As per Intent Market Research, the Muslin Fabric Market was valued at USD 1.1 billion in 2024-e and will surpass USD 1.6 billion by 2030; growing at a CAGR of 6.9% during 2025 - 2030.

The muslin fabric market is experiencing steady growth, driven by its versatility, natural appeal, and expanding applications across multiple industries. Originally valued for its lightweight and breathable properties, muslin fabric has become a popular choice in apparel, home textiles, and industrial applications. The increasing consumer preference for natural and sustainable fabrics, coupled with the growing demand for organic textiles, has further fueled the expansion of the muslin fabric market.

Additionally, muslin's ability to be easily dyed, printed, and treated makes it suitable for a variety of end-use applications, from everyday clothing to high-end fashion and home decor. The rise in e-commerce and online retail platforms has made muslin fabrics more accessible, enabling a global customer base to explore and purchase these versatile textiles, leading to broader market adoption.

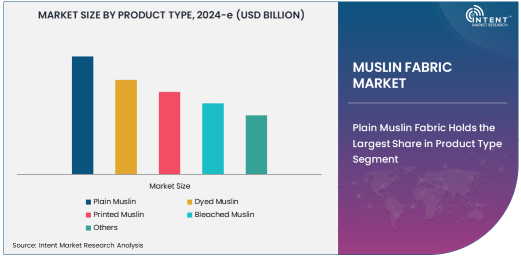

Plain Muslin Fabric Holds the Largest Share in Product Type Segment

Plain muslin is the dominant product type in the muslin fabric market, owing to its wide range of uses in both consumer and industrial applications. As a simple, unadorned fabric, plain muslin is an ideal choice for manufacturing garments, bed linens, and other textiles due to its soft texture and breathability. It is highly preferred by apparel manufacturers for creating comfortable clothing, as well as for its use in historical and costume designs where a natural, lightweight fabric is required.

Dyed and printed muslin fabrics are also witnessing increased demand, driven by the growing fashion and home textile industries. Dyed muslin is used to create vibrant, colorful textiles for various applications, while printed muslin fabrics are favored for their aesthetic appeal and versatility in creating custom designs. The trend towards customization and personalization in fashion and home decor has contributed to the popularity of printed muslin fabric in the market.

100% Cotton Muslin Dominates the Material Type Segment Due to Its Eco-friendly Appeal

100% cotton muslin remains the largest material type in the market, as it is favored for its softness, breathability, and natural origin. Cotton muslin is widely used in apparel and home textiles, offering comfort and versatility to consumers. The fabric’s hypoallergenic properties make it an attractive choice for individuals with sensitive skin, contributing to its popularity in children’s clothing and bedding products.

Organic muslin is gaining traction as the demand for eco-friendly and sustainable fabrics grows. Consumers are increasingly seeking out products made from organically grown cotton, free from pesticides and synthetic chemicals. This shift towards organic textiles is helping to fuel the growth of organic muslin fabrics, particularly among environmentally conscious consumers who prioritize sustainability. Blended muslin fabrics, offering a combination of cotton with other fibers, are also seeing growth due to their enhanced durability and functional properties.

Apparel End-User Segment Drives Muslin Fabric Demand

The apparel segment is the largest end-user for muslin fabric, accounting for a significant share of the market. Muslin fabric’s softness and lightweight nature make it a popular choice for comfortable and breathable clothing. It is often used in the creation of casual wear, summer dresses, blouses, and traditional garments due to its natural look and feel. As trends toward natural and sustainable textiles continue to rise, muslin is being adopted more widely in eco-friendly fashion collections.

The home textiles segment is also contributing to the market’s growth, as muslin is a popular choice for bedding, curtains, and upholstery. Muslin fabric’s light texture and natural drape make it a sought-after material for creating aesthetically pleasing and functional home decor items. Industrial applications of muslin, such as for use in medical supplies or as a filter fabric in certain industries, are also contributing to the growth of the market.

Online Retailers Drive Muslin Fabric Distribution

Online retailers are leading the distribution channels for muslin fabric, providing consumers with easy access to a wide variety of muslin textiles. The convenience of browsing and purchasing muslin fabric from home, combined with the ability to compare prices and view product reviews, has made online shopping the preferred channel for many consumers. E-commerce platforms like Amazon, Etsy, and Alibaba allow customers to explore muslin fabrics from different manufacturers and suppliers worldwide.

Offline stores, including fabric retailers and craft stores, continue to play a vital role in the muslin fabric market, especially for consumers who prefer to see and touch the fabric before purchasing. Wholesale suppliers also contribute significantly to the market, catering to larger-scale buyers in the apparel and textile industries who require bulk orders of muslin fabric for production.

Asia-Pacific Region Leads the Growth in Muslin Fabric Market

The Asia-Pacific region is experiencing the fastest growth in the muslin fabric market, owing to the rising demand for cotton textiles and the growing apparel industry in countries such as China and India. These countries are not only significant producers of muslin fabric but are also witnessing a surge in domestic consumption due to the expanding middle class and increasing disposable income.

North America and Europe remain mature markets, with high consumer demand for muslin fabric driven by trends in eco-friendly fashion and sustainable textiles. These regions are experiencing steady growth as consumers increasingly favor organic and natural fabrics. Additionally, muslin's use in medical and industrial applications in these regions is contributing to its continued demand.

Competitive Landscape

The muslin fabric market is highly competitive, with key players like Arvind Limited, Vardhman Textiles, Loyal Textile Mills Ltd., and Texhong Textile Group dominating the industry. These companies are focused on expanding their production capacities and offering a range of muslin fabric products in different types and grades to meet the diverse needs of end-users.

In addition to the larger textile companies, several smaller manufacturers and suppliers are focusing on niche segments, such as organic muslin and specialized printing techniques. The growing demand for eco-friendly and sustainable textiles has prompted many companies to invest in environmentally conscious production methods and certifications. With the rise of online platforms, smaller companies can access global markets, further intensifying competition.

Recent Developments:

- In December 2024, Arvind Limited launched a new collection of organic cotton muslin fabrics aimed at eco-conscious consumers.

- In November 2024, H&M Group expanded its sustainable muslin fabric line to include dyed and printed varieties.

- In October 2024, Welspun India introduced muslin fabrics for medical applications, targeting the healthcare industry.

- In September 2024, Patagonia announced a new initiative to use organic muslin fabric for its eco-friendly clothing line.

- In August 2024, Alibaba Group partnered with local manufacturers to supply muslin fabrics globally through its online platform.

List of Leading Companies:

- Cotton Inc.

- H&M Group

- Alibaba Group

- Lenzing AG

- Arvind Limited

- IKEA

- Triadex Group

- Usha Yarns

- Patagonia

- Texhong Textile Group

- Eastman Chemical Company

- Toray Industries

- Khadi and Village Industries Commission

- Tencel

- Welspun India Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 billion |

|

Forecasted Value (2030) |

USD 1.6 billion |

|

CAGR (2025 – 2030) |

6.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Muslin Fabric Market By Product Type (Plain Muslin, Dyed Muslin, Printed Muslin, Bleached Muslin), By Material Type (100% Cotton Muslin, Blended Muslin, Organic Muslin), By End-User (Apparel, Home Textiles, Industrial Applications, Medical Applications), By Distribution Channel (Online Retailers, Offline Stores, Wholesale Suppliers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Cotton Inc., H&M Group, Alibaba Group, Lenzing AG, Arvind Limited, IKEA, Triadex Group, Usha Yarns, Patagonia, Texhong Textile Group, Eastman Chemical Company, Toray Industries, Khadi and Village Industries Commission, Tencel, Welspun India Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Muslin Fabric Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Plain Muslin |

|

4.2. Dyed Muslin |

|

4.3. Printed Muslin |

|

4.4. Bleached Muslin |

|

4.5. Others |

|

5. Muslin Fabric Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. 100% Cotton Muslin |

|

5.2. Blended Muslin |

|

5.3. Organic Muslin |

|

5.4. Others |

|

6. Muslin Fabric Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Apparel |

|

6.2. Home Textiles |

|

6.3. Industrial Applications |

|

6.4. Medical Applications |

|

6.5. Others |

|

7. Muslin Fabric Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retailers |

|

7.2. Offline Stores |

|

7.3. Wholesale Suppliers |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Muslin Fabric Market, by Product Type |

|

8.2.7. North America Muslin Fabric Market, by Material Type |

|

8.2.8. North America Muslin Fabric Market, by End-User |

|

8.2.9. North America Muslin Fabric Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Muslin Fabric Market, by Product Type |

|

8.2.10.1.2. US Muslin Fabric Market, by Material Type |

|

8.2.10.1.3. US Muslin Fabric Market, by End-User |

|

8.2.10.1.4. US Muslin Fabric Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Cotton Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. H&M Group |

|

10.3. Alibaba Group |

|

10.4. Lenzing AG |

|

10.5. Arvind Limited |

|

10.6. IKEA |

|

10.7. Triadex Group |

|

10.8. Usha Yarns |

|

10.9. Patagonia |

|

10.10. Texhong Textile Group |

|

10.11. Eastman Chemical Company |

|

10.12. Toray Industries |

|

10.13. Khadi and Village Industries Commission |

|

10.14. Tencel |

|

10.15. Welspun India Limited |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Muslin Fabric Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Muslin Fabric Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Muslin Fabric Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA