcare, and financial services, further boosting their demand in global markets.

Bond Funds Segment is the Fastest Growing Owing to Rising Demand for Income Generating Investments

Bond funds are the fastest-growing segment in the mutual fund assets market, driven by a rising demand for income-generating investments and the need for portfolio diversification. As interest rates remain low in many developed markets, bond funds offer investors a relatively stable income stream and a lower risk profile compared to equities. These funds invest in government, municipal, and corporate bonds, making them an attractive option for risk-averse investors looking to preserve capital while earning regular income. The increasing need for fixed income investments, particularly among retirees and institutional investors, is further contributing to the growth of bond funds.

The demand for bond funds is particularly strong in regions with aging populations, such as Europe and North America, where investors seek safe, income-producing assets. Additionally, bond funds are increasingly being used as part of a diversified portfolio strategy, balancing higher-risk equity investments with more stable, lower-risk bond investments. The growth in bond fund assets is expected to continue as investors seek ways to hedge against market volatility while ensuring consistent returns over time.

Passively Managed Funds Segment is the Fastest Growing Owing to Lower Costs and Greater Transparency

Passively managed funds, including index funds and ETFs, are growing at the fastest rate in the mutual fund assets market due to their lower management fees and greater transparency compared to actively managed funds. These funds aim to replicate the performance of a specific index, such as the S&P 500, and do not require frequent trading, making them more cost-effective for investors. The rise of passive investing is also linked to a shift in investor behavior, with many individuals and institutional investors seeking cost-effective investment options that deliver market returns without incurring high fees.

The growth of passively managed funds is also supported by the increasing adoption of online investment platforms, which have made it easier for retail investors to access low-cost, diversified investment options. As more investors recognize the benefits of passive investing, particularly the ability to achieve market returns with lower fees, the demand for passively managed funds is expected to continue to rise. This trend is expected to challenge the dominance of actively managed funds, as passive funds have consistently outperformed their actively managed counterparts in many markets.

Retail Investors Segment is the Largest Owing to Growing Financial Literacy and Investment Participation

Retail investors represent the largest segment in the mutual fund assets market, driven by increasing financial literacy and a growing number of individuals seeking to invest for their future. As more retail investors gain access to online investment platforms, they are becoming more active participants in the mutual fund market. Retail investors are increasingly turning to mutual funds as a way to diversify their portfolios and build long-term wealth. The rise of robo-advisors and low-cost mutual fund options has also made it easier for retail investors to access professionally managed portfolios, which is contributing to the expansion of this segment.

The growth of retail investors is also supported by the increasing availability of information about mutual fund products, making it easier for individuals to make informed investment decisions. The growing trend of retirement savings and personal wealth accumulation is fueling the demand for mutual fund investments among individuals, especially in emerging markets where retail investment participation is on the rise. As more individuals look to invest in retirement plans, education funds, and other long-term savings accounts, the retail investor segment is expected to remain the largest contributor to the growth of mutual fund assets.

North America is the Largest Market for Mutual Fund Assets Owing to Strong Investor Participation and Developed Financial Infrastructure

North America is the largest market for mutual fund assets, owing to its developed financial infrastructure and high levels of investor participation. The United States, in particular, has a long history of mutual fund investments, with a large proportion of the population participating in retirement plans and investment portfolios. The presence of major asset management firms and financial advisors in the region, coupled with a robust regulatory framework, has helped North America maintain its dominant position in the global mutual fund assets market. The shift toward passive investing, coupled with the growing adoption of online platforms, has also contributed to the region's leadership in the market.

In addition to strong retail investor participation, institutional investors in North America continue to allocate a significant portion of their assets to mutual funds, further fueling the market's growth. The increasing awareness of investment strategies, along with the availability of various mutual fund products, is expected to ensure that North America remains the largest market for mutual fund assets. As financial technology and online platforms continue to evolve, North America's mutual fund market is expected to remain a key hub for investment activity.

Competitive Landscape in Mutual Fund Assets Market Owing to Increased Product Diversification and Technological Innovation

The competitive landscape in the mutual fund assets market is characterized by a mix of traditional asset management firms and newer fintech companies that provide online investment platforms. Leading asset managers continue to diversify their product offerings to cater to the growing demand for various investment strategies, such as equity, bond, hybrid, and passively managed funds. Additionally, the rise of robo-advisors and automated investment services has disrupted the market, offering lower-cost solutions for retail investors. Companies are investing in digital transformation, including user-friendly platforms and mobile applications, to attract the growing number of tech-savvy retail investors.

Furthermore, the increasing demand for sustainable and socially responsible investment options has led many asset managers to launch new mutual funds focused on environmental, social, and governance (ESG) criteria. As more investors seek to align their portfolios with their values, mutual fund providers are incorporating ESG factors into their fund offerings. The competitive environment is expected to intensify as firms focus on innovation, customer engagement, and expanding their product ranges to meet the evolving needs of investors.

Recent Developments:

- In December 2024, Vanguard Group launched a new series of ESG-focused equity funds to cater to sustainable investment trends.

- In November 2024, BlackRock announced an expansion of its passively managed fund offerings with the introduction of new index funds.

- In October 2024, JPMorgan Chase & Co. acquired a significant stake in a robo-advisory platform to enhance its mutual fund distribution.

- In September 2024, Fidelity Investments introduced a new hybrid mutual fund targeting both growth and income-focused investors.

- In August 2024, State Street Global Advisors announced a partnership with a fintech company to enhance their mutual fund offering via a digital platform.

List of Leading Companies:

- BlackRock

- Vanguard Group

- Fidelity Investments

- State Street Global Advisors

- JPMorgan Chase & Co.

- Charles Schwab Investment Management

- T. Rowe Price

- Allianz Global Investors

- Franklin Templeton Investments

- Invesco Ltd.

- BNY Mellon Investment Management

- Goldman Sachs Asset Management

- PIMCO

- Wellington Management

- Aberdeen Standard Investments

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 72.4 billion |

|

Forecasted Value (2030) |

USD 110.5 billion |

|

CAGR (2025 – 2030) |

7.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Mutual Fund Assets Market By Asset Type (Equity Funds, Bond Funds, Hybrid Funds, Money Market Funds, Index Funds, Sector-Specific Funds), By Investment Strategy (Actively Managed, Passively Managed), By Investor Type (Retail Investors, Institutional Investors), By Distribution Channel (Direct Investment, Online Investment Platforms, Financial Advisors) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BlackRock, Vanguard Group, Fidelity Investments, State Street Global Advisors, JPMorgan Chase & Co., Charles Schwab Investment Management, T. Rowe Price, Allianz Global Investors, Franklin Templeton Investments, Invesco Ltd., BNY Mellon Investment Management, Goldman Sachs Asset Management, PIMCO, Wellington Management, Aberdeen Standard Investments |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Mutual Fund Assets Market, by Asset Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Equity Funds |

|

4.2. Bond Funds |

|

4.3. Hybrid Funds |

|

4.4. Money Market Funds |

|

4.5. Index Funds |

|

4.6. Sector-Specific Funds |

|

4.7. Others |

|

5. Mutual Fund Assets Market, by Investment Strategy (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Actively Managed |

|

5.2. Passively Managed |

|

6. Mutual Fund Assets Market, by Investor Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Retail Investors |

|

6.2. Institutional Investors |

|

7. Mutual Fund Assets Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Investment |

|

7.2. Online Investment Platforms |

|

7.3. Financial Advisors |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Mutual Fund Assets Market, by Asset Type |

|

8.2.7. North America Mutual Fund Assets Market, by Investment Strategy |

|

8.2.8. North America Mutual Fund Assets Market, by Investor Type |

|

8.2.9. North America Mutual Fund Assets Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Mutual Fund Assets Market, by Asset Type |

|

8.2.10.1.2. US Mutual Fund Assets Market, by Investment Strategy |

|

8.2.10.1.3. US Mutual Fund Assets Market, by Investor Type |

|

8.2.10.1.4. US Mutual Fund Assets Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. BlackRock |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Vanguard Group |

|

10.3. Fidelity Investments |

|

10.4. State Street Global Advisors |

|

10.5. JPMorgan Chase & Co. |

|

10.6. Charles Schwab Investment Management |

|

10.7. T. Rowe Price |

|

10.8. Allianz Global Investors |

|

10.9. Franklin Templeton Investments |

|

10.10. Invesco Ltd. |

|

10.11. BNY Mellon Investment Management |

|

10.12. Goldman Sachs Asset Management |

|

10.13. PIMCO |

|

10.14. Wellington Management |

|

10.15. Aberdeen Standard Investments |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Mutual Fund Assets Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Mutual Fund Assets Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Mutual Fund Assets Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA